Summary

ESG investment trends buck the bear market

Environmental, social, and governance issues are now mainstream, and bucking the bear market. Sustainable funds saw $120 billion of new money in first half despite big outflows from traditional funds and oil performance. Europe dominates but all areas growing. 80% global retail investors consider ESG when invest, led by environmental issues. We launch ESG scores on 2,700 stocks, plus 13 involvement flags, to help.

Markets slump with more aggressive Fed

Markets slumped as Fed hiked rates 0.75% and signalled much more coming. Others from Switz. to Sweden accelerated hikes. UK ‘growth’ plan backfired. S&P 500 fell back to June lows, US 10- yr bond yields reached 3.7%, and US dollar index hit 111. Drove first JPY intervention in 25-yrs. Volkswagen kicked off huge Porsche IPO. Ford hit by supply issues. Meta saw more cost cuts. See video updates, and twitter @laidler_ben.

Not all recessions created equal

US recession risks rising even before latest FOMC meet and ‘dot plot’ made near inevitable. But are not all equal. This ‘cyclical’ recession is the least worst of the flavours, and investible.

UK’s costly step back from stagflation brink

In eye-of-the-storm, with some of world’s highest inflation and recession brink. But governments huge 7%+ of GDP unfunded spending splurge is a mixed blessing. See FTSE 100.

China’s Party Congress and next five years

Five-year Chinese Party Congress starts Oct. 16. To give President Xi a unprecedented third term and maybe a pro-growth policy pivot.

Energy stocks decouple from falling crude

Oil equities been resilient to falling oil prices, with their cheap valuations and only $20/bbl costs. Are a good hedge to the real risk of ‘high for-longer’ oil prices. @OilWorldWide.

Crypto pressured as equity fall deepens

Crypto assets were hurt again by renewed equity volatility, with bitcoin (BTC) back at 3-month lows. Ethereum (ETH) led the major coin falls following the strong performance into its recent successful merge to PoS. XRP was by far best performer, surging on hopes for a nearing end to the SEC lawsuit. NASDAQ was the latest ‘TradFi’ mover to launch bitcoin custody services.

Brent oil falls below $90, down 30% from high

A stronger US dollar and rising global recession risks took their toll on commodity prices yet again. But supply concerns offsets again large, as Russia’s conscription move stoked oil and wheat supply risks, whilst US refining issues supported both gasoline and heating oil prices.

The week ahead: Focus shifts internationally

1) EU inflation (Fri) to rise to near 10%, further pressuring the ECB. 2) China’s <50 PMI in focus as authorities step up stimulus. 3) Earnings from NKE, MU, PAYX plus meme stocks BBBY, BB. 4) Reaction to Italian election result and outlook for Oct. 2nd Brazil election 1st round.

Our key views: Sticky inflation raises risks

Sticky US inflation is delaying an end to Fed rate hikes and raising recession risk. Offsets still from resilient consumers and corporates, Recovery U shaped and takes time. Gradually lower inflation will be a bumpy ride but would de-risk market. And allow higher-risk assets, big tech to crypto, do better, alongside core defensives.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -4.00% | -8.34% | -18.57% |

| SPX500 | -4.65% | -8.98% | -22.51% |

| NASDAQ | -5.07% | -10.49% | -30.53% |

| UK100 | -3.01% | -5.50% | -4.96% |

| GER30 | -3.59% | -5.30% | -22.67% |

| JPN225 | -2.59% | -4.65% | -5.69% |

| HKG50 | -4.42% | -11.09% | -23.35% |

*Data accurate as of 26/09/2022

Market Views

Markets slump further with Fed more aggressive

- Markets slumped as Fed hiked rates 0.75% and signalled was much more to come. Other banks from Sweden to Switzerland accelerated hikes. UK ‘Growth’ plan backfired. S&P 500 fell to June lows and US 10-year bond yields reached 3.7%. The US dollar index hit 111, driving the first JPY intervention in 25-years. Volkswagen kicked off the huge Porsche IPO. Ford slumped on supply problems. Meta announced more cost cuts.

Not all recessions created equal

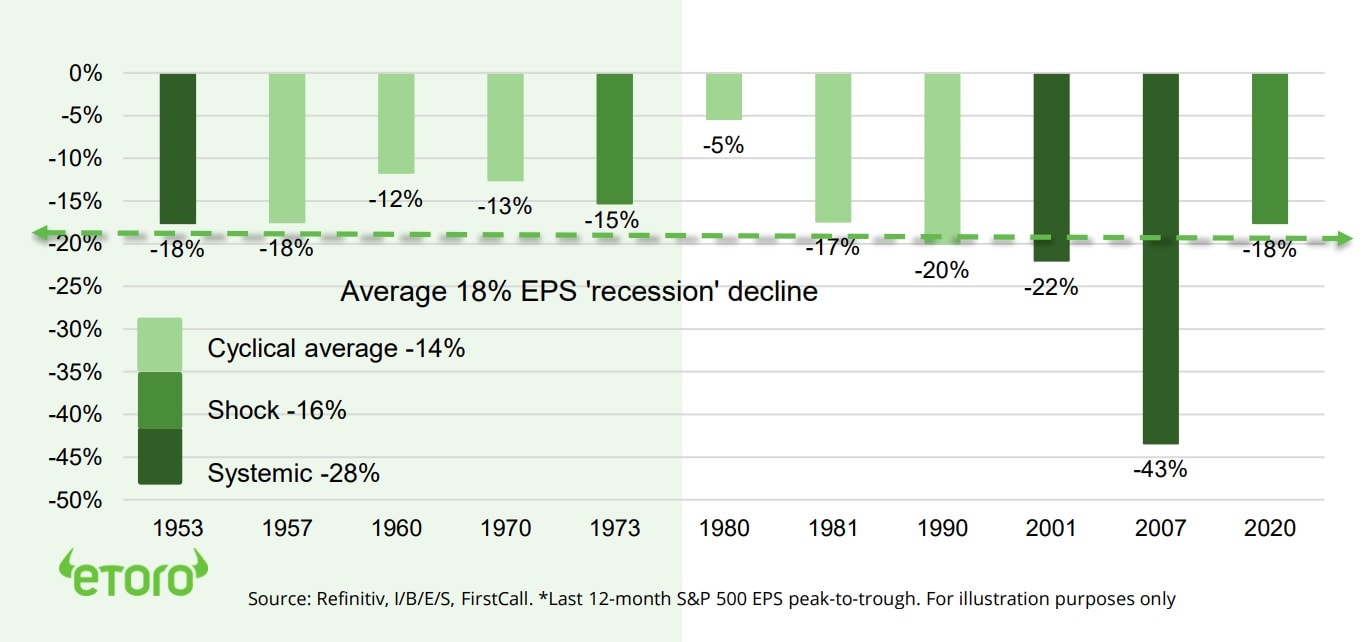

- US recession risks were rising even before the latest FOMC meeting and ‘dot plot’ guidance made it all but inevitable. But recessions are not all created equal, ranging from jut cyclical, to most damaging structural, and shock-driven.

- We face a ‘cyclical’ recession, typically the shortest and least damaging variety of this rare species. These average a 2% GDP and 14% earnings peak-trough fall, lasting 10 months. It will be painful but still investable and we see a gradual ‘U-shaped’ market recovery.

UK’s costly step back from stagflation brink

- UK been in eye-of-the-storm this year. With some of world’s highest inflation after triple-whammy of soaring energy costs, tight jobs market, and Sterling slump. Whilst growth hit by squeeze on incomes, government tax grab, low productivity.

- But 7%+ of GDP unfunded spending splurge from new Truss government is a mixed blessing.

- Big tax and energy support give-aways cushion the recession and slash inflation peak. But at risky cost of more debt and inflation pressure. Is taking a toll on Sterling and the bond market. But world-leading FTSE 100 performance remains stark reminder that stock-markets are not economies.

China’s Party Congress and the next five years

- The five-yearly Chinese Communist Party Congress starts October 16. This 20th Congress is set to give President Xi an unprecedented third term and lay out their future policy plans. It comes at a key time.

- China’s stop-start covid recovery is at risk, and geopolitical tensions high. The US and Europe are sliding towards a recession. The last Congress led moves to de-risk the economy, slow growth, and embrace ‘common prosperity’. This was hard for many. Hopes are for a pro-growth policy tilt to stabilize China’ (MCHI) outlook, and support Europe (IEUR) to Japan (EWJ) to commodities.

Energy stocks decouple from falling crude

- Oil equities resilient to falling oil prices given their cheap valuations and current oil prices still over four times the average production cost. Oil majors an attractive hedge to risk of ‘high-for-longer’ oil. Focus on recession risk and backwardated futures curve under-appreciates potential supply shocks.

- From end of US strategic reserve (SPR) sales, to low drilling activity, and EU’s coming Russia embargo. Also, lower oil has been a key anchor for global inflation outlook. See @OilWorldWide.

S&P 500 earnings fall during recessions, from prior peak (%)

Crypto falls further as equity sell off broadens

- Crypto assets hit hard again by the broadening sell-off in equity markets following the more hawkish Fed interest rate stance. Bitcoin (BTC) traded at three month lows below $19,000.

- Ethereum (ETH) the worst major coin performer after the prior week’s successful ‘merge’ had already priced in some of the expected benefits and as concerns raised over its centralization.

- XRP (XRP) was the best performer during the week as hopes were raised of a nearing end to Ripple’s long standing lawsuit with the SEC.

- NASDAQ latest to launch BTC custody services.

Brent crude falls below $90 a barrel

- Commodity prices fell with the stronger US dollar and rising recession risks. Brent crude oil fell below $90/bbl., now 30% below its March high.

- Supply concerns again came to the fore. Russia’s move to conscription escalates the Ukraine conflict and drove renewed supply concerns for the most exposed oil and what commodities.

- Refined products gasoline and heating oil boosted by new refining outages, a step up in the Atlantic hurricane activity, and inventory falls.

- European natural gas prices eased modestly under further impact of European measures to cap prices, despite the current cold weather.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -4.03% | -13.08% | -32.63% |

| Healthcare | -3.87% | -5.69% | -15.64% |

| C Cyclicals | -7.26% | -11.34% | -30.04% |

| Small Caps | -6.60% | -12.48% | -25.20% |

| Value | -4.65% | -9.02% | -16.56% |

| Bitcoin | -4.45% | -13.26% | -60.57% |

| Ethereum | -10.07% | -22.29% | -65.60% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: focus shifts internationally

- Inflation shift to Europe, with prices rising (est. 9.7%) and ECB talking tough on 0.75% Nov. meeting hike. Also Fed favourite US PCE prices.

- Manufacturing PMI’s in world’s no.2 economy China in <50 recession territory as authorities seek to boost economy and with coming Oct. 16 5-yearly Communist Party Congress.

- Large cap earnings from sportswear giant NKE, chipmaker MU, PAYX, CTAS. Also meme stocks BBBY, BB. Q3 earnings season starts Oct. 14. Porsche IPO is set to trade Thursday.

- Aftermath of Italian presidential election and outlook for Brazil’s on Sunday, Oct. 2nd. Leftist ex-President Lula leads polls. But Oct. 30th run off likely against rightist President Bolsonaro.

Our key views: Sticky inflation raises risks

- Sticky US inflation is delaying end to Fed rate hikes, raising recession risk, and spreading market fear. Market supports meantime from resilient consumers and corporates, Recovery to be U-shaped only. Gradually lower inflation will be a bumpy ride but would de-risk markets and allow more higher-risk assets, from big tech to small cap and crypto to do better.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to China markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -3.72% | -9.79% | 13.34% |

| Brent Oil | -5.79% | -13.55% | 9.75% |

| Gold Spot | -1.33% | -6.78% | -9.77% |

| DXY USD | 2.97% | 3.88% | 17.77% |

| EUR/USD | -3.25% | -2.77% | -14.80% |

| US 10Yr Yld | 23.43% | 64.49% | 217.40% |

| VIX Vol. | 13.76% | 17.06% | 73.75% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: ESG goes mainstream

Environmental, social, and governance issues are mainstream, despite some growing pains

Environmental, social, and governance issues have remained top of mind. $120 oil and outperforming commodity stocks have been a short-term performance headwind but has only further accelerated the long-term shift toward renewables. Regulators on both sides of the Atlantic are now demanding more and better company and fund manager disclosure. Inflows into sustainable investing funds continues despite the bear market and outflows from mainstream funds. 80% of polled investors globally see ESG as factor in their decision making. To further support this adoption and investors research Etoro launched ESG scores and business involvement flags. See also related smart portfolios @RenewableEnergy, @FemaleLeadership

The sustainable investing path has been set and tested, bucking the bear market

Despite the dramatic second quarter slump in global markets, with NASDAQ alone falling 20%, ESG funds attracted $33 billion of net new money, according to Morningstar. This took the first half sustainable inflow to $120 billion and was against the backdrop of huge outflows from conventional funds. Global sustainable assets are now an estimated $2.5 trillion, double the size of two years ago. This shows the rapid adoption of sustainable investing. Europe continues to dominate and accounts for over 80% of these funds. Whilst the US and Asia are lagging for now, we think the long-term adoption path has been clearly set and tested.

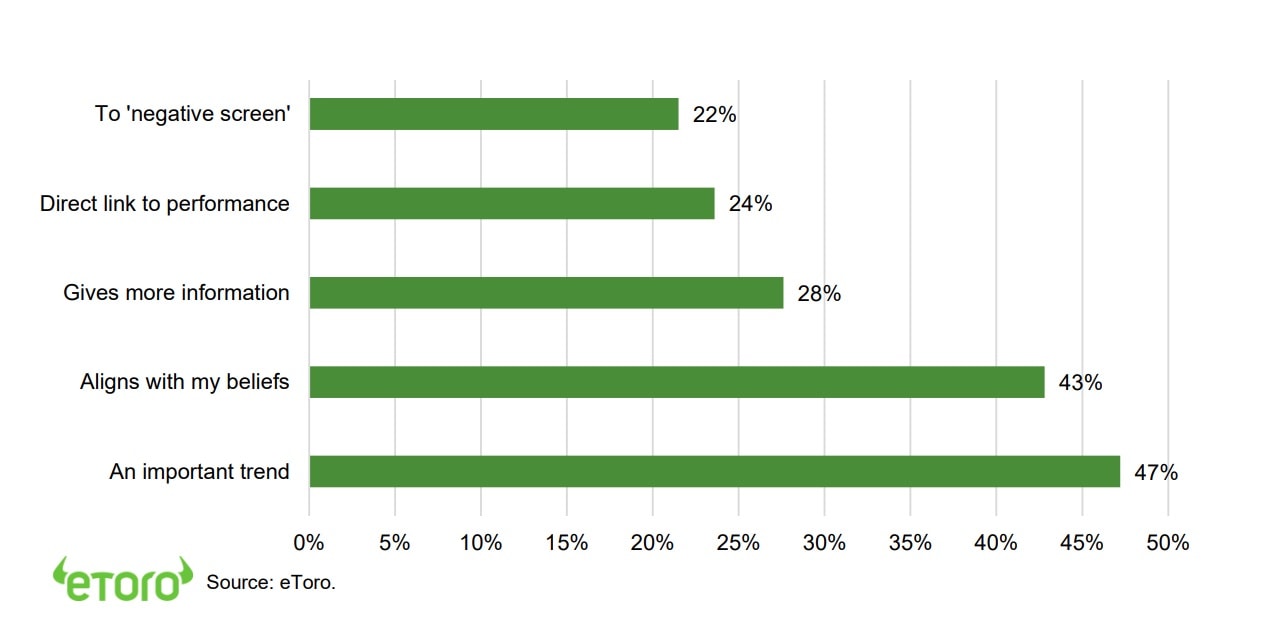

Over 80% of global retail investors consider ESG when investing

Over four fifths of global retail investors are considering ESG criteria today when they invest, according to the latest eToro survey. This polled 10,000 DIY investors in 14 countries, from Australia to Europe and the United States. Only 18% do not consider ESG factors, with the biggest impediment to adoption the priority of the current cost of living crisis, cited by 21%. Environmental issues are seen as the most important, by 55%, followed by governance, 29%. The main drivers are a realisation that ESG is an important future investment theme (47%), aligns with many personal beliefs (43%), and provides additional research information (28%). More broadly, ‘clean tech’ is also the most popular thematic investing category (33%).

Etoro launches ESG scores on 2,700 stocks alongside 13 business involvement flags

Using data from ESG Book, eToro is now providing an E, S, G and combined scores for more than 2,700 stocks. We also now provide business involvement flags for stocks that get more than 5% of revenues from any of 13 ethical categories, from alcohol to gambling and tobacco. These are additional complements to investors fundamental research. Strong ESG scores may be viewed as a further ‘quality’ indicator that can help reduce business risk. Whilst a rising ESG score may be viewed as a possible driver of higher valuation. Low or falling ESG performance can similarly be seen as adding business risk or cutting fair valuations.

Reasons to consider ESG for investing?

Key Views

| The eToro Market Strategy View | |

| Global Overview | The aggressive Fed interest rate hiking cycle and stubborn inflation has boosted uncertainty, recession risk, and hit markets hard. We see this gradually fading, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing GDP growth but still-resilient earnings growth. Valuations led market rout, and now at average levels, and are supported by peaked bond yields and high company profitability. Faster Fed hiking cycle is boosting recession risks. Focus on traditional cash-flows defensives, like healthcare and high dividend. Big-tech supported by structural growth outlook. See a gradual ‘U-shaped’ rebound as inflation falls. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Higher risk cyclical sectors, like discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Strong USD and rising recession fears hitting commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil by slow return of OPEC+ supply and Russia 10% world supply problems. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Clear supply rules a benefit as inflation high. Volatility still high, with the 16th -50% pullback of the last decade. Adoption and development continuing regardless. See Ethereum merge to Proof-of-Stake. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.