Summary

Focus: ‘Fight or flight’ after a weak start?

A weak January has improved the equity market risk/reward, with clear double-digit upside to our year end S&P 500 target. Fed risks are now well priced, earnings rising, valuations cheaper, and investor sentiment more supportive. But it is a new investment world, and likely to see new leadership. We are focused on cheaper sectors, like energy and financials, and overseas markets, from Europe to China. FAANGS offer strong relative value within the tech sector.

Recovery from January losses

Markets firmer after poor January, with Fed risks better priced and earnings strong. GOOGL and AMZN big-tech earnings offset FB’s shock. The Bank of England and ECB turned more hawkish, pushing up bond yields, and weakening USD. Oil is above $90/bbl and commodities with best ever start to year. See our latest presentation, video updates, and twitter @laidler_ben.

Cyclicals and tech in the earnings spotlight

US Q4 earnings season been strong so far, with earnings +26% and 5pp better than forecast. Europe has been even stronger. Cyclical sectors have led growth and tech the ‘beats’.

The better valuation ‘reality check’

January’s sell-off has improved valuation. The S&P 500 forward price/earnings ratio is down 10% to under 20x, and supported by low bond yields and high company profitability.

Checking for recession risks

An ‘inverted’ US yield curve is by far the best indicator of recession risks, the biggest threat to the market. These risks are still low.

Enjoy the palladium rally while it lasts

Palladium (PALL) have surged with the forecast car demand recovery and Russia sanctions risk. Platinum (PPLT) has also benefited. But the long term risks are high on EV transition.

Crypto assets stabilize. ETH and SOL lead

Bitcoin (BTC) stabilized under $40,000 whilst ETH and SOL rebounded. SOL boosted by new token listings, its new Pay app, and ‘Wormhole’ hack funds return. Ankr (ANKR), Bancor (BNT), dYdX (DYDX), 0x (ZRX) were added to the eToro platform, bringing total coins to 49.

Commodities best ever start to the year

Nat gas and oil are driving commodities to their best start to the year ever. Brent crude oil prices are over $90/bbl. as OPEC goes slow on adding new supply. Ag prices are seeing some support from building La Nina weather disruption in key Brazil and Argentina exporters.

The week ahead: A hopefully quieter week

1) Company Q4 earnings from consumer giants KO, PEP, DIS and big-pharma PFE, GSK, AZN.L. 2) US inflation (Thu) seen high but stable at 7.3%, ahead of coming rate hikes. 3) China reopens after holidays, with Olympics on, and focus on efforts to stimulate slower economy.

Our key views: Focus on the upside

We see a positive 2022, but with lower returns and higher volatility than last year. Economic growth is strong and earnings forecasts too low. Valuations should stay high as interest rates rise from still very low levels. We focus on cheaper and cyclical assets that have strong growth and offer defence to valuation risks: like Value equities, small caps, commodities.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.05% | -3.15% | -3.44% |

| SPX500 | 1.55% | -3.77% | -5.57% |

| NASDAQ | 2.38% | -5.61% | -9.89% |

| UK100 | 0.67% | 0.42% | 1.79% |

| GER30 | -1.43% | -5.32% | -4.94% |

| JPN225 | 2.70% | -3.65% | -4.69% |

| HKG50 | 1.36% | 5.51% | 5.02% |

*Data accurate as of 07/02/2022

Market Views

Recovery from sharp January losses

- Markets firmed after a poor January, with Fed hiking risks now better priced and earnings season ahead of forecasts. Strong GOOGL and AMZN big-tech earnings more than offset FB’s shock plunge. Both the Bank of England and ECB turned more hawkish, pushing up bond yields, and weakening USD. Oil prices are now above $90/bbl., with commodities seeing best ever start to year. Focus now on consumer and pharma Q4 earnings and US inflation report.

Cyclicals and tech lead strong earnings

- We are half-way through a good Q4 earnings season. 77% of S&P 500 have beaten forecasts, with 26% earnings growth versus last year, 5 points better than expected. European earnings are even stronger, helping global US stocks.

- The best growth is from ‘cyclicals’, like commodities and industrials, who are most levered to the strong GDP rebound. Tech is reminding of its earnings power, despite the big Meta (FB) miss. It has some of the stronger growth and highest forecast ‘beats’. See Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL).

The better valuation ‘reality check’

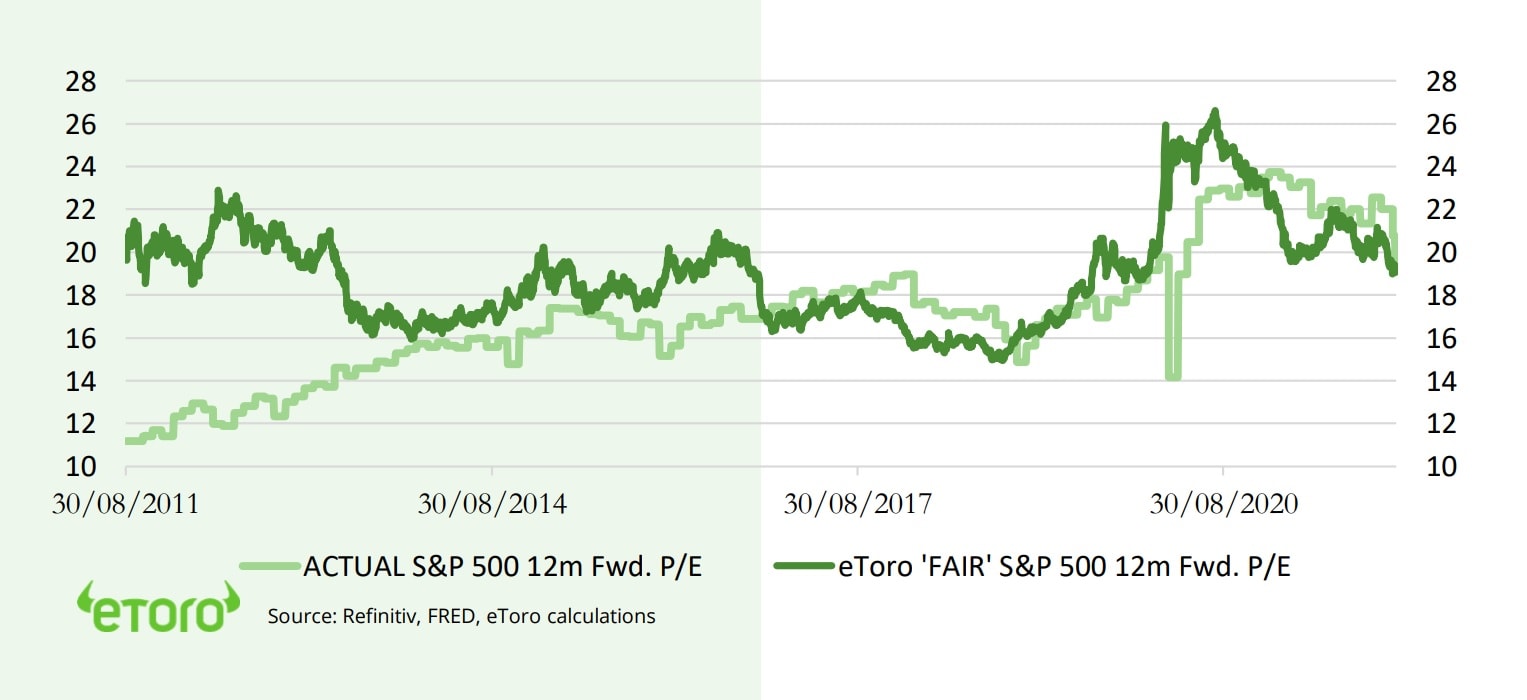

- The S&P 500 January sell-off combined with the continued solid earnings outlook, has cut valuation and therefore market risks. The forward price/earnings (P/E) valuation is down 10% to under 20x, and 25% from its 2020 high.

- P/E’s are still above the five (18.5x) and ten-year (16.7x) averages, as they should be. Company profitability is near records and bond yields still low. Our ‘fair value’ S&P 500 P/E ratio supports this, at over 19x. We focus on cheaper sectors and overseas markets, for both re-rating upside and protection from more valuation pressures.

Checking the US yield curve for recession risks

- History says to buy market weakness unless we are heading for a recession (the ‘R’ word), and a market crash. An inverted US yield curve, with 3-month bond yields above 10-year yields has predicted ten of the last nine US recessions. This is by far the best hit rate around.

- The Fed pushes up short term bond yields as it hikes interest rates, but the market often pulls down long term yields as it worries on the economic growth outlook. We are well off these levels, with the Fed indicator putting recession risks over next year at a low, but rising, 15%.

Enjoy the palladium rally whilst it lasts

- Platinum group metals (or PGM’s) are having a better start to the year after a miserable 2021, when they missed the commodity rally. The rebound is led by palladium (PALL) +25% surge. This is driven by sanctions-risks to largest producer Russia (40% of total) and the forecast recovery of the car market, at 85% of demand.

- Platinum (PPLT) has also rallied (+10%), on its coat tails as a substitute for palladium’s sky high relative price. Autos are 35% of platinum demand. Enjoy the palladium rally now, as long term outlook is terminal with EV substitution.

Valuations compared: eToro ‘Fair Value’ S&P 500 P/E ratio vs Actual (x)

Crypto assets stabilize. ETH and SOL lead

- Bitcoin (BTC) stabilized under $40,000 helped by the broader risk asset recovery. The rebound was led by Ethereum (ETH) and Solana (SOL).

- Solana (SOL) boosted as Coinbase (COIN) listed its ecosystem tokens, Solana Pay app launched, and big ‘Wormhole’ hack saw all funds returned.

- Ankr (ANKR), Bancor (BNT), dYdX (DYDX) and 0x (ZRX) were added to the eToro platform, bringing the number of available coins to 49.

- The Boston Fed and MIT released Phase 1 results of their Project Hamilton CBDC project.

Commodities best ever start to the year

- Brent crude rose over $90 as OPEC+ continued to only modestly increase supply, despite political pressures and high prices, and stoking inflation concerns. European carbon prices hit a new record, and are +150% versus last year, as industrial users switched from pricey natural gas to coal, needing more pollution credits.

- Leading agricultural exporters Brazil and Argentina are seeing weather disruption, worsened by the global La Nina weather phenomenon. This has been driving up ag commodity prices, especially soybeans.

- We think commodities remain in a ‘sweet spot’ of robust demand, tight supply, and increased investor demand for inflation-hedge assets.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.15% | -9.10% | -9.54% |

| Healthcare | 1.60% | -5.63% | -7.77% |

| C Cyclicals | 3.56% | -10.95% | -9.51% |

| Small Caps | 1.72% | -11.75% | -10.82% |

| Value | 1.19% | -3.57% | -2.41% |

| Bitcoin | 8.73% | -11.90% | -14.22% |

| Ethereum | 19.20% | -22.29% | -20.80% |

Source: Refinitiv

The week ahead: A hopefully quieter week

- Company Q4 earnings stay in the spotlight, led by consumer stocks KO, PEP, DIS, ULVR.L, and healthcare giants PFE, GSK, AZN.L, AMGN. US earnings are +26% versus last year.

- USD inflation the economic focus, with prices expected stable at a still very high +7.3%. This supports the Fed’s hawkish stance. The market is now expecting five US rate hikes this year.

- The Chinese markets re-open after new year holiday and Beijing Winter Olympics underway. Bank lending report (Thu) focus as authorities seek to boost the slowing economy.

- Other stock highlights include first investor day of Uber Technologies (UBER) and results from hard-hit Peloton Interactive (PTON).

Our key views: Focus on the upside

- We see a positive 2022, but with lower returns and higher volatility than last year. Earnings forecasts are too low, with GDP growth strong. Valuations should stay supported by still low bond yields and record company profitability.

- US Fed has turned hawkish, with markets now expecting 5 rate hikes this year to combat 7% inflation. This has been largely priced-in. Q4 earnings reports have been beating forecasts. The January has sell-off improved valuations.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.26% | 8.18% | 10.49% |

| Brent Oil | 4.10% | 12.93% | 18.71% |

| Gold Spot | 0.92% | 0.68% | -1.19% |

| DXY USD | -1.84% | -0.25% | -0.51% |

| EUR/USD | 2.69% | 0.75% | 0.67% |

| US 10Yr Yld | 14.17% | 14.57% | 39.95% |

| VIX Vol. | -16.05% | 23.77% | 34.84% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: ‘Fight or flight’ market outlook

Room for a bigger market return as January weakness improves the risk/reward

Global markets started the year on the wrong foot, with the US in the uncharacteristic position of leading major market declines. This took our S&P 500 year-end target of 5,050 clearly into double-digit return territory. The pullback has only improved the risk/return. We see a lower return and more volatile year, but higher earningsmore than offsetting lower valuations. It is a new world, and different assets will do better.

A weak January does not make the year, especially with no recession on the horizon

We normally see three 5% pullbacks a year, and a bigger 10% correction every 18 months. These have been rarer recently, but they happen regularly, and history favours buying them. Markets usually recover reasonably quickly. The exception is in recessions. We do not see a recession, with GDP growth still well above average. Market yield curves, which are the best recession indicators, are comforting. A January fall only leads to a down year a third the time. January 2009 and 2019 declined but were strong overall years.

Things are getting better, not worse. Four things that have improved the risk/reward

1) Markets have come a long way in re-pricing the more hawkish Fed, and now expect at least five interest rate hikes this year. We think we are near the inflation peak. Whilst supply chains are already loosening.

2) Earnings continue to rise. Q4 results will see 25% growth in the US, with likely double that in Europe. Whilst near all sectors are beating analysts’ expectations. 2022 earnings growth expectations are too low.

3) Combined with lower market prices this has cut S&P 500 valuations by around 10%, to under 20x P/E. These levels are well-supported by our ‘fair value’ calculation, with bond yields still low and profits high.

4) Short term measures of investor sentiment, from the VIX to put/call ratio to the AAII investor survey, have fallen to attractive contrarian levels. This leaves plenty of people cautious and able to buy the market.

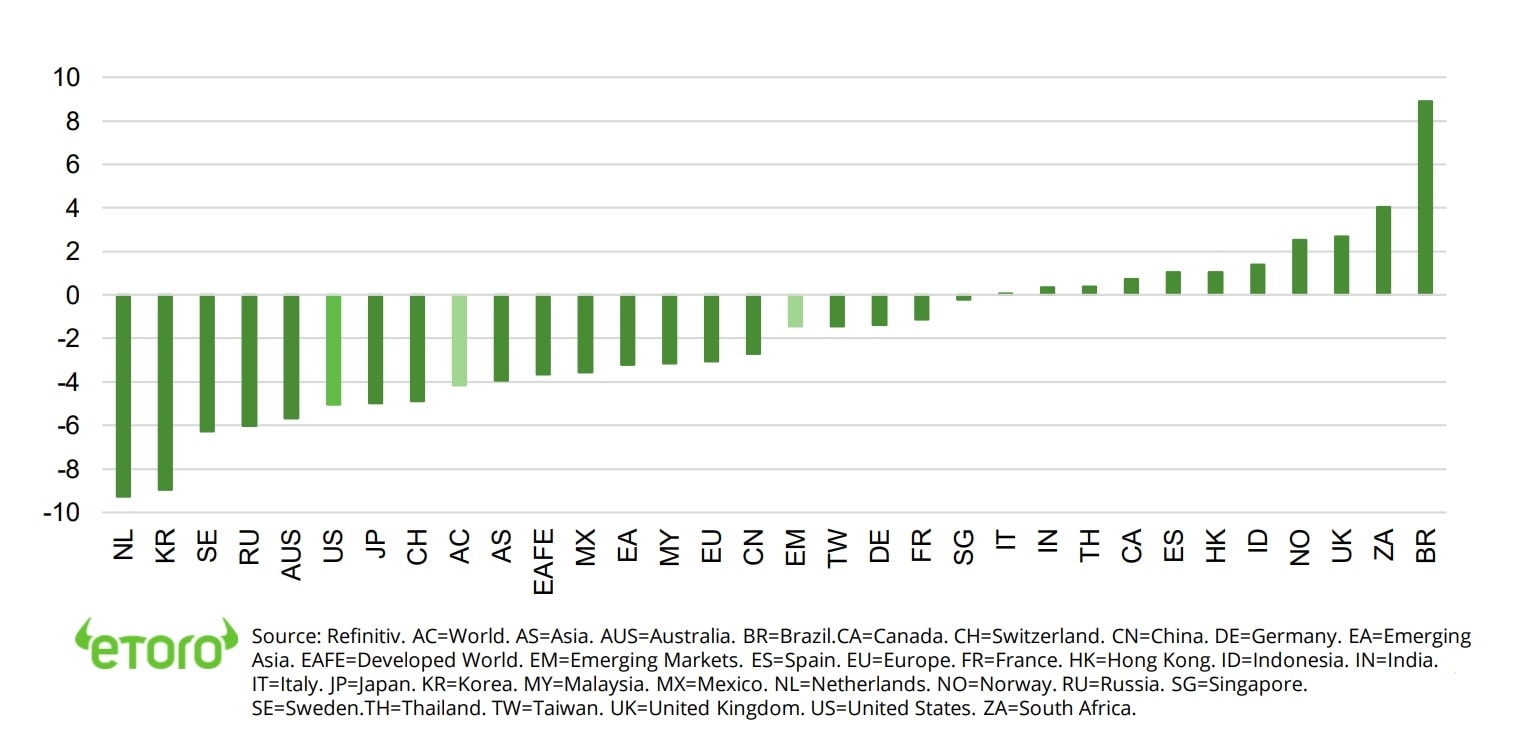

But its still a new investment world, with different sectors and countries set to lead

What led in the prior market environment is unlikely to lead now. The Fed is tightening policy and economic growth will slow. This means we are focused on assets with nearer term growth visibility, that have cheaper valuations. This gives clearer room for higher valuations and reduces risks from downward valuation pressure. Energy and financials are the markets cheapest sectors. Whilst ‘Big tech’ is clear relative value within the tech sector, with decent growth, big competitive ‘moats’ and fortress balance sheets. Many international markets, like Europe, UK, and China are on 30-45% cheaper P/E valuations than the US.

A more difficult start: Major equity market performance this year (%)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Forecast a very rare fourth consecutive positive year in 2022, with naturally lower returns and more volatility than last year. Main drivers of 1) GDP growth to remain well-above average, and supported by further vaccine-driven reopening. 2) Monetary policy tightening to be relatively gradual from very low levels, and inflation pressures to ease during the year. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap, value. Relative caution on fixed income, USD, and defensive equities. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.