Summary

Focus: Collectibles investing can pay

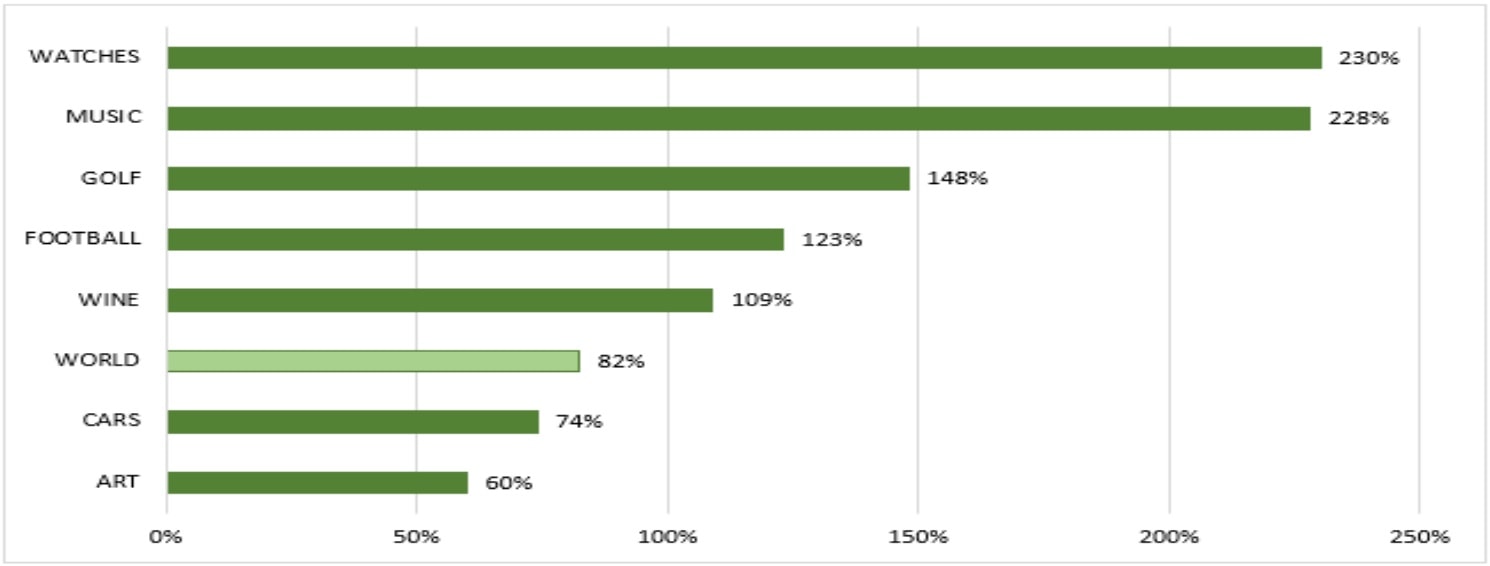

Collectibles investing, from wine to cars, has long been both popular and profitable. It is also increasingly possible indirectly through stocks. Most of our 7 collectible and hobby stock baskets have performed well. Watch and music stocks have beaten global equities near 3x the past five years. Golf and football stocks have also done well. Even the big laggard, Art, may now benefit from the NFT boom. These are complements, not replacements, for broader portfolios as they have limited choice and liquidity. Also see gaming and fashion smart portfolios.

Not the start we wanted. Stay positive`

First week of year saw weaker markets, sharply higher bond yields, and a big rotation away from tech. The catalyst was strong economic growth and lower omicron virus fears alongside a more hawkish Fed. US interest rate hikes are now expected to start in March. We remain positive markets, focused on cheaper cyclicals. See our latest presentation HERE, video updates, and follow us on twitter @laidler_ben.

The two big drivers – bond yields and omicron

US 10-year bond yields are surging, in a repeat of Q1 last year. Equities survived then, as we expect now. Also, omicron hospitalization rates are only 10% prior peaks, opening way to less restrictions and a ‘reopening’ stock rebound.

Healthcare defence as offence

Healthcare (XLV) is an exception to our caution on traditional ‘bond proxy’ defensive sectors like utilities, staples, and real estate. It has cheaper valuations, good growth, the least bond yield sensitivity, and upside catalysts.

Investing in the EV supply chain

Lithium been stand out ‘pick-and-shovel’ play on the EV boom. Supply now following prices, but surging battery demand will keep market tight. Company (ALB to SQM) valuations are a fraction of those further up the supply chain.

Bitcoin sells off. LINK in focus

Bitcoin (BTC) led crypto weakness as hawkish Fed boosted ‘risk-off’ sentiment. Price now 40% down from the November high, and its crypto asset ‘dominance’ near 40% level of 2018. Top-20 coin Chainlink (LINK) bucked downtrend with its plans for 2022 staking and a CCIP release.

Commodities firm. EU energy crisis continues

Commodity prices held firm in a volatile week of omicron fears and Central Bank cross-currents. European gas prices surged 30% to new all-time highs on cold weather and Russia supply fears, even as US prices fell, highlighting the localised nature of the natural gas market.

Energy prices surge again

Brent crude oil prices surged back over $80/bbl. and European NatGas prices rose 30%. Commodities are in a ‘sweet spot’, with omicron driven demand fears now easing even as supply still tight. By contrast, gold is hurt by competition from sharply rising US bond yields.

The week ahead: Q4 earnings kick off

1) US banks JPM, C, and WFC kick off global Q4 earnings season (Fri). See 21% US growth, and 49% in Europe. 2) Fed and inflation focus with US CPI to rise to a new high 6.9% (Wed) and Chair Powell in Congress. 3) China trade a key indicator of global and Chinese economic progress. Last export data +22% and imports +32%.

Our key views: Look through the volatility

We see a positive 2022, but with lower returns and higher volatility than last year. Economic growth is strong and earnings forecasts too low. Valuations should stay high as rates rise from still very low levels. We focus on cyclical assets that benefit from strong growth: like Value equities, small caps, commodities.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.29% | 0.72% | -0.29% |

| SPX500 | -1.87% | -0.74% | -1.87% |

| NASDAQ | -4.53% | -4.44% | -4.53% |

| UK100 | 1.36% | 2.65% | 1.36% |

| GER30 | 0.40% | 2.08% | 0.40% |

| JPN225 | -1.09% | 0.14% | -1.09% |

| HKG50 | 0.41% | -2.09% | 0.41% |

*Data accurate as of 10/01/2022

Market Views

Not the start we wanted. Still positive

- The first trading week of the year saw weaker equity markets, sharply higher bond yields, and a big rotation away from the tech sector. Our favoured cheaper and higher growth segments, like energy, financials, and Europe were resilient. The catalyst was lower omicron fears, rising US wage growth, and a more hawkish Fed. Rate hikes are now expected to start in March. We are positive markets for 2022. See our latest presentation HERE, 1-minute video updates, and follow us on twitter @laidler_ben

Two big macro drivers

- It’s déjà vu with US 10-yr bond yields spiking, as in Q1 last year, with GDP growth strong and Fed increasingly hawkish. Then yields surged 0.8%, Value beat Growth by 10%, but equities still rose. This helps our favoured short-duration and cheaper commodities and financials (XLF), but hurts ‘disruptive’ tech (proxied by ARKK).

- Omicron is driving unprecedented virus cases, causing huge quarantine disruption. But the UK example shows hospitalizations only 10% prior waves. This is a route to lower restrictions and a ‘re-opening’ stock recovery. The UK leads with peaking cases and disruption, but US and especially Asia peaks are still way off.

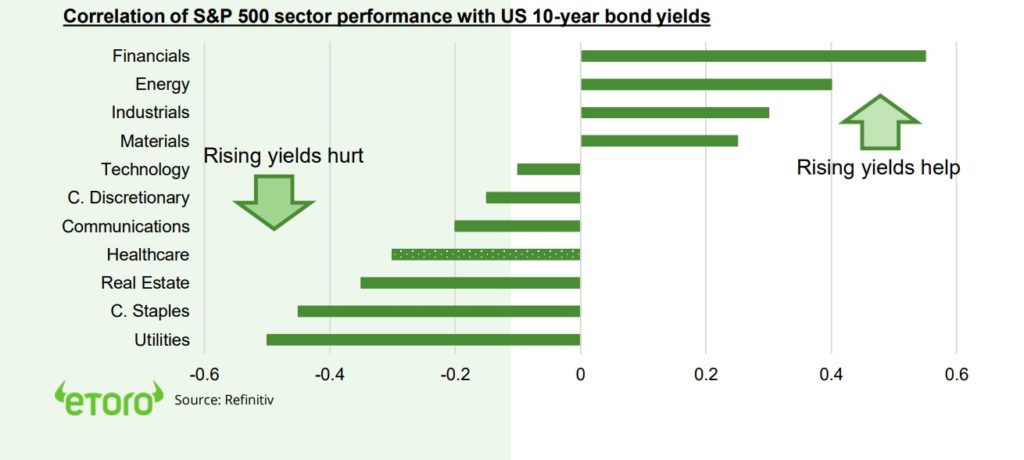

Healthcare defence as offense

- Healthcare (XLV) is an exception to our caution on traditional ‘bond proxy’ defensives like utilities, staples, and real estate. It has cheaper valuations, good growth, the least bond yield sensitivity (see chart), and upside catalysts.

- Endemic covid and mRNA breakthroughs support many. Medical equipment will benefit from more elective surgeries as economies re open. Whilst secular middle-class growth and ageing demographic drivers remain strong.

- US dominates the sector, led by UnitedHealth (UNH), Johnson & Johnson (JNJ), and Pfizer (PFE). Some overseas markets are over-represented. Switzerland, with Roche (ROG.ZU) and Novartis (NVS). Denmark’s Novo Nordisk (NVO) and Coloplast (COLO-B.CO). Also see the smart portfolios @Vaccine-Med and @Diabetes-Med.

Investing in the EV supply chain

- Lithium was the 2021 green commodities standout, up near 200%, and driving producer stocks. Electric vehicle (EV) battery demand surged, with supply tight given prior low prices. This remains an attractive ‘picks-and-shovel’ approach to invest to the accelerating multi decade EV adoption.

- Supply is forecast to rise 30% this year, but demand will grow more. This should keep the lithium market in deficit and support prices. 70% lithium is used for batteries, with c10kg needed for each EV. The earnings outlook for major lithium stocks has tripled and forward P/E valuations are now 40x. This seems high but is still a fraction of pure-play EV valuations.

- Our index of seven major lithium producers has a total market cap. of $100 billion. It includes global leaders Albemarle (ALB), SQM (SQM), Livent (LTHM) and Lithium Americas (LAC). A broad lithium and battery ETF (LIT) also exists, as well as related smart Portfolio @Driverless.

Correlation of S&P 500 sector performance with US 10-year bond yields

Bitcoin starts year weak

- Bitcoin (BTC) led crypto asset weakness as the Fed turned more hawkish, boosting ‘risk-off’ sentiment. Bitcoin is down near 40% from November high, and its ‘dominance’ of crypto asset market cap back at 2018 40% level.

- Top-20 market cap. Chainlink (LINK) bucked the downtrend. This universally connected smart contract blockchain published data showing its exponential 2021 growth. Also its plans this year for staking and the release of a Cross Chain Interoperability Protocol (CCIP).

Energy prices again the spotlight

- Commodity prices were resilient to global market volatility. NatGas was in the spotlight, surging on colder US weather and tight Russian exports to the EU. Nuclear fuel uranium rose on instability in its largest producer Kazakhstan, boosting listed producers (URA, CCJ). Whilst gold fell, as it is increasingly challenged by the competition from higher US bond yields.

- Brent crude oil prices surged over $80/bbl., up more than $10 in a month, as omicron growth fears eased and OPEC+ continued to add supply back only modestly. Energy (XLE) is the cheapest equity sector, with near-best earnings growth. We see high-for-longer oil prices with supply constrained by low investment, but demand growing. Related inflation fears are overdone, with expectations well-controlled and economies much ‘de-commoditised’.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -4.99% | -5.24% | -4.99% |

| Healthcare | -5.24% | -0.83% | -5.24% |

| C Cyclicals | -2.54% | -3.60% | -2.54% |

| Small Caps | -2.92% | -4.05% | -2.92% |

| Value | 0.58% | 3.50% | 0.58% |

| Bitcoin | -11.98% | -17.45% | -11.98% |

| Ethereum | -14.43% | -27.21% | -11.43% |

Source: Refinitiv

The week ahead: Q4 earnings kick off

- US financials JPM, C, WFC, and BLK to kick off Q4 global earnings season (Fri). We expect overall earnings growth above the consensus +21% vs last year for US and +49% for Europe.

- The Fed and inflation focus. US inflation seen +6.9% (Wed) versus last year, a new 4 decade high. Fed chair Powell speaks in Congress (Tue) at his re-nomination confirmation hearing.

- See China (Thu) trade data. Is a key barometer of the global recovery and its own stabilization. Exports +22% last month, and imports 32%. Is world’ no1 manufacturer and commodity user.

- Expect stock announcements from the big ICR retail and JP Morgan Healthcare conferences.

Our key views: Lookthrough the volatility

- We see a positive 2022, but with lower returns and higher volatility than last year. Earnings forecasts are too low, with economic growth still strong. Valuations should stay high, with interest rates rising from very low levels.

- Virus fears are dampening the growth outlook, but economies are increasingly resilient to this. Similarly, the US Fed turned more hawkish, to combat inflation. This will be a lower and slower rate upcycle than historic, and markets resilient.

- We focus on cyclical assets that benefit most from decent growth: commodities, crypto, small cap, and value. We are more cautious on fixed income, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.13% | 4.53% | 2.13% |

| Brent Oil | 5.12% | 8.85% | 5.12% |

| Gold Spot | -1.86% | 0.75% | -1.86% |

| DXY USD | -0.24% | -0.37% | -0.24% |

| EUR/USD | -0.09% | 0.40% | -0.09% |

| US 10Yr Yld | 25.38% | 28.19% | 25.38% |

| VIX Vol. | 8.94% | 0.37% | 8.94% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Investing in collectibles and hobbies

How to invest in your hobbies through public markets -Seven collectibles and hobby indexes

Collectibles from art to cars have long been popular with investors and have generated significant long term returns. They can also be invested in through the public markets, and the returns have been strong. We created equal-weighted indices of 6-8 global stocks exposed to seven common collectibles or hobbies (see chart). Most have outperformed global equities over the past five years. The caveats are that 1) the available stocks for each hobby is small and not well diversified, and many do not have a pure-play focus. 2) Some stocks were quite small, further amplifying risks. This means that ‘hobby’ investing should be a complement, not a replacement, for broader investment portfolios. Our list is not exhaustive and other ‘hobbies’ are available, through smart portfolios @InThe Game (Gaming) or @FashionPortfolio (Shopping).

Watches: The top performer has ridden the coat-tails of the boom in luxury stocks. Few listed watch pure plays are available. Most are within luxury groups like Richemont (CFR.ZU), where watches are 17% sales, LVMH (MC.PA), and Kering (KER.PA). Or supplymovements, like Swatch (UHR.ZU) does for luxurymakers.

Music: The industry has seen a dramatic renaissance driven by soaring streaming and live entertainment (pre-pandemic) revenues. The investment universe is also broadening with the recent stock market listings of top record labels Universal and Warner (WMG), alongside likes of Spotify (SPOT) and Live Nation (LYV).

Golf: This index saw a massive quintupling from its post-pandemic low to recent highs as it was a key lockdown beneficiary. But it is one of the most difficult to invest in through the stock market, with stocks ranging from Drive Shack (DS) to retailer Dicks Sporting Goods (DKS) and equipmentmaker Calloway.

Football: Clubs, like Manchester United (MANU) and Juventus (JUVE.MI), were hard hit by covid restrictions on match revenue. But big equipment and kit makers like Nike (NKE), Adidas (ADS.DE), Puma (PUM) saw strong demand and pricing offset supply woes. December’s Qatar World Cup will likely further boost sales.

Wine: The industry is increasingly dominated by conglomerates like Constellation (STZ), with brands from Mondavi to Woodbridge; LVMH (MC.PA), which owns Moet & Chandon and Krug; and Jacob’s Creek and Campo Viejo owner Pernod-Ricard (RI.PA). This reflects the very capital-intensive nature of the business.

Cars: The performance car segment has underperformed as niche brands face the very high costs of making the carbon transition and have seen supply chain disruptions. But the listed universe is expanding, ranging from Ferrari (RACE), Porsche (PAH3.DE), Aston Martin (AML.L), to Liberty Formula One (FWONA).

Art: The biggest laggard and toughest to invest in through the stock-market, where stocks range from Art Basel operator MCH to stock photographer Shutterstock. None of the big auctioneers, for example, are still listed. But art is seeing big changes with growth of non-fungible tokens (NFTs), and associated equities.

Listed collectibles and hobbies* vs global equities (5-years)

Source: Refinitiv.*eToro created collectible/hobby baskets of 6-8 simple-weighted stocks. World=MSCI ACWI index

Key Views

| The eToro Market Strategy View | |

| Global Overview | Forecast a very rare fourth consecutive positive year in 2022, with naturally lower returns and more volatility than last year. Main drivers of 1) GDP growth to remain well-above average, and supported by further vaccine-driven reopening. 2) Monetary policy tightening to be relatively gradual from very low levels, and inflation pressures to ease during the year. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap, value. Relative caution on fixed income, USD, and defensive equities. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.