Summary

Judging earnings versus valuations

We present a valuation and earnings matrix to judge S&P 500 risks. Valuations fallen below average, limiting risks unless see a big recession. But earnings growth is still seen a resilient 10%, and the main risk now. Profits typically fall over 20% in a recession. Caution for now as recession risks rising. But base case is for easing inflation, and a growth slowdown not recession. This gives valuation-led market upside, offsetting modest cuts to the company profits outlook.

Now officially a bear market

S&P 500 plunged well into ‘bear’ market territory, as Fed stepped up interest rate hikes, alongside others from UK to Switzerland and ECB struggled to contain peripheral bond yields. This pushed up economic recession fears significantly. The USD surged to new highs, 10-year bond yields are well over 3%, oil fell sharply, and crypto asset prices collapsed. Watch Fed this week. See latest presentation, video updates, and twitter @laidler_ben.

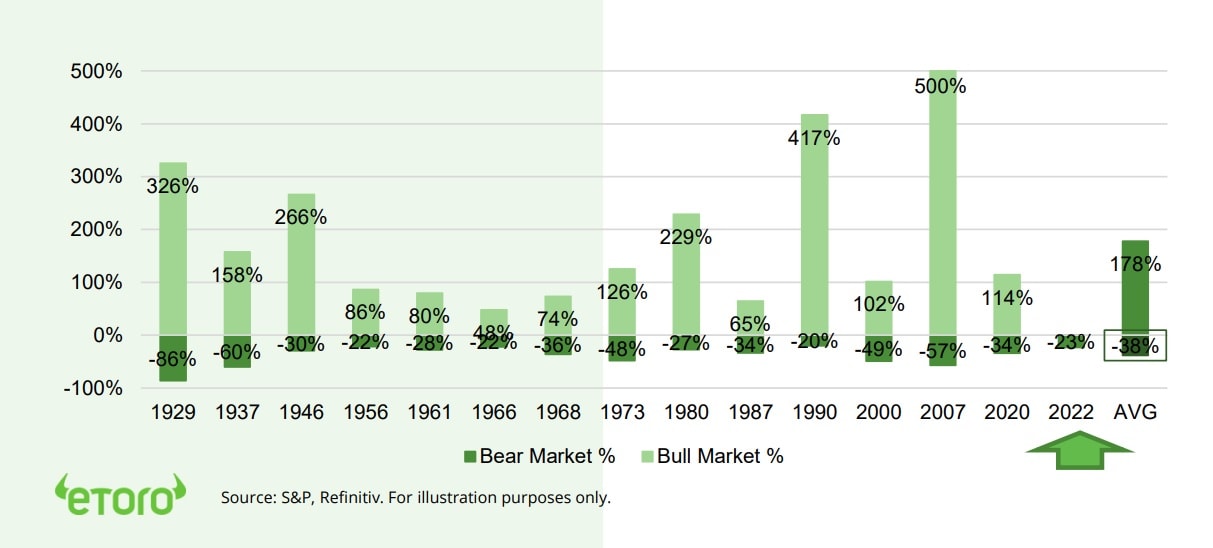

History says bear market has further to go

S&P 500 is now in bear market territory. History says there is c20% further to fall, with earnings outlook a key market decider. Longer term, bull markets are 4x bigger and longer.

Differences with the 1970’s

Are many parallels today with the ‘stagflationary’ 1970’s, but also two big differences. Central bank credibility and anchored inflation expectations. Gives hope for a shorter downturn.

Housing to lead the slowdown

Property prices are high and mortgage rates now soaring. This is starting to slow housing markets, impacting whole supply chain from builders (LEN) to brokers (RDFN).

The surging petrol/gas price tax

Petrol (gas) prices surging globally, impacting consumers, central banks, politicians. Winners are oil refiners from MPC to VLO.

The crypto asset crash

Bitcoin (BTC) crashed to a new 18-month low below $20,000 and less than 1/3 November price high, in a broad crypto sell-off. Driven by equity market volatility and US lender Celsius halting withdrawals. Contagion saw COIN lay off staff, and MSTR deny financing pressures.

Recession risks take commodity toll

Commodities pulled back as recession risks rose and strong US dollar increased further. Gold was undermined by surging US bond yields. Natgas volatility rose on Freeport LNG and Nord Stream disruption. ‘Less-bad’ China economic data was a support for copper and aluminium.

The week ahead: Is growth holding up?

1) Focus switches from Fed to flash PMI global growth and inflation. 2) ‘Stagflation’ leader UK inflation and retail sales. 3) Consumer earnings from builders (LEN), restaurants (DRI), car retail (KMX), logistics (FDX). 4). US Fed bank ‘stress test’ results. 5) The US Juneteenth holiday.

Our key views: Managing recession risks

Markets saw the biggest sell-off since 2020 covid crash, as aggressive central banks are raising recession risks, to slow inflation. See a ‘less bad’ gradual easing of inflation risks, and a slowdown not recession driving ‘U-shaped’ rebound. Focus on cheap and defensive assets to be invested in ‘new’ world but manage rising risks. See Value, commodities, and high dividends.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -4.79% | -4.39% | -17.75% |

| SPX500 | -5.79% | -5.81% | -22.90% |

| NASDAQ | -4.78% | -4.90% | -30.98% |

| UK100 | -4.78% | -5.06% | -4.99% |

| GER30 | -4.62% | -6.12% | -17.37% |

| JPN225 | -6.69% | -2.90% | -9.82% |

| HKG50 | -3.35% | 1.73% | -26.83% |

*Data accurate as of 20/06/2022

Market Views

Markets nerves return

- S&P 500 plunged well into ‘bear’ market territory, led by energy stocks, as Fed stepped up rate hikes, with others from UK to Switzerland, and ECB struggled to contain bond yields. This raised economic recession fears significantly. The US dollar surged to new highs, 10-year bond yields are well over 3%, Brent oil slumped, and crypto asset prices collapsed. Page 6 for Resources guide of reports, presentations, videos, twitter.

History says bear market has further to go

- The S&P 500 is now in bear market territory, over 20% down from its highs, and history tells us there is still a way to go yet. Recession risks are rising and could see this market fall another 20%.

- The average S&P 500 bear market is few and far between, lasts 19 months, and sees a 38% drop. This one has only lasted five months and is down 21%. The earnings outlook is decider from here.

- Eventual bull markets are built on bears though, and typically are four times bigger and longer. We remain invested, for a gradual U-shaped recovery, but defensive, to manage rising risks.

Differences with the 1970’s

- Central Banks are getting on the inflation-fighting front-foot, with Fed’s cathartic 0.75% hike and Bank of England 5th straight rate rise. Amidst the many real parallels with ‘stagflationary’ 1970’s, there are 2 big differences giving hope today. 1) Central bank credibility seen in the reactions to every Fed utterance and its forward guidance.

- 2) The resulting anchoring of longer term inflation expectations. These are a little over 2% in the US today versus inflation of 8.6%. This is ultimately positive for markets, implying a shorter, sharper economic cycle than the lost-decade of the 1970’s. Be invested for recovery, but defensive given risks.

Housing to lead the slowdown

- Soared global property prices and now rising mortgage rates are building pressure on housing markets. These are set to lead the slowdown. Our US housing misery index is at 40-yr highs, and new home sales already plunging. This is a cyclical not structural issue for most, not 2007, with household balance sheets secure and mortgage rates fixed.

- But national differences are big, and equity markets ‘supply chain’ of exposed stocks is long, from homebuilders (like LEN) to brokers (RDFN). Most vulnerable are markets with floating-rate mortgages, high debt ratios, and rising rates.

The surging petrol/gas price tax

- Petrol (gas) prices are surging globally on pent-up travel demand and refining limits. This complicates the lives of consumers, central bankers, and politicians. It’s a tax on consumption, diverts spending from other areas, and boosts inflation.

- Petrol prices have outpaced oil given a shortage of refining capacity and China’ export controls. This situation may worsen, with forecasts for an above average US hurricane season, and half US refining capacity on the gulf coast. The winners for now, are oil refiners from Marathon (MPC) to Valero (VLO).

History of S&P 500 ‘bull’ and ‘bear’ markets (% change)

Crypto crushed as contagion mounts

- Bitcoin (BTC) prices dramatically fell to a new 18- month low under $20,000, and less than 1/3 of the November peak. Driven by perfect storm combination of further sharp equity market falls, US crypto lender Celsius halting withdrawals, and a broad contagion across the asset class.

- Coinbase (COIN) announced 18% layoffs, joining cuts at BlockFi and Crypto.com. MicroStrategy (MSTR) denied a big margin call, saying it can withstand volatility. Whilst crypto hedge fund Three Arrows said was facing funding issues.

Rising recession risks take a toll

- Commodities fell with rising global recession risks and USD at 20-year high. Brent oil fell -7% to and energy equities -17%. Traditional ‘safe haven’ gold was undermined by competition from surging US bond yields. EU carbon prices (KRBN) rose as lawmakers struck deal to deepen world’s most developed emission trading system.

- Natgas volatility continued as shutdown of giant Freeport LNG export plant significantly extended, cutting US gas demand, but worsening European supply fears. These were added to with capacity cuts to the Nordsream I pipeline. Both imperil efforts to build EU inventories ahead of winter.

- China-centric commodities, like copper and aluminium, were boosted by ‘less-bad’ Chinese May industrial production and auto sales data as economy starts reopening from covid lockdowns.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -4.89% | -9.97% | -31.39% |

| Healthcare | -4.17% | -8.48% | -17.87% |

| C Cyclicals | -5.86% | -10.94% | -33.60% |

| Small Caps | -7.48% | -9.49% | -25.81% |

| Value | -6.57% | -10.61% | -16.19% |

| Bitcoin | -29.43% | -31.95% | -56.90% |

| Ethereum | -35.55% | -47.26% | -71.19% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: How is growth doing?

- After a busy Central Bank week the focus is on how growth is holding up, and potential signs of peaking inflation, with the monthly flash PMI’s in US, Europe, UK, Japan, and Australia.

- The UK is the global ‘stagflation’ poster-child, with high inflation and struggling economy. It reports inflation and retail sales this week.

- US earnings to give macro insights. from homebuilders (LEN), to restaurants (DRI), car sales (KMX), logistics (FDX), meme stocks (BB).

- 2022 Fed bank ‘stress test’ probes the likely strong ability of 34 largest US banks to manage an increasingly less hypothetical recession.

- US markets closed Monday for ‘Juneteenth’ holiday that commemorates end of slavery.

Our key views: A ‘U-shaped’ recovery

- Saw biggest sell-off since the 2020 covid crash. Concerns balanced between bond yields and valuations, and recession risk and earnings. See fundamentals stressed but secure, with slowdown not recession, on resilient corporates and consumer. But recovery U, not V, shaped.

- Focus on cheap and defensive assets, to be invested in ‘new’ world, but manage rising risks.

- Value, commodities, and high dividends and healthcare. Cautious on bonds, and ease back on Financials given rising recession risk.

| 1 Week | 1 Month | YTD | |

| Commod* | -6.39% | -2.89% | 27.84% |

| Brent Oil | -6.82% | 0.62% | 45.77% |

| Gold Spot | -1.79% | -0.19% | 0.61% |

| DXY USD | 0.48% | 1.45% | 9.05% |

| EUR/USD | -0.20% | -0.64% | -7.70% |

| US 10Yr Yld | 7.30% | 38.18% | 172.24% |

| VIX Vol. | 12.18% | 5.78% | 80.78% |

Source: Refinitiv. * Broad based Bloomberg commodity index

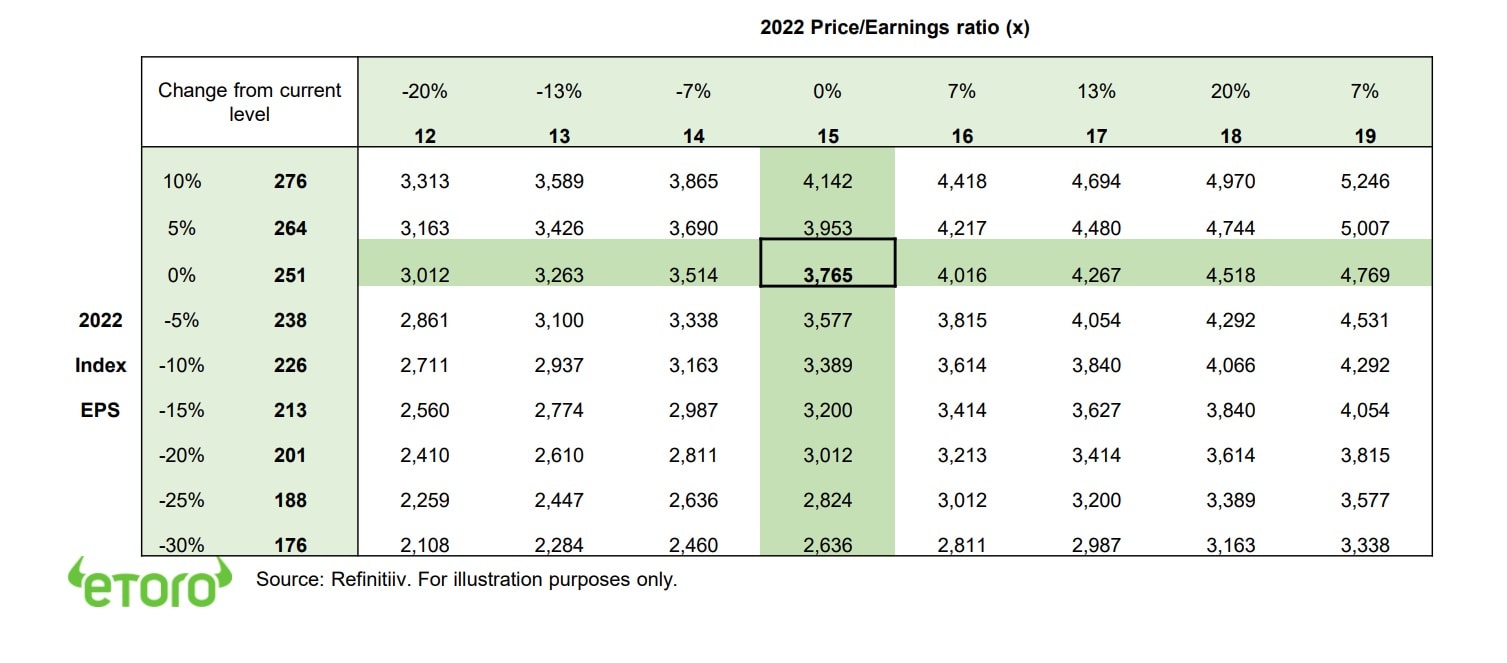

Focus of Week: judging risk versus reward

We present a valuation and earnings matrix to judge S&P 500 upside and downside risks

The S&P 500 is in bear market territory. Valuations have already plunged and driven the market sell-off, as bond yields soared. The earnings outlook has stayed firm despite rising economic recession risks. There are only two ways to make money in markets: company earnings and the valuation we put on those. We focus on this interplay (see table) and the roadmap it gives to the level of the S&P 500 index. More downside than upside short term, with earnings risks only part priced in. Focus on defensives sectors and markets, from healthcare and staples, to UK or counter-cyclical China. These have cheap valuations and resilient – or already depressed – profits. But valuations to lead an eventual ‘relief’ rally if avoid recession.

Valuations already fallen to below 10-year average levels, but still have downside if see a recession

S&P 500 valuations have plunged to a price/earnings ratio near 15x. This is down dramatically from the recent peak of 23x and is below the 10-year average of 16x. This is now supported by current 3.2% US 10- year bond yields, which give a ‘fair value’ P/E of 16x. So, valuations are fair but not cheap, especially with expectations still for 10% growth this year. The 2020 covid crash valuation low was 13x, albeit very briefly.

Earnings have been extraordinarily resilient but typically fall over 20% if we see a recession

Corporate earnings are the focus, remaining rock-solid this year, with companies not receiving the recession memo. Analysts are still forecasting 10% S&P 500 profits growth. Revenue growth has been running at 10%, profit margins near record levels as been able to navigate cost increases, whilst capex and M&A trends have been resilient. This is broadly sustainable if this is a economic slowdown not recession. This is our low-conviction base case, with the strong start point and robust consumers and corporates. But the longer the inflation spike and central bank interest rate hikes go on the higher recession risks are. Even a relatively mild recession could see earnings fall at least the c20% they have done in prior contractions.

Risks are asymmetric in short term. Focus on low valuations and defensive cash flows

Downside risk short term, with earnings fall part priced in. But valuations lead eventual slowdown ‘relief’. What is priced in? Assuming 10-yr average 16.9x P/E, markets already pricing over a 10% earnings decline. Worst case? Recession cuts earnings 20% and a panic multiple fall to 2020 lows 13x see S&P 500 down 25%.

Base case? Earnings to ease 10%, but not collapse, with growth slowdown not recession. Cooling inflation risks and bond yields combine to boost valuations towards 10-year average 17x. S&P 500 rises 10%.

S&P 500 Index level according to 2022 earnings and P/E valuation outlook

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and resilient earnings growth outlook. Valuations have now fallen back to average levels, and are supported by peaked bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after lagging for a decade, whilst big-tech supported by structural growth outlook. See overseas markets leading in global ‘U-shaped’ rebound. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks rising with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities cushioned by greater weight of cheap cyclical sectors, lack of tech, and 25% cheaper valuations versus US. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Cyclical sectors, like consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Volatility very high, and correlation with weak equity prices risen. Asset class seeing 16th -50% pullback of last decade. Upside from 1) continued Institutionalization of cryptoassets, from allocations, to investment products, and regulation. Also, 2) the steady broadening of the use cases and market development, from Ethereum PoS, to DeFi to payments |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.