Summary

Focus: Taking your investments global

International markets are cheaper, more cyclical, faster growing, but have extra risks. Today’s new investing world needs more diversification than just US and tech that has worked so well the past decade. Investors are very focused on home markets and the US (which is 4x bigger than its economy). Risks of going global can be higher, from currencies to politics, but it has never been easier. Favoured markets China (MCHI), UK (ISF.L), and Developed Europe (EZU).

Markets whipsawed by invasion of Ukraine

Russia’s invasion of Ukraine whipsawed markets. S&P 500 entered a 10% ‘correction’, and NASDAQ near 20% ‘crash’. Oil rose to $100, whilst Fed rate hike expectations eased. Safer havens, from USD to gold, initially rallied. Then markets saw some stabilization on limited Russia sanctions and with investor pessimism already extreme. We are positive markets. See latest presentation, video updates, and twitter @laidler_ben.

Eye of the geopolitical storm

Markets in the eye of a geopolitical storm. But history shows geopolitics, whilst tragic, has little lasting global market impact. Fundamentals are resilient and sentiment depressed.

Oil spikes to $100/bbl. Set for high-for-longer

Brent (OIL) prices spiked to $100/bbl. for first time since 2014. It is a triple-hit to the global economy, of higher inflation, lower economic growth, and greater uncertainty.

The direct Ukraine crisis impacts

Direct impacts of Ukraine crisis is on Eastern European assets and commodities. Russia (RSX) only 2% global GDP and <1% of equities. Exposed overseas stocks (PM, B4B.DE) firm.

The different female investor wave

Female investor numbers are surging, often misunderstood, and invest differently. We polled 9,500 female investors globally.

Crypto assets driven by equity volatility

Crypto assets were driven by broader markets volatility and saw double-digit price falls before a partial rebound. Bitcoin revisited a 50% fall from its November highs; it’s 16th of the past decade. Inflation-hedge BTC competitor gold benefitted from surging safer-haven demand.

Russia supplies 10% the world’s oil

Russia’s invasion of Ukraine saw Brent oil soar to over $100/bbl., it’s highest since 2014. Whilst Europe’ natgas prices initially surged 70% before easing. Russia pumps 10% of the world’s oil and dominates European natgas sales. Commodities are best performing asset this year.

The week ahead: All eyes on Ukraine

1) Ukraine will continue to dominate markets. OPEC meets Wednesday. 2) US non-farm payrolls (Fri) seen easing to 350k. 3) Earnings focus on US tech’s CRM, AVGO, SNOW and retailers COST, TGT. 4) Big China week with PMI data due and ‘two sessions’ government meeting.

Our key views: Need for less uncertainty

Geopolitical risks have added to those from high inflation and a tightening interest rate outlook. Markets need to see lower uncertainty – from Ukraine or the March 16th Fed meeting – to allow strong fundamentals to reassert. Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.60% | -1.92% | -6.27% |

| SPX500 | 0.82% | -1.06% | -8.01% |

| NASDAQ | 1.08% | -0.55% | -12.47% |

| UK100 | -0.32% | 0.31% | 1.42% |

| GER30 | -3.16% | -4.91% | -8.29% |

| JPN225 | -2.38% | -0.90% | -8.04% |

| HKG50 | -6.41% | -3.32% | -2.69% |

*Data accurate as of 28/02/2022

Market Views

Markets whipsawed by invasion of Ukraine

- Russia’ invasion of Ukraine whipsawed markets. S&P 500 entered 10% ‘correction’ territory, and NASDAQ near a 20% ‘crash’. Oil prices rose over $100, whilst Fed rate hike expectations eased. Safer havens, from USD, government bonds, to gold initially rallied. Then some stabilization on limited Russia sanctions and extreme investor pessimism. This week focus on Ukraine, US payrolls, Chinese growth. Global fundamentals are robust, but need easing uncertainty. See Page 6 for our Resources guide of reports, webinars, presentations, videos, and twitter.

Eye of the geopolitical storm

- The Ukraine invasion drove S&P 500 into -10% correction territory and NASDAQ near a -20% crash. Markets are in the eye of a geopolitical storm. But history shows geopolitics, whilst tragic, has little lasting global market impact.

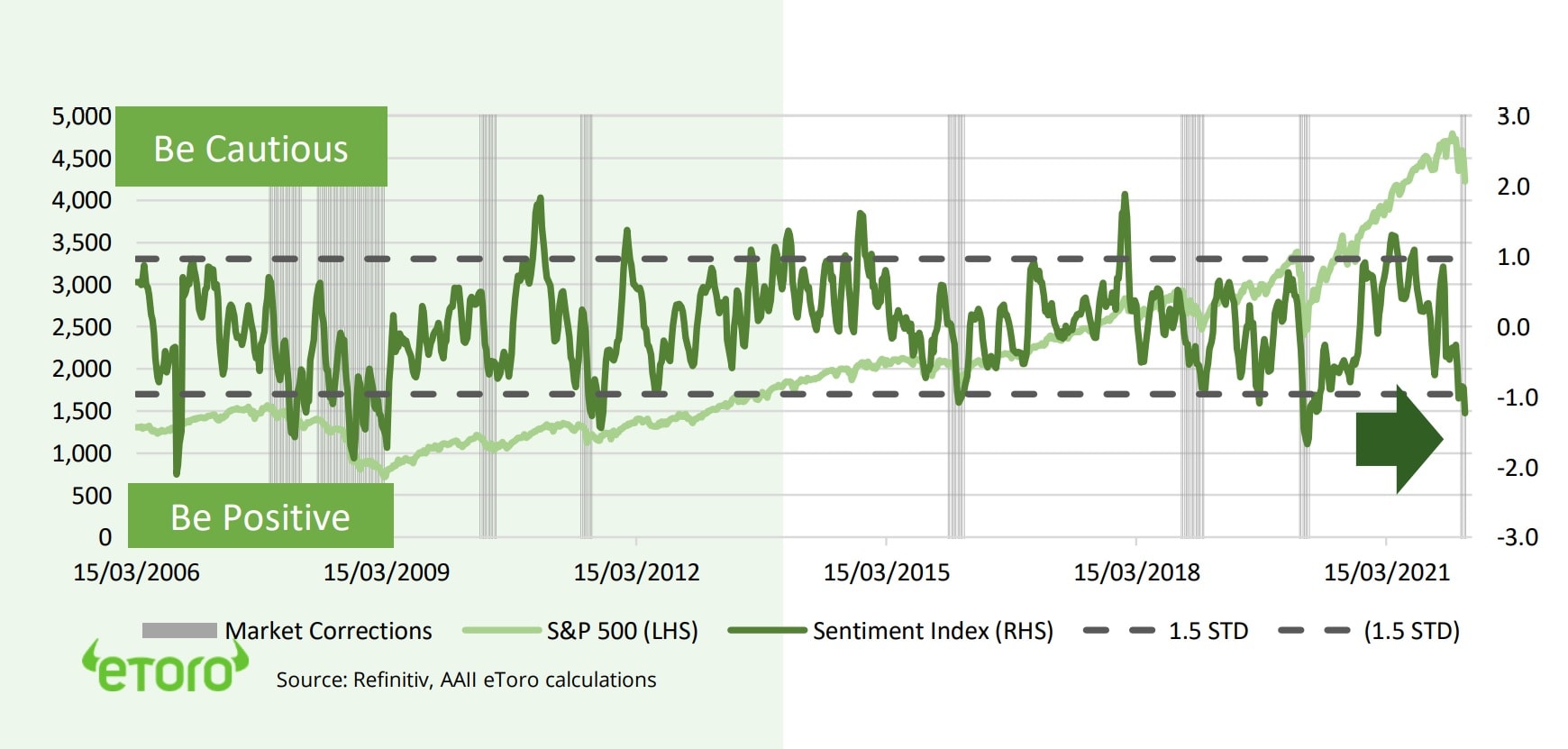

- Global fundamentals are secure and our contrarian sentiment indicator at very rare lows. More risk averse investors should consider dollar-cost averaging to both manage volatility and capture an eventual recovery. The more risk tolerant, see Value sectors like energy (XLE) and financials (XLF), and big-tech (XLK).

Oil spikes over $100. Set for high-for-longer

- Brent (OIL) prices spiked over $100/bbl. for first time since 2014 on geopolitical tensions. This is a triple-hit to the global economy, with a toxic combination of higher inflation, lower economic growth, and greater investor uncertainty.

- But global growth is strong, a slowdown buffer, and investors prepped for high inflation. We see high-for-longer commodity prices (DJP), with current ‘risk premium’ the latest driver of a tight market. Supply risks are low. Russia reliably supplied West through the cold war. Sanctions would also make global inflation much worse.

The direct Ukraine crisis impacts

- Direct impacts of the Ukraine crisis has focused on Eastern European assets and commodities. Russia only 2% global GDP and <1% of equities.

- Russian equities bore brunt of initial reactions, led by sanctions exposed banks (like SBER.L), with commodity stocks (like OGZD.L) more resilient. The Ruble (RUB) fell, though cushioned by high real interest rates. Global stocks with Russia exposure were more resilient, like Philip Morris (PM) and Germany’s Metro (B4B.DE).

The different female investor wave

- ‘Female investor numbers are surging, often misunderstood, and often invest differently. We polled 9,500 female investors in 14 markets, from US to Australia and around Europe.

- It shows 48% are new to markets the past two years, extending roles as owners of household finances into the investing world. Green energy is the favourite sector. Crypto set to be the top asset held. Whilst they are ‘future proofing’ by looking at commodity and real estate assets.

- This is set to stay, with the most regularly investing monthly, and many ‘super-savers’. This growing female influence is also seen more broadly in the rise of the female company CEO.

eToro Composite Investor Sentiment Index vs S&P 500

Bitcoin backto a 50% plunge since November

- Crypto assets saw initial double-digit losses for the week, before partially recovering. This took the asset class market cap. down to $1.6 trillion. Performance was driven by the volatile global markets environment and the recently more heighted correlation with equities.

- Bitcoin fell back in the week to a 50% fall from its November $67,000 high. This is the average correction seen of the 16 over the last decade.

- ‘Safer-haven’ and inflation-hedge competitor gold had a better week as investors added to lower risk assets such as USD, bonds, and gold.

Russia supplies 10% the world’s oil

- Russia’s invasion of Ukraine saw Brent oil soar to over $100/bbl., it’s highest since 2014. Whilst European natgas prices initially surged up to 70% before easing. Russia pumps 10% world’s oil, and dominates European natgas sales.

- Other Russia-centric commodities, from palladium to platinum eased, having already rallied sharply this year. Wheat prices were the exception, rallying sharply, with both Russia and Ukraine major global exporters.

- The broad-based Bloomberg commodity index is up 13% this year, leading all asset classes. We think commodities remain in a ‘sweet spot’ of robust demand, tight supply, and increased investor demand for inflation-hedge assets.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.46% | 0.72% | -12.85% |

| Healthcare | 2.77% | 2.68% | -8.65% |

| C Cyclicals | -1.40% | 0.51% | -12.47% |

| Small Caps | 1.57% | 3.26% | -9.10% |

| Value | 0.66% | 0.60% | -4.01% |

| Bitcoin | -3.00% | 4.70% | -18.11% |

| Ethereum | -3.35% | 7.06% | -28.03% |

Source: Refinitiv

The week ahead: All eyes on Ukraine

- Russia’s invasion of Ukraine will dominate markets. This will include the war itself, the sanctions response of both sides, and OPEC’s meeting (Wed) with oil prices over $100/bbl.

- Of secondary importance will be the monthly US non-farm payrolls report (Fri). A new jobs slowdown to 350,000, steady 5.7% wage growth, and a stable 4% unemployment rate.

- The earnings view focuses on US big-tech stocks CRM, AVGO, SNOW and retailers COST, TGT. S&P 500 Q4 profits have risen by 32% with revenues up 15%. Tech has led ‘surprises’.

- It’s a big week in China with it’s struggling PMI seen inching up to near 51, whilst it’s annual ‘two sessions’ government conference may announce an annual 6% GDP growth target.

Our key views: Need for less uncertainty

- Geopolitical risks have added those from high inflation and a tightening interest rate outlook. Markets need to see lower uncertainty – from Ukraine or the March 16th Fed meeting – to allow the fundamentals to reassert themselves.

- Earnings are key focus. Q4 results were strong and economies are reopening. This should offset valuation pressures. They have fallen significantly, and Fed risks are better priced.

- Focus on cheap and cyclical assets that benefit from good growth and stubborn inflation: Value, commodities, crypto. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 0.69% | 4.90% | 13.34% |

| Brent Oil | 1.01% | 6.39% | 21.32% |

| Gold Spot | -0.64% | 5.65% | 3.23% |

| DXY USD | 0.52% | -0.75% | 0.60% |

| EUR/USD | -0.43% | -1.11% | -0.88% |

| US 10Yr Yld | 4.09% | 19.72% | 45.50% |

| VIX Vol. | -0.58% | -0.25% | 60.22% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Risks and rewards to investing overseas

Cheaper, more cyclical, faster growth, but with extra risks to consider

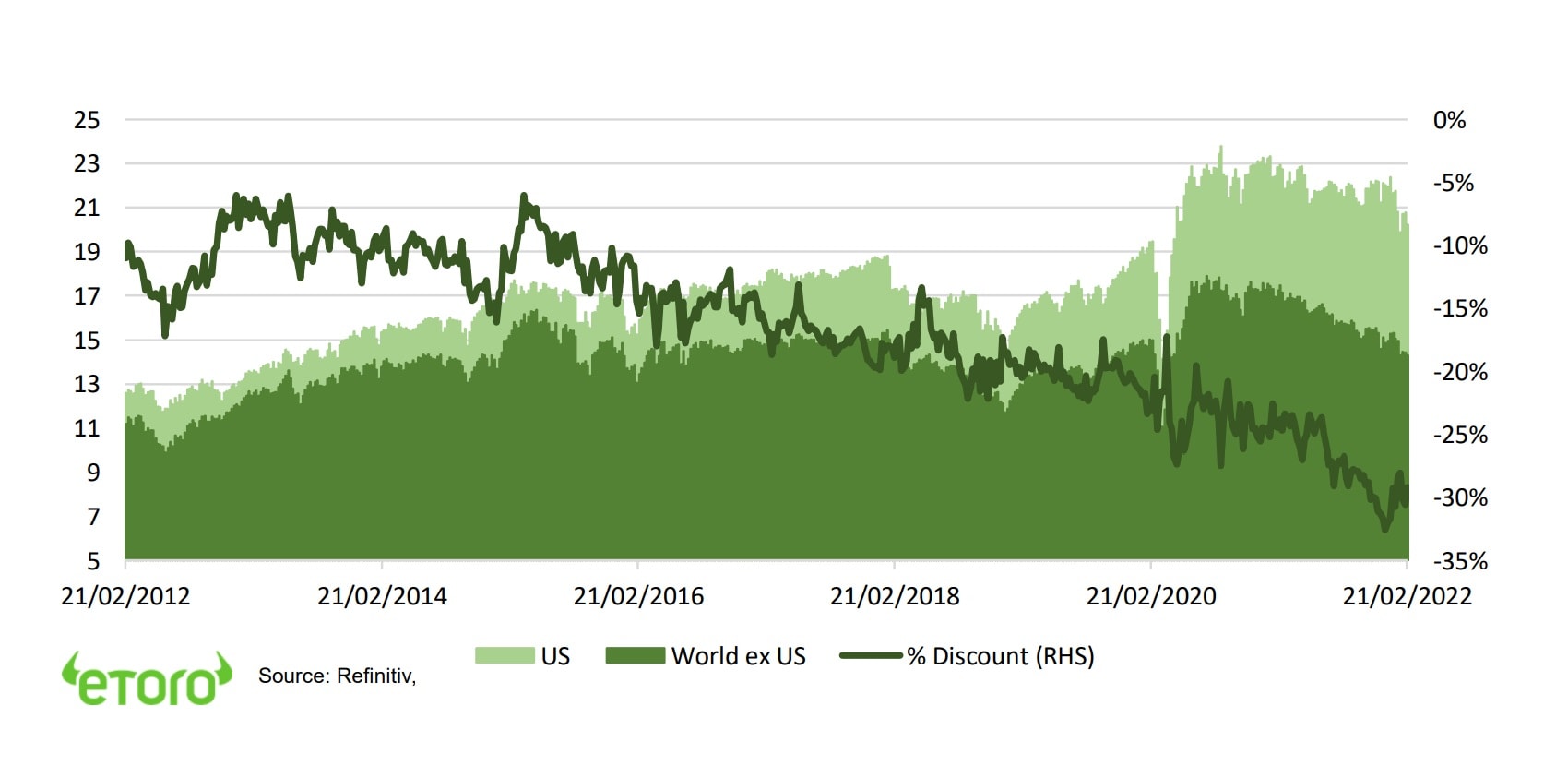

Eastern European markets are under 1% of global equities, but the Ukraine crisis a stark reminder of the risks of overseas investing. These share broad characteristics. 1) Economic and currency risks are generally higher than the US. Investors need to be compensated for this. 2) These markets underperformed in recent years; meaning are less in favour with investors. A contrarian positive. 3) They are cheaper, with international equities on an overall 30% discount to the S&P 500. 4) They are much less tech-focused, with a tech weighting half that of the US. 5) They are growing quicker. European earnings, for example, are growing 60% this quarter, double that of the US, as economic growth rebounds sharper from lower levels.

A different investing world turns against an overwhelming focus just on US and tech

International equity markets had a resilient start to the year, significantly outperforming weaker tech driven US markets, until geopolitical concerns spiked. This is a significant potential change in trend after over a decade of US and tech outperformance. We think we are in a new investing world of slower growth, higher interest rates, higher volatility, and lower returns. This new world favours the cheaper and faster growing companies found more in overseas markets. It also argues for a deeper diversification focus.

Diversification matters more now than ever. Home market and US focus needs examined

Many are too focused on their home markets, and not globally diversified enough. Many are unaware how huge the US has become. It represents 60% of many global equity benchmarks, four times its GDP size. Many argue events like Russia’s invasion of Ukraine is a reason to avoid overseas markets. Yet these risks are unavoidable. 40% of US company revenues come from overseas. This is nearer 60% for the tech sector.

Risks of going global can be higher. But has never been easier

Investing globally is not a free lunch, requires work, and carries more risks. Investors are naturally more knowledgeable on their home markets. Overseas markets carry currency risks. Also, additional economic and political risks to consider as we are seeing in Ukraine today. Yet it has also never been easier to get global diversified exposure through low-cost exchange traded fund (ETF) and Smart Portfolio products.

Favoured markets, and why. China, UK, and Developed Europe

Our favoured overseas markets include China (MCHI). The central bank is uniquely cutting interest rates. The UK (ISL.L) is particularly focused on the cheaper and cyclical financials and commodity sectors we like. Europe (EZU) is under pressure from Russia-Ukraine contagion risks today but is more broadly benefitting from its low-for-longer interest rates, weak currency, and with GDP growth set to rival the US the year.

US and Rest of World 12-month forward Price/Earnings valuation

Key Views

| The eToro Market Strategy View | |

| Global Overview | Forecast a very rare fourth consecutive positive year in 2022, with naturally lower returns and more volatility than last year. Main drivers of 1) GDP growth to remain well-above average, and supported by further vaccine-driven reopening. 2) Monetary policy tightening to be relatively gradual from very low levels, and inflation pressures to ease during the year. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap, value. Relative caution on fixed income, USD, and defensive equities. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Markets helped by 1) greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by investors. Helped by a dovish ECB to hold rates ‘low-for-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. Main risk from energy crisis, Ukraine invasion, and Russia gas exposure (2% global GDP). |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment, and increased investor ‘inflation-hedge’ demand. Industrial metals and battery materials well positioned as China growth stabilizes. Oil helped by slow return of OPEC+ supply and Russia risks. Gold hurt by higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.