Summary

Focus: The pulse of the retail investor

Retail investors are more important to markets than ever, and holding firm, according to our latest global investor survey results. Inflation is seen as by far the biggest risk, but investors are still confident in their investments. They are focused on equities and tech, with crypto assets increasingly well owned. Thematic investing is also booming, led by cleantech. The average retail investor is newer to markets, more risk tolerant, younger, and more female.

US slumps as risk aversion spreads

US markets fell sharply, with tech-heavy NASDAQ now in a -10% ‘correction’. Drivers were Fed rate fears, a mixed Q4 earnings start, and geopolitical tensions. Overseas equities were more resilient. US bond yields fell, Bitcoin was below $40,000, and oil rose near $90/bbl. MSFT bid for ATVI, and NFLX results disappointed. Fed meeting is focus this week. See our latest presentation, video updates, and twitter @laidler_ben.

Nearing capitulation on the Fed outlook

Investors are now near capitulation on the Fed outlook, pricing at least 4x hikes this year and shrinking its huge balance sheet. This repricing is improving the market risk/reward.

Watching investor sentiment for entry point

Our investor sentiment indicator is not yet down to the extremes signalling a strong contrarian buy, like March 2020. ‘Be greedy when others are fearful’. Watch VIX and put/call ratio.

China bucking the downtrend

The Chinese (MCHI) equity stars are re-aligning, after a tough 2021. Interest rates are being cut, policy makers focusing on stability, valuations very cheap and market out-of-favour.

History argues for a stronger commodity rally

The current commodity rally is smaller than average of +120% over 30 months. This supports our fundamental view that it has more to go. Demand is strong and supply tight.

Crypto falls below key levels. Cardano focus

Bitcoin (BTC) and Ethereum (ETH) fell below key $40,000 and $3,000 levels on rising risk aversion and Russia’s crypto crackdown. Cardano (ADA) helped by its major scaling plans. Fed published long-awaited CBDC discussion paper. MSFT bid for ATVI supportsmetaverse outlook.

The commodity surge continues

No.1 commodity importer China’s interest rate cuts and a stable USD helped commodities. Brent oil rose near $90/bbl., levels not seen since the 2011-14 surge over $100/bbl. Long-suffering precious metals were helped by growing risk aversion, led by silver and platinum.

The week ahead: A Fed and earnings double

1) Fed meets (Wed) with hawkish expectations reaching extreme levels. 2) A so-far mixed Q4 earnings start looks for tech support from AAPL, MSFT, TSLA, INTC, V report. 3) Forward-looking PMI’s (Mon) from US, UK, EU gives key insight into the growth and inflation outlook.

Our key views: Look through the volatility

We see a positive 2022, but with lower returns and higher volatility than last year. Economic growth is strong and earnings forecasts too low. Valuations should stay high as interest rates rise from still very low levels. We focus on cheaper and cyclical assets that have strong growth and offer defence to valuation risks: like Value equities, small caps, commodities.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -4.58% | -4.69% | -5.70% |

| SPX500 | -5.68% | -6.94% | -7.73% |

| NASDAQ | -7.55% | -12.04% | -11.99% |

| UK100 | -0.65% | 1.66% | 1.36% |

| GER30 | -1.76% | -0.97% | -1.77% |

| JPN225 | -2.14% | -4.38% | -4.41% |

| HKG50 | 0.04% | -2.64% | -3.22% |

*Data accurate as of 24/01/2022

Market Views

US slumps as risk aversion spreads

- US markets sold off sharply, with tech-heavy NASDAQ entering a -10% ‘correction’. Drivers were further Fed rate tightening fears, a mixed Q4 earnings season start, and rising geopolitical tensions. Overseas equities continued to be more resilient. US bond yields fell, Bitcoin was below $40,000, and oil rose near $90/bbl. MSFT bid for ATVI, and NFLX results disappointed. The Fed meeting is the key focus this week.

Investors nearing capitulation on Fed outlook

- Investors seem near capitulation on the Fed (see chart). Futures are pricing four interest rate hikes this year. Jamie Dimon is looking for up to seven, and Dan Loeb for a 0.5% hiking pace.

- Markets are also now expecting the Fed to shrink – not just end expansion – of its massive $8.7 trillion balance sheet this year.

- Such a tightening combo is unprecedented and seems fully priced. Markets have been resilient to surging bond yields before. Inflation expectations are now falling. Opportunities emerging in our favoured ‘big tech’ stocks.

….but investor sentiment has not capitulated

- Our proprietary investor sentiment indicator has not yet fallen to the extremes signalling a strong contrarian buy, like March 2020. This indicator echoes Warren Buffett’s maxim to ‘be greedy when others are fearful’. Because if everyone is bullish, who is left to buy?

- Investors are more cautious and equity funds seen strong selling. But S&P 500 VIX volatility and ratio of put/call buying are still better than even Q4 last year levels. These are the shoes that need to drop for a sentiment capitulation.

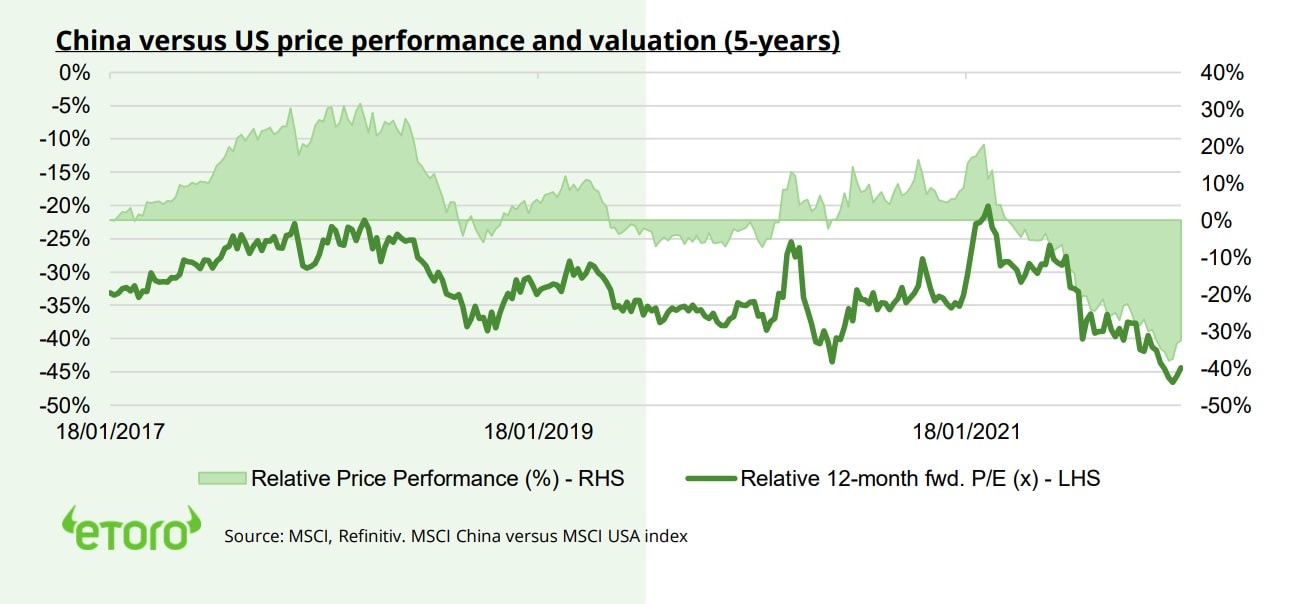

China bucking the downtrend

- The Chinese equity stars are re-aligning, after a very tough 2021. Interest rates are now being cut, bucking the global trend. Whilst policy makers focus on stability rather than sector intervention ahead of the 20th Party Congress.

- The market (MCHI) is deeply out-of-favour and now better priced. Valuations are half the US, with twice the profits growth, and an as big tech sector (55% of the index). The country remains dramatically under-owned versus its size. Focus is on local China (ASHR) or Hong Kong (EWH) shares rather than China ADRs in US (KWEB).

- A recovering China helps emerging markets (EEM) and global materials and luxury sectors.

History argues for a stronger commodity rally

- The commodity rally likely has further to go. The broad-based Bloomberg commodity index is now up 70% from its low 27 months ago. By comparison, the average commodity rally has been 120% over 30 months. Rallies are normally ended by recession, which not on our horizon.

- Our analysis of 7 big commodities – from copper to wheat – shows only oil over an average rally. But we see ‘high-for-longer’ oil (OIL and XLE for equities) prices, even above a politically sensitive $85/bbl. Demand is recovering, supply tight, inflation still high, and the USD now off its highs.

China versus US price performance and valuation (5-years)

Crypto falls below key levels. Cardano boost

- Bitcoin (BTC) fell below the key $40,000 price level and Ethereum (ETH) to under $3,000, on spiking global risk aversion, and Russia’s move to crackdown on crypto. Whilst the metaverse saw a boost as tech-giant Microsoft (MSFT) bid for video game leader Activision blizzard (ATVI).

- Cardano (ADA) price was helped as its parent 1) announced plans for a major 11-point scaling update this year. Also as 2) SundaeSwap, a DeFi exchange on Cardano, launched last week.

- US Fed published its long-awaited discussion paper on introducing a ‘digital dollar’ CBDC.

The commodity surge continues

- Commodity prices rallied further. The broad based Bloomberg commodity index is +6% this year, boosted by China cutting interest rates to boost economy of world’s largest commodity user. Also the easing USD, which cheapens dollar-priced commodities for many. Brent crude oil surged toward $90/bbl. on rising geopolitical tensions. These are levels not seen since 2011-14 when oil averaged over $100/bbl.

- Stubbornly high inflation, a USD stabilization, and spiking market volatility gave long-suffering precious metals a boost. This offset headwinds from higher US 10-year bond yields for zero yielding precious metals. Rise led by platinum and silver. Precious metal equities have done even better, including NEM, FRES.L, and AAL.L.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -7.10% | -11.36% | -11.86% |

| Healthcare | -4.03% | -8.79% | -9.69% |

| C Cyclicals | -8.23% | -10.49% | -12.09% |

| Small Caps | -8.07% | -10.53% | -11.46% |

| Value | -4.40% | -1.94% | -3.92% |

| Bitcoin | -11.98% | -22.54% | -20.08% |

| Ethereum | -17.48% | -31.77% | -27.08% |

Source: Refinitiv

The week ahead: A Fed and earnings doubl

- US Federal Reserve meets (Wed). It’ll keep interest rates at zero, for now, but focus is on its plans. Market now expects a hawkish 4 rate hikes and a shrinking balance sheet this year.

- Big Q4 earnings week with tech heavyweights like AAPL, MSFT, TSLA, INTC, IBM, V. We see over 20% US profits growth and 50% in Europe. 100 S&P 500 stocks report this week.

- Forward-looking purchasing manager indices (PMI) from US, UK, EU (Mon) likely show stable growth outlook, resilient to omicron fears. Also, signs of stabilizing inflation pressures.

- Key US data with fourth quarter GDP growth (Thu) accelerating near 6% QoQ, whilst Fed’s favourite PCE inflation (Fri) rises to 5.9%.

Our key views: Lookthrough the volatility

- We see a positive 2022, but with lower returns and higher volatility than last year. Earnings forecasts are too low, with economic growth still strong. Valuations should stay high, with interest rates rising from very low levels.

- US Fed has turned more hawkish, set to raise rates 3x this year to combat 7% inflation. But this will still be a lower and slower rate upcycle than historic. The omicron virus is dampening growth but economies are increasingly resilient.

- We focus on cyclical assets that benefit most from growth: commodities, crypto, and value. We are cautious on fixed income and the USD.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.75% | 6.53% | 6.24% |

| Brent Oil | 1.65% | 16.29% | 12.78% |

| Gold Spot | 1.03% | 1.44% | 0.31% |

| DXY USD | 0.49% | -0.40% | -0.35% |

| EUR/USD | -0.61% | 0.20% | -0.24% |

| US 10Yr Yld | -2.95% | 26.75% | 24.91% |

| VIX Vol. | 50.34% | 60.63% | 67.54% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Taking the pulse of retail investors

Retail investors are more important than ever, and holding firm

We surveyed 8,500 self-directed investors in 12 countries, from Australia to Romania, in our latest ‘Beat’ survey. With markets volatile, and many retail investors new to markets, taking their pulse has never been more important. US household equity investments, for example, are at a record and double long-term levels, whilst online investment platforms have continued to see strong growth. These drivers are largely structural. The rise of online community and investment platforms, of free equity trading and fractional ownership. This has come as household finances have strengthened and with interest rates still low. A bigger role for retail investors is here to stay. A summary of the full survey results can be seen here.

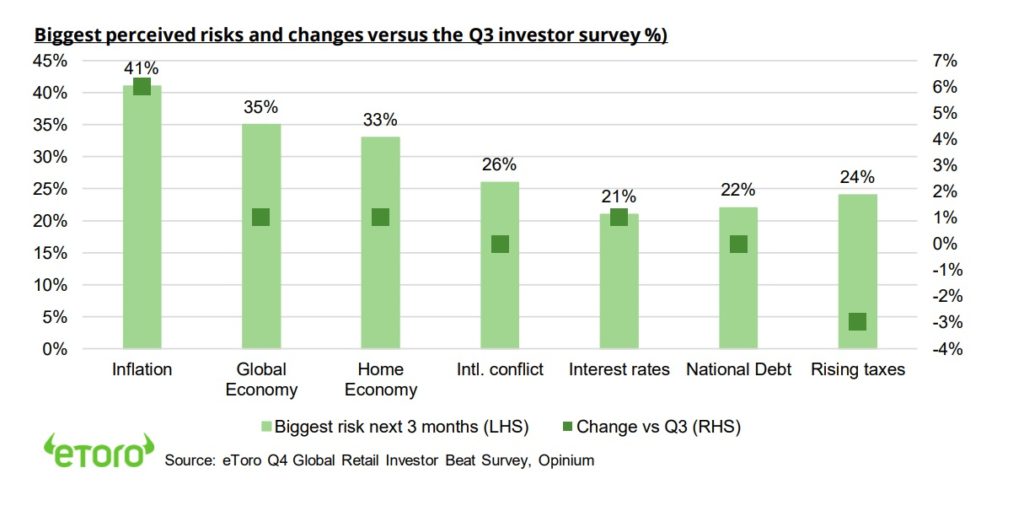

Inflation is by far the biggest risk, but investors are confident in their investments

Inflation is seen as the biggest risk, and this has risen in significance since the last survey. This likely keeps a focus on inflation-hedge assets. Fear of rising interest rates, that is currently roiling markets, is only seen as the 5th biggest risk. Most are holding firm in the face of these rising risks, with 80% confident in their investments, and over half leaving portfolios unchanged. This is all reassuring for those worried that the new retail investors will cut-and-run withmarket volatility. By contrast, we are seeing the opposite.

Investors are focused on equities and tech, with crypto increasingly well owned

Retail investors are unsurprisingly focused on equities, and within that on the tech sector. US equities are the most popular, with the UK remaining deeply out-of-favour (though performing well so far this year). Energy and real estate equities are especially popular relative to their relatively small sector sizes. They were the best performing sectors last year, and likely important inflation hedges this year. Crypto assets are increasingly well owned and now the 3rd most owned asset class, a remarkable feat in only a decade.

Thematic investing is booming – led by cleantech and digital transformation

Nearly 80% of investors are considering investing in themes, as opposed to traditional sectors or countries. This compares to only around 5% of total investment assets being in such funds. This shows the potential duration of the thematic investment boom. Clean-tech is the most popular theme, followed by digital transformation. This is driven by the accelerating carbon transition, recent COP26 momentum, and the needed tripling of climate investments. Robotics and automation saw the biggest decline in popularity.

Anatomy of the retail investor – newer, younger, female

A quarter of retail investors are new to markets since pandemic, and they are disproportionately young and female. They trend to have higher risk profiles, be more tech savvy, a focus on ESG, and use a wide range of sources to research investment ideas. Under 10% trade daily, and under 20% own meme stocks.

Biggest perceived risks and changes versus the Q3 investor survey %)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Forecast a very rare fourth consecutive positive year in 2022, with naturally lower returns and more volatility than last year. Main drivers of 1) GDP growth to remain well-above average, and supported by further vaccine-driven reopening. 2) Monetary policy tightening to be relatively gradual from very low levels, and inflation pressures to ease during the year. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap, value. Relative caution on fixed income, USD, and defensive equities. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Consumer staples, utilities, real estate offer more defensive cash flows, less exposed to economic growth. Makes them more sensitive to rising bond yields. Expect them to underperform in a more cyclicals focused environment with earnings strong and yields rising. Healthcare is more attractive, with cheaper valuations and more growth. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| Italy | Gabriel Dabach |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.