Summary

Taking a third quarter breather

Expect more measured Q3 returns as markets digest big gains and prepare for strong finish to year. With summer seasonality weaker, volatility too low, and the growth slowdown to come. Tech and Japan led Q2 gains, with resilient growth and lower inflation. Focus is on long duration assets and defensive growth from tech to healthcare to bonds and crypto. We steer clear of ‘value-trap’ cyclicals, small cap, and commodities.

June’s rally reality check

Stocks saw a reality check after big early June strength. Hawkish Fed’ Powell testimony, big BoE hike, and weaker PMI’s, all raised recession risks. But June has still seen broad market gains, from small cap to commodities, and especially crypto. RIVN latest to join TSLA charger network. Buffett raised stake again in Japan. Siemens Energy renewable plunge. See Q2 Outlook HERE. Video updates, twitter @laidler_ben.

The sum of all UK fears

Some of world’s highest headline inflation, falling house prices, 13 rate hikes, and more to come. UK is in a tough spot and world is watching, but markets been surprisingly resilient.

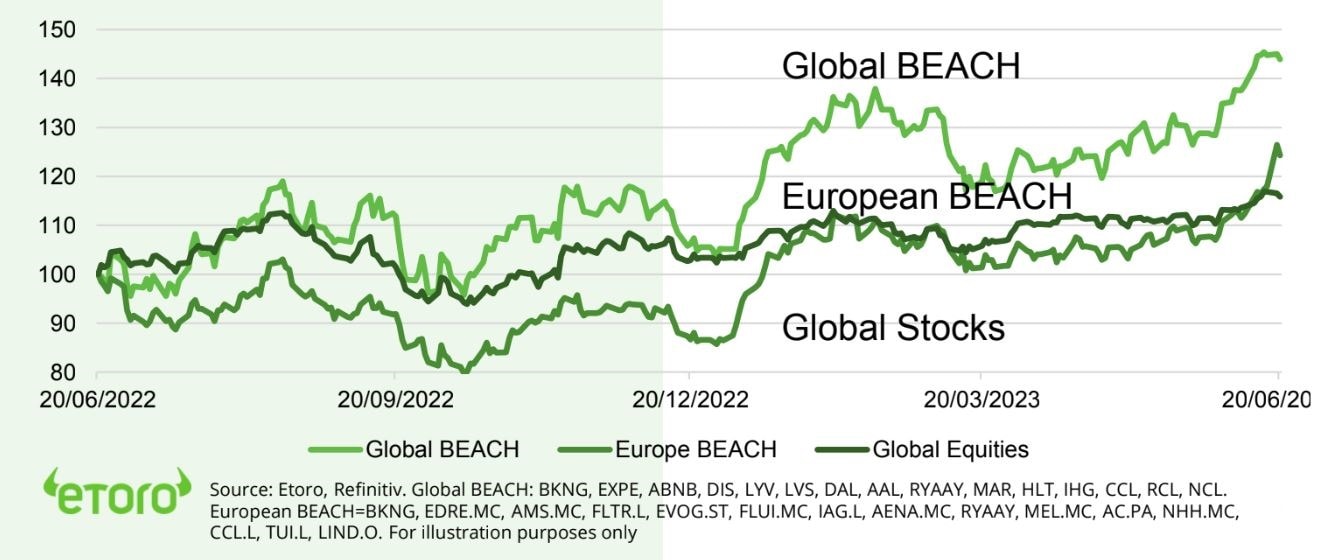

How BEACH stocks are beating tech

BEACH travel and tourism stocks doing well. Our baskets of booking sites, entertainment, airline, cruise, hotel stocks outpacing even high-flying tech in summer season. @TravelKit.

Reawakening animal spirits

Long dormant IPO markets showing signs of life in further sign of better company and investor confidence, firming rally foundations.

Signs of life from natural gas

Prices signs of life after dramatic plunges. Is a reminder further big price falls should not be expected. Been big driver of consumer and stock relief this year, especially in Europe.

Bitcoin soars on ETF optimism

BTC soared 20% to $30,000 last week, heading a crypto rally. This took its YTD gains to 80% and its asset class ‘dominance’ to a 2-year high 48%. The big twin drivers were 1) the world’s largest asset manager Blackrock spot Bitcoin ETF application and 2) TradFi stalwarts Citadel, Fidelity, Schwab launching their EDX crypto exchange.

Ag strength offset precious weakness

Weak performance with muted China stimulus response, a stronger dollar, returning recession fears. Non-yielding precious metals fell on higher interest rate outlook. Double-digit Wheat gains led grains complex as Russia threatened Black Sea deal exist and US hot weather hurt yields. Nat gas eased from recent rally.

The week ahead: Inflation, banks, Nike, Q3

1) Inflation spotlight on EU (est. fall to 5.6%) and Fed-favourite PCE (est. 4.1%).

2) US big banks recession ‘stress-test’ results.

3) Earnings from NKE, MU, WBA, STA, GIS, BB.

4) Friday is end of a positive month, quarter, and 1H end, with investors looking ahead to 2H.

Our key views: A goldilocks moment

Markets boosted by resilient economic growth and gradually easing inflation pressure, and now capitulating investor sentiment. Coming growth slowdown hurts earnings. But low yields help valuations. Focus on cheap and defensive assets from healthcare to big tech. More cautious on growth exposed cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.67% | 1.92% | 1.75% |

| SPX500 | -1.39% | 3.40% | 13.25% |

| NASDAQ | -1.44% | 3.98% | 28.91% |

| UK100 | -2.37% | -2.17% | 0.14% |

| GER30 | -3.23% | -0.96% | 13.69% |

| JPN225 | -2.74% | 6.03% | 25.63% |

| HKG50 | -4.74% | 0.76% | -4.51% |

*Data accurate as of 26/06/2023

Market Views

June’s rally reality check

- Saw a stocks reality check after recent strength. Fed’s Powell testimony, big BoE hike, weak PMIs, put attention on recession risk. But June has seen broader gains, from small cap to commodities, and especially crypto. RIVN latest to join TSLA charger network. Warren Buffett increased stake again in Japan’s conglomerates. Siemens Energy saw renewables plunge.See our Q2 Outlook HERE.

The sum of all UK fears

- The developed world’s highest headline inflation. Still rising core inflation. 18% food price rises. 13 central bank rate hikes. And investors pricing of more hikes to come. Plus falling house prices. This is the UK today. And the world is watching, with this predicament the one other policy makers and global investors fear most.

- Especially with Canada and Australia recently reversing course and restarting rate hikes, and investors continuing to ‘fight the Fed’. Only silver lining is sanguine market reaction so far. With Sterling strong, and FTSE 100 underperforming rather than capitulating.

How BEACH stocks are beating tech

- Summer holiday season is well underway and BEACH travel and tourism stocks doing well. Our global and European leisure baskets of booking sites, entertainment, airline, cruise, hotel stocks outpacing even high-flying tech. This is driven by resilient consumer demand and travel company price rises. Travelers willing to prioritize holiday spending despite the cost-of-living squeeze.

- Whilst managements disciplined in managing new capacity as seek to recover big pandemic losses. Global travel and tourism revenues seen surging 23% this year, boosting economies from Greece to Mexico, but to still be below pre pandemic levels. @TravelKit.

Reawakening animal spirits

- Equity animal spirits are slowly reawakening after 18 months of hibernation. The S&P 500 is in bull market territory. Market volatility low. Tech stock leadership broadening. Whilst bearish investors were capitulating and chasing markets higher.

- Even the long dormant M&A and IPO markets are now showing signs of life from depressed levels. In further sign of better company and investor confidence. Markets will need the further validation of less inflation, and have to endure a coming growth slowdown, but the foundations are firming. The bigger picture remains one of buybacks and delisting’s still dwarfing IPOs, and restricting stock supply.

Signs of life from natural gas

- Prices showing signs of life after dramatic plunges this year. Is a reminder that amongst most volatile commodities, and further big price falls should not be expected. Has been a big driver of consumer and company relief this year, especially in Europe.

- US prices have bounced off key $2.00/MMBTu level as we enter summer ‘cooling season’, with production easing. Asia leads demand growth and the coming El Nino adds uncertainty.

BEACH stocks outperformance of global equities (Relative, 1-Year)

Bitcoin soars on ETF optimism

- BTC led a sharp crypto asset rally, taking its price to $30,000. The 20% weekly gain took it to 80% so far this year, by far the most of any asset class.

- Altcoins SOL, ADA, MATIC rose but lagged BTC rally, held back by SEC’s regulatory crackdown on ‘securities. Saw Bitcoin market cap ‘dominance’ of crypto rise to a two-year high of 48%.

- Optimism driven by world largest asset manager BlackRock (BLK) application to launch a spot BTC ETF, along with applications from WisdomTree and Bitwise. TradFi leaders Citadel, Fidelity, Schwab also launched new crypto EDX exchange.

Ag strength offset precious weakness

- Commodity performance was weak with a muted reaction to China interest rate cuts, a stronger US dollar, and renewed economic growth fears as Fed chair Powell talked tough on inflation, the BoE jacked up rates, and global PMIs weakened.

- Non-yielding precious metals, like gold and silver, were hurt by the rising competition from the ever-higher interest rates outlook.

- Wheat rose double-digits and led whole grains complex higher, driven by Russian threats not to extend the Black Sea Grain Export Initiative, and as hot weather has hit US mid-west grain yields.

- European natural gas prices fell after doubling from recent lows on heightened supply fears.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -1.70% | 7.86% | 35.95% |

| Healthcare | 0.05% | 1.76% | -1.77% |

| C Cyclicals | -0.43% | 8.67% | 23.45% |

| Small Caps | -2.87% | 1.90% | 3.43% |

| Value | -2.12% | 1.78% | -1.88% |

| Bitcoin | 17.01% | 13.45% | 86.40% |

| Ethereum | 10.45% | 2.63% | 58.71% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Inflation, banks, Nike, Q3

- Spotlight remains on inflation with central banks getting back on the rate hiking front foot. EU price rises are seen easing to 5.6%, and the Fed’s favourite US PCE measure down to 4.1% (Fri).

- US banks annual ‘stress-test’ results (Wed) for 23 largest to a hypothetical global recession. Helps determine dividends and buybacks, and after the real Q2 banks scare, amidst tighter regulation talk.

- The start of global Q2 earnings season is a few weeks away on June 14th but now have results from sportswear giant NKE, plus semiconductor MU, WBA, STZ, CCL, GIS, PAYX plus meme BB.

- Friday marks the mid-year half-way point and end of a positive June and Q2 for stocks. With focus shifting to summer, Q3 and second half outlook with growth resilient and inflation stubborn.

Our key views: A goldilocks moment

- Markets being boosted by combination of resilient economic growth, helping earnings, and slowly easing inflation, helping valuations. The capitulation of very bearish investor sentiment is an additional, and recent, big technical driver.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -2.66% | 2.26% | -9.27% |

| Brent Oil | -2.24% | -3.40% | -13.30% |

| Gold Spot | -2.05% | -0.81% | 5.48% |

| DXY USD | 0.61% | -1.28% | -0.63% |

| EUR/USD | -0.46% | 1.55% | 1.79% |

| US 10Yr Yld | -2.75 | -6.46 | -13.80 |

| VIX Vol. | -0.74% | -25.13% | -37.98% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: Bears capitulation drives the rally

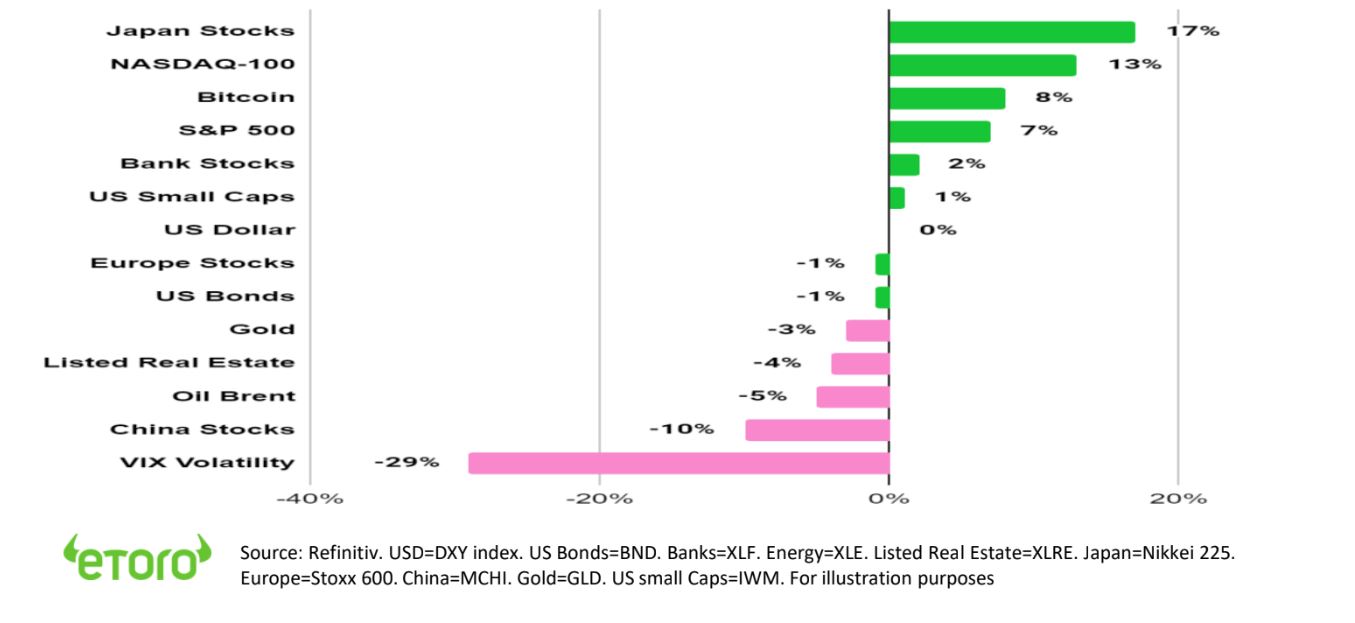

Look for a third quarter breather to digest gains and prepare for strong end to year

Global stocks are on track for a third quarterly gain after the deep 2022 losses. The S&P 500 is in a bull market. It’s been driven by ‘less bad’ fundamentals and signs of capitulating bearish sentiment. We see a summer breather after strong performance and with weaker seasonality and macro challenges still ahead. We are focused on ‘defensive growth’ assets like big tech, and long duration assets, from bonds to crypto. Ahead of a strong end to the year as investors look ahead to Fed rate cuts and an economic reacceleration.

Q2 tech rally drove US stocks higher, whilst Japan took over the overseas lead

The rally of the ‘magnificent seven’ big tech stocks drove the S&P 500 into bull market territory, whilst VIX equity volatility plunged. The NVIDIA sales surge began to validate the AI hope. Japanese stocks took the overseas outperformance baton over from Europe, whilst China’s grand reopening disappointed. Bonds and the US dollar flat-lined. Whilst crypto assets refused to lie down after the SEC extended its crackdown.

Economies remain resilient and earnings outlook surprisingly rebounds

The long forecast economic slowdown remained elusive. The US consumer grew 3.8% last quarter, China GDP rebounded 4.5%, and Europe saw only a ‘technical’ recession. Combined with less-bad Q1 results, earnings forecasts have been on the rise, and wrong-footing bearish investors. Whilst inflation is sticky but fell just enough to signal rate hikes are nearing their end and in-turn supporting stock market valuations. As importantly potential ‘black swan’ events like the US banks scare and debt ceiling default were avoided.

Markets to see some summer indigestion and long-awaited growth slowdown

An economic slowdown is still ahead, with manufacturing already in recession. But it will be milder, and the world will avoid recession. It will speed the inflation fall, as jobs and housing markets weaken, reinforcing a lower interest rate outlook. But summer vulnerabilities are real after big 1H returns, with weak seasonality and overly low volatility. Surprise ‘wild cards’ include a Ukraine war ceasefire and Japanese YCC tightening.

Focus on long duration and defensive growth and steer clear of value-trap cyclicals

July starts the earnings season test and month-end maybe final Fed and ECB rate hikes. August ends with first US presidential primary debate and Fed’s Jackson Hole meet. September typically the weakest month of year. Our outlook for slower growth and lower inflation is positive for long duration tech, bonds and crypto. Economically sensitive small caps to commodities cheap but vulnerable. Volatility a possible hedge.

Second quarter 2023-to date major assets performance

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, financial sector and debt ceiling concerns accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery.See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the rebound this year and are supported high company profitability and peaked bond yields. Focus on cash-flows defensives, like healthcare and high dividend. And Big-tech supported by defensive growth, cost cutting, and AI. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and boosts tech and crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices and reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive China as economy reopens, supports property sector, eases tech regulation pressure. Valuations 30% cheaper than US and markets out of favour. Recovery helps global sectors from luxury to materials. EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia have benefitted from strong equity market weight in commodities and financials, as global growth resilient and bond yields risen. Now could be becoming headwinds. Japanese equities among worlds cheapest with own and China-proxy growth and governance improving but threats of tighter monetary policy and stronger Yen. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Expect better performance as 1) lower bond yields take pressure off valuations and 2) high profit margins and fortress balance sheets make defensive to recession risks. 2) Cost cuts and AI add to growth. ‘Disruptive’ tech much more vulnerable. |

| Defensives | More attractive as recession risks rising and bond yields have peaked. Consumer staples, utilities, (some) real estate attractive with defensive cash flows, less exposed to rising economic growth risks, and with robust dividends. Healthcare is the most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authority’s response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hathaway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long-term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has widespread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attractive cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+. But commodities not to repeat their 2021 and 2022 performance leadership. Gold benefits from safer haven demand. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.