Summary

Market tip-toeing towards taking more risk

Investors turning less defensive as rate cuts on the horizon. Cuts typically start next bull market. Stocks move ahead of economies. Fed waits as little as 6 months before cutting. But each cycle different. Real estate and financial rate sensitives derailed by banks scare and office worries. Tech now offers right balance of defence vs offense, after big rate upcycle. Bonds and other ‘long duration’ perform after rates peak.

Big tech leads debt ceiling and banks relief

Big tech led market relief as US bank deposit outflows eased and debt ceiling talks progressed. Japan’s Nikkei continued a stealth rally, breaking 30,000. Commodities held back as US dollar DXY rose to 103. Strong WMT results show consumer resilience. NFLX soared on new subs. SONY joined spin-offs pick up. Whilst Buffett buys $1 billion of COF. See our Q2 Outlook HERE. Video updates, twitter @laidler_ben.

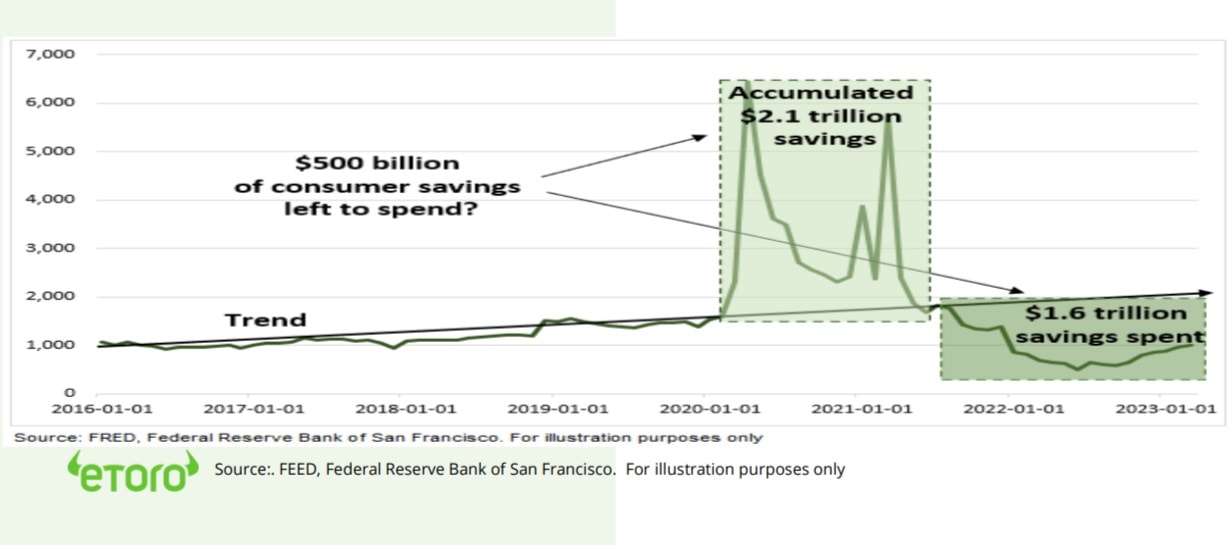

Room in the consumers wallet

Consumers still have $500 billion of pandemic savings, enough to last till year end. Is buffer to a stronger macro slowdown. But are spending differently, on staples and online.

Help from the bond market

Lower long-term US government bond yields a big help for equities this year. Gold/copper ratio proxy, and slower growth outlook, see’s this support to stay. Especially to big tech.

An obesity epidemic solution

2nd largest sector, Healthcare, lagged this year. A bright spot is new generation of effective weight loss drugs to tackle global obesity epidemic. Led by NVO and LLY, but many following.

El Niño upside to commodities

90% chance of El Niño weather phenomenon this year. Bringing supply disruption. Could boost wheat to natgas, but hurt others.

Crypto assets hold on to gains

Another resilient week for both BTC and ETH with gains led by LTC. It benefitted as alternative to soaring bitcoin network settlement costs with ordinals surge. Biggest stablecoin Tether to use 15% of profits to buy BTC. Largest Bitcoin23 conference of year saw smaller attendance but headliners from MSTR to RIOT.

Stronger dollar drives commodities lower

Asset class pressure continued as US dollar DXY index broke 103 and China recovery data weaker than hoped. Precious metals led falls, with China focused industrial metals, like nickel, also weak. Wheat fell back on Black Sea Grain Initiative deal extension. SHEL to XOM seeing annual meeting ESG pressures on oil stocks.

The week ahead: PMI’s, Fed outlook, NVDA

1) Flash US, EU, UK, JP, AU, PMI health-check to ease from an expansionary 54. 2) FOMC minutes (Wed) outlook on Fed pause and coming cuts. 3) Q1 results ZM, ADI, COST, LOW and S&P 500’s top performer NVDA. Plus AMZN AGM. 4) Big UK data week and Turkey run off (28th).

Our key views: Accelerated macro outlook

Low stock volumes and volatility obscuring rising growth slowdown risks and hastening of interest rate cuts. We see a market recovery with coming bumps in road. Slowdown hurts earnings. But low yields help valuations. Focus on cheap and defensive assets from healthcare to big tech. More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.38% | -1.13% | 0.84% |

| SPX500 | 1.65% | 1.41% | 9.18% |

| NASDAQ | 3.04% | 4.85% | 20.94% |

| UK100 | 0.03% | -1.99% | 4.09% |

| GER30 | 2.27% | 2.48% | 16.89% |

| JPN225 | 4.83% | 7.86% | 18.06% |

| HKG50 | -0.90% | -3.11% | -1.67% |

*Data accurate as of 22/05/2023

Market Views

Easing debt ceiling and bank fear soothes stocks

- Big tech led stockmarket relief as US bank deposit outflows eased and debt ceiling talks progressed. Japan’ Nikkei 225 continued stealth rally, breaking 30,000 ceiling. Commodities hurt as US dollar DXY index rose to 103. Strong WMT results showed consumer resilience. NFLX soared on new subs. SONY joined spin-offs pick up. Whilst Buffett buys $1 billion of COF. See our Q2 Outlook HERE.

Room in the consumers wallet

- Consumption dominates US economy at 2/3 GDP, and its resilience the biggest reason it’s not in recession. Consumers still have $500 billion of pandemic savings (see chart). This is a buffer to a weaker jobs market that will depress confidence further, and the broader macro slowdown.

- So far it’s been a case of ‘see what they buy, not what they say’. Forecasts are for a small deceleration from last year’s 7% retail growth to a still above average 4-6% rate. But the shift in spending from discretionary and goods to staples and services is clearly on show in Q1 earnings and driving share price divergence.

Help from the bond market

- Lower long-term US government bond yields have been a big help for equities this year. They have boosted the present-value-of-future cashflows and pushed stock valuations up. With earnings under pressure this has driven all returns this year. The good news is that these bonds yields are likely to stay down, and be supportive for both equity markets and big tech.

- That is message from our copper/gold ratio proxy, and our fundamental outlook for a hastening economic and inflation slowdown. Every 0.5% move in the US 10-year bond yield changes our fair-value P/E valuation multiple for S&P 500 by +/- 8%. With yields moving inversely to prices, it’s also positive for long duration bonds (IEF, TLT).

An obesity epidemic solution

- S&P 500’s second largest sector is down this year, held back after 2022 outperformance. The Inflation Reduction Act hastened pricing worries in world’ largest market and seeing a Covid boom payback.

- A sales growth bright spot is a new generation of effective weight loss drugs to tackle the global obesity epidemic. Led by diabetes leaders Novo Nordisk (NVO) and Eli Lilly (LLY), but with many others following. It’s a reminder of the healthcare sector’s improving growth outlook, from mRNA to AI. As it trades on just a 16x P/E valuation, similar to global equities, but alongside its strong balance sheets and robust dividends.

El Niño upside to commodities

- There is an est. 90% chance of an El Niño weather phenomenon this year. This could bring further supply disruption to volatile global ag and energy markets, supporting prices and boosting inflation.

- The last severe El Niño in 2016 saw the highest ever global temperatures. Impacts are typically global and varied across supply and demand. It could boost prices from cocoa to sugar and natgas, whilst posing threat to prices from soybean to heating oil.

US personal savings (US$ millions, monthly)

Crypto assets hold on to gains

- Leading crypto assets BTC and ETH were flat on the week, holding onto their market-leading gains this year. Performance leaders include XRP and LTC. The latter benefitting as an alternative to the recently clogged BTC network that saw settlement costs soar with ordinal subscriptions.

- $80 billion stablecoin Tether announce it would use 15% of profits going forward to buy Bitcoin (BTC) and add to its existing $1.8 billion position.

- Largest crypto event of year, Bitcoin23 in Miami, saw weaker attendance but plenty headliners from Michael Saylor of MSTR, to RIOT and HUT.

Commodities prices suffer again

- Broad based Bloomberg Commodity Index was pressured again, now down 10% this year. The brunt born by precious metals gold, silver, and platinum as the US dollar DXY rallied over 103.

- Whilst industrial metals, led by nickel, suffered as the latest set of Chinese economic data, from retail sales to industrial production rose sharply but again underwhelmed market expectations.

- Wheat prices fell back as the Black Sea Grain Initiative facilitating Ukraine and Russia ag exports was renewed for an further 60-days.

- May and June is peak season for company Annual General Meetings. Energy stocks from SHEL to XOM are facing many climate and ESG votes.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 3.86% | 6.00% | 27.37% |

| Healthcare | -0.61% | -1.68% | -2.58% |

| C Cyclicals | 1.88% | 1.23% | 15.18% |

| Small Caps | 1.89% | -1.43% | 0.71% |

| Value | 0.50% | -2.92% | -2.85% |

| Bitcoin | 2.92% | -8.37% | 62.34% |

| Ethereum | 2.97% | -8.58% | 51.62% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Global PMI’s, Fed outlook, NVIDIA

- Markets see global macro health-check with April flash PMI’s (Tue) for US, EU, UK, Japan, Australia set to ease from healthy expansion levels around 54. Will also give insights on easing price pressure.

- Minutes (Wed) of May 2nd last Fed rate hike to 5%. With hope this is cycle peak and market pricing six month pause before 2 rate cuts this year. Also Fed favourite PCE inflation (Fri) est. to fall below 4.2%.

- Tail-end Q1 earnings with techs NVIDIA, ADI, ZM, and retailer COST, LOW. NVIDIA led tech rally YTD as best S&P 500 performer, +114%, then META 104%. JPM investor day (22nd). AMZN AGM (24th).

- A big UK week with inflation to ease <10% (Wed), an energy price cap fall, and IMF’s annual macro report. Runup to May 28th Turkey election runoff with incumbent Pres. Erdogan in pole position.

Our key views: An accelerated macro outlook

- Low stock volumes and volatility obscuring rising growth slowdown risks and hastening interest rate cuts. Banking sector fears doing the Fed’s job for it. Alongside the lagged 5% interest rate impact and spending cuts to come from a debt ceiling deal.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.11% | -4.26% | -10.40% |

| Brent Oil | 1.91% | -7.54% | -12.09% |

| Gold Spot | -1.77% | -0.71% | 8.19% |

| DXY USD | 0.50% | 1.35% | -0.32% |

| EUR/USD | -0.43% | -1.69% | 0.96% |

| US 10Yr Yld | 21.50 | 10.65 | -19.64 |

| VIX Vol. | -1.29% | 0.24% | -22.43% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

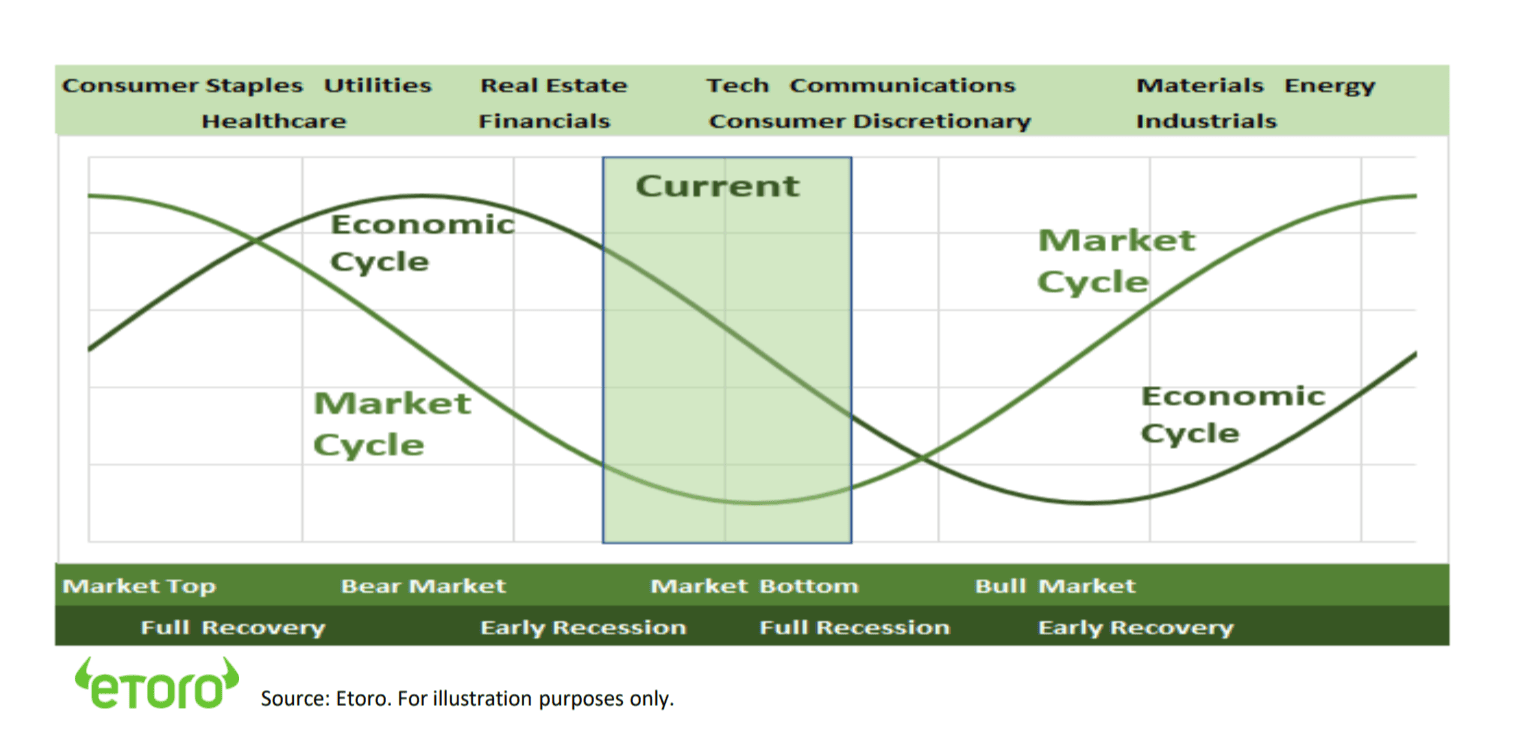

Focus of Week: Stock market leads the economy

Stock markets move well ahead of economies. But every cycle is different.

Markets move ahead of economic cycles. Investors have started moving to a less defensive crouch, adding to tech. The typical next move is buying interest rate sensitives, like real estate, as the Fed prepares to cut interest rates. But every cycle is different, and this move delayed by the banks scare and commercial real estate problems. We are invested but defensive. Still focused on traditional defensives and big tech. With interest rate cuts the catalyst for the next bull market, but a faster economic slowdown still to come first.

Market cycle says investors should be looking to become less defensive as rate cuts loom

The market has transitioned from a pure focus on traditional defensive sectors, like consumer staples and healthcare. To a slightly more offensive focus on tech and communications. With the Fed likely now done hiking interest rates and a soft economic landing still possible. But every cycle is different. This one ignored traditional interest rate sensitives, like real estate and some financials, that typically benefit from coming interest rate cuts. It is too early to bottom-fish the most economically sensitive commodities and small cap.

Fed typically waits as little as six months before cutting interest rates. Market is pricing similar

The Fed typically does not wait a long time at the interest rate cycle peak. The pause length ranged from 6- 13 months the past four cycles in past 30 years. The market is now pricing a 6 month wait between the last May hike and the start of cuts in November. There is some room for disappointment in the exact timing and magnitude of coming cuts. But it remains the clearest indicator to investors of the next bull market.

Real estate and financial interest rate sensitives derailed by banks scare and office WFH worries

Real estate and many financials are the typical interest rate sensitive segments that would typically perform well as cuts come into view. This has been disrupted in this cycle. By structural doubts on commercial real estate lending and office demand. To the smouldering banks scare of deposit outflows and squeeze on profitability. But improving housing market activity, with 30-year mortgage rates off highs and strong structural demand, seen a sharp rally in homebuilding stocks showing is not completely absent.

Fixed income typically performs when rates peaked, along with other ’long duration’ assets

The top of the Fed rate cycle has typically been good for fixed income. These saw an average 8% one year forward return in recent cycles. More broadly, the outlook for less economic growth and lower inflation is a support for ‘long duration’ assets, from tech to crypto. These benefits offset uncertainties over less growth.

Equity sector rotation during average Stock market and Economic cycles

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, and now financial sector concerns, is accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery. See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.