Summary

Short term growth pain for long term gain

Stars aligning for long-awaited growth slowdown, and markets are not prepared. Three drivers are 1) now 5% Fed funds rate, 2) banks scare, 3) debt ceiling June 1 showdown. May drive short term volatility, overwhelm jobs strength, but be a long term positive. Tech heavy stock market is more sensitive to lower interest rate outlook than to growth view. Market recession indicators show market complacent on recession risk.

Fed pauses hikes but bank fears return

Stocks eased as US bank fear returned even after JPM bought FRC, Fed paused 5% rate cycle but cautioned against cut forecasts, and June 1 debt ceiling deadline looms. But jobs report resilient and AAPL gave more big tech results relief. PACW and WAL centre of bank fears. MSFT and AMD to develop AI chip. KVUE $45 billion spin off from JNJ soared. See our Q2 Outlook HERE. Video updates, twitter @laidler_ben.

Prepare for harder won returns

After a strong start to the year we think positive returns will be harder won now, with growth to slow, US debt ceiling looming, volatility too low, and market seasonality worsening.

China’s stealth stock rally

The weak recent performance of China’s markets obscures a stealth stock rally by overseas proxies luxury, semis, gaming. Recovery broadening, and market large, and counter-cyclical.

Luxury is resilient but not immune

It’s best performer YTD, with investors rewarding luxury’s all-weather combo of resilient demand and pricing power. But history shows a recession would still hurt. @LuxuryBrands.

Europe’s bullish carbon market reforms

Europe’ carbon emissions allowance prices have been falling. But obscures long term reforms to boost demand and cut supply.

Bitcoin bucks market weakness

BTC resilient around $29,000 and taking its asset class market cap ‘dominance’ to near 2-year high 47%. Was supported by 1) return of fiat US bank system fears, and 2) Fed 5% interest rate cycle pause. Elsewhere saw White House float idea of 30% crypto mining tax, and BABA build a metaverse launchpad on AVAX.

Commodities slump resumes

Brent crude led renewed commodity weakness as nears $70/bbl. as US bank fears stoked recession demand worry. This also boosted safer-haven gold demand to near all-time-high price. High-flying sugar and cocoa prices took a breather. eToro added 5 new ag commodities to platform, from OJ to oats and rice.

The week ahead: Buffett, inflation, BoE

1) Highlight est. 10th US inflation (Tue) fall to <5%. 2) BoE 12th hike, to 4.5%, with near world’ highest inflation. 3) Continued resilient Q1 earnings. Turn of DIS, PYPL, ABNB, OXY. 4) Last weekend’s BRK Omaha AGM w/ Buffett, UK coronation holiday (Mon), and key Turkey election (14th).

Our key views: Accelerated macro outlook

Banking fears individual not systemic. But doing Fed’s job for it. Accelerating GDP and inflation slowdown and interest rate peak. See market recovery with bumps in road. Slowdown hurts earnings. Low yields help valuation. Focus cheap and defensive assets, from healthcare to big tech More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.24% | 0.56% | 1.59% |

| SPX500 | -0.80% | 0.76% | 7.73% |

| NASDAQ | 0.07% | 1.22% | 16.90% |

| UK100 | -1.17% | 0.48% | 4.38% |

| GER30 | 0.24% | 2.33% | 14.63% |

| JPN225 | 1.88% | 3.08% | 11.74% |

| HKG50 | 0.78% | -1.39% | 1.35% |

*Data accurate as of 08/05/2023

Market Views

Fed pauses rate hikes but bank fears return

- Stocks eased as US bank fear returned even after JPM bought FRC, Fed paused 5% rate cycle but cautioned against cut forecasts, and June 1 debt ceiling deadline looms. But jobs market firm and AAPL gave more big tech Q1 results relief. PACW and WAL centre of small bank fears. MSFT and AMD to develop AI chip. KVUE $45 billion spin off from JNJ soared.. See our 2023 Year Ahead HERE.

Prepare for harder won returns

- Markets surprised this year, and we see more gains. The long-duration heavy stock market disproportionately benefits from peak Fed rates, capped bond yields, and lower inflation outlook. And poor investor sentiment is a clear support.

- But returns will be harder won. Current low stock volatility and strong Q1 cyclicals earnings are diversions, with economic slowdown to speed up. Stocks seem complacent to debt ceiling risk and start of weak seasonality is a clear technical headwind. We focus on long duration big tech and traditional defensives and are cautious small cap and commodity cyclicals.

China’s stealth stock rally

- China’s economy recovering, inflation low, and market P/E valuations near half of US averages. Yet China’s equities have not performed well this year. Due to 1) consumer-led economic rebound, with exports and property market weak. 2) High expectations after Q4’s big stock rebound. 3) Less appetite for Chinese tech stocks when those in the world’s largest market are performing so well.

- But this understates a stealth stock recovery seen in many, but not all, consumer-focused offshore China proxies from luxury to semiconductors and gaming. China’s economic recovery is broadening and it’s a large, counter-cyclical, and uncorrelated market opportunity for investors.

Luxury is resilient but not immune

- Sector is up 23% globally this year, equal to semis as world’s best performing industry. It has powered France and Italy to double digit market gains. LVMH to Europe’s biggest stock. Our ‘King Charles’ index of UK heritage brands has left the FTSE 100 in dust.

- Investors rewarded luxury’s all-weather resilient demand and pricing power. Sector side-stepped covid recession but hit harder by global financial crisis. when valuations and earnings fell sharply. The now stocks bigger, more diversified, China’s recovery counter-cyclical. But it’s reminder luxury recession resilient not immune. These remain discretionary buys. @LuxuryBrands.

Europe’s bullish carbon market reforms

- European carbon emissions allowance prices fallen below the symbolic €100/tonne of CO2 reached for first time in Q1. Europe’s industrial output has been weakening, cutting demand for allowances. Whilst the huge 80% natgas price slump led to less gas-to coal switching and demand for allowances.

- But this cyclical weakness obscures the recent passage of structural reforms to cut allowance supply and boost demand. This is likely to only push prices up in the longer term.

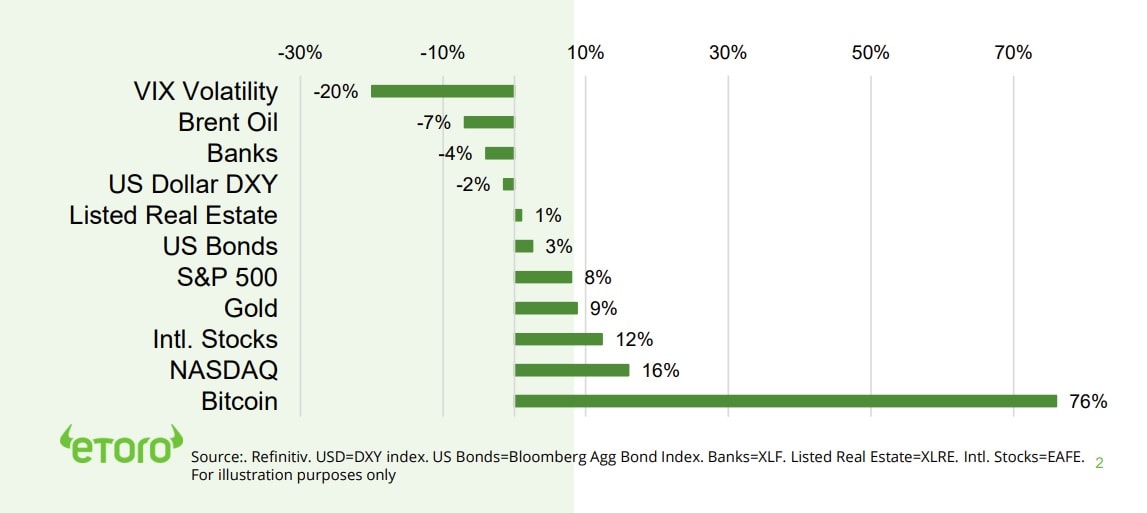

Year-to-date asset class returns (%)

Bitcoin resilient to market volatility

- Bitcoin (BTC) remained resilient to the pick up in broader market and crypto volatility, holding around the $29,000. This has taken its market cap. ‘dominance’ of the crypto asset class to near a 2-year high of 47%.

- Bitcoin resilience been driven by 1) return of fear to fiat US banking system highlighting benefits of decentralised crypto, and 2) relief from US Fed signalling a pause to its 5% one year hiking cycle.

- US White House float idea for a 30% crypto mining tax. Whilst Alibaba (BABA) built a metaverse launchpad on Avalanche (AVAX).

Commodities slump resumes

- Brent crude prices fell sharply towards $70/bbl., leading the asset class decline, as global demand fear returned on renewed US bank worries. Lower prices starting to feed to lower US drilling activity which now only +6% YoY at 748 rigs.

- These fears also boosted demand for safer haven gold and silver precious metals prices. Gold neared an all-time-price at $2,070/oz.

- High-flying sugar and cocoa prices, amongst top performers YTD, prices fell after recent strength. The FAO world food price index is down 20% YoY.

- eToro has added five additional agricultural commodities to the platform: orange juice, soyabean oil, soy meal, oats, and rough rice.

The week ahead: Buffett, inflation, BoE, earnings

| 1 Week | 1 Month | YTD | |

| IT | 2.18% | 5.10% | 21.63% |

| Healthcare | -0.78% | 5.06% | -1.37% |

| C Cyclicals | 0.15% | 4.24% | 13.76% |

| Small Caps | -1.26% | 0.93% | 0.44% |

| Value | -0.11% | 3.97% | -0.61% |

| Bitcoin | 7.16% | 7.50% | 77.63% |

| Ethereum | 2.48% | 6.79% | 58.71% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Fed and ECB hikes, AAPL earnings

- Tuesday’s April US inflation report is the highlight of the week, after the Fed’s recent rate pause. Estimates for a 10th headline fall to under a 5% rise, and producer price (Thu) to fall to <2.5%.

- The Bank of England (BoE) the next in the central bank spotlight as is set for a 12th consecutive interest rate hike, to 4.5%, as it battles still double digit inflation that is near the world’s highest.

- The resilient Q1 earnings season starts to begin winding down with reports from PYPL, ABNB, DIS, BNTX, and OXY. 75% of reports have beaten expectations so far, with S&P 500 EPS -1% YoY.

- UK markets closed on Monday for the coronation holiday. Investors will review weekend’s Buffett Berkshire Hathaway AGM from Omaha, and look ahead to Turkey’s tight election on May 14th.

Our key views: An accelerated macro outlook

- Banking sector fears are likely individual not systemic. Bank buffers are bigger now and the authorities response stronger. But this is doing the Fed’s job for it. By accelerating the GDP and inflation slowdown and the interest rate peak.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -1.30% | -3.09% | -8.73% |

| Brent Oil | -3.75% | -11.27% | -12.35% |

| Gold Spot | 1.40% | 0.06% | 10.64% |

| DXY USD | -0.37% | -0.80% | -2.16% |

| EUR/USD | 1.15% | 2.18% | 4.14% |

| US 10Yr Yld | 1.78 | 3.51 | -43.97 |

| VIX Vol. | 8.94% | -6.58% | -20.67% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: Three horsemen of the coming growth slowdown

The stars are aligning for the long-awaited growth slowdown, and markets are not prepared

Markets are set to see a faster economic growth slowdown. After months of waiting and false dawns, and jobs market still resilient, this could now be just around the corner. This would drive volatility with current levels too low and markets complacent. But it is ultimately positive. Accelerating the inflation slowdown and timing of interest rate cuts. And giving entry points to the majority of still cautious investors. The stock market is heavily weighted to tech and healthcare that have defensive cash flows and valuations sensitive to lower bond yields. And lacking cyclical small cap and commodities most exposed to the growth shortfall.

Three horsemen of the slowdown: 1) 5% Fed funds rate, 2) banks scare, 3) debt ceiling showdown

Many have been crying wolf on a faster slowdown for months, but it hasn’t arrived yet. Corporate revenue growth still positive in Q1, US consumer spending rose 3.7%. The economy was still adding over 200,000 jobs a month. Yet a faster slowdown is coming with 1) the lagged impact of 5% Fed interest rates after the shortest and sharpest increase in modern history. 2) The still smouldering US banks scare tightening lending, especially for commercial real estate and small caps. 3) The debt ceiling standoff raising uncertainty now and cutting spending in the future. All against a backdrop of below average VIX volatility.

Tech and healthcare heavy stock market more sensitive to lower interest rate than growth outlook

Stocks may suffer short term, as the economic and earnings slowdown reality combines with low volatility and poor mid-year seasonality. But they should be resilient, and any meaningful weakness a buying opportunity for the medium term. Over 50% of the US stock market is made up of defensive and long duration technology stocks. Other defensive sectors like healthcare and staples only further add to this weighting. This is dramatically more than their size in the real economy. Economically sensitive mall caps, by contrast, are 50% the labour market but only 15% the stock market. Plainly put, the stock market is more sensitive to the coming lower interest rate cuts than the near-term weakness in the growth outlook.

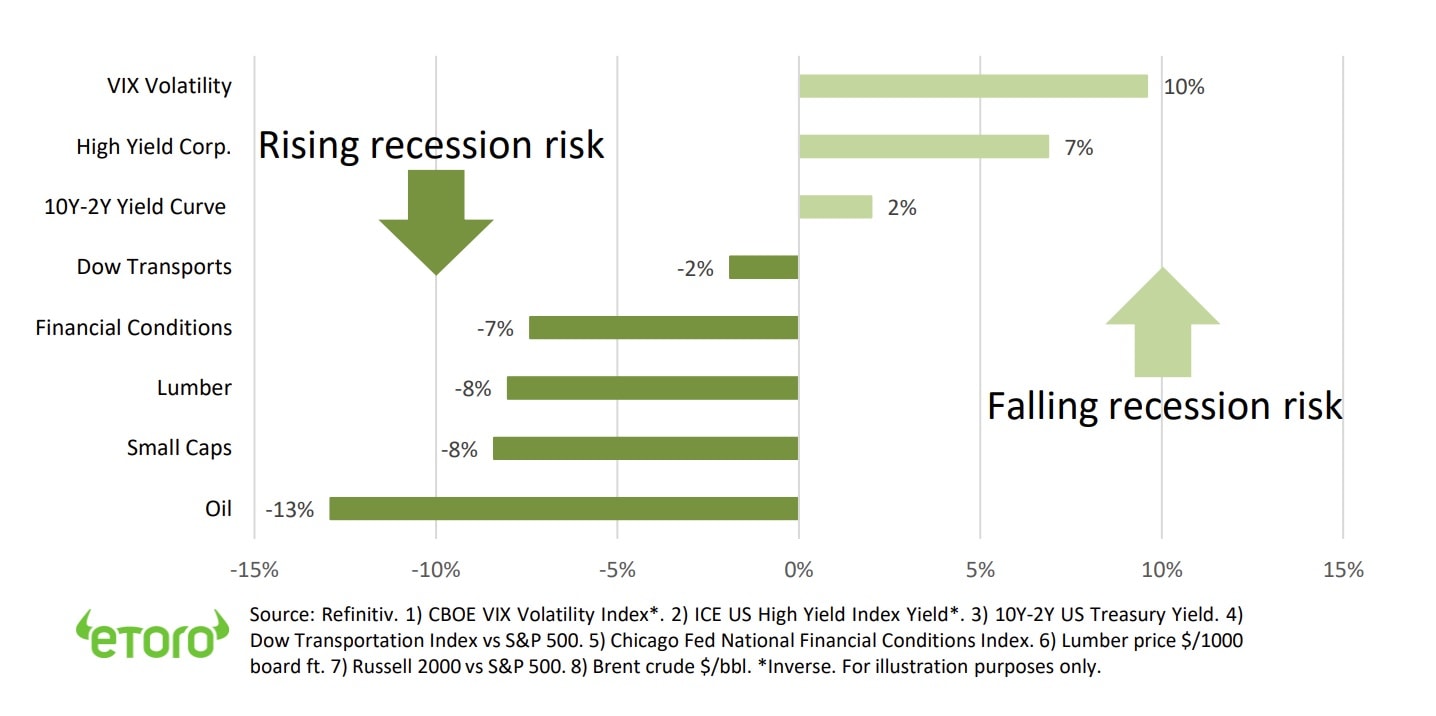

The market recession indicators we are watching show investors are still complacent on recession

There is a cottage industry of recession lead indicators. Many of these are lagging or reported infrequently. So, we watch the real time and forward-looking market indicators. Most have been deteriorating, but not dramatically so. This has been led by lower oil and lumber (for housing) prices, and underperformance of small cap and transport stocks, and tightening financial conditions. But others have become less worrying. The VIX volatility index and yields of riskiest high yield corporate bonds have fallen. Whilst the inverted yield curve has not got any worse. This tells us markets are still complacent to the rising growth risks.

Market based recession indicators (% Change Year-to-date)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, and now financial sector concerns, is accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery. See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.