Summary

Winners and losers from the US debt deal

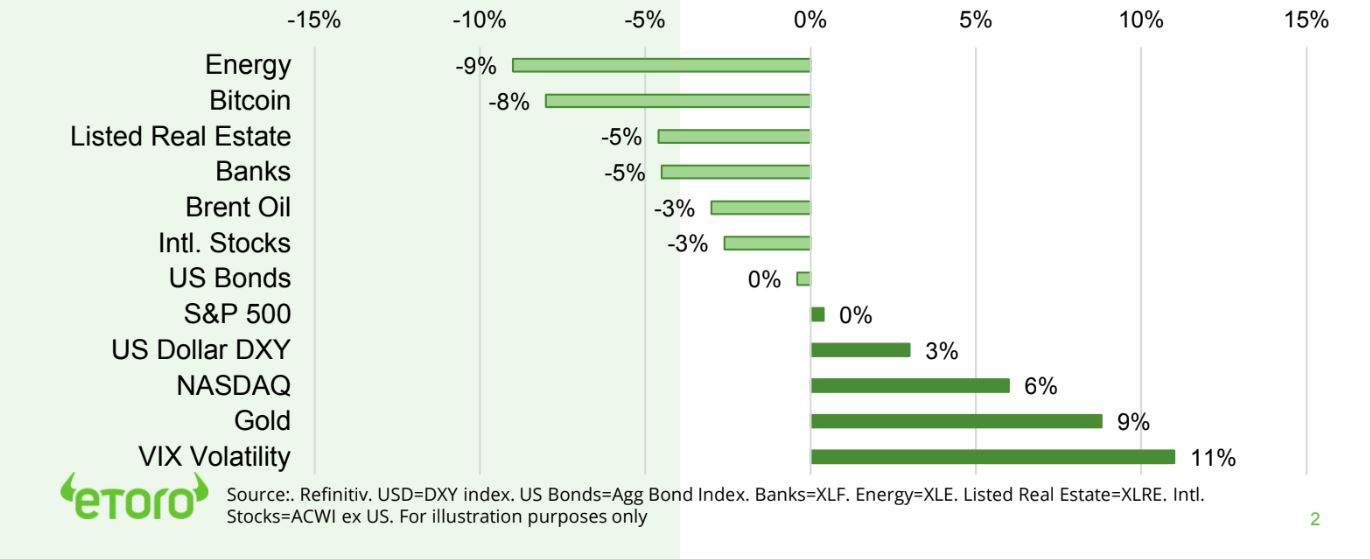

The last-minute 2-year US debt ceiling deal gives markets one less thing to worry about. But don’t expect a big relief rally, having seen no big sell off and with some macro costs still to come, with $100bn/yr. budget cuts, $1trn of bond issuance, and a potential Fitch AAA debt rating downgrade. Consumer is to face pressure from welfare cuts and the 3.5yr student loan re-start. But Defence, healthcare, and energy to see relief.

Debt deal and AI optimism drives markets

Stock markets closed May strong as US debt deal passed, jobs growth eased recession fears, and Fed pushed back on a June hike. Europe core inflation fell below the US. China stocks bounced from bear market, after -20% vs January. NVDA became only 9th stock to hit $1 trillion market cap on AI optimism. BLND dumped from FTSE 100 in real estate hit. See our Q2 Outlook HERE. Video updates, twitter @laidler_ben.

Kicking off the summer

Harder won but positive returns ahead as enter peak summer. June typically 2nd weakest month of year. Concerns focused on more US Fed hikes and bond issuance indigestion.

AI moves from hope to reality

NVDA led move to AI sales reality, and remade case for thematic investing. Retail investors early into AI boom. Whilst underperformance of AI driven ETF reminder it’s not infallible.

Apple’s ‘new era’

May launch AR/VR headset in first product since 2016. Firming growth prospects and supporting recent rally, reignite enthusiasm for out-of-favour metaverse, and further boost Semis.

The best of both bond worlds

Bond funds $80bn inflows as equity funds lost $90bn, as investors sought security and income. Target Maturity ETFs a growing niche with single bond experience but ETF benefits.

Crypto assets sit out AI craze

Crypto markets largely immune to broader tech rally, with correlation low. BTC and ETH held on to asset class leading gains this year. XRP gained on SEC lawsuit end hopes, and LTC on coming August 10th halving. Largest interdealer broker TCAP.L launched crypto trading, whilst miner CLSK spent $40 million on new rigs.

Energy prices hold back commodities

Brent fell toward $70/bbl ahead of OPEC meeting with hope low for production cuts. US natgas fell toward key $2.0/MMBtu on output rises. 40% EU natgas plunge in last month pulled down carbon credits to 4-month low. XOM and CVX climate resolution support plunged at AGMs. Metals up on China property support hopes.

The week ahead: OPEC, China, Apple, earnings

1) Digesting OPEC+ six-month Vienna meeting as Brent 40% off high. 2) China services PMI, trade, inflation and new stimulus as -20% bear market. 3) AAPL potential AR/VR headset launch (Mon) in first new segment since 2016. 4) Earnings NIO to ITX.MC, WIZZ.L and GME.

Our key views: A goldilocks moment

Markets boosted by resilient economic growth and gradually easing inflation pressure. We see a market recovery but with coming bumps in road. Coming slowdown hurts earnings. But low yields help valuations. Focus on cheap and defensive assets from healthcare to big tech. More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 2.02% | 0.26% | 1.86% |

| SPX500 | 1.83% | 3.53% | 11.53% |

| NASDAQ | 2.04% | 8.22% | 26.51% |

| UK100 | -0.26% | -2.20% | 2.09% |

| GER30 | 0.42% | 0.57% | 15.28% |

| JPN225 | 1.97% | 8.12% | 20.81% |

| HKG50 | 1.08% | -5.48% | -4.20% |

*Data accurate as of 05/06/2023

Market Views

Debt deal and AI optimism drives markets

- Stock markets closed May strong as US debt deal passed, jobs growth eased recession fears, and Fed pushed back on June hike. Europe helped by core inflation falling below US levels. China stocks bounced from bear market after -20% vs January. NVDA 9th stock to hit $1 trillion market cap, on AI optimism, whilst BLND dumped from FTSE 100 in real estate blow. See our Q2 Outlook HERE.

Kicking off the summer

- Our outlook for harder won but positive returns in place as enter peak summer. Typically, see’s lower stock market returns and volumes, with June historically 2nd weakest month of year (and worst in France and Italy). Concerns further US Fed hikes and post debt-ceiling bond indigestion.

- Markets are being supported by well-founded tech optimism, a broad upturn in earnings forecasts, and negative investor sentiment. We focus on long duration big tech and traditional defensives and are cautious small cap and commodity cyclicals. Economic growth will slow, lowering inflation and interest rates.

AI moves from hope to reality

- Big-tech stocks driven all before them this year. NASDAQ up 24% and S&P 500 10%. Whilst equal weight S&P 500 index and Value-heavy Dow index are flat. This tech ‘reversal rally’ from 2022 losses has three supports: 1) a cost-cutting and artificial intelligence (AI) driven return to earnings growth. 2) investor revaluation of big tech’ fortress balance sheet and wide profit margin attributes.

- 3) lower bond yields easing the valuation ceiling. NVIDIA (NVDA) has led the move from AI hope to surging revenue reality. This also remade the case for thematic investing. Retail investors were early into this AI boom. Whilst the underperformance of AI-driven ETF is a reminder that it’s not infallible. See @AI-Revolution.

Apple’s ‘new era’

- World’ largest market cap stock, Apple (AAPL) World Developers Conference June 5-9. Potentially set to launch long-awaited AR/VR headset, in biggest launch since iWatch in 2015 and Air Pods in 2016. Could firm up earnings growth prospects, reignite enthusiasm for out-of-favour ‘metaverse’, and further boost demand for semiconductor chips.

- Its stock is up 38% this year, near quadruple S&P 500 gain. Has taken forward P/E to 27x, well above average 21x, even as earnings growth forecasts stagnated after the pandemic boom. The company could do with a new growth driver, alongside its fast-expanding services empire.

The best of both bond worlds

- US government two- and three-year bond yields 4x post global financial crisis average and above long term average. Bonds attracting big fund inflows, with yields high and inflation shock easing.

- A newer breed of target maturity ETF bond funds are also proving popular to lock in high yields, along with low cost and diversification. Are not for everyone, with some maturity reinvestment risk, but shows renewed bond interest.

Major asset price performance in May (%)

Crypto sits out the AI craze

- Crypto assets largely immune to AI-driven surge in many tech stocks, and relief on the US debt ceiling deal. BTC and ETH have held on to their asset-class leading gains so far this year.

- Crypto performance was led by gains at Ripple (XRP) on hope its long-running SEC lawsuit is near ending, and by Litecoin (LTC), as it nears its August 10th supply ‘halving’ event.

- Other news saw TP ICAP (TCAP.L), the world’s largest interdealer broker, launch crypto trading for its institutional clients. Whilst miner Clean Spark (CLSK) spent $40 million on new rigs.

Commodities hurt by weaker energy price

- Brent fell toward $70/bbl. ahead of six-monthly OPEC meeting in Vienna, with hopes low for more cuts in already big supply curbs, with reported differences between top producers.

- US natgas prices fell back toward key $2.0 MMBtu level on further output increases, and despite outlook for hotter summer weather. EU carbon credit prices fell to four-month low as 40% plunge in local natgas prices last month and slower industrial activity cut demand for credits.

- Oil giants Exxon (XOM) and Chevron (CVX) saw climate AGM resolution support plunge.

- Industrial metals rose on hope for government support to the key China property sector.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 1.52% | 11.42% | 34.03% |

| Healthcare | 2.33% | -1.75% | -3.12% |

| C Cyclicals | 2.72% | 4.86% | 18.07% |

| Small Caps | 3.26% | 5.70% | 3.96% |

| Value | 1.68% | -0.43% | -2.48% |

| Bitcoin | 1.64% | -5.53% | 64.62% |

| Ethereum | 3.97% | 1.69% | 59.58% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: OPEC, China, Apple, and earnings

- Markets will digest OPEC+ (Sun) six month meet in Vienna where chose to keep production cuts flat at 2mbpd even as Brent crude prices have fallen towards $70bl, down near 40% from 2022 high.

- China stocks fell to bear-market -20% vs Jan. high as investors sour on the China reopening. Focus week’s services PMI (est., 55), trade (imports est. – 5%), inflation (0.2% YoY) and new stimulus plans.

- World’ largest stock AAPL hosts World Developers Conference (Mon) with expectations high for launch of its first AR/VR headset. It follows last week META launch of its $500 Quest 3 headset.

- Latest earnings focus on US consumer stocks SJM, CPB, CASY, and GME, plus tech names GTLB, SMAR, and DOCU. As well as overseas stocks from China’s NIO to Spain’ ITX.MC and Hungary’ WIZZ.L.

Our key views: A goldilocks moment

- Markets being boosted by combination of resilient economic growth, helping earnings, and slowly easing inflation, helping valuations. The economic slowdown is still coming on impacted of lagged 5% rates impact, less lending, and spending cuts.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.26% | -3.04% | -11.51% |

| Brent Oil | -1.00% | 1.37% | -11.15% |

| Gold Spot | 0.94% | -2.99% | 7.33% |

| DXY USD | -0.16% | 2.79% | 0.50% |

| EUR/USD | -0.18% | -2.80% | 0.07% |

| US 10Yr Yld | -10.67 | 25.96 | -18.01 |

| VIX Vol. | -18.66% | -15.07% | -32.63% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

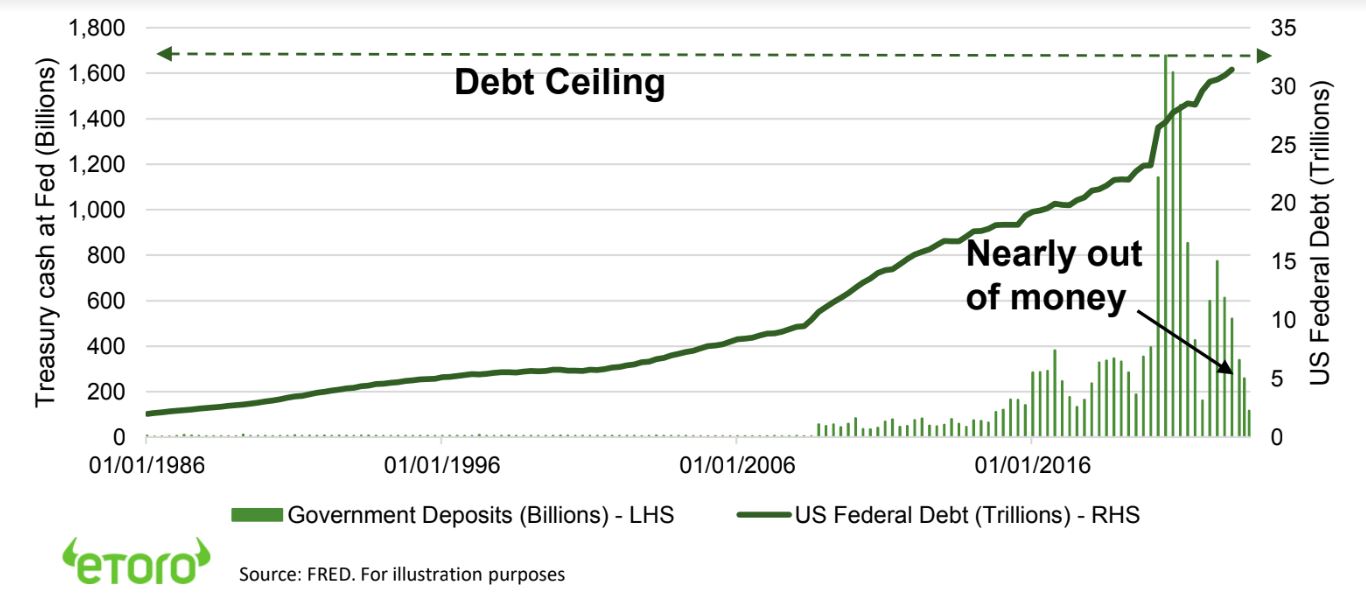

Focus of Week: US debt ceiling deal relief

Last minute US debt ceiling deal gives markets one less thing to worry about

The two-year US debt ceiling deal is positive, but reaction likely muted as most markets never sold off and the deal has modest negative bond market and economic growth consequences. Poorer consumers will bear the brunt of the spending cuts, whilst defence, healthcare, and energy are likely relative winners. The deal will suspend the $31.4 trillion US debt ceiling for two years, in return for government spending caps for two years. The outlook for catch-up Treasury bond issuance is depressing prices near term, and the country may set lose its AAA Fitch rating. The deal has been approved by both houses of US Congress. We are positive markets, underpinned by resilient growth and earnings, falling inflation, and coming rate cuts.

But don’t expect a big relief rally, having seen no sell-off and with some economic costs to come

An end to this showdown is a market relief. But any rebound limited as markets never really sold off , with S&P 500 flat in May. Whilst there are economic and market costs. The deal will see $100 billion a year less government spending. Focused on 25% the budget that is not mandatory spending, like social security or Medicare, or interest payments. These cuts are equal to 0.05% of GDP and cut expected US GDP growth rate of 0.8% next year. This will combine with 5% interest rates and less bank lending to slow the economy.

Sector winners and losers will become clearer in September, but consumer to face more pressures

Specific spending winners and losers will not be clear until the September budget bill negotiations. Cuts will be most felt at welfare programs, where work requirements are raised, and student loans, where repayments to resume in August after a 3.5-year pause. Both will fall hardest on low-income consumer spending, already seeing drained pandemic savings and rising labour market uncertainty. Defence and healthcare will see some relief as spending will still grow or be untouched. Energy permitting rules are to be eased. And Virginia’ Mountain Valley natgas pipeline, involving NextEra (NEE) and ConEd (ED), approved.

Coming catch-up Treasury bond issuance depressing prices today, and debt downgrade could come

With the ceiling now raised the US Treasury is set to issue around $1 trillion of bonds to fund itself. Markets have already been pushing down bond prices in anticipation. This is a technical factor, and the lower growth and inflation fundamentals still argue for higher bond prices medium term. The US could still be downgraded by third-largest credit rating agency Fitch, which put it on review for a downgrade from the highest AAA level. This would follow S&P Global’s rating cut in 2011, the last time the US neared default.

US Federal debt versus Treasury cash account balance

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, financial sector and debt ceiling concerns accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery.See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the rebound this year and are supported high company profitability and peaked bond yields. Focus on cash-flows defensives, like healthcare and high dividend. And Big-tech supported by defensive growth, cost cutting, and AI. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and boosts tech and crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices and reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive China as economy reopens, supports property sector, eases tech regulation pressure. Valuations 30% cheaper than US and markets out of favour. Recovery helps global sectors from luxury to materials. EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia have benefitted from strong equity market weight in commodities and financials, as global growth resilient and bond yields risen. Now could be becoming headwinds. Japanese equities among worlds cheapest with own and China-proxy growth and governance improving but threats of tighter monetary policy and stronger Yen. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Expect better performance as 1) lower bond yields take pressure off valuations and 2) high profit margins and fortress balance sheets make defensive to recession risks. 2) Cost cuts and AI add to growth. ‘Disruptive’ tech much more vulnerable. |

| Defensives | More attractive as recession risks rising and bond yields have peaked. Consumer staples, utilities, (some) real estate attractive with defensive cash flows, less exposed to rising economic growth risks, and with robust dividends. Healthcare is the most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authority’s response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hathaway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long-term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has widespread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attractive cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+. But commodities not to repeat their 2021 and 2022 performance leadership. Gold benefits from safer haven demand. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.