The Daily Breakdown takes a much closer look at the S&P 500 ETF — SPY — as it tests a key support/resistance area.

Friday’s TLDR

- Stocks hit 2025 lows

- Jobs in focus today

What’s happening?

Stocks took a punch square in the mouth on Thursday, with investors reacting to the latest round of tariffs announced by President Trump on Wednesday evening. The market’s reaction was clear — investors did not like what was unveiled.

In many investors’ minds, the announcement was far worse than they had anticipated. That’s even as Trump talked about his leniency ahead of the new tariffs. The reaction was clear, with all major US stock indices hitting new year-to-date lows yesterday.

The S&P 500 fell 4.8%, the Nasdaq 100 lost 5.3%, the Dow dropped 4%, and the Russell 2000 plunged 6.6%.

Now investors will have to incorporate the latest jobs report into their assessment.

At 8:30 a.m. ET, the latest monthly jobs figure will be released. Economists estimate that 137K jobs were added to the economy last month — down from 151K in the prior report — and are forecasting an unemployment rate of 4.1%, unchanged from last month.

Investors are seeking some reassurance on the labor market. Thursday’s jobless claims report was better than expected. So was Wednesday’s ADP report. That doesn’t mean today’s report will be good, but it at least gives some hope.

A reassuring report will allow investors to refocus on the tariff front and gain some clarity. However, a disappointing report could add to the recent uncertainty and worries over the economy.

Perhaps, Fed Chair Powell can provide some reassurance when he speaks at a conference at 11:25 a.m. ET on Friday.

Want to receive these insights straight to your inbox?

The setup — S&P 500

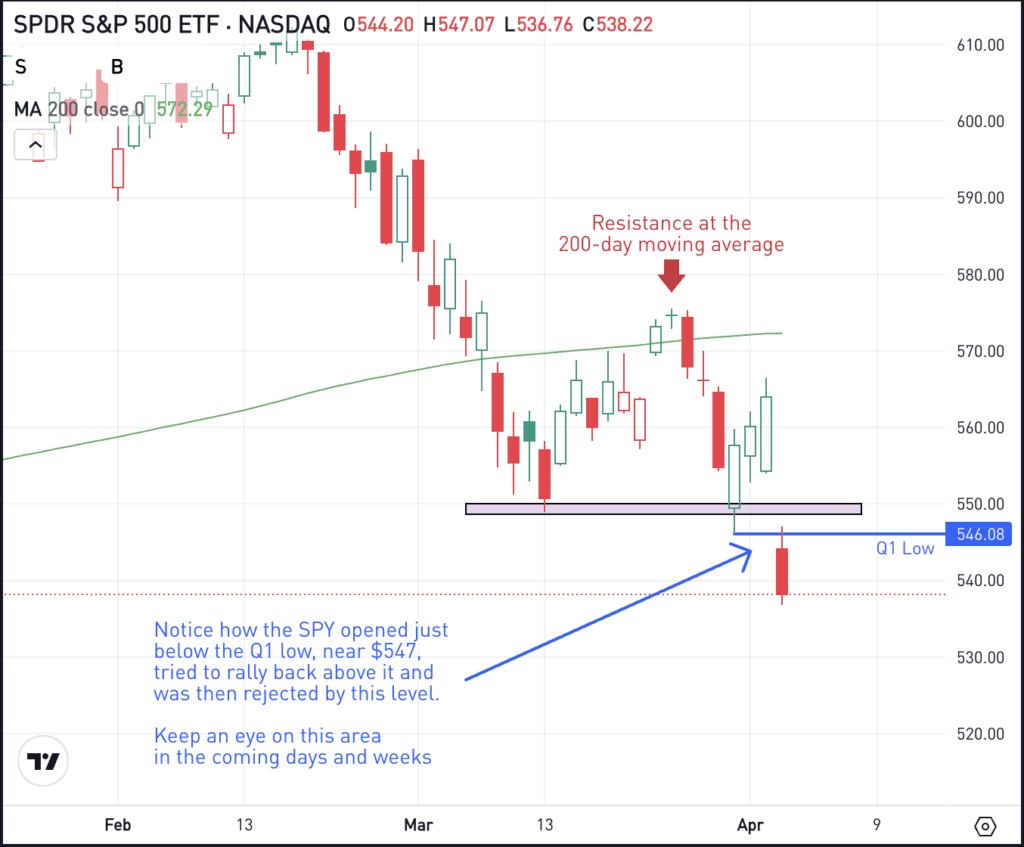

The S&P 500 made new 2025 lows on March 31st, the last day of Q1. However, the index powered higher off the open and actually finished positive on the day.

That low — which is ~5,488 in the index and $547 in the SPY ETF — was on watch today, with investors hoping that the index would either hold above this level or regain it if the index dropped below it.

Instead, the SPY broke this low, failed to regain it, then tumbled lower into the close.

Daily chart of SPY ETF, for The Daily Breakdown

Long-term investors probably aren’t worried about the day-to-day price action in the S&P 500 — nor should they be, really. However, active investors may want to keep an eye on this Q1 low.

If the SPY can regain the Q1 low in the next few days or weeks — and ideally, the $550 area — active investors will have a new low to measure against for risk management purposes.

However, if the SPY fails to regain the Q1 level, then it’s a telling technical sign suggesting that the “risk-off” vibe remains ongoing.

Options

This is one area where options can come into play, as the risk is tied to the premium paid when buying options or option spreads.

Bulls can utilize calls or call spreads to speculate on a rebound, while bears can use puts or puts spread to speculate on more downside should support break.

For those looking to learn more about options, consider visiting the eToro Academy.

That being said, investors can be neutral on SPY and choose to do nothing with the stock. Remember, you don’t have to be involved with every stock all the time.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.