The Daily Breakdown takes a scoop into Chipotle, examining what’s going wrong with the stock. Is the decline enough to entice investors?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Most of us are familiar with Chipotle, the company that’s famous for its bowl and burrito offerings. This fast-casual juggernaut commanded a market cap of almost $100 billion at its all-time high from 2024, but has struggled since, with shares down nearly 40% from the peak and into an interesting technical area.

It didn’t help that former CEO Brian Niccol — the one who helped lead a massive turnaround at the firm — left last year and went to Starbucks. From that perspective, some investors have likely lost faith in management’s ability to properly steer the Chipotle ship.

The Business

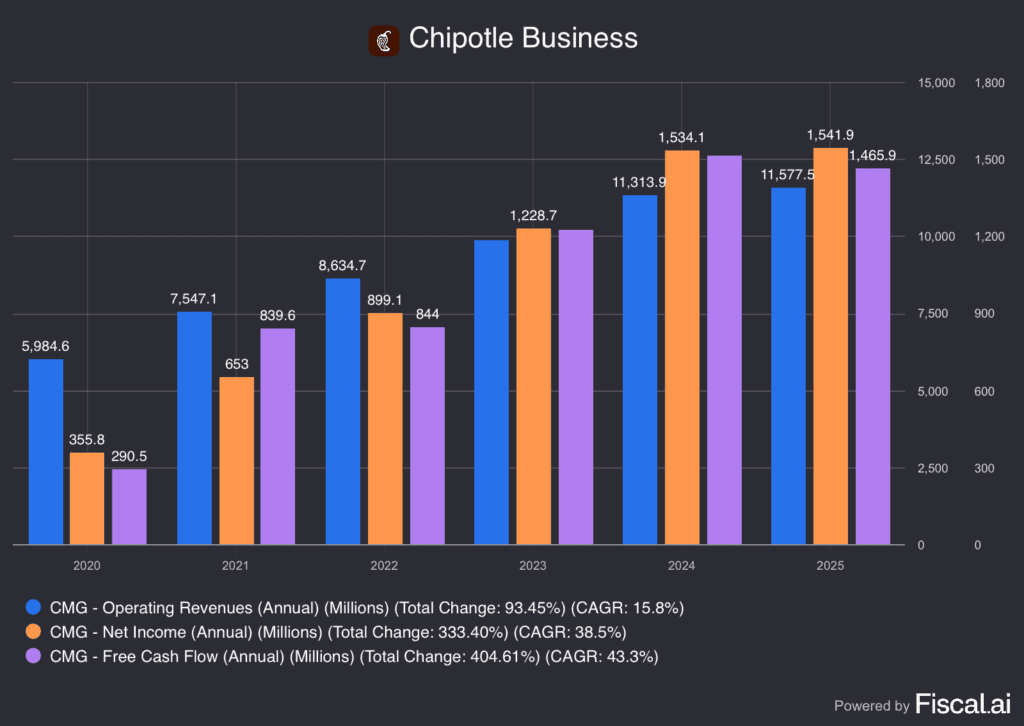

When we look at the business, we can see that revenue, net income, and free cash flow have been steadily growing over the years. When we look at expectations for 2025, analysts expect revenue to rise 7.5% and earnings to grow 8.5%. Further, they expect both figures to accelerate to double-digit growth in 2026 and 2027, with earnings growth outpacing revenue growth (which would be good for margins).

The risk: While analysts’ estimates could be spot-on accurate — or even too conservative — one risk is that the estimates are too optimistic. If that’s the case, Chipotle may not grow as fast as investors currently expect and that could inflict further pain on its share price.

Another risk? The consumer. In the company’s last conference call, CEO Scott Boatwright said:

“I think much of what we’re experiencing right now is due to macro and the low-income consumer is looking for value as a price point. At present you have to look no further than what’s going on with our competitors with snack occasion or $5 meals, and that’s where the consumer is drifting towards, [with] value as a price point because of low consumer sentiment.”

However, he added:

“We did see some share loss in the April-May time frame as the low-income consumer pulled back, but we’re back to share gains yet again in June-July.”

Want to receive these insights straight to your inbox?

Diving Deeper

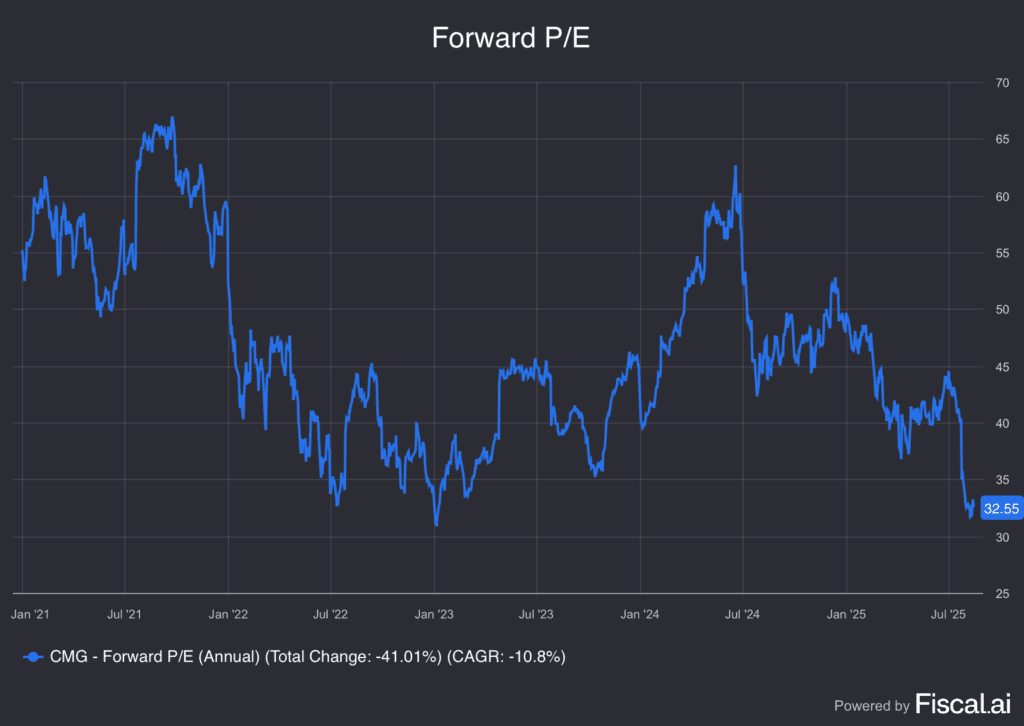

For what it’s worth, analysts’ consensus price target calls for roughly 38% upside in the stock. With expectations still calling for growth, we’ve seen Chipotle’s valuation fall as the share price has moved lower.

The stock now trades with its lowest forward P/E ratio in more than two years.

Bulls may decide that a ~40% decline in the stock price, solid forward growth, and a multi-year low in its forward valuation is enough to warrant a long-term position. Other investors might argue that Chipotle could be prone to a further slowdown in its business or that its valuation is too rich — even if there isn’t a further slowdown from here.

Either way, the stock’s decline has now brought forward an interesting debate among investors.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.