The US caught a downgrade from Moody’s, putting markets in a sour mood. The Daily Breakdown looks to see if stocks can bounce back.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Monday’s TLDR

- HD and Lowe’s lead earnings

- US debt gets a downgrade

- BTC hits new monthly highs

What’s Happening?

What an eventful week it was. Monday’s news of a temporary US-China trade truce gave the Nasdaq 100 a 4% lift on the day, helping to fuel a so-called “perfect week” on Wall Street, with the index gaining on all five days in the week en route to a 6.9% gain. The S&P 500 also strung together five straight daily gains on its way to a 5.3% gain.

As for the next few days, it’s a quiet week of economic reports, while retail earnings are in full focus. However, the discussion has also shifted to US credit, as Moody’s downgraded the US from its AAA rating (down to AA1).

My colleague Lale Akoner wrote a great column on it, saying, “Moody’s just pulled the US’s final AAA rating, citing ballooning debt, a $2T+ annual deficit, and political gridlock over taxes and spending. But for many in the market, this was already priced in. The 27-year era of fiscal stimulus ended in 2023 and net interest payments have quietly climbed to 18% of tax revenues, far above historic norms.

The irony? Moody’s might be late to the party. In 2011, S&P downgraded the U.S. after Congress passed $2T in cuts. Bond yields fell. Now, Moody’s is flagging deficits tied to tax cut extensions that haven’t even passed while ignoring tariffs, which function as a $2T consumption tax that actually supports revenue.”

Looking ahead:

On Tuesday, we’ll get earnings from Home Depot before the open, followed by Palo Alto Networks and Toll Brothers after the close.

Wednesday includes earnings from Lowe’s, Baidu, Target, TJX Companies, Snowflake, Zoom, and Urban Outfitters.

Jobless claims will be on watch on Thursday morning. We’ve seen a slight uptick in this figure in recent weeks, although nothing too alarming. Also on Thursday, Analog Devices, Deckers, Autodesk, Ross Stores, and Workday will report earnings.

Want to receive these insights straight to your inbox?

The Setup — Nasdaq 100

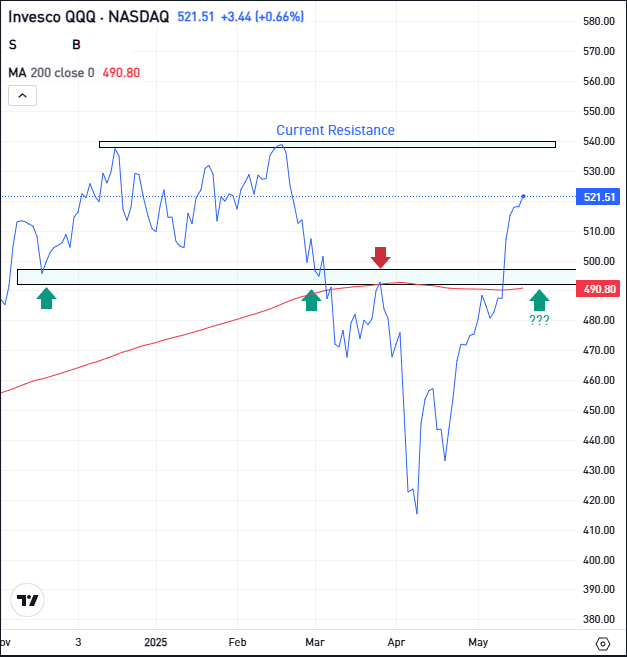

The QQQ follows the Nasdaq 100 and is one of the most traded ETFs in the US. It’s done a tremendous job bouncing from its April lows, ripping back above the $500 area as big tech leads the recent rebound.

Under pressure this morning due to the downgrade news, let’s take a closer look at the chart.

With its rally back above the $490 to $500 zone, the QQQ regained a key support/resistance area and its 200-day moving average. However, notable resistance near $400 looms large.

With this morning’s weakness, some profit-taking isn’t surprising. If more selling pressure comes into the market this week, let’s see if this $490 to $500 zone can resume acting as support. On the flip side, if the rally continues over the next few weeks and months, let’s see how $540 holds up as resistance.

Options

If QQQ is going to remain in an uptrend, bulls will want to see these measures hold as support.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the ETF.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

TLT

Bonds are under pressure this morning, including the TLT ETF — the most popular bond ETF by trading volume. All year long, the $85 area has been support for the TLT, buoying the ETF in January, April and earlier this month. Can it do so again? Check out the chart for TLT.

BTC

Over the weekend, Bitcoin pushed to new highs on the month, but has since faded lower. Still, it’s done a great job consolidating its recent gains as of late, as it hovers between $100K and $105K. Bulls are keeping a close eye on BTC to see if it can lead crypto higher from here.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.