The Daily Breakdown takes a closer look at the US government, as President Trump’s tariffs get a legal ruling and as Musk steps down from DOGE.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Thursday’s TLDR

- Tesla’s Musk refocuses

- Tariffs blocked by courts

- Nvidia beats earnings

What’s Happening

A lot went down on Wednesday, including major news with Tesla’s Elon Musk, President Trump’s sweeping tariffs being blocked by the courts, and of course, Nvidia’s earnings report.

Going in order, Musk said he would step down from his role in the current administration. After having helped spearhead the Department of Government Efficiency — or DOGE — he’s now looking to wind down his involvement.

Musk was critical of the latest spending bill — Trump’s “One Big Beautiful Bill” — while some have said his time was set to end due to his designation as a temporary government official. Others have been critical of DOGE’s efficiency, with the cost-saving outlook dwindling significantly over the past few months.

Regardless of opinions or assumptions, Musk’s Tesla stake has taken a sizable hit since his efforts with the government took hold earlier this year. Now rebounding, investors are cheering his full-time return to helm.

Now on to Trump’s global trade policy, the courts have made a notable ruling.

According to Bloomberg, “The vast majority of President Donald Trump’s global tariffs were deemed illegal and blocked by the US trade court, dealing a major blow to a pillar of his economic agenda…For now, the ruling permanently blocks the tariffs unless the appeals court allows Trump to reinstate them during litigation.”

Not surprisingly, this is sending US equities higher this morning. While there’s already pushback from the Trump administration, the (potential) elimination of sweeping tariffs could be a positive catalyst going into the second half of 2025.

Keep on scrollin’ for Nvidia.

Want to receive these insights straight to your inbox?

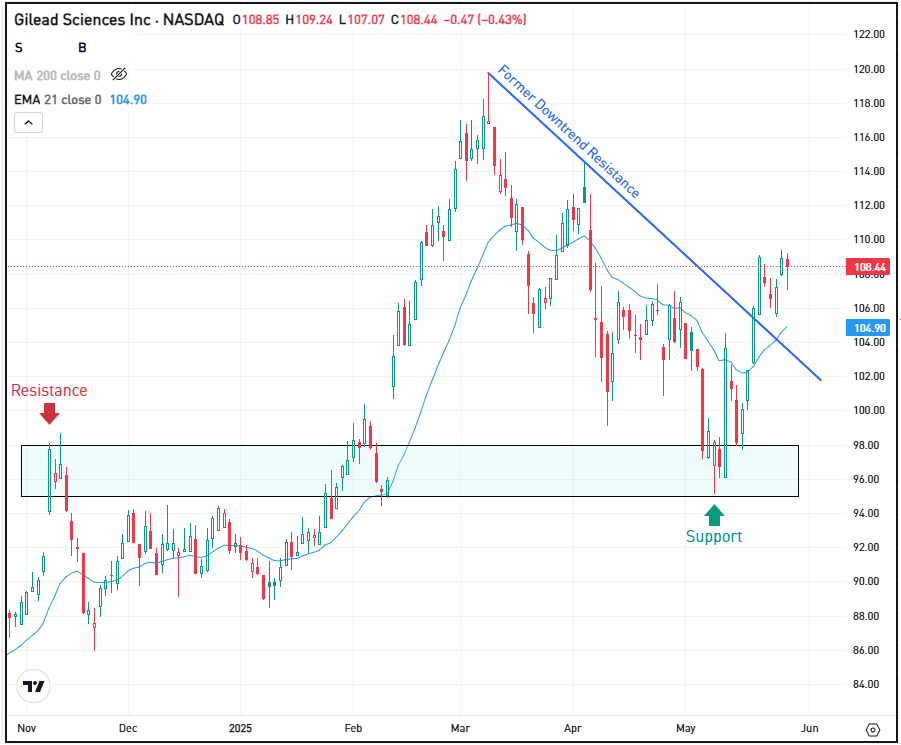

The Setup — Gilead Sciences

Gilead Sciences currently pays a dividend yield of 2.9% and trades at roughly 13.5 times this year’s earnings. In this sense, the yield is higher than the S&P 500 and the valuation is lower. Even though it’s not an apples-to-apples comparison, this will at least have some investors taking a closing look at the fundamentals.

Analysts expect a big jump in adjusted earnings, up to almost $8 a share this year even as revenue is only expected to increase slightly. Consensus estimates call for these figures to grow modestly in 2026, up 6% and 4%, respectively.

Some investors like to see a combination of technical and fundamental catalysts, and on the charts, technicians are taking a closer look as well.

That’s as shares recently found support near $97 and cleared downtrend resistance (blue line).

From here, bulls want to see shares stay above this former downtrend mark. If GILD can do so, investors could see a potential rebound toward the recent highs. However, if shares break down, dipping below the $102 to $104 area, then we could see a further retracement to the downside.

If that happens, GILD could retest recent support in the upper-$90s.

Options

For some investors, options could be one alternative to speculate on GILD. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and GILD rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

Shares are trading higher by about 5% this morning after reporting fiscal Q1 earnings. The company beat on earnings and revenue expectations, while quieting investors’ fears about chip restrictions to China as demand surfaces from other buyers. Analysts currently have a price target of roughly $170 a share, implying about 26% upside from Wednesday’s closing price.

Bitcoin ETFs continue to attract investors, with inflows of about $9 billion over the last five weeks. Amid that momentum, IBIT has been leading the way, while gold ETFs — the largest of which is GLD — has seen a net outflow of roughly $2.8 billion.

Shares of C3.ai are in focus this morning, up more than 10% after the firm delivered a better-than-expected quarter. A loss of 16 cents a share was better than expected, while revenue of $108.7 million grew 26% year over year and topped analysts’ estimates. Check out the chart for AI stock.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.