While eToro’s investment platform is intuitive and easy to use, there are several steps that you can take to make the beginning of your online investing journey smoother. Below you will find a short guide on how to start your eToro experience.

How to open an account on eToro

- Step 1: Sign up for eToro – it only takes a few minutes to open an account. Learn how here.

- Step 2: Verify your identity – verification is a crucial step that will keep your account safe. More information about verification can be found here.

- Step 3: Make your first deposit. There are many ways to fund your account and you can read about them here.

- Step 4: Start investing!

Once your account has been set up, here are five things you can try:

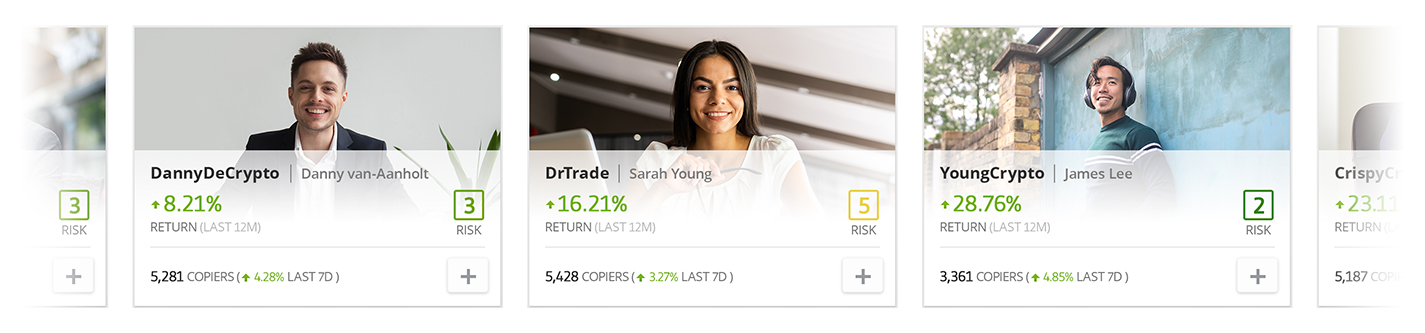

1 – Copy other traders and investors

Perhaps the most popular feature on eToro, CopyTrader™ was introduced in 2010, positioning eToro as a leader in the social trading space. By enabling users to follow and copy one another, the entry barriers were lowered, enabling even those who lack time or experience to invest online. Once you copy another user, anything they do is automatically replicated in real time in your portfolio. With CopyTrader you can:

- Search for Popular Investors and filter results based on gain, success rate risk score, favourite assets and more

- Transparently see the stats of investors you are considering copying

- Check out Editor’s Choice to find successful Popular Investors

- If you feel like you have what it takes, you, too, can join the Popular Investor program and receive monthly cash payments and other great perks.

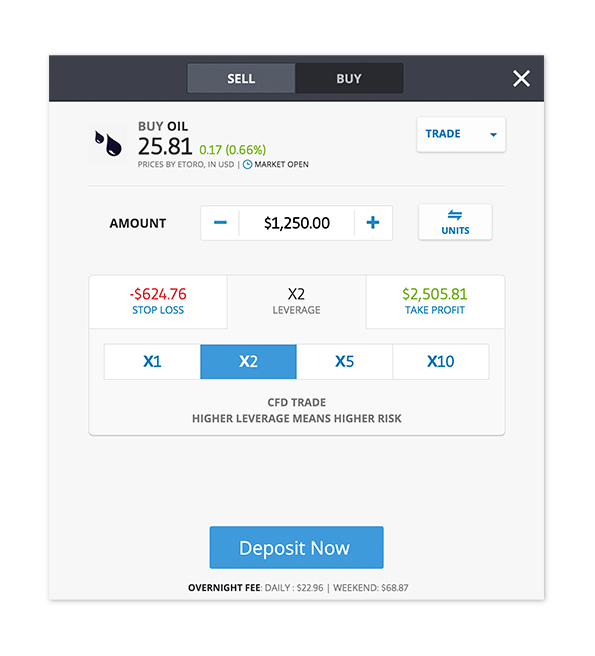

2 – Practice with a virtual account

After you sign up for eToro, you will receive a $100,000 virtual money account with which to experiment for free. This service enables you to hone your investing skills before risking your own funds. With your virtual account you can:

- Open positions

- Experiment with leverage, Stop Loss and Take Profit

- Test different strategies

- Practise copy trading

- Invest in eToro Portfolios

- Interact with the eToro community

You can start practising with your FREE virtual account now.

3 – Start trading or investing manually

Once you’re comfortable enough with the platform and feel that you have gained the necessary information on the financial instruments in which you would like to invest, you can start using the eToro platform manually. With eToro you can:

- Invest in stocks from around the globe.

- Open short or leveraged positions using CFDs

- Use ProCharts to perform technical analysis

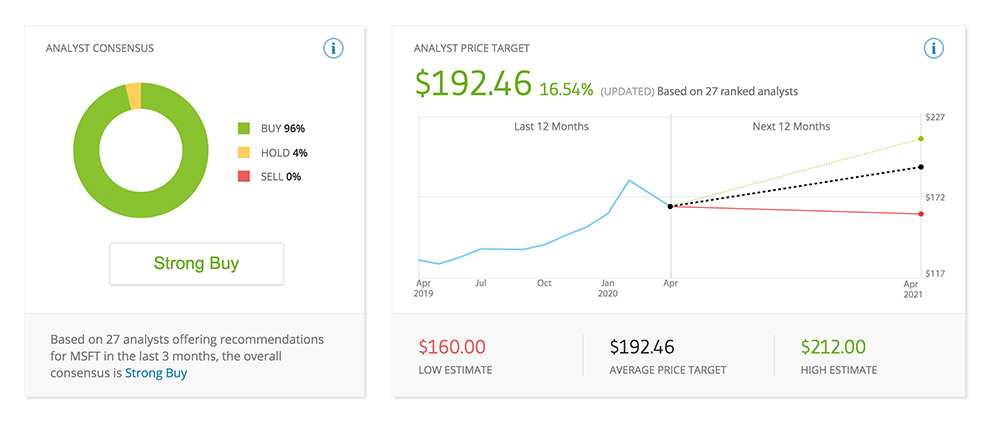

- Use the Research Tab to gain valuable market insights

4 – Use our unique trading tools

eToro offers a variety of special features, including:

- Stop Loss and Take Profit — close the position automatically when reaching a certain profit or loss point.

- Trailing Stop Loss — The Stop Loss point rises proportionately, as long as the market is moving in your direction.

- One Click Trading — predetermine your investment amount, leverage, take profit and stop loss, to later apply those values to every trade on that instrument.

- Create a personalised Watchlist and receive real-time volatility alerts.

5 – eToro Portfolios: long-term investment option

eToro realises that some of its clients are looking for a long-term investment tool, so it created its Portfolios — an innovative thematic investment tool. Each eToro Portfolio bundles various assets following a thematic investment strategy, into a single investment portfolio. eToro Portfolios are created and managed by eToro’s Investment Team and optimised by a machine learning algorithm.

There are three types of Portfolios:

- Market Portfolios focus on a specific segment of the market, such as tech, gaming, finance etc. and group together key assets from each segment into one Portfolio.

- Top Trader Portfolios bundle together various traders on the eToro platform into a single asset, enabling users to invest in their cumulative experience and knowledge.

- Partner Portfolios are created by eToro’s partners, which are some of the world’s leading financial institutions, and operate similarly to Market Portfolios.

You can explore a variety of Portfolios here.

Your capital is at risk.

Conclusion: eToro is your gateway into innovative investing

Choosing eToro for your online investing adventure could prove to be a very good move. To sum up, here are some of the advantages which eToro offers:

- Multi-asset: eToro offers a variety of financial instruments, across various categories, catering to the diversified needs of traders and investors.

- Trusted: eToro is a regulated, secure platform, with millions of traders and investors worldwide.

- Innovative: eToro is constantly introducing new innovations and tools to improve its clients’ investing experience, such as ProCharts and One Click Trading.

- One platform fits all: Whether you are new to investing or already have some experience, and whether you are a short-term or long-term investor, eToro has everything you need to fulfil your online trading and investing needs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

The information above is not investment advice.