COPYTRADER – INVEST LIKE eToro’S TOP INVESTORS

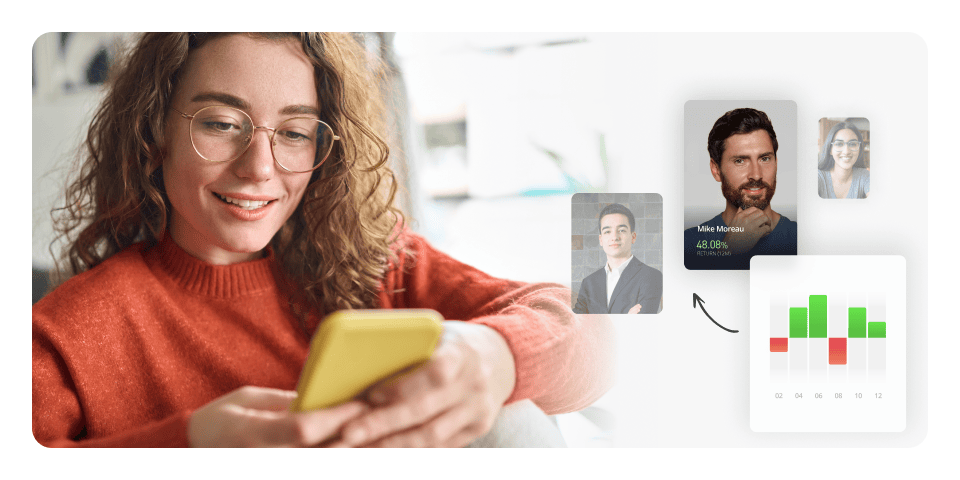

Replicate the investment moves of other traders in real time, automatically

Why copy top-performing traders?

Invest like our best-performing traders: simply choose an investor to copy, and when they trade, so do you.

Start/stop copying and add/remove funds at any time

Copied trades are replicated to your portfolio in real time

Buy the assets they buy for themselves

No additional charges for using the CopyTrader feature

View our complete pricing policy here

Manage your portfolio without having to constantly watch the markets

Benefit from their knowledge and experience

Meet our Popular Investors

Thousands of investors, each with a unique strategy, risk level and transparent track record, are available for you to copy. Choose just one, or build a team of up to 100 traders to “work” for you simultaneously.

The traders you copy get paid directly as part of our Popular Investor Program. Interested in earning income by being copied on eToro? Click Here

How it works

CopyTrader is built to be simple and intuitive. Just find the investor you wish to copy through the Copy Discover page — there, you can search for the kind of investor you’re looking for.

Select an investor

Hit the COPY button

Choose how much to allocate

THIS IS HOW YOU DO IT

Learn how to copy top-performing investors in less than 10 minutes.

Backed by community

Join the largest collaborative community of traders and investors in the world — a place to connect, share, and learn from other experienced investors. Chat with them, discuss strategies and benefit from their knowledge.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Take it for a test drive

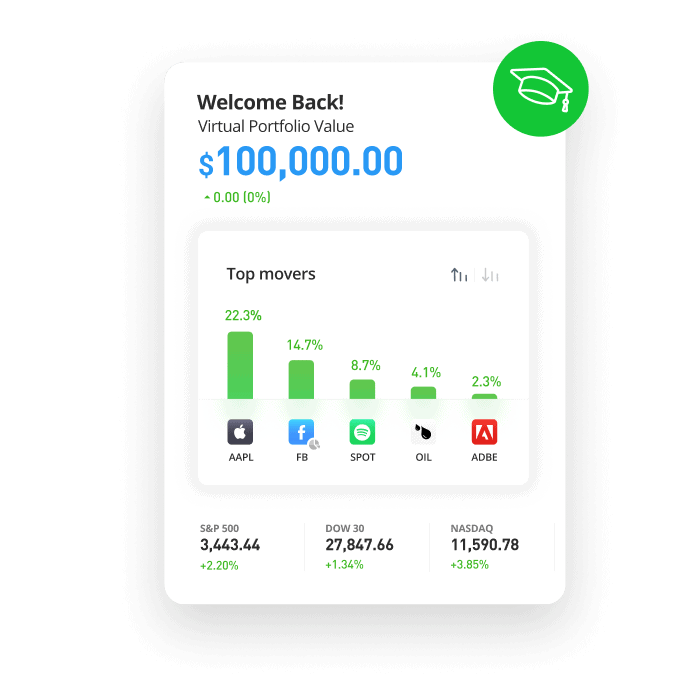

Want to try CopyTrader without risking any capital? Try it in demo mode. Every eToro account includes a free $100,000 virtual portfolio for you to practise with.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQ

- How much will copy trading cost me?

-

There is no additional charge for copying another trader or traders. You will still be charged spreads on the trading and/or transaction fees where applicable. To view our complete pricing policy, click here.

- What is the minimum amount required to copy a trader?

-

The minimum amount required to copy a trader is $200.

Please note that there is a minimum amount for each copied position of $1. Positions not meeting the $1 minimum will not be opened. - How does copy trading work? How do I set up my copy trading?

-

Setting up your copy trading is simple. Choose the user that you’d like to copy, input the amount you’d like to allocate, and click COPY. You’ll be duplicating their positions automatically in real time and direct proportion.

You can start or stop copying a user at any time. You may also set a stop loss for the copy, add or remove funds, or pause the copy. For more details on how copy trading works, click here.

- How long does it take for copied trades to be executed in my account?

-

Trades are typically executed in less than a second from the instant the trader you copy executes their own trades.

- Can other traders copy me?

-

Yes, other traders on eToro can copy you if your profile is public. However, only users approved to participate in eToro’s Popular Investor Program are eligible to receive monthly earnings. For more information about becoming a Popular Investor, click here.