Hi Everyone,

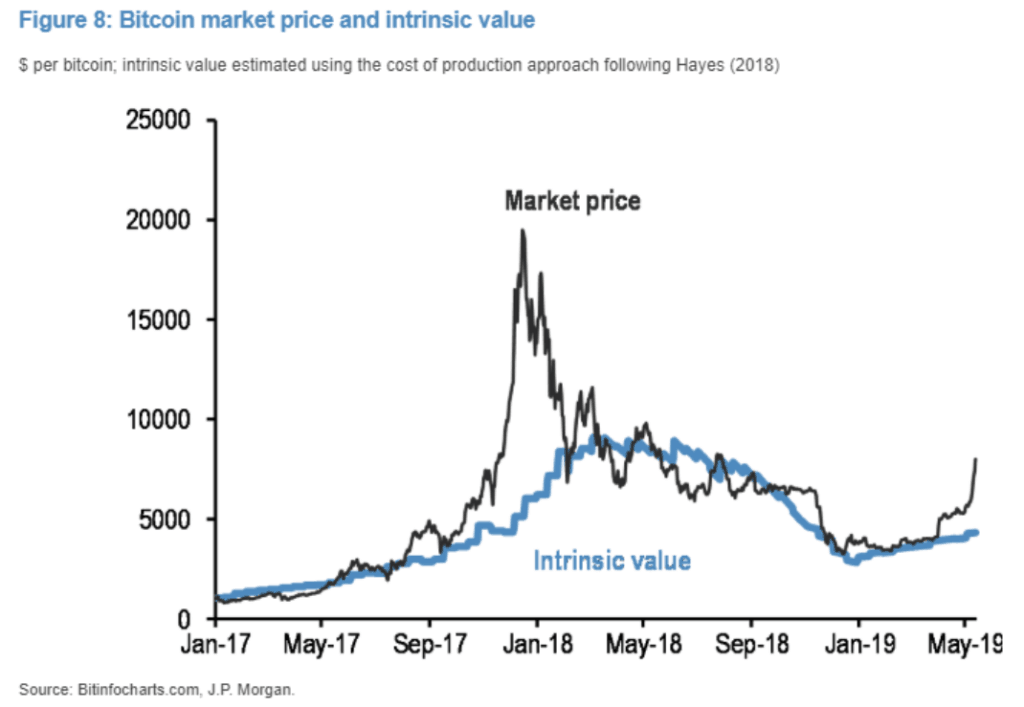

It’s wonderful that JPM is finally ready to admit that bitcoin has intrinsic value, and it’s not at all surprising that they see the current price as overvalued in comparison to their calculations.

Yes, bitcoin is well above the mining cost at current rates, but what JPM has failed to take into account is that frequently, when miners are running a surplus, they will start hoarding coins. By withholding supply from the market when times are flush, they aim to further limit liquidity and send prices even higher.

Of course, this also has the opposite effect when prices are falling and miners are forced to sell to cover their overhead. A quick glance at the above chart shows that mining cost is closely correlated with price per coin but they do often disconnect.

eToro, Senior Market Analyst

Today’s Highlights

- Escalation Continues

- Crude Divergence

- Testing 8k

Please note: All data, figures & graphs are valid as of May 20th. All trading carries risk. Only risk capital you can afford to lose.

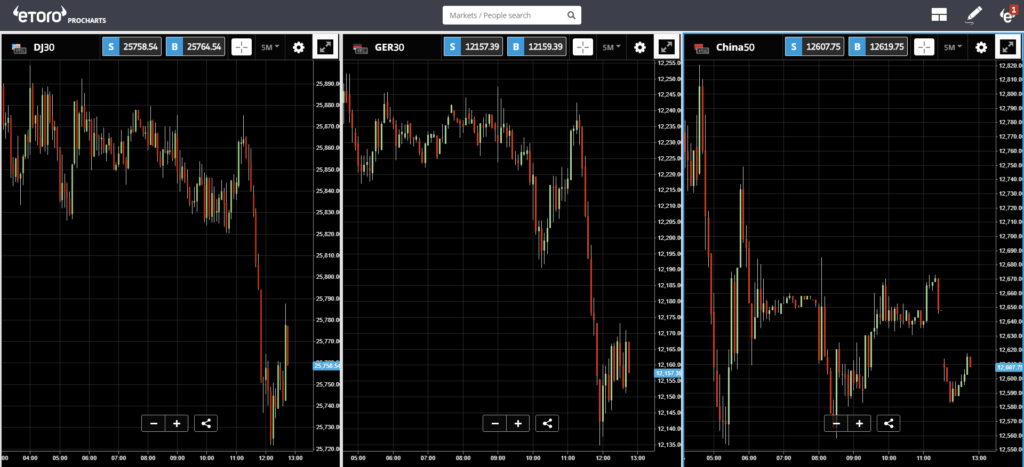

Traditional Markets

Still, looking at the big picture, this morning’s dip is barely noticeable.

Crude Awakening

The second best performing asset this year is one for which price is largely controlled by a small group of individuals. Of course, I’m talking about crude oil.

This morning’s OPEC meeting in Jeddah brought together some of the largest oil producers in the world but unlike in the past, it seems that not everyone is exactly aligned as to where they want the prices to go from here.

Russia says that they’re committed to keeping the previous pact and limiting production… as long as the price doesn’t start moving up. If prices begin to rise, Russia will most likely increase production in order to meet the demand.

Saudi Arabia, on the other hand, is pretty happy with the production cuts that have been made so far and advocates to ‘gently’ reduce output in order to nudge the price higher.

Similar mixed signals can be observed on the graph. We’ll call the yellow line Saudi Arabia. This rising trendline would like to see the price continue to rise gradually. The purple box is more in line with what Russia is looking for, a steady and stable trading range between $60 and $65 per barrel.

Testing $8k

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.