Hi Everyone,

One of bitcoin’s core value propositions is the ability to provide a store of value that is completely segregated from your local economy.

So, it’s no wonder that when the country of Zimbabwe announced that they’re bringing back the Zimbabwe Dollar, the price of bitcoin skyrocketed in the African country.

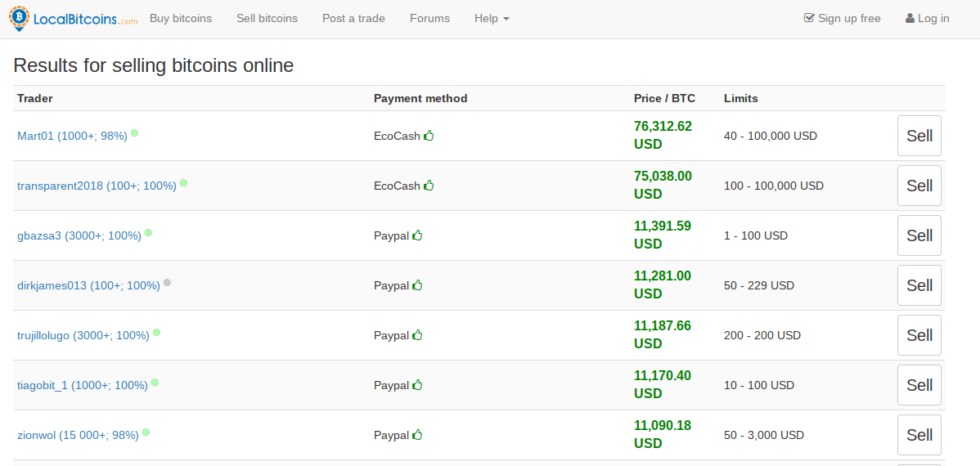

Several crypto-centric news sites were quick to report that the price of a single bitcoin had risen as high as $76,000. Before you book a flight for Harare and a 5-star hotel, please know that these figures are misleading.

Notice in the screenshot above that the two erroneous quotes at the top are using the payment method EcoCash, which is Zimbabwe’s mobile phone payment system.

No doubt, after the government abruptly made trading in USD illegal, many locals will be trying to offload their EcoCash holdings in any way possible.

Don’t get me wrong, there’s still a significant premium on trading BTC for ZWL, but unless you have a contact at a Zimbabwean bank who can exchange EcoCash for USD at the rate of the day, the margins probably won’t be worth the trip. And if you do, let me know so I can load up my ledger. I’m coming with you!!

Today’s all-access webcast will be held at 3:00 PM London time. We already have a record number of people who signed up. Make sure to join in as well! Register now at this link.

Today’s Highlights

- Profit Warnings

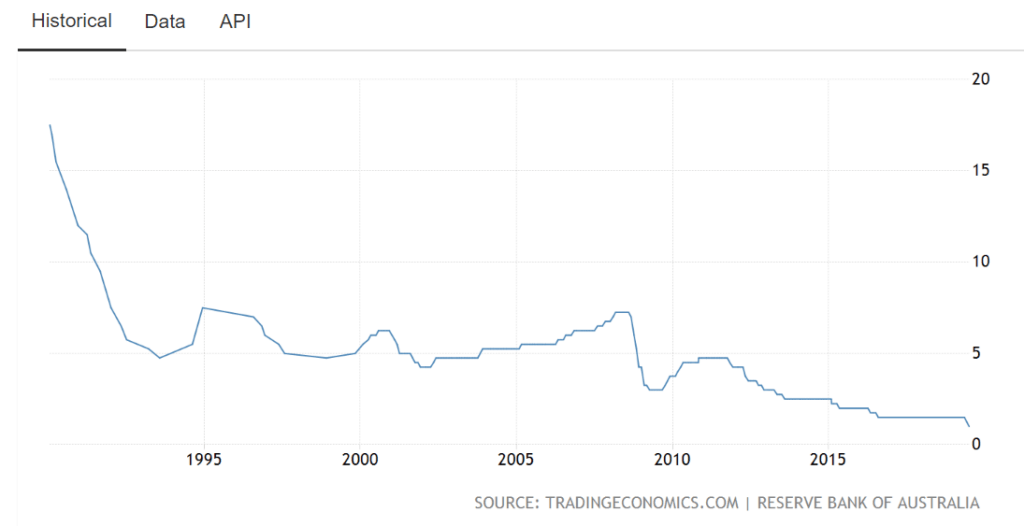

- Record Low Rates

- Pullback Continues

Please note: All data, figures & graphs are valid as of July 2nd. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Record Low Down Under

Showdown in Taipai

The blockchain conference in San Fransisco was quite festive this year and many participants were extremely bullish despite the massive pullback. Now that it’s over, many blockchain influencers have migrated to Taipai.

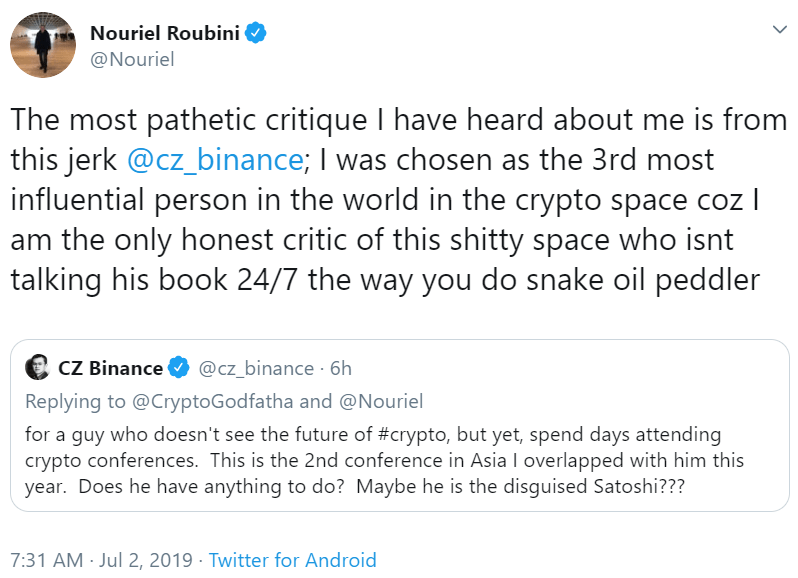

The highlight of the Taipai conference will no doubt be a much-anticipated debate between crypto antagonist Nouriel Roubini AKA Dr. Doom and Arthur Hayes, the CEO of BitMex.

Dr. Doom has been largely quiet during the recent rally but has come back with a vengeance since the market cooled down last week. This morning he was seen lobbing insults at the CEO of Binance.

In preparation for the debate, Bloomberg has already interviewed both participants. You can catch them here…

So, enjoy the show. Will try to share a link on twitter if it’s being live streamed.

As always, thanks a million for all the awesome feedback and well thought out questions you guys are sending. Have an excellent day!

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.