1. Introduction

The semiconductor industry is undergoing a structural transformation, and few companies are better positioned to capitalize on it than AMD. With a growing presence in data center computing, PC processors, and AI acceleration, AMD is emerging as a key beneficiary of rising demand for high-performance computing.

Founded in 1969, AMD is a fabless semiconductor firm that designs CPUs, GPUs, and adaptive SoCs, outsourcing production to foundries like TSM. Under the leadership of CEO Lisa Su, the company has pulled off one of the most notable turnarounds in tech, steadily gaining CPU market share from Intel and more recently setting its sights on Nvidia’s dominance in AI with its Instinct GPU lineup.

Despite macroeconomic pressures and export restrictions to China, AMD’s strategic focus on AI infrastructure, next-gen silicon, and expanding data center partnerships is starting to bear fruit. With the AI accelerator market expected to exceed $500 billion by 2028, investors are watching closely.

Can AMD sustain its momentum in CPUs and break through in AI?

2. Segment Breakdown: A Diversified, AI-Driven Portfolio

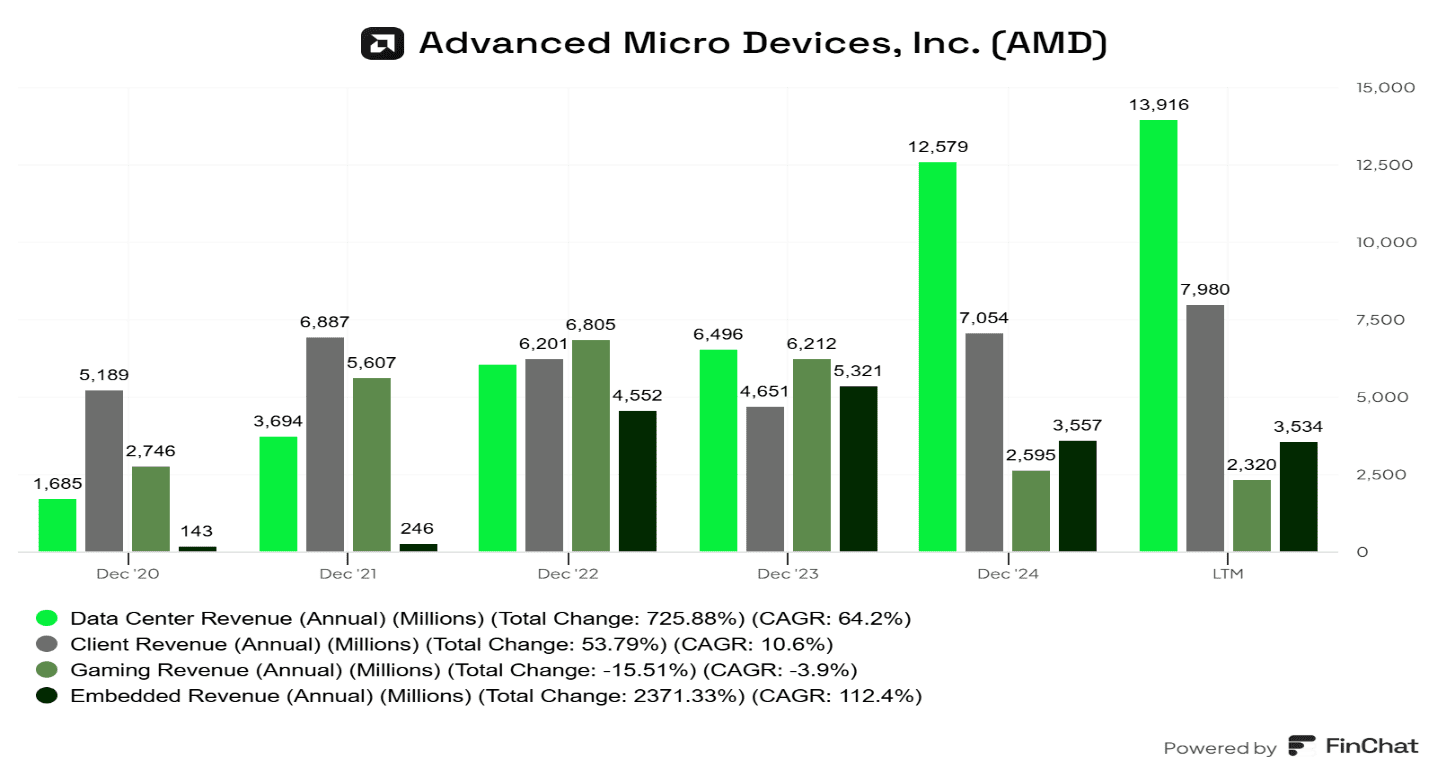

AMD operates across four business segments:

- Data Center – 50% of LTM revenue: The company’s most critical and fastest-growing segment, driven by EPYC server CPUs and Instinct GPUs for AI workloads and cloud computing. This segment has grown significantly from just 17% of revenue in FY20.

- Client – 29% of LTM revenue: Includes Ryzen CPUs and APUs for desktops, laptops, and commercial PCs. This segment is rebounding after the post-pandemic PC market correction.

- Gaming – 8% of LTM revenue: Comprises Radeon GPUs and semi-custom chips used in consoles like Sony’s PlayStation and Microsoft’s Xbox.

- Embedded – 13% of LTM revenue: Stemmed from the Xilinx acquisition, this segment offers adaptive SoCs and FPGAs used in industrial, automotive, aerospace, and telecom applications.

While all segments contribute to AMD’s top line, the sharp rise in Data Center revenue underscores its growing strategic importance and alignment with AI and cloud megatrends.

Source: Finchat.io

3. Financial Performance: Momentum is building

AMD kicked off 2025 with a strong Q1 performance, marking the fourth consecutive quarter of accelerating growth:

- Revenue grew 36% YoY to $7.4 billion, beating expectations

- Non-GAAP EPS rose 55% YoY to $0.96

- Gross margin expanded by 140 bps YoY to 54%

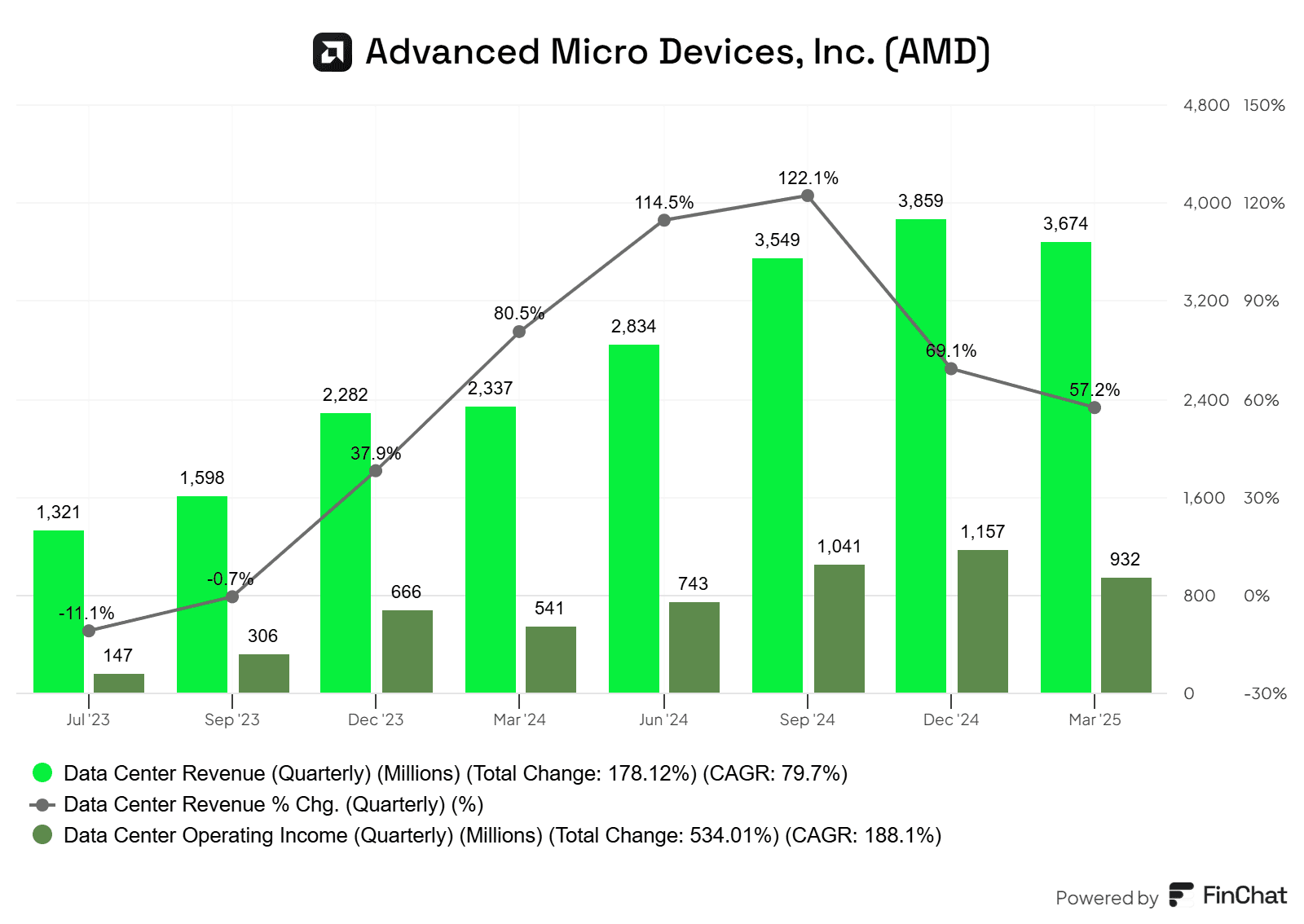

Data Center Leads the Charge

The Data Center segment surged 57% YoY, driven by robust demand for both EPYC CPUs and Instinct AI accelerators.

- EPYC CPUs recorded double-digit YoY growth for the 7th consecutive quarter, with expanding deployments across major cloud providers (AWS, Google, Oracle, Tencent).

- Instinct GPU revenue also posted strong double-digit growth as MI325X deployments ramped, with use cases including generative AI search, ranking, and recommendation across hyperscalers.

Source: Finchat.io

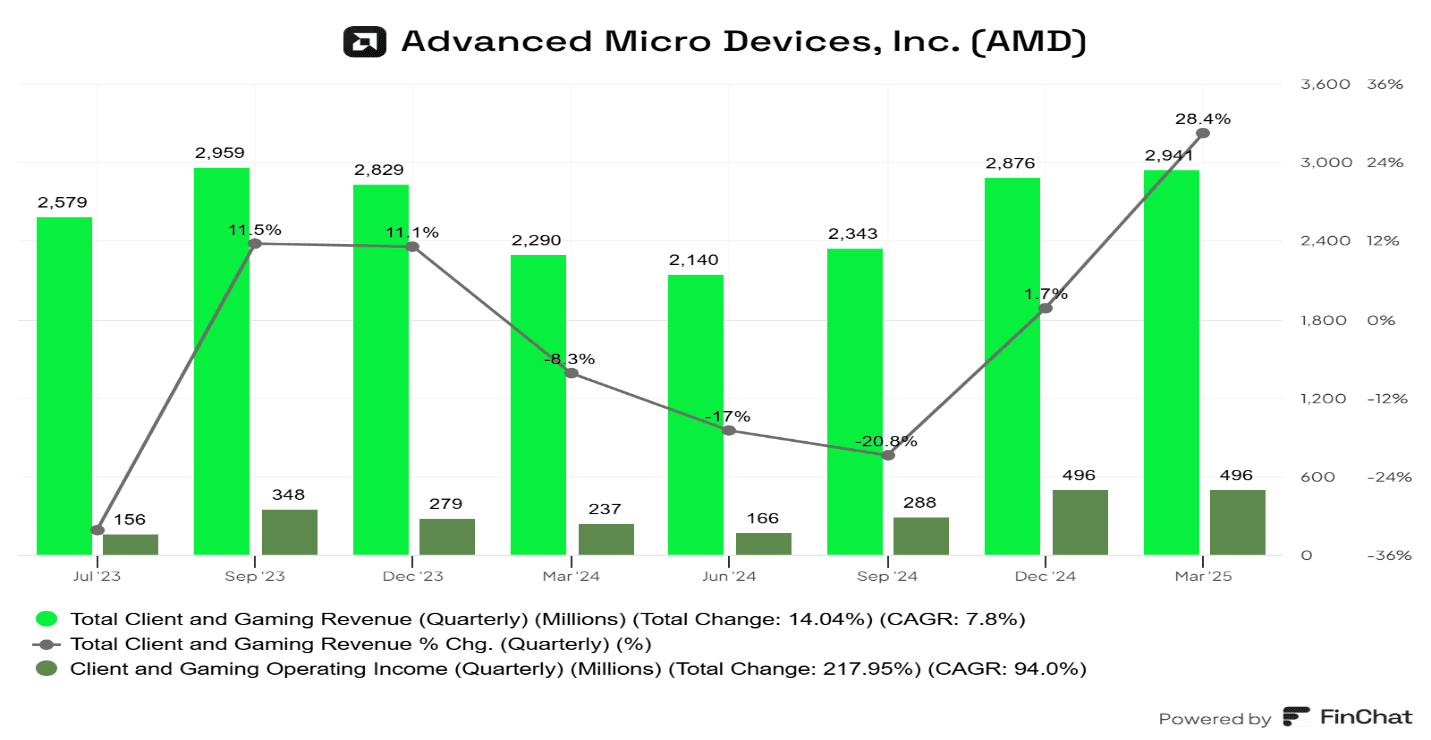

Client Rebound Gathers Pace

The Client segment jumped 68% YoY, reflecting a recovery in the PC market. Growth was driven by:

- Strong Ryzen processor sales

- Higher mix of high-end desktop and mobile CPUs

- Ramp up demand for AI PC processors which grew over 50% QoQ

- Strong commercial PC demand with Ryzen PRO PC sell-through growing over 30% YoY

Gaming Softens, but Signs of Stabilization

The Gaming segment declined 30% YoY due to lower semi-custom chip sales for consoles. However, Radeon GPU sales improved, and console inventories have now normalized.

- Semi-custom SoC sales were up quarter-over-quarter

- Management expects full-year growth in this segment

Source: Finchat.io

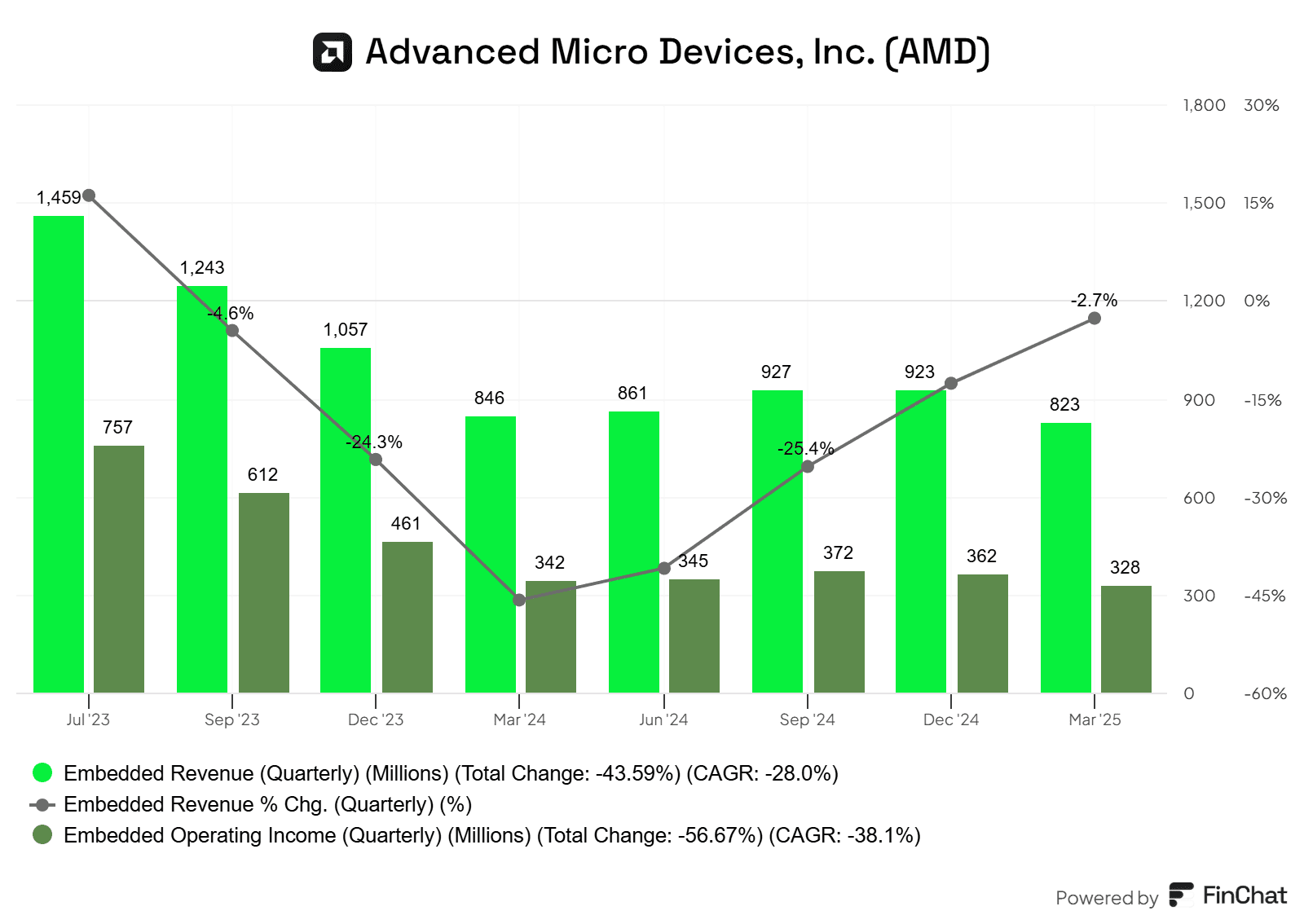

Embedded on the Path to Recovery

Embedded segment revenue declined 3% YoY, marking the fourth straight quarter of gradual recovery. AMD anticipates year-over-year growth to return in H2 2025, supported by improving demand across industrial, aerospace, and networking end markets.

Source: Finchat.io

Source: Finchat.io

Outlook

Management reaffirmed its guidance for strong double-digit revenue growth in FY25, even after factoring in an estimated $1.5 billion headwind from newly imposed export restrictions on AI chips shipped to China.

4. Valuation: Undervalued Amid Secular Tailwinds

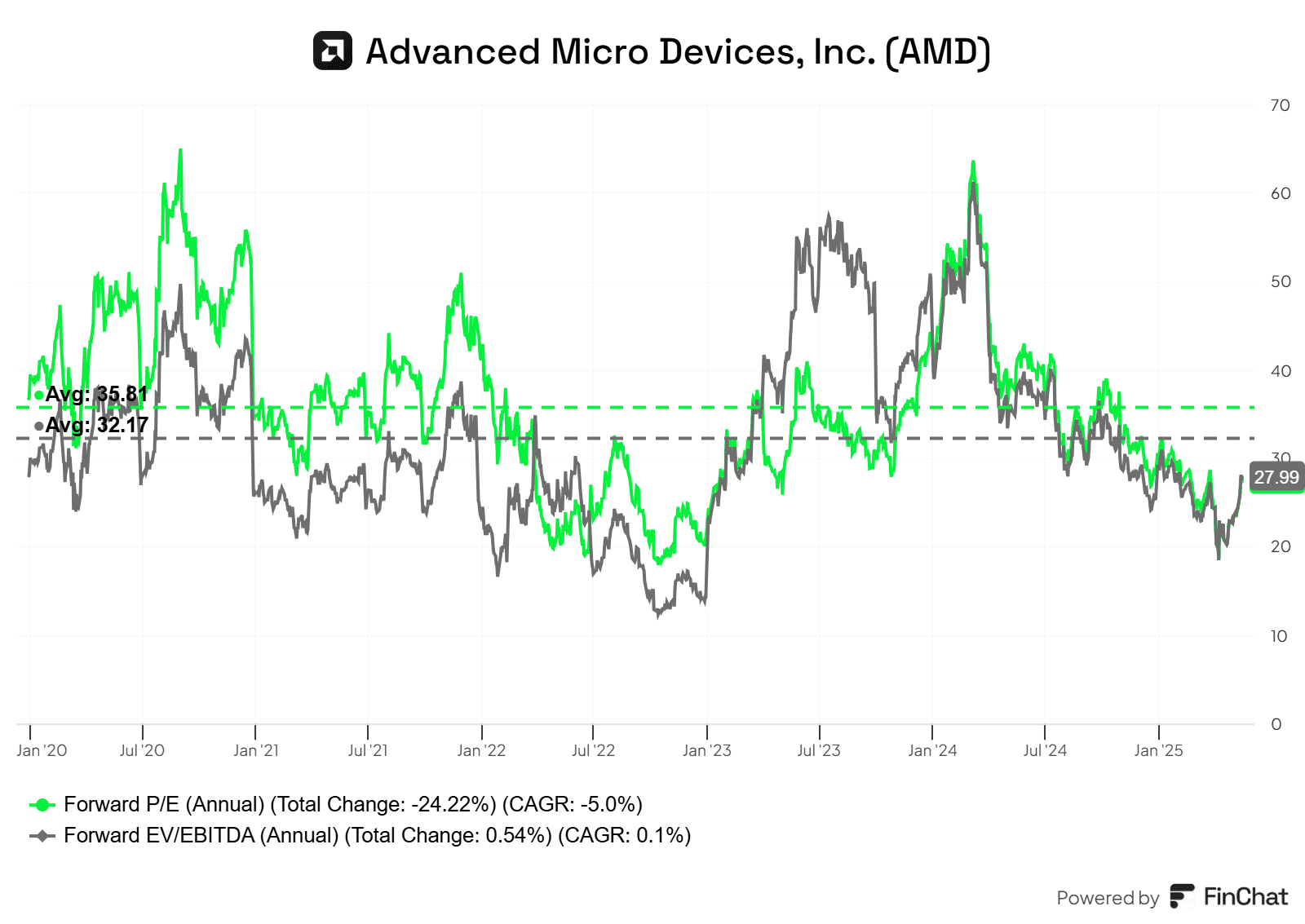

AMD trades at 27.7x forward earnings and 28.0x forward EBITDA, well below its 5-year averages of 35.8x and 32.2x, respectively. While these multiples may seem rich compared to the broader semiconductor sector, they are compressed relative to AMD’s own historical norms, and do not fully price in the long-term upside from AI, data center expansion, and adaptive computing.

Despite short-term headwinds, such as export restrictions, a cyclical downturn in certain segments, and console inventory normalization, analysts forecast AMD’s EPS to grow at a 26% CAGR over the next five years. This implies a PEG ratio of just 1.06x (P/E of 27.7 divided by 26% growth), which appears undemanding. Growth is expected to be driven by rising adoption of Instinct AI accelerators, EPYC CPUs, and Ryzen processors.

Given AMD’s strong positioning across several high-growth markets, the stock looks attractively valued for long-term investors with the patience to ride the AI wave.

Source: Finchat.io

5. Risks and Opportunities

Investment Risks

- China Export Restrictions: U.S. export controls on AI chips to China have already impacted AMD’s outlook. Further regulatory tightening or trade tensions could limit revenue and increase supply chain risk.

- TSMC Dependency: AMD relies heavily on TSMC for advanced chip manufacturing. Any supply disruptions or geopolitical tensions involving Taiwan could impact production.

- Hyperscaler Capex Sensitivity: AMD’s growth is closely tied to spending by cloud giants like AWS and Microsoft. A slowdown in hyperscaler investments or weaker-than-expected AI adoption could temper demand for AMD’s server CPUs and GPUs.

- CUDA Ecosystem Dominance: Nvidia’s CUDA still holds a strong lead in AI software. Slower adoption of AMD’s ROCm platform could limit its AI GPU momentum.

Investment Opportunity

- AI Acceleration with Instinct GPUs: With the AI chip market projected to reach $500 billion by 2028, AMD’s Instinct GPU lineup is well-positioned to gain share in both training and inference workloads. The launch of the MI325X, MI350 expected later in 2025 and the MI400 expected in 2026, reflect AMD’s aggressive roadmap to challenge Nvidia. The acquisitions of Xilinx and ZT Systems further expand its AI footprint, enabling a full-stack solution from chips to rack-level systems for next-gen data centers.

- Expansion into Adaptive Computing: The Xilinx acquisition enables AMD to scale into high-growth areas like aerospace, automotive, industrial automation, and 5G through its FPGA and adaptive SoC portfolio.

- ROCm’s Open-Source Edge: Unlike Nvidia’s closed CUDA ecosystem, AMD’s open-source ROCm platform offers flexibility and vendor neutrality. Ongoing improvements and industry support could help close the software gap in AI acceleration.

6. Conclusion: Is AMD a Buy?

AMD is a global leader with a diversified product portfolio and a bold AI roadmap. While macro and regulatory headwinds remain, the company is executing well and gaining ground in strategic areas like AI, data centers, and adaptive computing.

For investors seeking exposure to high-performance compute and long-term tech tailwinds, AMD presents a compelling opportunity at an attractive valuation. Let me know in the comments if you agree!

Disclosure: I own AMD in my eToro portfolio.