Summary

Focus: Year end health check up

Timely PMI activity indicators show India, US, and much of Europe leading growth momentum, and resilient to rising omicron fears. Whilst China and Germany are laggards. We also see tantalising signs that inflation fears are peaking. This would allow Central Banks to go slow in hiking interest rates, and help equities. We see another year of positive returns, though not as strong as 2021. Earnings forecasts are too low, and valuations to stay high. We focus on cheaper and faster growing cyclical sectors and markets. This is our last Analyst Weekly of 2021. We are backon January 10th. Happy holidays to all!

Rotation from Tech follows hawkish Fed

Volatile week. The anticipated hawkish Fed pivot no worse than feared, providing some relief. But also catalysing a sharp move away from tech and towards more defensive sectors, like healthcare and real estate. UK was the surprise, becoming first major central bank to hike rates. December PMI’s showed first omicron slowdown impacts.. See our latest presentation HERE.

Some relief from the Fed

The Fed turned more hawkish, doubling tapering pace, and pencilling in three rate hikes next year. Was expected, in face of the strong economy and 7% inflation, and markets reacted with initial relief. Interest rate rises for end of this upcycle seen at only 2.5%, less than historic.

Changes to your favorite sector

Visa (V), Mastercard (MA), Paypal (PYPL), could change sectors in proposed 2022 reorganisation. Would boost the size of the financials (XLF) and industrials (XLI) sectors and make IT both smaller and its stock-concentration worse.

High-for-longer oil prices

Oil (OIL) saw quadruple headwinds of omicron demand fears, stronger USD, US oil sales, and increased OPEC+ production. These set to ease, allowing high-for-longer oil and XLE.

Bitcoin stays under pressure. AVAX focus

Bitcoin (BTC) stuck under $50,000 but we are seeing more dispersion in performance and growth from those exposed to smart contracts, gaming, and NFT’s as infrastructure develops. Avalanche (AVAX) bucked weakness, with positive reviews of its scalability and security.

Commodities firm. EU energy crisis continues

Commodity prices held firm in a volatile week of omicron fears and Central Bank cross-currents. European gas prices surged 30% to new all-time highs on cold weather and Russia supply fears, even as US prices fell, highlighting the localised nature of the natural gas market.

The week ahead: winding down the year

1) A shortened trading week with Thursday US bond market holiday, and Friday’s equity holiday. 2) Data highlight is the US PCE inflation report (Thu), Fed’s favoured measure, to accelerate to 5.5%. 3) Earnings week focus on sportswear giant NKE, semiconductor MU, cruise line CCL, consumer food GIS, meme-stock BB.

Our key views: …and now to 2022

2021 was very positive for crypto, commodities, real estate, and equities. We see a good 2022. 1) global vaccine rollout and economic re-opening to continue, 2) still large support from low interest rates and fiscal spending. We focus on cyclical assets that benefit from decent growth: like commodities, crypto, and value.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.68% | -0.66% | 15.55% |

| SPX500 | -1.94% | -1.65% | 23.02% |

| NASDAQ | -2.95% | -5.53% | 17.70% |

| UK100 | -0.30% | 0.64% | 12.53% |

| GER30 | -0.59% | -3.98% | 13.21% |

| JPN225 | 0.38% | -4.03% | 4.01% |

| HKG50 | -3.35% | -7.41% | -14.83% |

*Data accurate as of 20/12/2021

Market Views

Rotation from Tech follows hawkish Fed

- Volatile pre-Christmas week for markets. The much-anticipated hawkish Fed pivot no worse than feared, providing initial relief. But also a big rotation away from tech. The largest sector is seen as sensitive to higher interest rates. Defensive sectors, like healthcare and real estate, rose strongly. UK was the surprise, becoming first major central bank to hike rates. December PMI’ showed first omicron slowdown impacts. See our latest presentation HERE.

Some relief from the Fed

- The Fed turned more hawkish, doubling the pace of its bond tapering, and pencilling in three rate hikes next year. This was expected, in face of the strong economy and 7% inflation, and markets reacted with relief. Interest rate expectations for end of this upcycle are 2.5%. This would make it a lower and slower increase than the average 3% move over 15 months.

- The Fed threaded-the-needle. By accelerating its monetary tightening pace to combat inflation. Without destabilizing highly valued markets worried on economic growth. This is an unprecedented move, with the Fed balance sheet a record $8.7 trillion and rates at zero.

Changes to your favorite sector

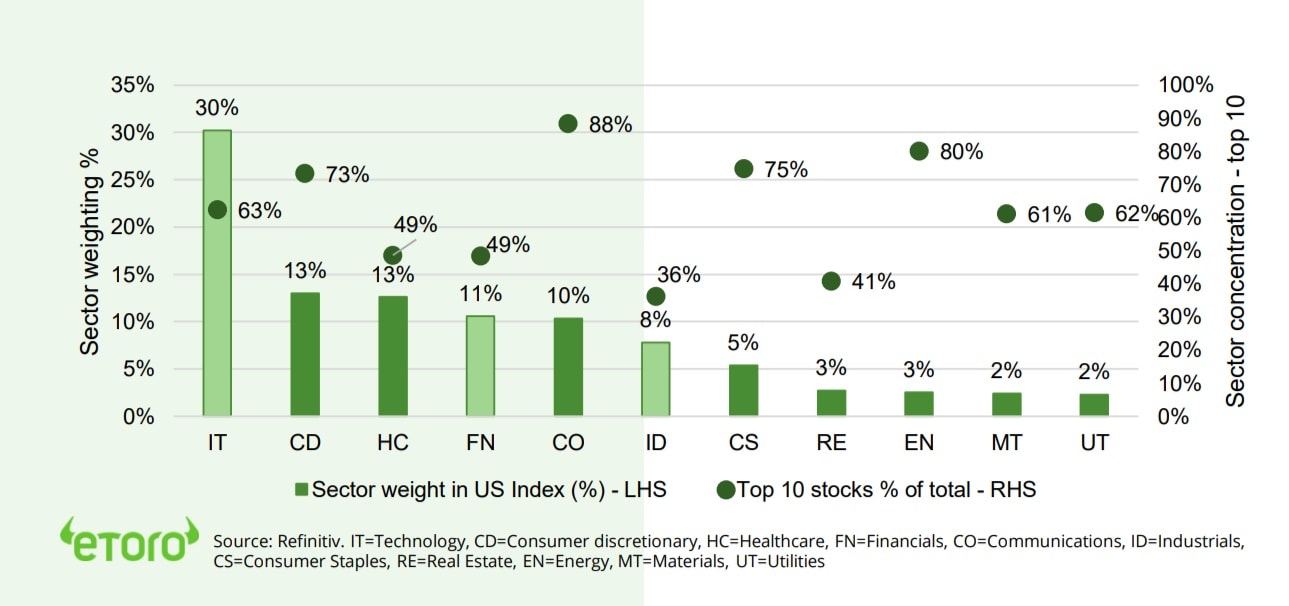

- Some of the largest tech stocks, like Visa (V), Mastercard (MA), and Paypal (PYPL) could change sectors in a proposed 2022 reorganisation. This could significantly boost the size of the financials (XLF) and industrials (XLI) sectors and make tech (XLK) both smaller and stock-concentration worse (see chart).

- It also highlights the difficulty in classifying many industries, from payments to renewables and cannabis, within traditional sectors. This has continued to drive the big surge in thematic investing we have seen this year.

High-for-longer oil prices

- Oil (OIL) prices survived a quadruple headwind of omicron-demand fears, a stronger USD, US strategic reserve sales, and increased OPEC+ production. We see these headwinds all easing, in the future allowing high-for-longer oil prices.

- GDP growth is to be twice long-term levels next year. Supply rising slowly, given ESG concerns. Oil (XLE) will do well even if prices only stay here, with strong cash flows and dividends.

- Oil prices are not as high as they look. Adjusted for inflation they are the same as 50-years ago. The oil sector is now only 3.5% of the S&P 500.

‘Quadruple witching’ bigger than ever

- Friday was one of the highest volume days of year with the ‘quadruple witching’ futures and options (F&O) expiry. This see’s volumes five times average and it has become even bigger as retail-driven options activity has surged.

- The volume of global derivatives has risen 39% this year led by a 47% increase in equity indices and 43% in individual equity derivatives.

- The third Friday of March, June, September, and December see’s stock index futures and options, and individual stock futures and options, all expiring together. This drives a lot of portfolio rebalancing, contract rollovers and expirations.

US sector weights (%) and top-10 stock sector concentration (%)

Bitcoin pressure remains. AVAX focus

- It was a lacklustre week for the asset class, with bitcoin (BTC) stuck below $50,000. We are seeing an increasing dispersion in growth and asset performance, with those exposed to smart contracts, gaming and NFTs (non fungible tokens) leading as asset class infrastructure accelerates. Also seeing evidence of increased market development and availability of hedging tools reducing fears of dramatic drawdowns.

- Layer one blockchain and top-10 market cap. coin Avalanche (AVAX) bucked the crypto price downtrend following a Bank of America report praising both its scalability and security.

Commodities firm. Europe’s energy crisis

- Commodity prices were resilient to cross currents of a firm US dollar (that makes USD denominated commodities more expensive for many to buy), and some relief that the Fed’s hawkish pivot was not more aggressive (that would threaten commodity demand). We remain positive the outlook, with a ‘sweet spot’ of better commodity demand and tight supply.

- UK and European natural gas prices spiked 30% last week and set new all-time-highs. European natural gas storage levels are well below average. This makes gas markets very sensitive to colder weather and geopolitical tensions. Russia is Europe’s largest gas supplier and tensions over Ukraine and delays to new Nord Stream 2 pipeline approval have been rising.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.29% | -3.75% | 23.91% |

| Healthcare | 2.73% | 1.41% | 16.10% |

| C Cyclicals | -3.78% | -7.32% | 14.48% |

| Small Caps | -1.71% | -8.02% | 10.08% |

| Value | -0.58% | -0.25% | 20.68% |

| Bitcoin | -3.68% | -19.98% | 61.79% |

| Ethereum | -4.00% | -4.74% | 415.47% |

Source: Refinitiv

The week ahead: Winding down the year

- It’s a shortened week with US markets closed on Friday, December 24th (as Christmas falls on a Saturday this year). US bond markets will also close early on Thursday.

- The data highlight in a light week is the Fed’s favoured PCE inflation report (Thur) that is seeing rising to 5.5% for November, vindicating the Fed’s more hawkish policy stance, set to raise interest rates three times next year.

- Light earnings week focus on sportswear giant Nike (NKE), semiconductor Micron (MU), largest cruise line Carnival (CCL), ‘Big G’ consumer food General Mills (GIS), and prominentmeme-stock Blackberry (BB).

Our key views: and now to 2022

- 2021 was a very positive year across crypto, commodities, real estate, and equities. We see a positive 2022, though likely with lower returns. 1) global vaccine rollout and economic re-opening to continue, 2) still large support from low interest rates and fiscal spending.

- Virus fears are dampening the growth outlook, but economies are increasingly resilient to this. Similarly, the US Fed turned more hawkish, to combat inflation. This will be a lower and slower rate upcycle than historic, and markets resilient.

- We focus on cyclical assets that benefit most from decent growth: commodities, crypto, small cap, and value. We are more cautious on fixed income, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.49% | -5.76% | 23.53% |

| Brent Oil | -3.19% | -7.36% | 40.89% |

| Gold Spot | 0.87% | -2.61% | -5.42% |

| DXY USD | 0.60% | 0.67% | 7.50% |

| EUR/USD | -0.70% | -0.37% | -8.00% |

| US 10Yr Yld | -7.83% | -14.16% | 48.82% |

| VIX Vol. | 15.41% | 20.44% | -5.19% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Taking the investment pulse

Taking the global GDP growth pulse ahead of 2022. India, US, and Europe lead

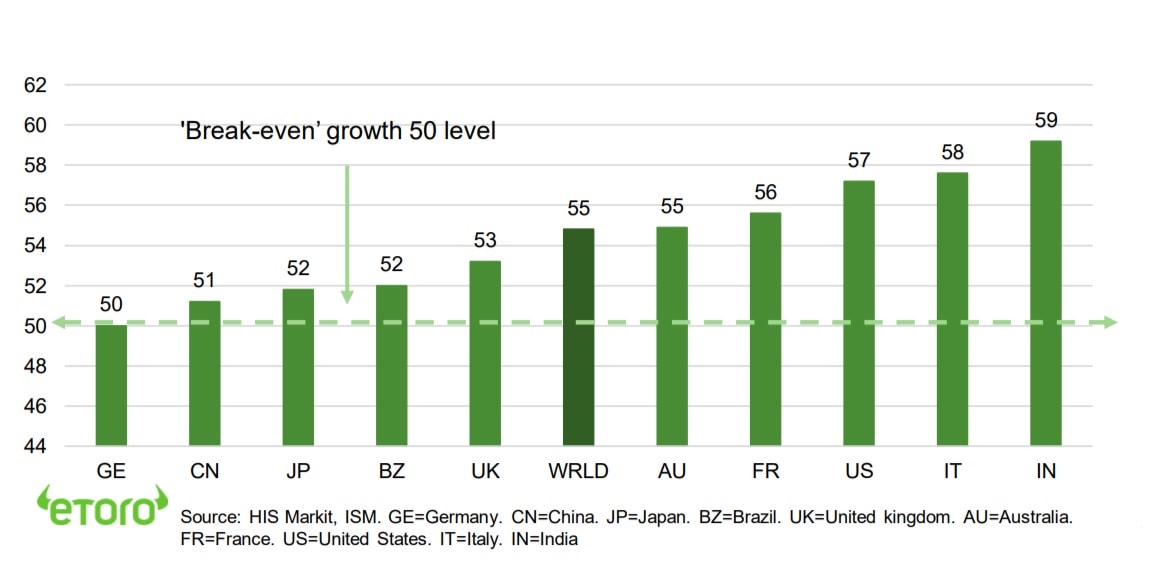

Latest purchasing manager index (PMI) data provides a timely heath check for the global economy (see chart). Growth is naturally easing back from the huge recession-rebound this year and with omicron fears now rising. But no major economy is below the PMI level of 50 that indicates a recession risk. India is seeing the strongest growth, followed by much of Europe as well as the US. By contrast Germany is suffering form surging covid cases and its huge auto sector hobbled by semiconductor shortages. UK numbers are falling fast as it remains the centre of the omicron outbreak. China is hurt by the impact of a zero-tolerance covid on the consumer, and a very large and indebted property sector. Global growth is forecast at around 4.5% next year, and we see upside to consensus earnings growth rates only around 7%.

Tantalising signs that inflation fears may be peaking, and Central Banks to go slow, helping equities

Latest PMIs also provide a tantalising glimpse of peaking inflation. Price pressures are seen easing slightly from November peaks, as supply chains adjust. This is consistent with our proprietary index which shows lower freight rates and semiconductor prices, though from very high levels. But even with global inflation to ease from this year’s level near 5%, central banks are beginning to respond. The UK surprised by starting to hike interest rates last week, the first of the biggest central banks. The Fed is now targeting three hikes next year. These tightening cycles are lower and slower than historically, and still able to support equity valuations well-above long-term levels. Whilst some, in Europe and Japan, will not hike next year at all.

What are the purchasing manager indices?

The indices are available for over 40 countries and industries globally, produced monthly, and derived from business condition surveys of senior company executives. The questions provide insight into the outlook for GDP, inflation, exports, inventories, and employment, among other indicators. They are seen as an important and timely leading indicator. The index represents the degree of change from the prior month. A level over 50 indicates expansion, whilst a level below 50 contraction.

Bringing it together. Another year of positive – though likely lower – returns

Still-strong GDP growth will drive upward revisions to overly conservative consensus earnings growth. A gradual central bank tightening will allow valuations to stay high. We see around a 10% global equity return next year, significantly lower than this year, but a near unprecedented fourth straight year of strong returns. Risks can be managed by focusing on stronger growing sectors, like consumer discretionary and industrials, or cheaper segments like financials, energy, and Europe. Multi-year themes such as renewables, electric vehicle, and crypto, remain attractive. We also see room for a modest China equity turn around, as growth and regulatory pressures ease, and are at least well priced-in now.

Health check: composite purchasing manager indices (Latest)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.