Summary

Focus: The earnings season catalyst

Global Q3 earnings season starts Wednesday, and is more important than ever. Growth worries are high, and earnings expectations low. Luckily, we see another strong earnings beat, above the +29% S&P 500 consensus growth, led by energy, materials, and industrials. Europe’s growth may be even stronger, given its greater sensitivity to the GDP recovery. Earnings forecasts have room to rise, helping the market, whilst valuations have already fallen a long way.

Some market relief

In another volatile week, markets saw some inflation relief, as the oil surge eased, and lower Washington DC dysfunction, as politicians made a temporary debt deal. US bond yields rose to 1.6% and the US dollar was firm. Chinese ADR’s also saw some overdue relief. We expect bond yields to rise modestly more, driving further rotation to cyclicals. See our global markets presentation here for background.

Leading the tech race

Technology has become the dominant driver of investment returns, putting a focus on who does it well. Four trends are clear from the latest World Digital Competitiveness survey. 1) The US dominates tech competitiveness, in 1st place for the fourth year, 2) Asia is surging, with China up 15 places in only four years. More surprising is 3) the dominance of smaller ‘start-up’ countries, and 4) Europe’s strong showing.

Japan, the world’s forgotten market

Japan (EWJ) is the world’s 3rd largest economy, 2nd largest stock market, and best major Q3 performer. But it is chronically overlooked. Only 12% of our Retail investor survey saw it as one of the best markets, despite its cheap valuation, low correlation with other markets (which helps in pullbacks), and world beating stocks, from Toyota (TM) to Sony (SONY). But it has deflation, poor demographics, and high debt. This makes it a bottom-up stock pickers market.

Bitcoin back over $50,000. All eyes on Shiba

Bitcoin (BTC) surged back over $50,000, again showing a low correlation with volatile equities. Decentralised meme token Shiba (SHIBxM) surged over 200% after a Elon Musk tweet, taking its market capitalisation over $9bn.

‘Gas-ageddon’ stokes inflation fears

Energy prices surged, after OPEC+ meeting left production unchanged, stoking inflation fears. Cotton was also up strongly on the unintended consequences of US-China trade tensions. Energy winners are the self-sufficient US, Saudi Arabia, Russia, Canada; gas exporters like Shell (RDS.L), Cheniere (LNG), Gazprom (OGZDL.L); and broad smart portfolio OilWorldWide.

The week ahead: Kicking off earnings

1) JP Morgan (JPM) and US financials unofficially kick off the crucial Q3 global earnings season on Wednesday. 2) Wednesday also see’s the latest Fed meeting minutes, as they consider tapering bond purchases, and CPI inflation, estimated at a high 5.3%. 3) China export (+29%) and producer prices (+9.8%) with slower economy.

Our key views: Looking through the volatility

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting virus third wave and Fed tightening risks. We like assets helped by this growth: equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.22% | 0.40% | 13.53% |

| NASDAQ | 0.79% | -1.51% | 16.91% |

| SPX500 | 0.09% | -3.55% | 13.12% |

| UK100 | 0.97% | 0.94% | 9.83% |

| GER30 | 0.33% | -2.59% | 10.84% |

| JPN225 | -2.51% | -7.68% | 2.20% |

| HKG50 | 1.07% | -5.22% | -8.79% |

*Data accurate as of 11/10/2021

Market Views

Some market relief

- In another volatile week, markets saw some inflation relief, as the oil surge stabilized, and lower DC dysfunction, as US politicians made a temporary debt deal. US bond yields rose to 1.6% and US dollar was firm, even after another shocking jobs report. The S&P 500 rose 0.8%, led by energy and financials. Chinese ADR’s also saw some relief. We expect bond yields to rise modestly more, driving rotation to cyclicals. See our global markets presentation here.

The implications of high company debt

- Company debt as a percentage of GDP is 100% globally, as big as government debt (105%) and well-above households (65%). This has key implications for China as they try to deleverage their property sector, and for US bond yields, where high debt will limit the yield increase.

- Debt levels are now falling as GDP and profits rebound. Financing costs are low, and company bond spreads tight. Default rates are under 4% for the riskiest, Fed’s financial stress index at lows, and US companies have $1.8 trillion cash.

Who is leading the tech race?

- Technology has become the dominant driver of investment returns. The World Digital Competitiveness survey measures the capacity of countries to use technology to drive growth and the latest results contain several surprises. Four trends are clear. 1) The US dominates tech competitiveness, in 1st place for the fourth year, 2) East Asia is surging up the ranks, with China up 15 places over the same period, and Korea, Taiwan, Japan up. More surprising is 3) the dominance of smaller ‘start-up’ countries, and 4) Europe’s strong showing.

Japan, the world’s forgotten market

- Japan (EWJ) is the world’s 3rd largest economy, 2nd largest stock market, and best major Q3 performer. This comes as, or because, it is chronically overlooked. Only 12% of our Retail investor survey saw it as one of the best markets, despite its cheap valuation, net-cash balance sheets, low correlation with others (which helps in pullbacks), and world beating stocks, from Toyota (TM) to Sony (SONY). But Japan has deflation, poor demographics, high debt, and low shareholder rights. Not all valuations are low. It is a stock pickers market,

The ‘Gas-ageddon’ in context

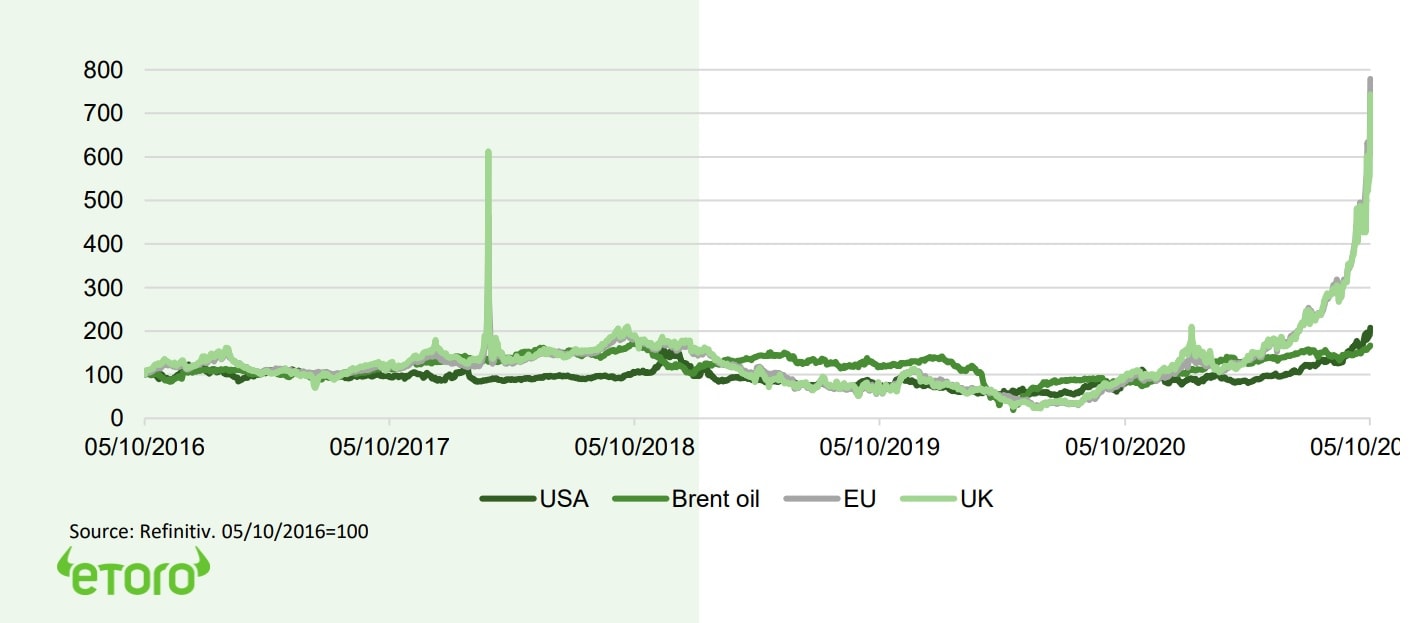

- Europe’s gas prices are +530% this year and US +130%, leading an energy boom with oil +60%. Commodities are in a rare sweet spot of strong demand, as economies reopen, and tight supply, after 10 years of under-investment. The carbon transition is disrupting the ‘solution to high prices is high prices’ supply response. US drilling is 75% lower than when oil last $80/bbl.

- Macro risks should not be overdone. In 2010- 2014 when oil was last over $80/bbl, US inflation was 2.1%, bond yields stable, and equities up. Markets have de-commoditised. Manufacturing is only 12% the US economy, direct energy 3% of the inflation basket, and energy equities 3.5% of total. Winners are the energy self-sufficient US, Saudi Arabia, Russia, Canada; gas exporters like Shell (RDS.L), Cheniere (LNG), Gazprom (OGZDL.L); and smart portfolio OilWorldWide.

US, European, and UK natural gas prices and Brent oil (Last 5 years, Rebased)

Bitcoin back over $50,000. All eyes on Shiba

- Bitcoin (BTC) surged 15% during the week, once again showing its low correlation with weaker equity markets, and above the $50,000 level for the first time since May. Polkadot (DOT) and Filecoin (FIL) were added to the eToro platform, taking the total number of listed coins to 32.

- Decentralised meme token Shiba Inu (SHIBxM) was the spotlight, soaring 200% last week, after Elon Musk tweeted a picture of his Shina Inu puppy on Monday. Shiba is near a top 20 largest market capitalisation coins, at $9 billion.

Energy surge stokes inflation fear. Cotton focus

- European gas prices led a spike in energy, rekindling global inflation fears, and as the OPEC+ meeting surprised by not increasing production. The spike was only dampened by promise of more gas (from Russia) and oil (from US strategic reserve). It remains to be seen how lasting this can be, with energy supply so tight.

- Cotton prices soared 10% last week, and are now up 45% so-far this year, to the highest in a decade. Weather has disrupted supply, and US cotton demand been pushed higher by trade restrictions on Chinese cotton. Impacts seem limited so-far, with leading jean maker, and big cotton user, Levi Strauss (LEVI) reporting Q3 revenues +41% versus prior year quarter, and saying its business is insulated from rising prices until mid next year. Cotton volatility is not new. Prices surged four-fold from 2009-11.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 0.15% | -4.34% | 17.90% |

| Healthcare | -0.67% | -6.46% | 9.69% |

| C Cyclicals | 0.40% | -2.02% | 10.79% |

| Small Caps | -0.38% | -0.74% | 13.08% |

| Value | 1.31% | -0.74% | 16.44% |

| Bitcoin | 14.45% | 22.10% | 90.09% |

| Ethereum | 9.91% | 11.34% | 389.73% |

Source: Refinitiv

The week ahead: Q3 earnings kick off

- Wednesday see’s JP Morgan (JPM) kick off a crucial third quarter global earnings season (see focus), with S&P 500 forecast 27% earning growth versus last year, led by cyclical sectors.

- Wednesday also see’s inflation and interest rates in focus with minutes of Fed’s September meeting, and their bond purchase tapering views ahead of a November announcement. Also, the latest inflation report, with forecast for a stable but very high 5.3% rate.

- Latest China data will be closely watched given its slowing economy, property sector fears, and tech regulation crackdown. Exports (+21%) and imports (+29%) growth is expected to slow. Whilst producer prices to rise to 9.8%.

- FDA considers approving booster shots from Moderna (MRNA) and J&J (JNJ). Also focus on space race with Jeff Bezos’ Blue Origin launch.

Our key views: Looking through the volatility

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which we see as gradual and well-flagged. Also. risks from 3rd virus wave, which has peaked already.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.68% | 5.68% | 31.47% |

| Brent Oil | 4.22% | 13.20% | 59.67% |

| Gold Spot | -0.23% | -1.73% | -7.59% |

| DXY USD | 0.07% | 1.64% | 4.64% |

| EUR/USD | -0.15% | -1.98% | -5.23% |

| US 10Yr Yld | 14.93% | 27.16% | 69.37% |

| VIX Vol. | -11.25% | -10.41% | -17.49% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: The earnings season catalyst

This is an especially important earnings season – and we see a positive catalyst

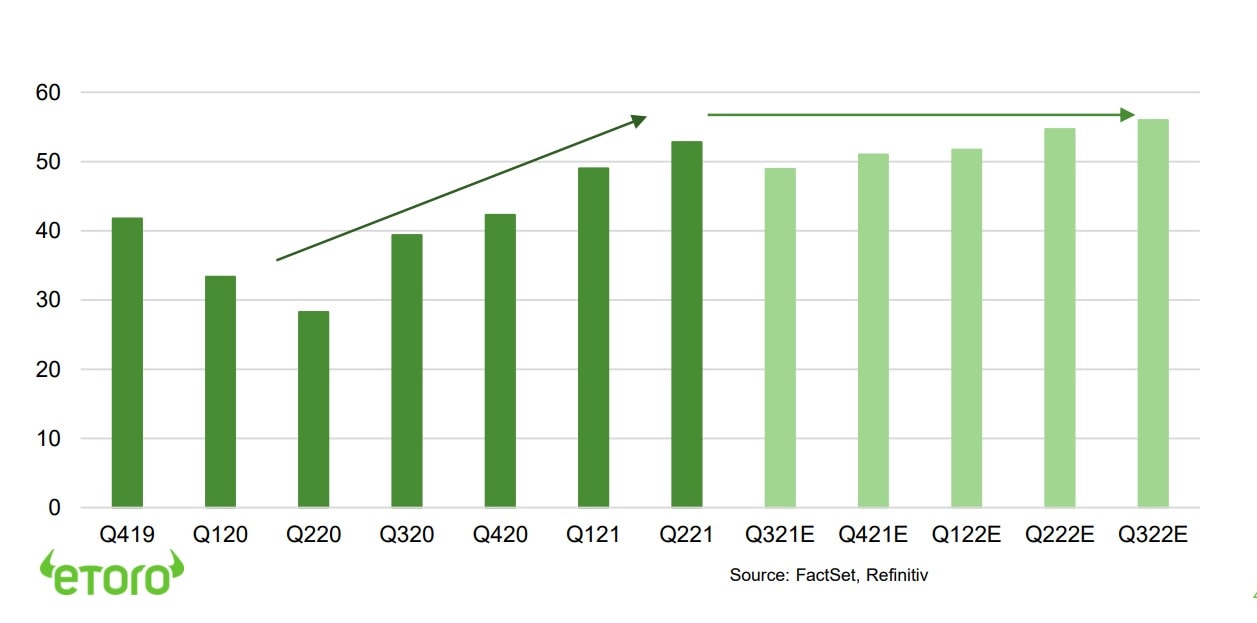

Every earnings season is important, but this one especially so: to prove the growth doubters wrong and provide insurance against lower valuations. Concerns on the growth recovery have mounted as virus cases soared, inflations is high, and supply disruptions continued. Expectations for third quarter US GDP growth have fallen from 6% to 1.3%, and the earnings outlook is for lower absolute earnings than last quarter (see chart). The Fed is about to start tightening its very loose monetary policy, first by tapering its $120 billion/month bond purchases, and then eventually raising interest rates. This will likely bring down valuations somewhat. High earnings growth is the best insurance against this. The good news is we see room for Q3 earnings, starting Wednesday, to significantly beat expectations and support higher markets.

US earnings expectations are too low – setting up for another upside surprise

S&P 500 revenues and earnings are forecast to rise 14% and 29% respectively versus the same quarter last year but fall versus Q2. These expectations are too low: with the economy still growing, many sectors still re-opening, and more companies than usual giving positive guidance – led by tech. Cyclical’s energy, materials, industrials will keep leading the recovery, with earnings up over 75%, whilst defensives utilities and consumer staples are seen up less than 5%. Financials earnings, the first to report, are likely up over 17%. Analysts’ earnings growth expectations have been beaten by an average 15% in recent quarters. They will be lower this time, but enough to reaffirm the strong growth outlook and offset any lower valuations.

European growth is set to be even higher – with its stronger sensitivity to the GDP rebound

European revenues and earnings are set to rise 12% and 46% respectively versus the same quarter last year. Cyclical’s energy, materials, and industrials are the leaders, with earnings seen up over 100%, whilst defensives consumer staples and healthcare have earnings flat or down. The UK is likely to lead with earnings up 120%, with Italy the laggard, up only 7%. Europe’s recovery is stronger than the US, given its more depressed profit margins and more cyclical industry composition (less tech). Similarly, international focused S&P 500 companies are growing revenues and earnings faster than more US-focused peers.

Earnings expectations have room to rise, and valuations have already fallen a lot

Stronger Q3 earnings could be a catalyst for analysts to raise their 2022 growth expectations, helping the market. These seem too low at only 9%, and not far above nominal GDP growth (4.2% real GDP + 3% inflation). Higher earnings is a key offset to lower valuations, but these risks have been falling. The 12- month forward S&P 500 P/E ratio is under 20x and closing in on the 5-year average 18x. Though still above the long term 16.5x, it compares to a peak last year over 23x. Our roadmap for the S&P 500 at 5,050 by end next year is for further earnings surprises combined with well-supported, and above-average, valuations.

S&P 500 index consensus earnings per share forecasts looks too low

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | A big beneficiary of the global growth rebound. Helped by 1) a greater weight of sectors most sensitive to the growth rebound, and lack of tech, 2) 25% cheaper valuations than the US, 3) a decade of under performance has made under-owned by global investors. Combination of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ government spending to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown is hurting the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Supported by GDP growth rebound, ‘green’ industry demand, years of supply under-investment. China GDP and property sector are short term concerns. Industrial metals and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Italy | Edoardo Fusco Femiano |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.