Summary

Focus: The fourth quarter outlook

Markets saw more strength in Q3, with S&P 500 on track for over 3% gain. But crypto, real estate, and commodities have led the rally this year. In Q4 we see lower virus pressures, the well telegraphed start of Fed tapering, another Q3 earnings beat, temporary political noise from Washington DC, a renewables boost from the COP 26 climate conference, and lower China risks. The twin earnings surprise and dovish Fed market pillars, and our positive 5,050 S&P 500 outlook for next year, remain. We see Q4 sector rotation into Value as growth fears subside and US bond yields rise modestly.

Markets helped by China and Fed

Nervous markets stabilized, with China moving to ease ongoing Evergrande property concerns, and the US Fed delaying its tapering decision. Monthly global PMI growth data showed slowdown concerns may be overdone. Rising US 10-year bond yields boosted Value sectors, financials and energy. See our global markets presentation here for background.

Messages from Burgernomics and gold

Our look at global burger prices reiterates how expensive the USD is. We expect it to gradually weaken, helping assets from commodities, to emerging markets, and US tech. Dollar strength has been one driver of gold’s very weak performance, but also highlights investors lack of concern on inflation or of a market correction, and with crypto competition rising.

Opportunities in the music and cars rebound

The $50 billion IPO of no.1 record label Universal highlights booming music industry, from Vivendi (VIV.PA) to Warner Music (WMG), which rose from ashes on the music streaming boom. We also examine how to invest in electric vehicle growth, with legacy autos, from Toyota (TM) to Volkswagen (VOW3.DE), leading EV leaders, from Tesla (TSLA) to NIO (NIO), this year on the cyclical growth rebound, their accelerating EV transition and rock-bottom stock valuations.

Twitter pushing crypto asset adoption

Bitcoin (BTC) weakened with asset market volatility. Smart contract blockchain Tezos (XTZ) was a notable exception to the broad crypto weakness. Adoption continues to broaden with Twitter (TWTR) to integrate micropayments Bitcoin Lightening into its platform and provide verification features for NFT’s.

Oil rise leads commodity stabilisation

Oil prices rose as US inventories fell to 3-year low in sharp reminder of supply constraints across markets. Broad commodities stabilized on some easing of China growth concerns..

The week ahead: Washington in focus

1) As Oct. 1 federal debt ceiling deadline looms, expect efforts at compromise and government shutdown preparation. 2) China PMI data to be scrutinized as growth slowdown and property pressures built, 3) Fed’s favourite PCE inflation measure in spotlight as they inch to tapering $120bn/month purchases. 4) Quiet earnings week focused on Micron (MU), IHS Markit (UNFI), and Bed, Bath, & Beyond (BBBY).

Our key views: Staying the course

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting virus third wave and Fed tightening risks. We like assets helped by this growth: equities, commodities, crypto, and are cautious fixed income, and the USD.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.62% | -1.86% | 13.69% |

| NASDAQ | 0.51% | -1.20% | 18.62% |

| SPX500 | 0.02% | -0.54% | 16.75% |

| UK100 | 1.26% | -1.35% | 9.15% |

| GER30 | 0.27% | -2.02% | 13.22% |

| JPN225 | -0.25% | 9.04% | 10.22% |

| HKG50 | -2.92% | -4.78% | -11.16% |

*Data accurate as of 270/09/2021

Market Views

Markets helped by Fed and China

- Nervous markets stabilized, with China moving to ease ongoing Evergrande property concerns, and the US Fed delaying its tapering decision. Monthly global PMI growth data showed slowdown concerns may be overdone. The S&P 500 rose 0.5%, whilst US 10-year bond yields rose to 1.45% helping boost Value sectors, financials and energy. See our global markets presentation here for background.

Messages from Burgernomics

- Our look at global burger prices shows how pricey the USD is. A big mac in the US costs near $6, the fourth most expensive of the 21 markets we looked at, and near three times the cheapest in Russia (RUB) and South Africa (ZAR).

- We think the USD gradually weakens from here. This has traditionally helped many assets, ranging from commodities (priced in $), to emerging markets (indebted in $), and US tech.

…and from the weak gold price

- Gold has been the weakest asset class performer this year, down 6%. Dollar strength has been one driver of this weak performance, but we think it also highlights investors lack of concern on inflation or of a coming market correction, and with crypto competition rising.

- We remain positive on equities and prefer diversification opportunities there, across high dividend yield, quality, and mid caps, rather than using traditional diversifiers such as gold.

Opportunities in music’s rise from ashes

- The $50 billion IPO of no.1 record label Universal Music highlights the booming music industry, benefitting everyone from Vivendi (VIV.PA) to Warner Music (WMG), and even Spotify (SPOT).

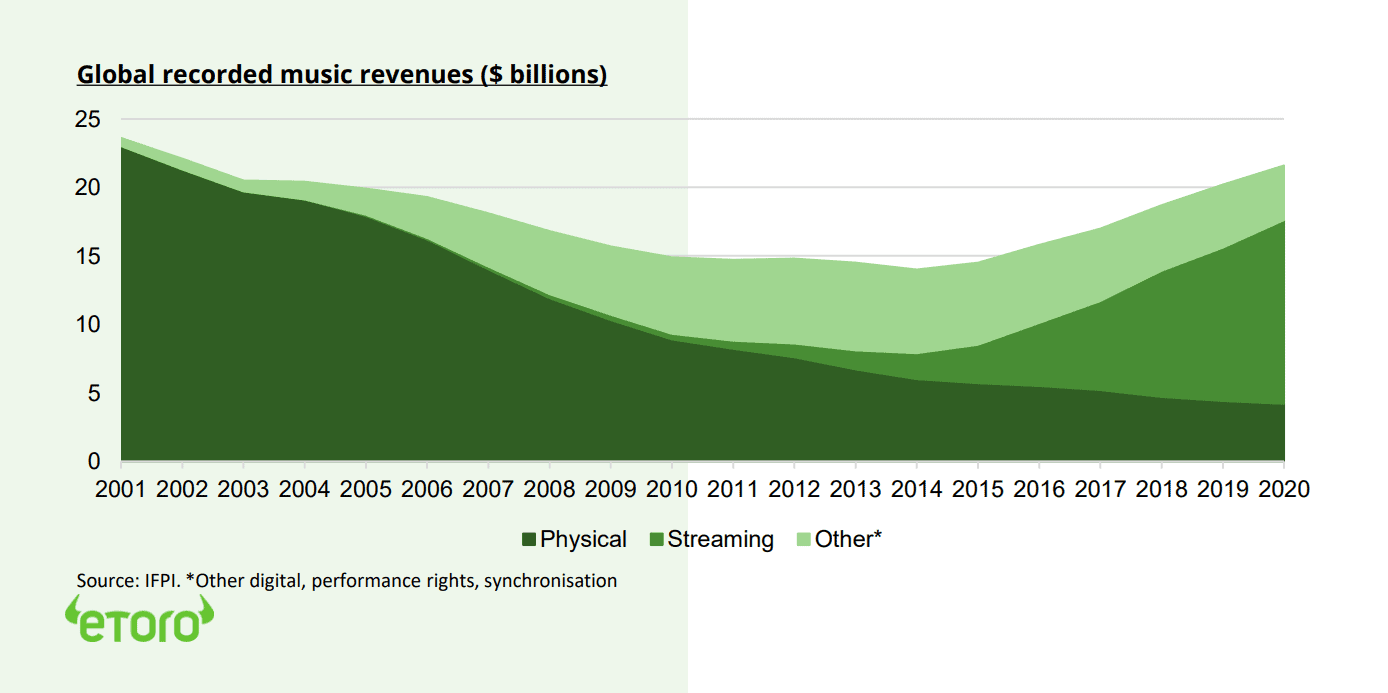

- The music industry has risen from the ashes. Surging music streaming revenues (see chart) has taken the industry back to the cusp of regaining the revenue levels of 20-years ago. Global recorded music revenue was $21 billion last year, with streaming 62% of that, per the International Federation of Phonographic Industry (IFPI). Industry revenues grew a fast 7.4%, and streaming by a huge 18.5%, last year.

How to invest in the EV boom

- We examine how to invest in electric vehicle growth, Global electric vehicle (EV) sales crossed 10 million units last year, up 43% on prior year, but still only 1% of the world-wide fleet. Near term global targets are for 30% annual EV unit growth to take the industry to over 10% of the vehicle fleet by 2030. This is driven by tighter emission standards, subsidies, new products, longer ranges, and charging infrastructure.

- Legacy automakers, from Toyota (TM) to Volkswagen (VOW3.DE), price performance has been beating EV leaders, from Tesla (TSLA) to NIO (NIO), this year. They have been boosted by the cyclical economic growth rebound, their accelerating EV transition investments, and their rock-bottom stock valuations. Volkswagen price/earnings valuation is 6x versus Tesla 114x, for example, with the German automaker funding a four times larger $22 billion investment plan.

Global recorded music revenues ($ billions)

Twitter pushing crypto asset adoption

- Bitcoin (BTC) weakened with market volatility, and as China broadened its mining crack down to crypto trading. $5 billion market cap. smart contract blockchain Tezos (XTZ) was a rare exception to the broad crypto weakness.

- Adoption continues to broaden with Twitter (TWTR) announcing plans to integrate micro payments Bitcoin Lightening into its platform and to provide verification features for NFT’s.

- The latest Fidelity Institutional Investor digital assets study shows 90% find digital assets appealing but only 52% are invested today. We see institutional adoption as a key crypto driver.

Oil leads commodity stabilization

- Oil prices rose as US inventories fell to 3-year low in a sharp reminder of supply constraints across markets. Broad commodities rose 1.5% on some easing of China growth concerns.

- Markets fear default by Evergrande (0333.HK) on its $300 billion debt may be China’s ‘Lehman moment’, with non-financial corporate debt the world’s highest at 157% of GDP, property sector 20% GDP, and key source of local government finance. And with global impact, as world’s no.1 commodity importer and no.2 economy. But we see China with plenty room to help economy and manage a property slowdown. It’s interest rates and bank-reserve requirements are some of world’ highest, and it has a 45% savings rate.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 0.67% | 0.04% | 21.76% |

| Healthcare | -0.51% | -2.04% | 14.32% |

| C Cyclicals | 0.12% | 1.07% | 12.70% |

| Small Caps | 0.50% | 0.77% | 13.83% |

| Value | 0.55% | -1.38% | 16.20% |

| Bitcoin | -10.30% | -12.06% | 47.40% |

| Ethereum | -14.57% | -9.19% | 287.04% |

Source: Refinitiv

The week ahead: Central Bank week

- Washington DC nears the Oct. 1, Federal debt ceiling deadline. A government shutdown is very possible, generating uncertainty but an eventual agreement. Meanwhile, the historic German election will see coalition building.

- Purchasing manager indicators (PMI) in China to show degree of the economic slowdown as world’s no.2 economy deals with the virus pandemic and property sector contagion. Elsewhere in Asia, Japan’s ruling LDP party elects a new leader and de facto Japanese PM.

- The Fed’s favoured PCE inflation (Est. at 4.2%) measure will reveal the pressures on the Fed to begin its tapering, and with more Governors looking for an 2022 interest rate rise.

- Quiet earnings week including semiconductor heavyweight Micron (MU), IHS Markit (UNFI), Cintas (CTAS), and Bed, Bath & Beyond (BBBY).

Our key views: Staying the course

- A positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- The main risk is Fed policy tightening, which we see as gradual and well-flagged. Also. risks from 3rd virus wave, which has peaked already.

- We focus on cyclical assets that benefit most from the rebound: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.47% | 2.73% | 26.81% |

| Brent Oil | 2.27% | 7.72% | 49.27% |

| Gold Spot | -0.19% | -3.84% | -7.94% |

| DXY USD | 0.09% | 0.64% | 3.72% |

| EUR/USD | -0.05% | -0.64% | -4.05% |

| US 10Yr Yld | 8.33% | 14.06% | 53.54% |

| VIX Vol. | -14.70% | 8.30% | -21.98% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Fourth quarter outlook

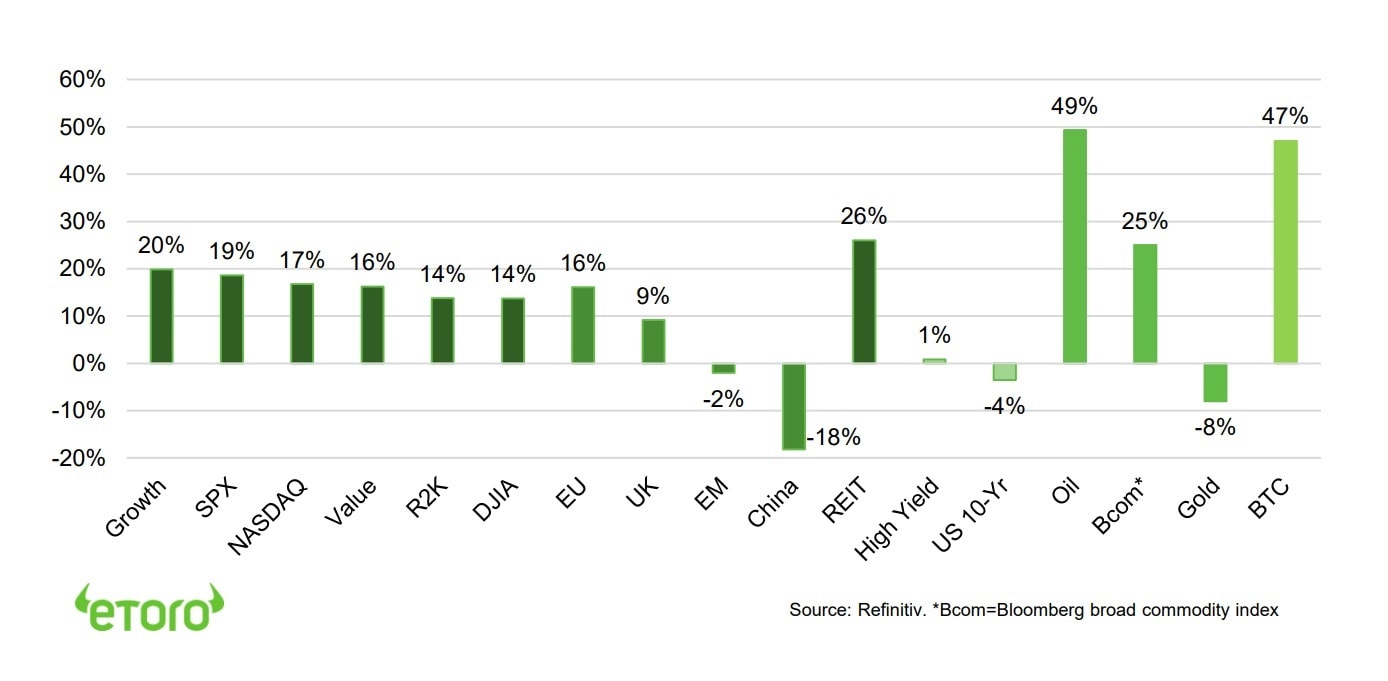

What worked so far: crypto, commodities, real estate, equities, and tech

Markets rallied through third quarter. Crypto saw a 50% correction, 15th of the decade, but is by far the best performer this year. Listed real estate follows, with REIT’s seeing a sharp residential price recovery and tech-led industrial and tower boom, offsetting office and hotel weakness. Lower US 10-year bond yields over Q3 boosted the attraction of their long-term cash flows and high dividends. Commodities did well, with a ‘sweet spot’ of strong demand and tight supply, offsetting a firm USD. Equities ground higher, even after seeing the first 5% pullback since November. US, Europe, and Japan led. China was the loser, with a slower economy, tech regulatory crackdown, and property sector concerns. Global tech was strong, benefitting from its earnings visibility, as virus concerns increased, and bond yields fell. Bonds under performed, but not as much as feared, as US 10-year yields fell (prices rose) as low as 1.2% on demand from foreigners facing even lower yields locally. Safer-haven gold suffered in this buoyant environment.

What to expect in Q4: lower virus cases, Fed tapering, DC political noise, COP 26 climate conference

Peaked third-wave virus cases (down for a month now globally) and rising vaccinations (44% globally now had 1-dose) open room for looser Q4 restrictions and a boost to long-suffering ‘re-opening’ stocks, from hotels to airlines, where earnings are very depressed. The Fed will start the long-awaited tapering of its $120 billion/month bond purchases, likely at its 2-3 November meeting, taking to zero by mid 2022, as prepare to start raising rates at end of next year. This will cause some volatility, raise bond yields, but has been well-telegraphed to markets. Third quarter earnings start October 13, with S&P 500 earnings growth forecast at 28% versus same quarter last year, and room for another positive surprise with consensus earnings forecasts lower than in Q2. Political noise from Washington DC will be high, but ultimately we see compromise, and limited market impact. US debt ceiling expires October 1, Democrats looking to pass a $3.5 trillion spending bill, including corporate and personal income tax rises, and Fed chair Powell up for re-appointment. The November 1-12, COP 26 UN climate conference will refocus attention on the carbon transition and outlook for renewables. China growth concerns will likely ease, with its policy flexibility high.

Two pillars of the market remain earnings surprises and the Fed. See a Value rotation in Q4

The two pillars of further market gains are 1) further earnings surprises as economies re-open and profit margins stay high. Consensus expectations for 10% earnings growth next year are far too low. Secondly, a gradual Fed allows valuations to remain well-above long term average levels. Current 1.4% bond yields are less than half the level in prior recoveries. Our 5,050 S&P 500 target for end of next year, implies near 15%

upside from here. The major investment change in Q4 is a likely sector rotation into cheaper and more growth sensitive value sectors, such as financials, commodities, and industrials, as virus cases fall and bond yields rise modestly. Tech is likely to remain well-supported, but to not lead performance as it did in Q3.

Cross-asset price performance year-to-date %, (Left to right by asset class)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | A big beneficiary of the global growth rebound. Helped by 1) a greater weight of sectors most sensitive to the growth rebound, and lack of tech, 2) 25% cheaper valuations than the US, 3) a decade of under performance has made under-owned by global investors. Combination of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ government spending to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown is hurting the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in the current cyclicals focused environment with growth and earnings strong. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Commodities supported by record-breaking GDP growth rebound, ‘green’ industry demand, years of supply underinvestment, and a stable or weaker USD. Industrial metals (copper) and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Italy | Edoardo Fusco Femiano |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.