Summary

Focus: Managing the 2022 risks

We forecast a near-unprecedented 4th straight year of good returns in 2022. We examine the risks to this, and how to manage them. We see earnings growth forecasts too low. This is rare, as they normally fall. Similarly, valuations are high, especially in US, and many think they fall. We see them as supported, and any fall offset by better earnings. We look to faster growing sectors (like cyclicals) and cheaper segments (like financials, and overseas markets) to manage these risks, alongside big-tech ‘new’ defensives.

Market rebound faces the Fed test

Markets rebounded back to near all-time-highs as initial omicron virus fears eased. But the Fed leads a pivotal set of upcoming central bank meetings in the last full pre-Christmas holiday week, with inflation pressure still rising. China performed better as it boosted policy stimulus. Germany saw new chancellor after Merkel’ 16- years. See latest presentation here.

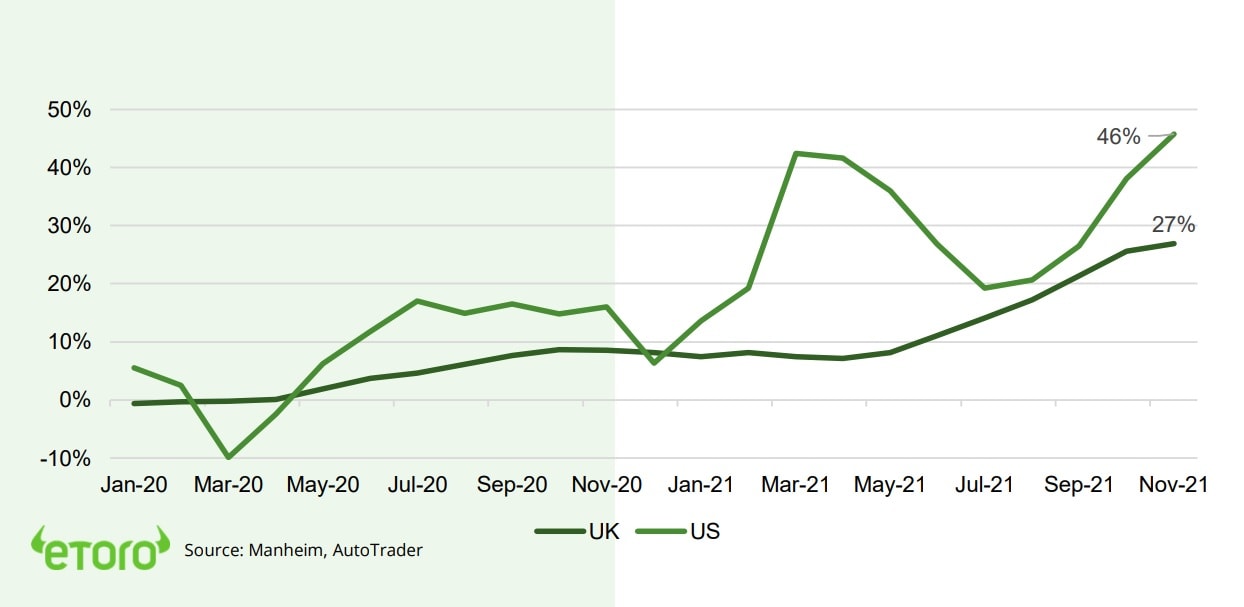

Used car prices still soaring….it matters

Used car prices still soaring, up 46% in US and 27% in UK vs last year. Good for retailers (PAG), lenders (ALLY), renters (CAR), and manufacturers. But it is also still boosting inflation.

What the ‘metaverse’ means for investors?

It incorporates video, augmented and virtual reality. Also, shared architecture allowing virtual goods and identities to move platforms. It needs more processing capacity, bandwidth, and better headset and glasses hardware. To boost sectors from luxury to NFTs. But gaming enjoys a first mover advantage. See @InTheGame.

Carbon prices new kid on commodity block

Europe’s ETS carbon price is up a dramatic 150% this year, boosted by the energy crisis, but is also setting pace for many new global carbon pricing initiatives. The utility sector is most exposed, with carbon credit costs at 11% of revenues vs a European stock average 2% revenue hit. See KRBN ETF and @RenewableEnergy. See Page 2

Bitcoin struggles to recover

Bitcoin couldn’t rebound from prior weekend ‘flash crash’. Crypto saw broadening adoption, as payments giant Visa (V) launched more crypto services. Moves to formalize regulation gathered pace with US Congress hearings, and Australia’ exchange licensing proposals. Digital currency (CBDC) momentum is accelerating.

Commodities regain footing. Coffee in focus

Better week as omicron growth fears eased, USD stabilized, and oil rebounded. Broad Bloomberg commodity index is +23% this year. Price of a cup of Joe set to rise with coffee bean prices near doubled on rising supply disruption fear in major producers Brazil, Vietnam, Ethiopia.

The week ahead: central bank extravaganza

1) More hawkish Fed the focus (Wed) in big week of central bank meets. 2) Flash PMI’s (Wed) from around world to give sense of new virus impact. 3) Rare stock market ‘quadruple witching’ (Fri) to drive volumes. 4) Light earnings week focus on software ADBE, CAN, FDX, and DRI

Our key views: Virus and Fed risks remain

Still positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support. Risk focus on new virus lockdowns and a more hawkish Fed. We see economies resilient, and Fed to still move slowly. We like cheaper and higher-growth equities, commodities, and crypto. Whilst are cautious on fixed income.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 4.02% | -0.39% | 17.53% |

| SPX500 | 3.82% | 0.62% | 25.45% |

| NASDAQ | 3.61% | -1.45% | 21.28% |

| UK100 | 2.38% | -0.76% | 12.87% |

| GER30 | 2.99% | -2.93% | 13.88% |

| JPN225 | 1.46% | -3.96% | 3.62% |

| HKG50 | 0.96% | -5.26% | -11.88% |

*Data accurate as of 13/12/2021

Market Views

Market rebound faces the Fed test

- Markets rebounded back to near all-time-highs as initial omicron virus fears eased. But the Fed leads a pivotal set of upcoming central bank meetings in the last full pre-Christmas holiday week, with inflation pressure still rising. China performed better as it boosted policy stimulus. Germany saw new chancellor after Merkel’ 16- years. Tech sector led, up 5.5% in a broad rally. US 10-year bond yields rose, and the USD stabilized. See our latest presentation here.

Used car prices still soaring. Why it matters?

- Used car prices are still soaring, up 46% in US and 27% in UK versus last year. New car production is being held back, for now, by chip shortages, as consumer spending rises strongly. New car sales seen rebounding 17% next year.

- Surging used car prices boosts car retailers, like Penske (PAG); lenders like Ally (ALLY); renters like Avis (CAR), as well as the manufacturers. US new car buyers are paying an average $800 above the list price today. Higher car prices are also one of the biggest drivers of inflation rises.

A focus on metaverse opportunities

- It incorporates video, augmented and virtual reality. Also, a shared architecture allowing virtual goods and identities to move platforms. The idea is 20 years old, but accelerating now. It needs more processing capacity and bandwidth and improved headsets, glasses, smartphones. Market size forecasts reflect this breadth and early-stage, from $800 billion up. Boosted areas include gaming, advertising, NFT’s and luxury.

- The gaming community enjoys a first mover advantage in creating this more immersive metaverse ecosystem, with Roblox (RBLX) an early leader, alongside software stocks, like Unity (U), and graphics chip makers, like Nvidia (NVDA). See the smart portfolio @InTheGame.

Carbon prices are the new kid on the block

- Europe’s ETS carbon price is +150% this year, a multiple of Bloomberg commodity index, and behind only continent’s gas prices and lithium. Is clear direction-of-travel for 1) growing carbon credit schemes, like China, 2) deals at COP26 for international carbon trading, and 3) more voluntary company moves to price. KRBN for direct exposure. @RenewableEnergy indirect.

- Utilities are the most impacted. Buying carbon credits to offset their CO2 pollution would cost 11% of revenues. Materials (9%), energy (5%), staples (2.5%) are all over European 2% average

What the growth of CBDC’s means?

- Digital currency (CBDC) momentum is accelerating with launches by Bahamas (Sand dollar) and Nigeria (e-Naira). 1/3 of global central banks are now researching them, double last year. China has set pace, retail testing its e-CNY. ECB is focused on technical issues. The Fed has delayed its paper, given diverging opinions and most to lose with USD 60% of global FX reserves.

- Impacts depend on type and structure of CBDC. Could see 1) Ethereum boost as most supportive blockchain. 2) Stable coins like Tether (USDT) seen calls for more regulation but centralised CBDC’s could stoke demand. 3) Early China and EU movers may boost their currency global use.

US and UK used car price rises still rising (% year-over-year)

Bitcoin pressure remains

- Bitcoin (BTC) struggled to recover from the prior weekend ‘flash crash’, and remained below $50,000, with a $1.0 trillion market cap.

- Payments processor Visa (V) launched a crypto consulting service to drive adoption. Whilst Australia is creating a crypto exchange licensing framework as overhauls its payments industry.

- US Congress hearings on $3 trillion market cap. crypto asset industry. Participants welcomed possible new regulation as way to grow industry, whilst being cautious overly restrictive rules that could prove to be counter-productive.

Commodities regain footing. Coffee price focus

- Commodity prices regained footing, as omicron growth concerns eased, the USD stabilized, and oil prices rebounded. Large gainers included lumber, carbon credits, and coffee. The broad Bloomberg Commodity Index is now up 24% this year. We remain positive the outlook, with a ‘sweet spot’ of better demand and tight supply.

- The price of a cup of coffee is set to rise. Coffee bean prices have nearly doubled this year, to the highest in a decade. This has been driven by weather disruption in largest producer Brazil, and supply concerns in other top-5 producers Vietnam (recent covid case surge) and Ethiopia (political instability). This has been part of the broader rise in ‘breakfast’ commodities this year, particularly impacting emerging markets.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 5.08% | 1.69% | 28.12% |

| Healthcare | 2.88% | -1.40% | 13.02% |

| C Cyclicals | 2.20% | -1.12% | 18.98% |

| Small Caps | 2.43% | -8.19% | 12.00% |

| Value | 3.05% | -0.12% | 21.39% |

| Bitcoin | -9.27% | -25.88% | 67.97% |

| Ethereum | -3.17% | -15.35% | 436.94% |

Source: Refinitiv

The week ahead: Central Bank extravaganza

- Central bank meetings from Fed, ECB, BoE, BoJ in jammed pre-Christmas calendar. Biggest changes likely from newly more hawkish Fed. To accelerate bond-buying taper and publish a new ‘dot plot’ of its interest rate hike forecasts.\

- December flash PMI numbers from EU, UK, Japan, US to give timely check on omicron and new lockdown impacts on global growth. A modest slowdown to mid/low-50’ growth seen.

- Light earnings week focus on software giant Adobe (ADBE), professional services Accenture (CAN), trade proxy Fedex (FDX), restaurant operator Darden (DRI), and EV Rivian (RIVN).

- One of four ‘quadruple witching’ days of year (Fri). US index and stock futures and options contracts all expire, driving heavy volumes.

Our key views: Virus and Fed risks remain

- Still positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large support of low interest rates and fiscal spending.

- Focus still virus fourth wave and new lockdown impacts on GDP and earnings growth. We see economies as increasingly resilient. Also more hawkish Fed interest rate outlook. We see rate hikes still gradual and much already priced-in.

- We focus on cyclical assets that benefit most from decent growth: commodities, crypto, small cap, and value. We are more cautious on fixed income, the USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.15% | -5.74% | 24.14% |

| Brent Oil | 7.31% | -8.15% | 45.53% |

| Gold Spot | -0.04% | -4.53% | -6.23% |

| DXY USD | -0.07% | 0.97% | 6.80% |

| EUR/USD | 0.04% | -1.11% | -7.35% |

| US 10Yr Yld | 12.82% | -8.09% | 56.65% |

| VIX Vol. | -39.06% | 14.73% | -17.85% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: What are the big risks?

Risk management in an unprecedented year – earnings, valuations, and sentiment

We are forecasting a near 10% S&P 500 return next year to our 5,050-index target. Earnings growth expectations will likely rise, and a slow-moving Fed would support current high valuations. We have only seen such a fourth year of consecutive double-digit returns once before over the past fifty year, in 1995- 2000. So, risk management in this near unprecedented environment is key. We focus on where we have strong growth visibility – such as big tech, ‘reopeners’, and value segments. And where we believe valuations are particularly attractive, such as energy, financials, and Europe. We focus below on the three key equity market risks – to earnings, valuations, and investor sentiment.

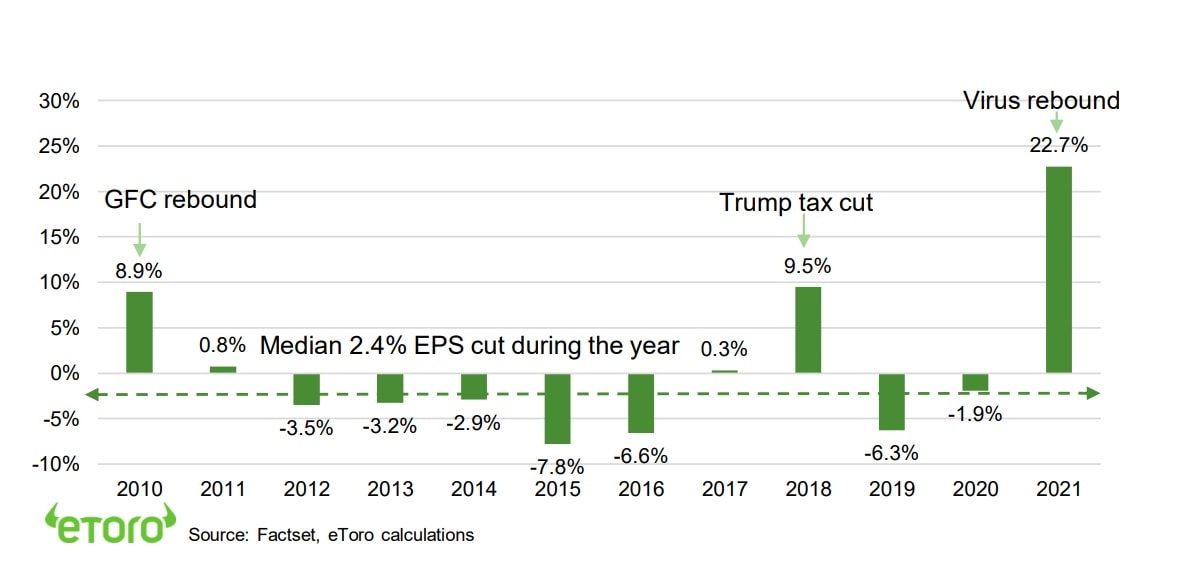

We believe earnings growth forecasts are too low. But estimates normally fall.

We look for over 15% earnings growth next year, double current consensus forecasts. We see GDP growth near double long-term averages, and increasingly resilient to new virus lockdowns. Also, that companies record profit margins are sustainable, driven by the ability to pass on price pressures, a bigger tech sector, and recovering ‘reopener’ sectors. That has been the lesson of this year so far. However, history says we are probably wrong. Earnings estimates normally fall during the year rather than rising (see chart). But the small number of exceptions share two characteristics – either a GDP rebound (like 2010) or stimulus (like 2007). Next year has both, to a lesser degree than this year, but enough to support rising expectations.

Valuations are high, especially in the US. We think well-supported, and any fall offset by earnings

Valuations are high, especially in US where the estimated price/earnings ratio is 22x, or a third higher than its long-term average. This is supported by low interest rates that will rise only modestly, at least by historical standards. Also, by high corporate profitability, with record profit margins, a larger and more profitable tech sector, and strong GDP growth. But we protect ourselves by focusing on lower valued ‘big tech’ within tech. Also ‘cyclicals’ like energy and financials, the two cheapest sectors. Also, overseas markets like Europe. Every 0.5% higher US 10-year bond yield reduces our ‘fair value’ S&P 500 P/E ratio by 10%.

Markets are concerned by high investor sentiment. We are not. Retail and buybacks also a help.

Our composite measure of investor sentiment is around average but has been a lot higher. A collapse in investor sentiment would be a contrarian positive. If everyone is positive there is no one left to buy the market. We also see more investors in the market now. Retail investor allocations have rebounded strongly and shown themselves resilient in the recent two pullbacks. Whilst share buybacks have rebounded strongly and will continue to grow along with profits and with company cash levels high. Corporate buybacks are the single largest buyers of US equities. Unless we see a much sharper rise in interest rates than expected the ‘TINA – ‘There is no alternative to equities’ – phenomena continues next year.

Estimates normally fall: S&P 500 EPS expectations. (End of Year vs Start)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of under performance made under-owned by global investors. Helped by a dovish ECB to hold rates ‘lowfor-longer’, and multi-year €750bn ‘Next Generation’ fiscal support. A weaker EUR helps many companies, with 50%+ company revenues from overseas. ‘4th wave’ virus resurgence may provide additional buying opportunities. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China equities hurt by tech regulation crackdown, property sector debt, and slower GDP growth. But this is increasingly well-priced. LatAm and Eastern Europe have more upside to global growth recovery, a weaker USD, and higher commodities. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in a more cyclicals focused environment with earnings strong and yields rising. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Cross-currents of rising global growth conern on virus fourth wave, and stronger USD. But remain in ‘sweet spot’ of above-average GDP growth, ‘green’ industry demand, years of supply under-investment. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply. Gold hurt by likely rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.