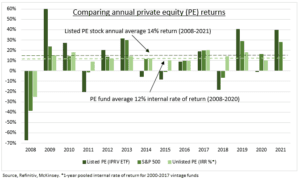

BOOM: Private equity (PE) has boomed in the last decade. Their assets have risen to over $7 trillion, returns have averaged 12% annually, and uninvested ‘dry powder’ is near a record $3 trillion. There are now more private equity funds than hedge funds. PE managers have grown into huge, diversified asset managers and are increasingly listed on the stock exchange. TPG (TPG) was the latest yesterday in a $10 billion IPO. These stocks have been better – if more volatile – investments than the actual funds themselves.

PUBLIC OR PRIVATE: We compare stock market performance of 88 publicly listed global PE firms like KKR (KKR), Blackstone (BX), Apollo (APO), Brookfield (BAM), 3i (III), Partners Gp. (PGHN.ZU). Versus S&P 500 and the performance of private equity industry funds (see chart) since 2008. The median PE stock return is similar to the S&P 500, at 14% per year, and 2pp more than for the average private equity fund. But this comes with a much higher volatility, near double the S&P 500 and 3x the unlisted funds.

THE FUTURE: More firms will list, given rising valuations and a race for scale. The industry is consolidating and converting from partnerships – boosting governance and inclusion in market indices. Listed PE firms have more focus on recurring management fees and less on volatile (but lucrative) performance fees. This has helped valuations rise to an average 18x earnings, from 12x five years ago, and is now 40% above listed banks.

All data, figures & charts are valid as of 13/01/2022