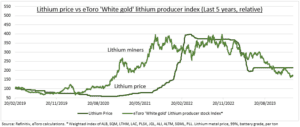

BUST: Lithium prices have plunged 77% in the past year, despite the ‘white gold’ moniker. It’s the worst of a rout in battery metals with cobalt -20% and nickel -40%. It is seeing a glut of new supply and an EV demand slowdown. A price turnaround may be slow in coming, and miners pressured, despite already very poor sentiment. With lithium prices still above pre-2022 levels and above the industry cost-curve. But it’s also a competitiveness silver-lining for battery and EV makers, from Tesla (TSLA) to @BatteryTech. As they try to rekindle growth with lower prices. Lithium-ion battery pack costs are 30% the total of an EV and fell 14% last year to $139/kWh.

LITHIUM: The supply glut will deepen this year, and equal over 15% of the market. With new supply coming alongside lower-than-expected EV battery demand growth. The pain is most felt by Australian spodumene hard rock producers that have led supply increases. This is a low cost process but gives a lower-margin product vs LatAm ‘lithium triangle’ brine operators. All have started to cut costs and trim supply plans but this has a long way to go. Prices remain above the top of the industry cost curve, pre-2022 levels, and much under long term contracts. Whilst new direct lithium extraction (DLE) tech, including new entrant Exxon (XOM), may drive new supply.

STOCKS: We constructed a basket of ten major lithium stocks, from Albemarle (ALB) and SQM (SQM) to Piedmont Lithium (PLL) and Lithium Americas (LAC). It has fallen 58% from its Sept. 2022 highs (see chart). And has seen a 63% fall in its forward net profit estimates. Investor sentiment on the group is terrible with short interest ratios running as high as 21%, at Pilbara (PLS.AX). This has started to drive cutbacks and consolidation, including the recent creation of Arcadium (ALTM). But prices remain above the top of the cost curve, and these 10 still on track to make combined profits of $6 billion, with a prospective P/E that has risen to an overall 12.3x.

All data, figures & charts are valid as of 21/02/2024.