Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Risky assets up globally for a strong finish of Q3

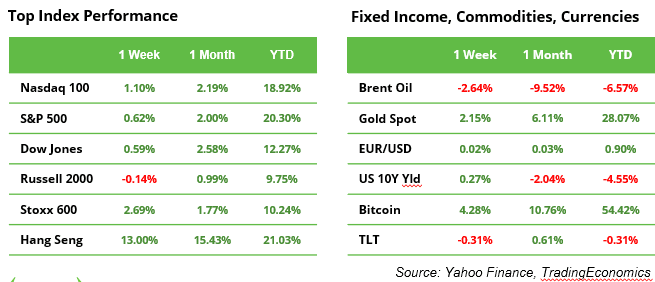

US GDP growth for Q3 was confirmed at 3.0%, and softer Personal Consumption Expenditure (PCE) inflation data for August, at 2.2%, supported the Federal Reserve’s outlook for a “Goldilocks” scenario. This optimism helped the S&P 500 and Dow Jones close the week up by 0.6%, while the Nasdaq rose by 1.1%. The European STOXX gained 2.7%, and Japan’s Nikkei added 5.6%. However, the most remarkable performance came from Hong Kong’s Hang Seng, which surged by 13%, its best week in 16 years, highlighting a rotation towards regions previously lagging the US.

As of the end of Q3, the S&P 500 is up 20% for the year, Nasdaq +19%, Hang Seng +21%, gold +28%, and Bitcoin +54%, offering strong returns across various investment strategies. With Q4 traditionally performing well, optimism remains high for the remainder of 2024.

China’s $284 billion stimulus package

Relief for Chinese equities arrived when the Chinese government unveiled a significant economic stimulus package to address the slowing economy and stabilise the property market. The PBoC lowered interest rates, reduced reserve requirements for banks, and introduced measures to lower mortgage costs, benefiting 50 million households. Furthermore, the package included new policies aimed at bolstering the stock market and issuing 2 trillion yuan in bonds to support local governments and stimulate consumer spending.

Outlook October

October will shift the focus back from macro to micro, with JP Morgan unofficially kicking off the new earnings season on October 11, running through to NVIDIA’s report in mid-November. Analyst expectations for realised revenue and earnings growth in Q3 remain modest but are significantly higher for the subsequent periods. As time goes on, investor attention will increasingly turn to the outcome of the tense US presidential election on November 5, as well as the high-profile BRICS Summit in Russia, beginning on October 22. For more guidance, watch our Q4 Investment Outlook video due to be released on October 7.

The US labour market must not cool much further

The US labour market data for September, due for release on Friday, is of paramount importance to investors. The Federal Reserve has made it clear that its priority is to avoid further cooling of the labour market, as achieving a “soft landing” remains its top goal. Any signs of weakness in the labour market could increase the chances of the Fed considering an additional 50 basis point rate cut in November. However, such signs may also trigger heightened volatility in the markets. A moderate increase of 145,000 new jobs is anticipated, while the unemployment rate is expected to remain steady at 4.2%.

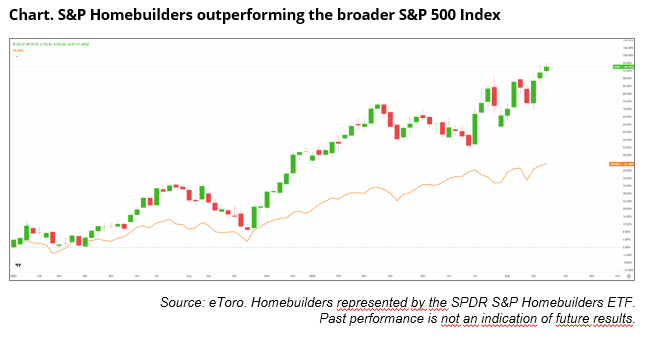

Interest rate cuts not yet sufficient for property boom

The US homebuilder sector has significantly diverged from the S&P 500 since late 2023 (see chart below), as investors anticipate the positive impact of forthcoming rate cuts on the housing market. The SPDR S&P Homebuilders ETF has delivered more than double the return of the broader market since the start of 2023. Despite this optimism, a full recovery in the real estate sector has yet to materialise, as weak building permit and housing start figures suggest. Although there have been occasional strong months, a sustained upward trend remains elusive. The 30-year fixed mortgage rate has dropped to 6.1%, making homebuilding more affordable, but for a true boom, rates would need to fall further. The normalisation of monetary policy is on the horizon.

Earnings and events

Earnings are due for Nike (where Elliot Hill will replace John Donahue as CEO), Carnival Cruise Lines, Levi Strauss and Constellation Brands. Investors will be watching not only Chinese stocks such as Alibaba, Tencent, JD.com, PDD, BYD and NIO after the historic rally following the economic stimulus announcement last week, but also luxury goods makers such as LVMH, Tesla and Apple with a strong focus on the Chinese consumer.

Looking ahead on the agenda, next week we will see Amazon Prime Big Deal Days (Oct.8-9), TSMC monthly sales (Oct.9), Tesla robotaxi unveil (Oct.10), and JP Morgans Q3 earnings (Oct.11), marking the unofficial start of the new earnings season.