Understanding foreign exchange (FX) exposure is essential for investors as currency fluctuations can impact the returns on international investments.

We therefore put together this post to explain how to evaluate the effects of FX on your asset holdings at eToro.

Cash holdings, deposits, and withdrawals

When you deposit to your eToro investment account, funds are converted from your local currency and held in USD (subject to FX conversion charges). When you withdraw, we will convert the USD amount to the currency of your destination account.

Note: if we do not support the currency of your bank account, your bank will convert the funds at their exchange rates and fees.

Your eToro Money account

If you have an eToro Money account, your cash is held in GBP or EUR.

Display currency

You can change the display currency shown in the app. You can also see amounts reflected in your local currency to your account statement. This is for display purposes only and does not change the value of your holdings.

Where to check your exchange rates and fees

- When you deposit or withdraw you can see the exchange rate used for each transaction in corresponding screens in the app. Learn more here.

- Learn more about how to check underlying exchange rates and conversion fees on our website.

Now let’s look at how FX impacts the value of your non-cash holdings at eToro.

Valuing your positions

Regardless of the asset type, the value of any non-CFD position is calculated in the same way:

Value = Units * Unit Price

The USD PnL displayed on each position in your portfolio includes any FX impact on its change in value.

Note: Non-USD-based stock positions opened before March 3, 2024 are hedged against USD (see details below).

US-listed stocks and ETFs

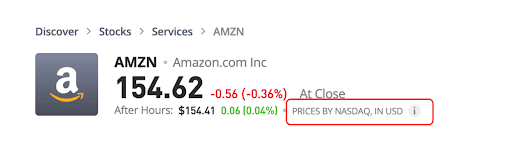

Stocks and ETFs listed on US exchanges like the NASDAQ or NYSE are USD-based. So there is no currency exposure beyond USD.

You can always tell if the stock is USD-based by checking the symbol data on the top right of the corresponding assets screen and in the trade screen:

Non-US-listed stocks and ETFs

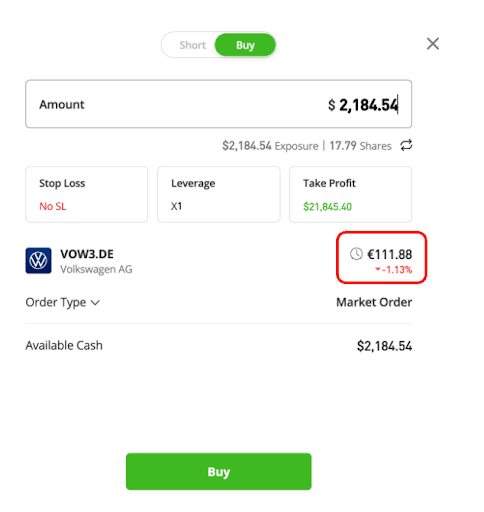

When you invest in a non-USD-based stock, its value is calculated in the currency by which the stock was listed. For example, Volkswagen is listed in Germany and traded in Euros:

Here is how the value is calculated in its base currency:

Value = units * unit price

And in USD:

Position value in USD = value * USD FX rate

CFDs

At eToro, CFDs can be used to trade in several different asset classes including stocks, crypto*, commodities, forex and indices.

Depending on the underlying asset, a CFD may be USD or non-USD based. You can always check the corresponding asset screen to confirm this.

The value of a CFD position is calculated based on the price change and not on its total underlying value. This means the FX exposure of a CFD position only applies to its change in price. You can understand this clearly in our PnL formulas:

USD PnL of a long CFD position = number of units * (current price – opening price) * FX rate

USD PnL of a short CFD position = number of units * (opening price – current price)* FX rate

And the total value of the position:

CFD position value in USD = USD position value at open + USD PnL

*Crypto CFDs are not available in some countries, including the UK and Australia

We are no longer FX hedging new non-USD-based stock and ETF positions.

Before March 3, 2024, when you opened a non-USD-based real stock/ETF position, the amount you invested was immediately hedged (fixed) to the USD exchange rate when it was opened. Only the profit/loss (P/L) portion would remain valued in its base currency.

The USD value of your positions opened on or after March 3, 2024 100% floats against their base currency while they remain open.

How we calculate the value positions where the FX floats (not hedged):

On or after March 3, 2024, when you invest in a non-USD-based asset, the entire position remains valued in its base currency:

Position value in USD = (Number of units * Price per unit in base currency) * FX rate

For example:

- You buy 10 shares of EuroStock at €1 per share, a EURO-based stock, with an exchange rate of 1 USD to every EUR.

- At buy, your investment is valued in Euro: €10.

- At close, the EUR has risen against the USD by 10%, to $1.10.

- And the value of EuroStock has risen by 20% to €1.20 per share.

- At close, your position is valued at €12.00.

- and $13.20 when converted to USD in proceeds.

How we calculate the value of your older positions where the FX is hedged (as well as CFDs):

For real stock/ETF positions opened prior to March 3, 2024, your original investment amount was converted to USD at purchase and only the P/L portion floats at the current FX rate:

Position value in USD = (number of units * price at opening * FX rate at opening) + (number of units * (current price – price at opening) * current FX rate)

As an example:

- You buy 10 shares of EuroStock at €1 per share, an EUR-based stock, at an exchange rate of 1 USD to every EUR.

- When you buy, the original amount you invested is fixed to the USD and valued at $10 for the duration of the investment.

- At close the EUR has risen against the USD by 10% to $1.10.

- And the value of EuroStock has risen by 20% to €1.20 per share.

- Your original investment value remains $10 – remember, it is not valued in EUR.

- The P/L portion is valued at €2.00.

- So, when sold and converted to USD, you would receive $10 + (€2.00 x 1.1) = $12.20 in proceeds.