Bitcoin Cash, the cryptocurrency created by a ‘hard fork’ in early August, is now available to trade on the leading global social trading and investment platform, eToro. As of 13th November, eToro will offer seven cryptos. They are Bitcoin (BTC, the original crypto), Ethereum Classic (ETC), Ethereum (ETHEREUM), Dash (DASH), Litecoin (LTC), Ripple (XRP), and now Bitcoin Cash (BCH).

A Brief History Of Bitcoin Cash

Bitcoin Cash is a fully decentralised peer-to-peer electronic currency. It was born in August after a hard fork, an upgrade to the blockchain, the decentralised digital ledger that serves as the technological infrastructure for most cryptocurrencies, which makes it backwards incompatible. A hard fork happens when a cryptocurrency’s blockchain bisects into two potential routes forward, having been determined by a large amount of people.

Due to the explosion of interest in digital currencies, demand for more tokens, and quicker transaction speeds, triggered this hard fork – wittily, and topically, labelled ‘Bitexit’ by some. It happened when a cluster of disgruntled Bitcoin activists, digital miners and entrepreneurs managed to forge a new version of the world’s original and most famous cryptocurrency, Bitcoin. As a result it sparked even more interest in Bitcoin and cryptos in general.

Indeed, the cryptocurrency revolution has gathered astonishing pace in 2017, with the collective market capitalisation of Bitcoin and the hundreds of other cryptos jumping from $18 billion at the start of the year to over $200 billion in November. Little wonder that in early October top American investment bank Goldman Sachs revealed it is considering offering Bitcoin instruments to its clients.

Bitcoin Cash has become increasingly popular, and recently Li Ang, head of a Bitcoin mining project called Canoe Pool, said: “Bitcoin Cash is Bitcoin now.” On 11th November it hit a record $2,500 per token, having quadrupled in price in just over 24 hours, and moved above Ethereum to become the second-biggest crypto in terms of market capitalization, behind Bitcoin.

The jump in price was caused because the Bitcoin2X (B2X) hard fork – scheduled to happen later in November – was suspended indefinitely. It was due to increase Bitcoin block size to 2MB while supporting SegWit. However, it was felt a consensus had not been gained from the Bitcoin community.

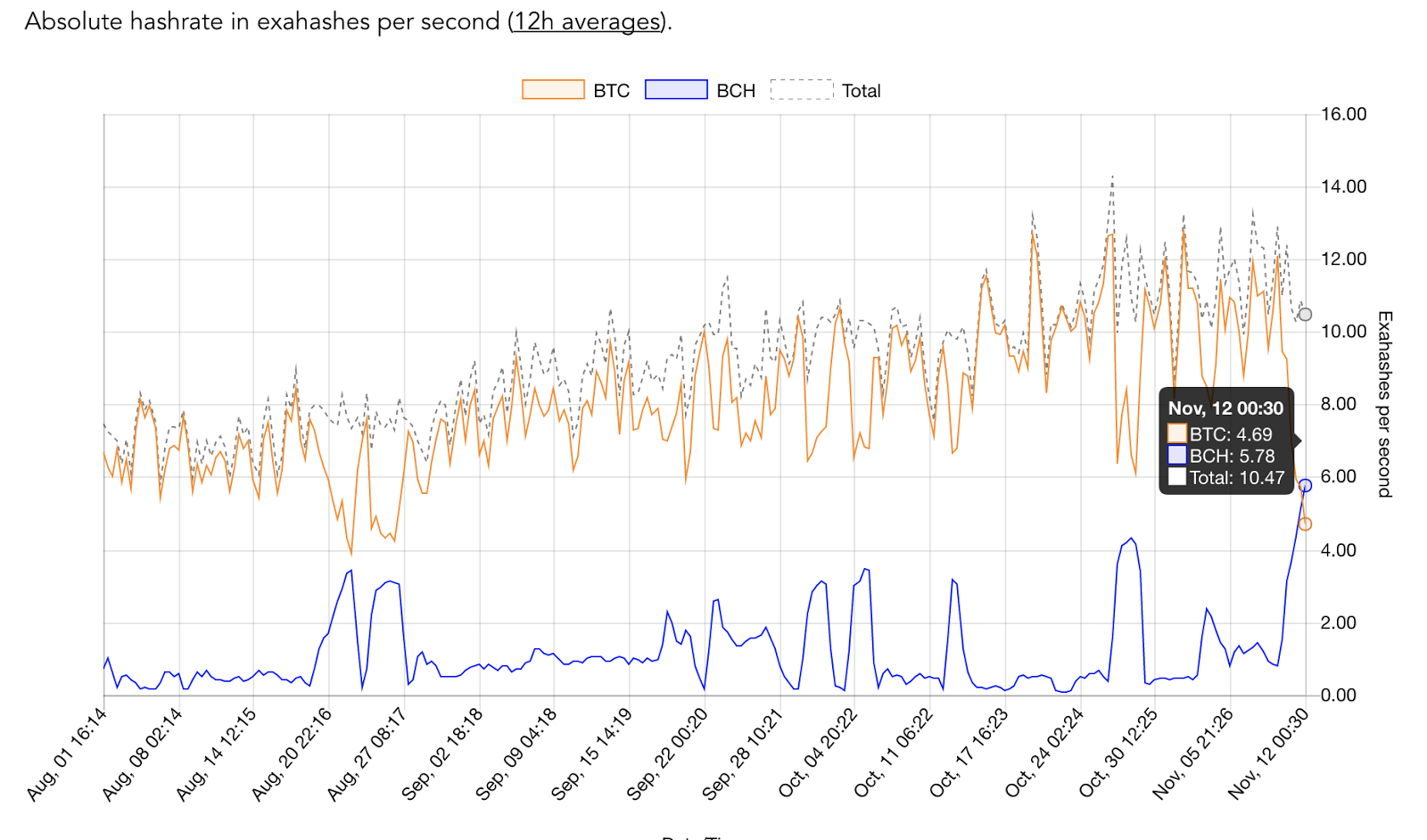

At around 4:30am GMT on 12th November the total amount of mining power backing the Bitcoin Cash blockchain exceeded that of the Bitcoin blockchain for the first time, data obtained from www.Fork.lol suggests.

How Is Bitcoin Cash Different To Bitcoin?

– To solve worries about bitcoin scaling, Bitcoin Cash adjusted the block size: it now has an increased default of 8MB (Bitcoin’s block size is capped at 1MB). This means transactions are faster: around two million transactions can be processed every day compared to Bitcoin’s 250,000 in the same period. It follows the Satoshi Nakamoto (the pseudonym of the unknown inventor of Bitcoin and the blockchain technology) roadmap of global adoption.

– Bitcoin Cash forked ‘SegWit’ – the Segregated Witness protocol – before it was activated in August.

– Bitcoin Cash’s new ‘SigHash’ transaction signature provides replay protection, as well as better hardware wallet security, while eliminating the problem of quadratic hashing.

– Miners are allowed to migrate from the legacy Bitcoin chain as they wish with an Emergency Difficulty Adjustment (EDA) which means a more responsive ‘proof-of-work’ difficulty that provides protection against hashrate volatility.

– As Bitcoin Cash is resistant to political and social attacks on protocol development – no single group or project is able to control it – the development of a decentralised crypto is assured.

To find out more head to www.eToro.com, where we say: “Crypto Needn’t Be Cryptic.”

Own and Trade Bitcoin Cash Now

Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Your capital is at risk.