Hello eTorians,

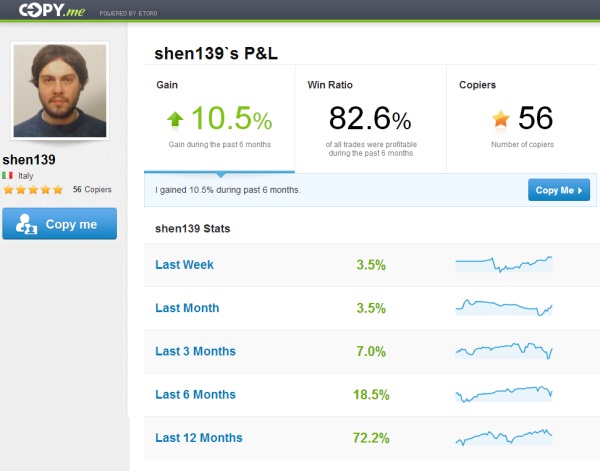

@shen139 here.

@shen139 here.

Next week begins with a very important event for AUDUSD: the Interest Rate Decision and subsequent official statements by the RBA.

From a technical point of view, as you can see in the chart, the pair is on a very strong support and what will happen in the next few days will be indicative of the movements of the following weeks.

NZD/USD: The break-down of an important channel has been followed by a no less important support. At the time the cross is moving inside a small downward channel. I would say that everything is still possible, although I think the 0.83 area will be very hard to overcome. Next noteworthy-support is in 0.80-81 area. As for AUDUSD, the next few days will be very crucial. A break-down of 0.82 will open the way for further declines.

I recommend to sell NZDUSD from about 0.8300 to 0.8350 with a SL over the main channel. An overcome of 0.8350 and a significant consolidation will instead be a good opportunity to return LONG.

(I will give you more advices on my wall in the next days)

EURUSD is a bet that I want to avoid! In my opinion 1.29 is quite likely.

EURCHF gave me good profits this week. At the moment this cross is following a well defined downtrend channel but “ghost interventions” by the SNB can not be excluded and so I consider EURCHF much less risky compared to EURUSD. The “floor” imposed by the SNB gives us the opportunity to open LONG positions with a relative low risk.

Happy Trading,

Stefano

Feel free to leave your comments here or on my wall: