February Non-Farm Payrolls data is due this Friday and growth is expected to remain flat. On a daily basis questions about the strength of the U.S. economy arises and the big question this upcoming week is whether or not we can expect to see an improvement in the economy’s recovery. U.S. employment numbers for February is expected to show little to no improvement as no big changes in the economic landscape suggest major moves in terms of employment. On Thursday Trade Balance data is scheduled to be released and expectations are a minor increase due to changing global demand. Whereas these factors normally guarantee volatility, this week will most likely be influenced by the sequester discussion in Washington and the continued attempts to reach an agreement to reduce the cuts.

February Non-Farm Payrolls data is due this Friday and growth is expected to remain flat. On a daily basis questions about the strength of the U.S. economy arises and the big question this upcoming week is whether or not we can expect to see an improvement in the economy’s recovery. U.S. employment numbers for February is expected to show little to no improvement as no big changes in the economic landscape suggest major moves in terms of employment. On Thursday Trade Balance data is scheduled to be released and expectations are a minor increase due to changing global demand. Whereas these factors normally guarantee volatility, this week will most likely be influenced by the sequester discussion in Washington and the continued attempts to reach an agreement to reduce the cuts.

Analyst’s expectations for the NFP are in the range of 110-200k newly added jobs in February with the expectation that not minor changes in economic outlook and worries about the impact of the sequester. Some suspect that the steady growth trend might be coming to an end, while others believe that the labor market in the U.S. has been stable in the last couple of months and the trend will remain unchanged.

According to eTorians the NFP figures will show a decrease in payroll figures, as all positions on U.S. indices are short, also supported by the short dollar positions on forex.

While good NFP data normally would increase the demand for the dollar, recent macro dynamics has changed investor behavior and nowadays a strong NFP usually has a negative effect on the U.S. dollar against its counter parts in the longer term. Because positive NFP data and the Fed ‘s continued commitment to keep boosting the economy as long as the unemployment rate is above 6.5% will push investors’ appetite towards riskier yields like European currencies.

Furthermore U.S. equities and indices will be the main beneficiaries of good payroll numbers, as equities will go up on the basis of an improved outlook for growth.

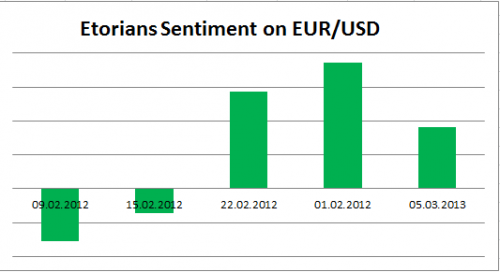

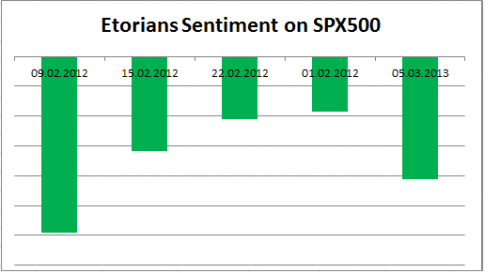

eTorians sentiment :

eTorians positions on the EUR/USD are long with average TP rate at 1.3334 and SL rate at 1.2747 with long positions opening within last three weeks.

eTorians positions on SPX500 have been short throughout the whole of February with current average TP rate at 1478 and SL rate at 1572.

What do you think will happen the next couple of days? Please feel free to share your comment.