The Budget can be a great opportunity for eagle-eyed investors. It is a time where new government measures can dictate the future fortunes of big brands and even entire industry sectors, impacting stock prices and currencies. So what can we interpret from Chancellor Hammond’s speech? Here we consider who might prosper and who might perish, and how investors could be looking to benefit.

Philip Hammond’s first Budget – and the last ever to be held in the traditional Spring window – could be considered cautious, but there are few signs yet of the bullish momentum in global markets subsiding and this certainly did nothing to reverse such enthusiasm among equity investors.

Growth forecasts improve

Hammond, dubbed ‘Spreadsheet Phil’, announced that growth projections for 2017 had been revised upwards from 1.4% to 2%. There was also good news for borrowing forecasts, which were lower than the figures unveiled in the Autumn Statement, and we heard that growing inflation is set to peak at 2.4%. All in all, these are positive signals that suggest an economy in decent shape ahead of the looming Brexit challenges, although it has been argued before that forecasts at Budget time can often be revised down again later in the year.

Mati Greenspan, Senior Market Analyst at eToro, commented: “They’ve upgraded estimates for growth and downgraded their inflation forecast. Sterling is reacting well, gathering strength and stability. We hope the momentum will continue, at least until the Brexit Bill gets back to the House of Commons.”

Energy and ‘new tech’ set for a boost

Investors might look to the detail behind these macro figures for more interesting developments. For instance, Hammond was very clear in his commitment to helping the oil and gas industries. With considerable spending in that area, any big companies set to benefit could see a lot of interest in their stock prices over the coming months, in turn creating potential opportunities for traders.

In the same vein, he has promised significant additional funding for education, and there were several beneficiaries in the science sector, where he announced a raft of spending initiatives, including:

- £300m for research talent, including 1,000 PhD places for STEM subjects

- £270m for robots, driverless cars and biotech

- £16m for a 5G mobile technology hub

- £200m for fibre broadband

Business rates under scrutiny

The controversial new business rates have been dogging the government recently and it came as no surprise to see Hammond use his Budget to offer some support to small companies in the form of tax relief. Corporation tax is set to be reduced as well, to 17%. But he did nothing on business rates for the bigger high street retailers, to the frustration of Ewan Venters, chief executive of Fortnum & Mason.

“Our rates at Fortnum’s will increase by 49% and it will be hard for some businesses to cope with such a hike,” he said. “This is an unfair commercial advantage within the digital space, and gives a company like Amazon, for instance, a benefit on top of their low tax bills.”

It will be intriguing to see how small-cap and mid-cap stocks react to the news, as well as those of the big digital competitors that Venters fears.

Meanwhile, high-net-worth equity investors will have been disgruntled to see the annual tax-free dividend allowance reduced from £5,000 to £2,000. If you earn combined dividends that are greater than that in a year then you’ll have to pay tax on.

Beyond the Budget – Snap, Apple & Foxtons

But not all eyes have been firmly focused on the Budget. Markets are being shaped by a lot of other factors. The big tech stocks are particularly active off the back of the recent Snap IPO and the CIA Wikileaks saga, which has had Apple, Samsung and Microsoft in emergency-response mode.

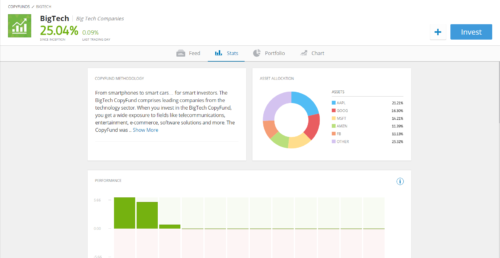

On eToro, trader sentiment has since been largely positive for Apple CFDs with 96% buying at one stage after they issued a detailed statement intended to calm any consumer fears over its security. Remember, on eToro we have a bespoke BigTech CopyFund which comprises CFDs on a selection of global tech giants. At the time of writing it’s around 14% up over the last 3 months.

And finally, while Hammond was putting the finishing touches to his speech over breakfast, we should note that renowned high street estate agency firm Foxtons were announcing a 23% fall in 2016 property sales. It was a timely reminder that, despite the bullish momentum in markets right now and the Chancellor’s buoyant broadcast of the latest OBR figures, the full effects of Brexit are yet to be realised and could yet impact UK industry, in various guises, for years to come.

There will inevitably be winners and losers as that process unravels. Knowing which investments to put your faith in, and at what time, will be crucial.