Invest in stocks, from local to global

Get the advantages of a local broker on a global investment platform, with over 6,000 stocks to choose from 20 exchanges

Invest in stocks — whole units or fractional shares — starting from $10

Automatically receive dividend payouts straight to your account balance

Low flat fees and no markup on spreads

eToro adheres to strict standards of investor protection and safeguarding

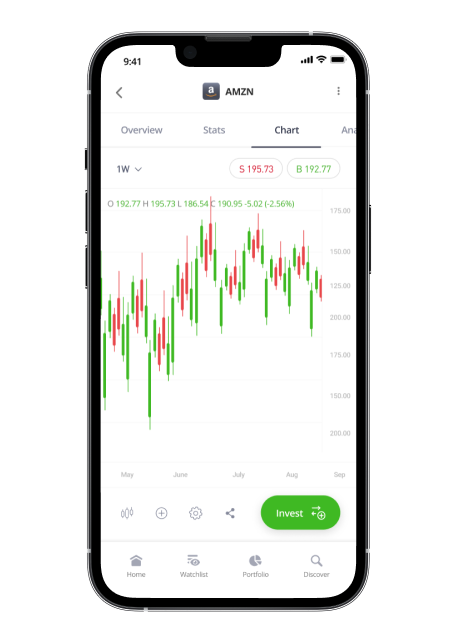

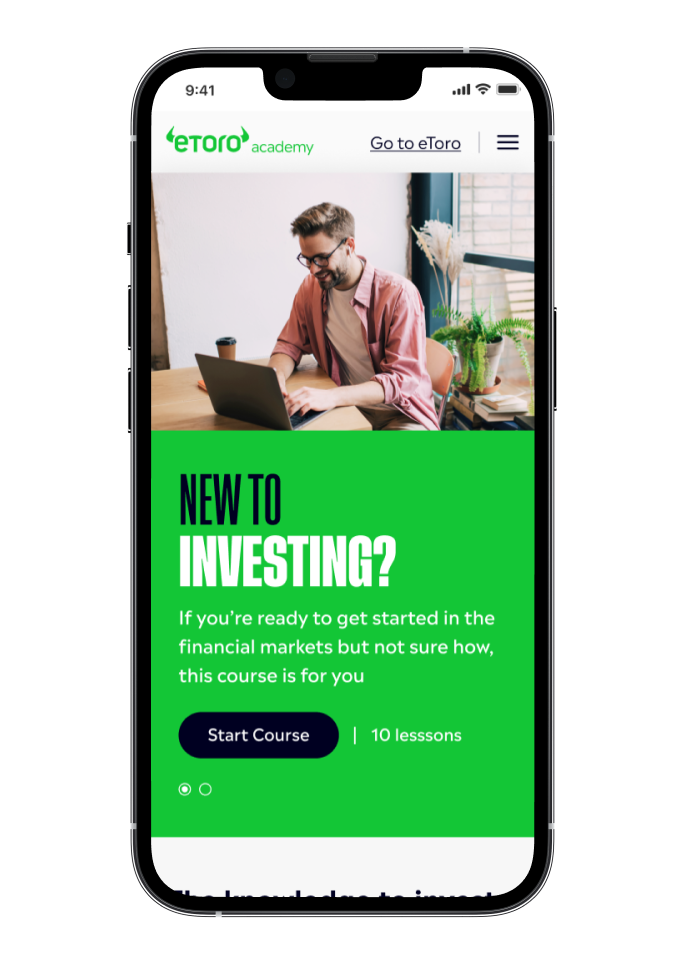

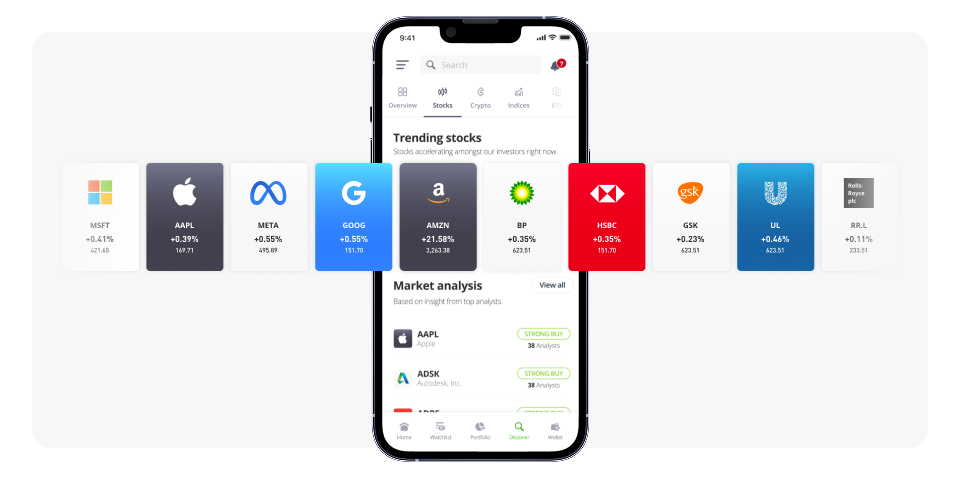

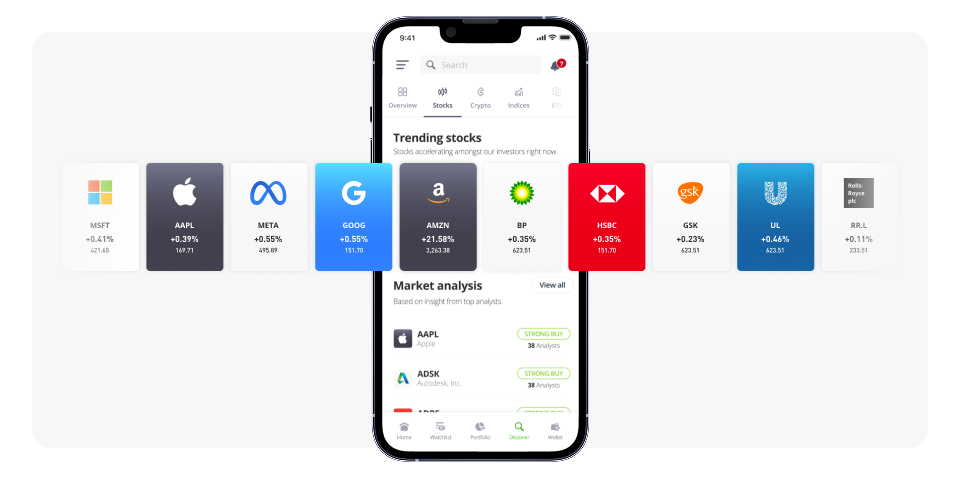

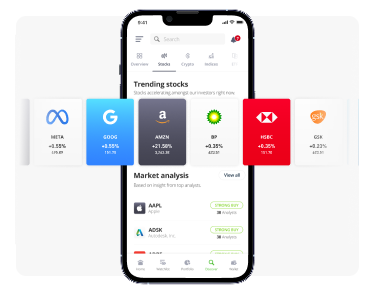

The tools to help you invest smarter

From foundational basics to advanced strategies, eToro offers unique features that take your portfolio to the next level

Invest with the best

Join eToro and discover why millions have chosen our award-winning platform to start investing in stocks

share trading platform

best stock trading app

best investment trading app

Start investing in stocks today

Registration is absolutely free and takes just a few minutes

Once you’ve verified and funded your account, you’re ready to go

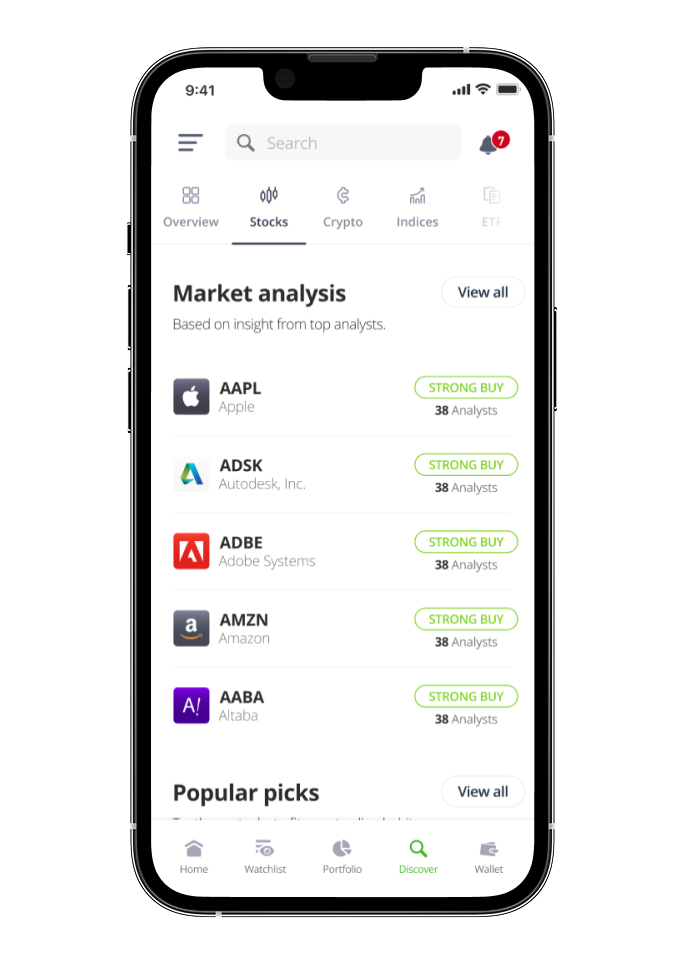

Choose from 6,000+ leading stocks on 20 exchanges

A world of stocks at your fingertips

From technology to healthcare, New York to Hong Kong, eToro empowers traders with real-time access to stocks from top exchanges worldwide.

FAQ

Get the answers you need to start building your stock portfolio today.

- Is my investment account on eToro limited to stocks only?

-

No. eToro is a multi-asset platform that offers ETFs, indices, commodities, currencies, cryptocurrencies and thematic Smart Portfolios as well as stocks. You can easily manage a single portfolio while diversifying with a variety of other assets in one place.

- What fees apply when investing in stocks?

-

Commissions on stock investing may incur a flat fee of either $1 or US $2, depending on your country of residence and the exchange that the chosen stock trades on. See more information here.

Other fees may include:

Stamp Duty Reserve Tax (UK only): 0.5%. Stamp duty is a regulatory transaction tax levied by the UK government on the electronic purchase of all UK-listed stocks.

Market spreads: Each transaction is subject to a market spread upon opening and closing. This is determined by the market and is a characteristic that is consistent across all banks and brokers. eToro does not charge a markup on the spread.

You can easily view commission and other fees before executing a trade by tapping on Estimated Cost in the Trade screen. More information about eToro’s fees may be viewed here.

- Can I receive dividend payments for the stocks I invest in on eToro?

-

Yes. If you invest in shares of a company on eToro, you will be paid in proportion to the number of stocks you own whenever that company issues dividends.

- Can I trade real-time stocks in a demo account?

-

Absolutely! Each new eToro user receives $100,000 in their eToro demo account, also known as a virtual portfolio, for free. The account gives you access to all of the assets available on eToro, including real-time stock trading.

- Which exchanges are available on eToro?

-

eToro offers stocks from 20 exchanges around the world. However, please be aware that not every stock from each exchange is available on the platform. For a full list of stocks and exchanges, click here.

- Would I own shares on eToro?

-

When you open a non-leveraged BUY (long) position on a stock, you are investing in the underlying asset. The stock is purchased by eToro and recorded in our system under your name.

You retain proxy voting rights, and should the company issue dividends, your balance will be updated in accordance with your holdings.

- Can I transfer my stock trades to another broker?

-

Yes.

- Is my money safe in an eToro account?

-

Yes. The safety and security of your money is our top priority.

eToro operates in accordance with FCA, CySEC and ASIC regulations, meaning that there are measures in place to protect investors. Client funds are kept secure in top-tier banks or placed in qualifying money market funds. All personal information is safeguarded with industry best-practices and cutting-edge technology.

For more information on investor protection, click here.