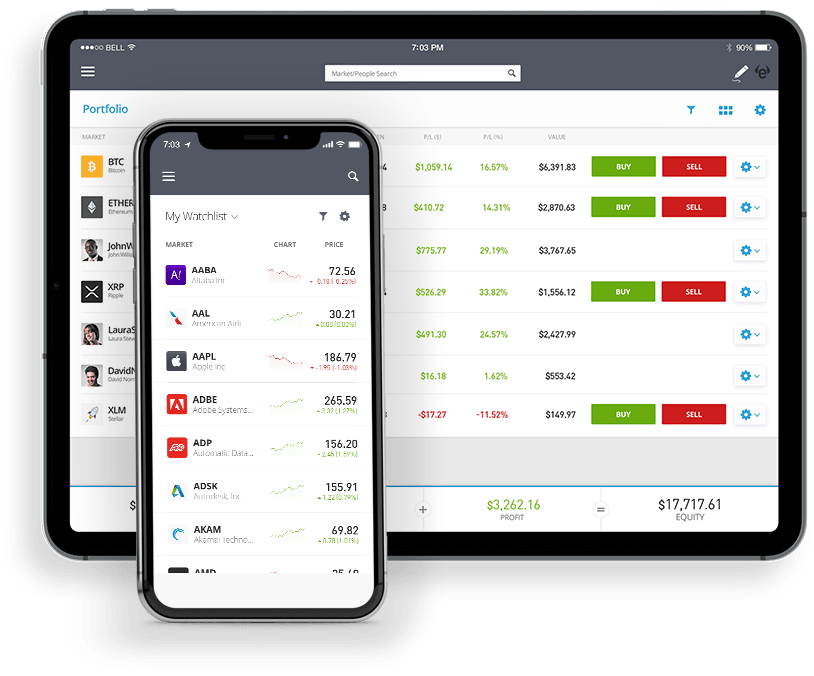

Join eToro today and start discovering a wide variety of benefits, on mobile or web platform:

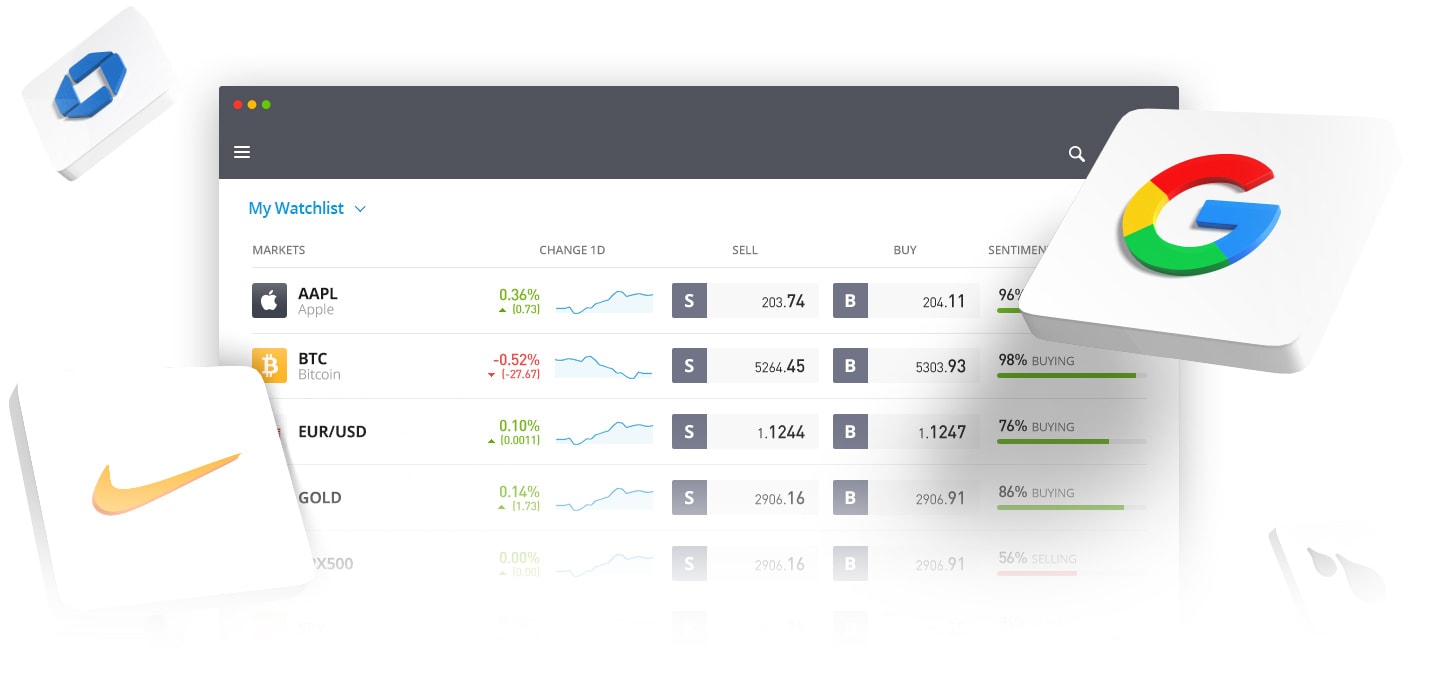

Multi-asset platform

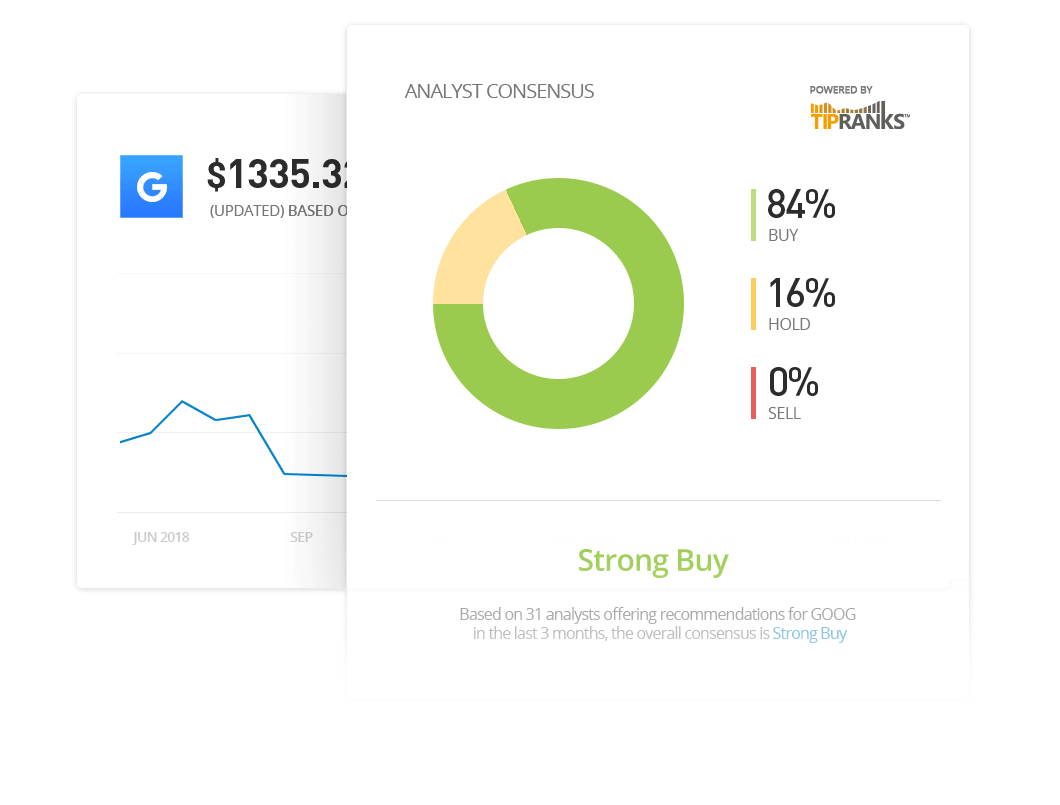

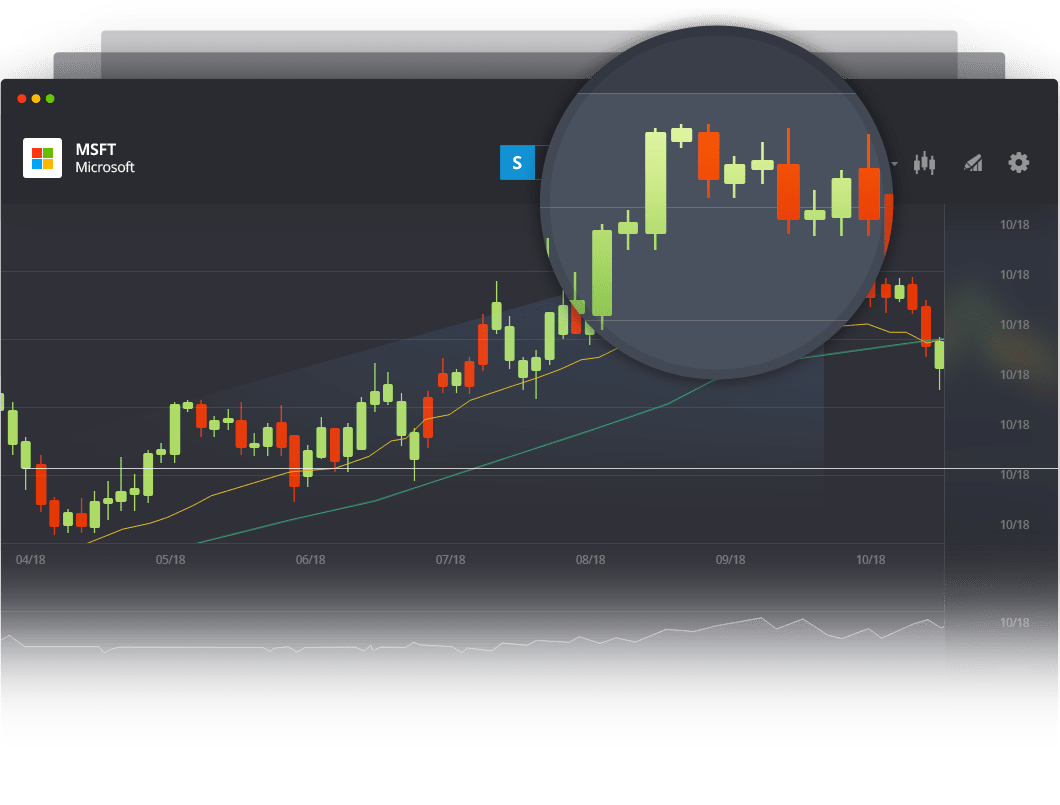

eToro offers 7,000+ financial instruments across various classes, such as stocks, crypto and more. To explore more visit the Trade Markets Page.

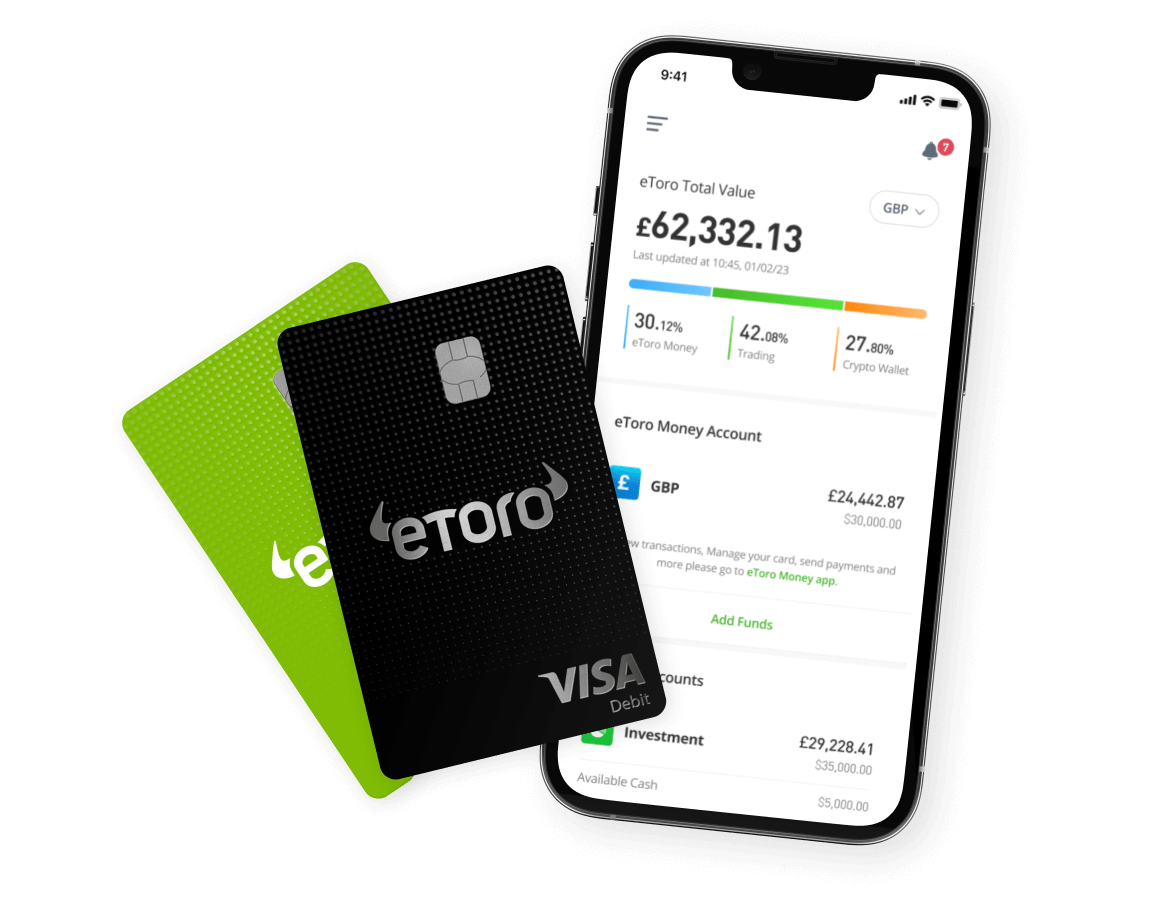

Deposits, withdrawals and fees

You can deposit, hold and withdraw using both an eToro USD account and an eToro GBP or EUR account*.

Deposits made in the same currency as the eToro account you’re using, are free.

We offer a range of deposit and withdrawal methods, including bank transfers, cards, and more, depending on your region and preferred currency. eToro offers low minimum deposits and unified fees. Read more on the Market Hours and Fees page.

* GBP and EUR accounts are only available in selected regions, see here.

Platform features

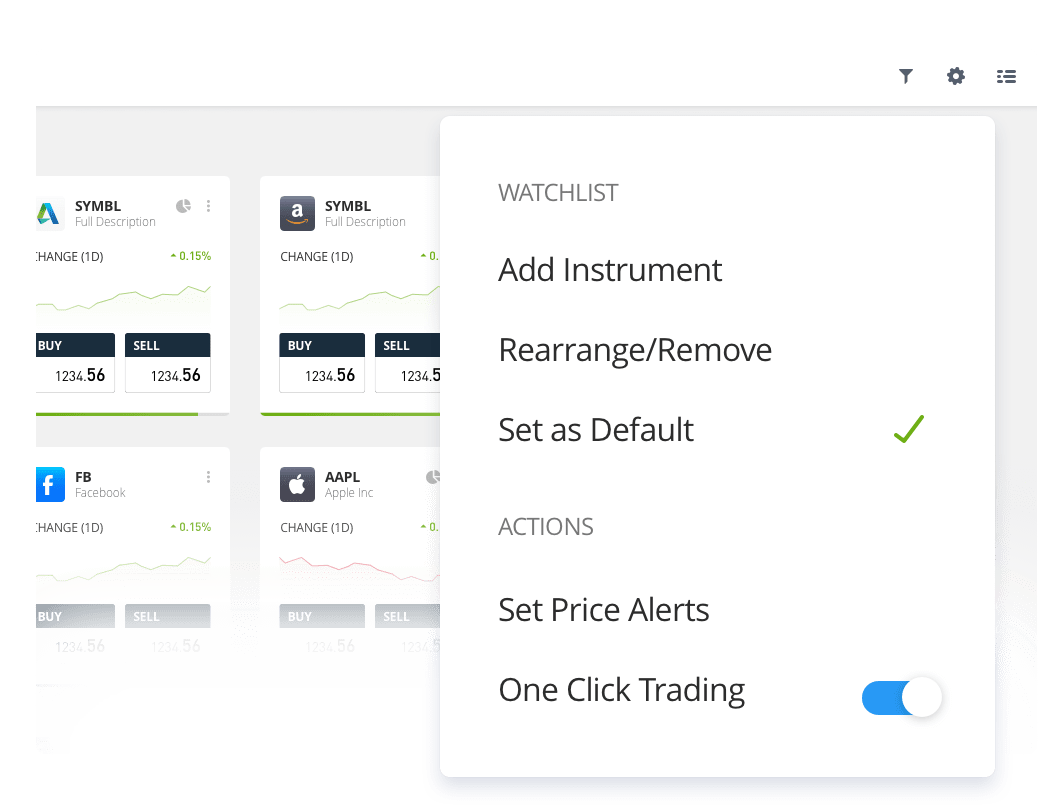

eToro’s aims to open up markets to everyone, with an easy-to-use, intuitive interface. To help clients better manage their finances, it developed innovative trading features:

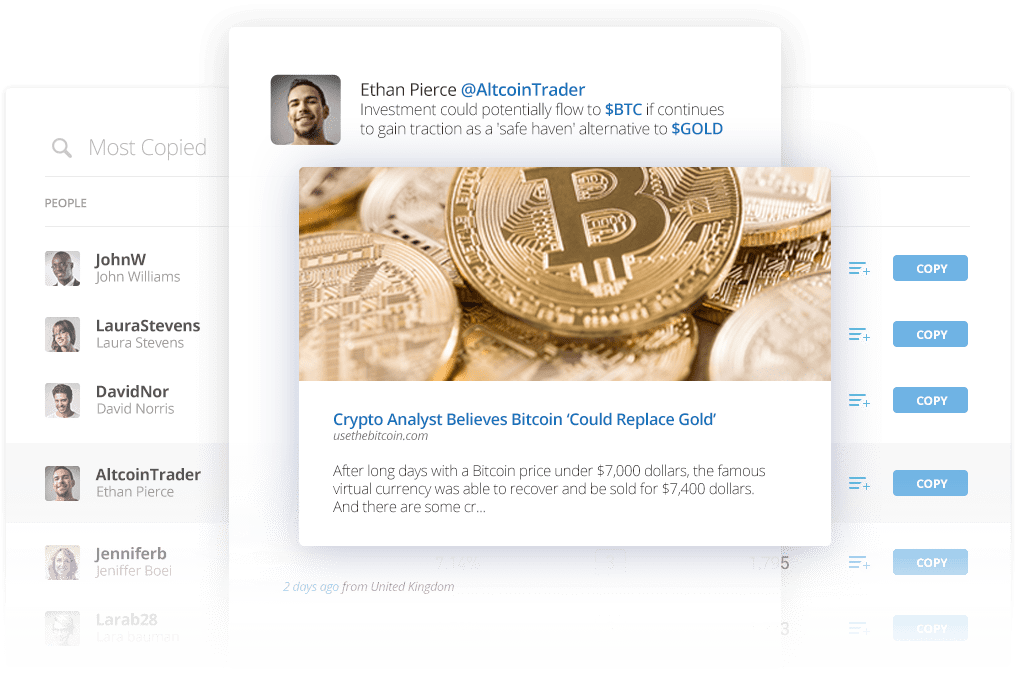

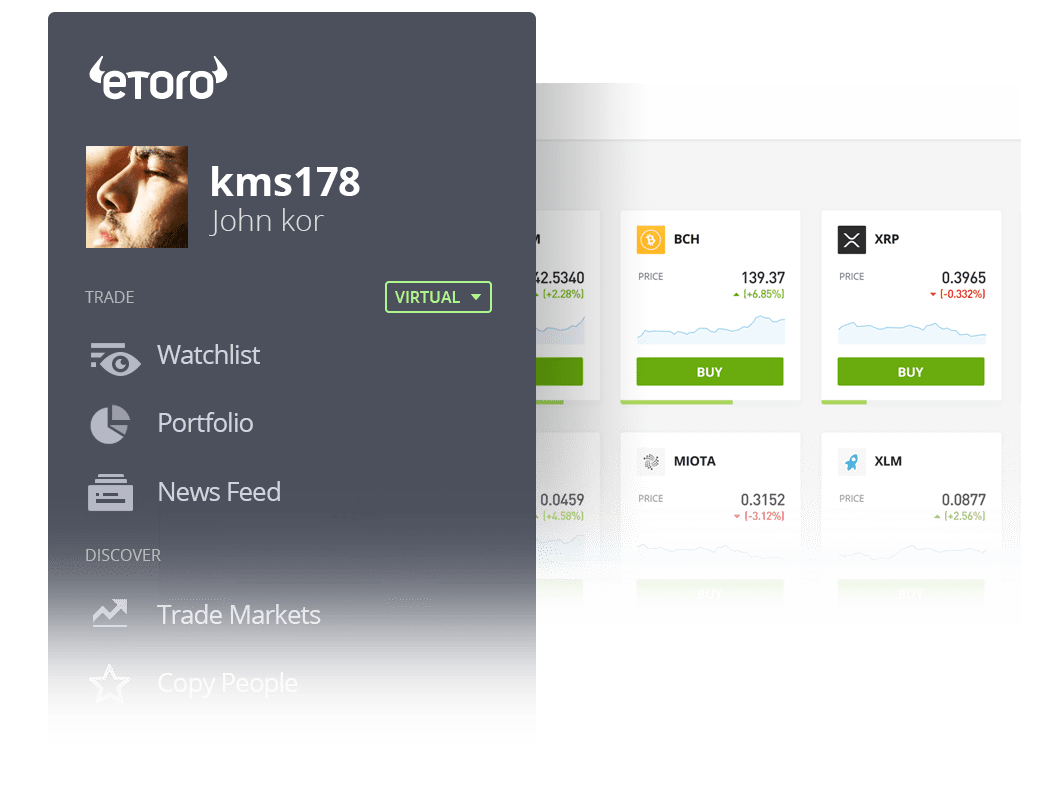

Social trading

Since 2010, eToro has placed a growing focus on social trading, harnessing the wisdom of the crowd for the benefit of its clients.

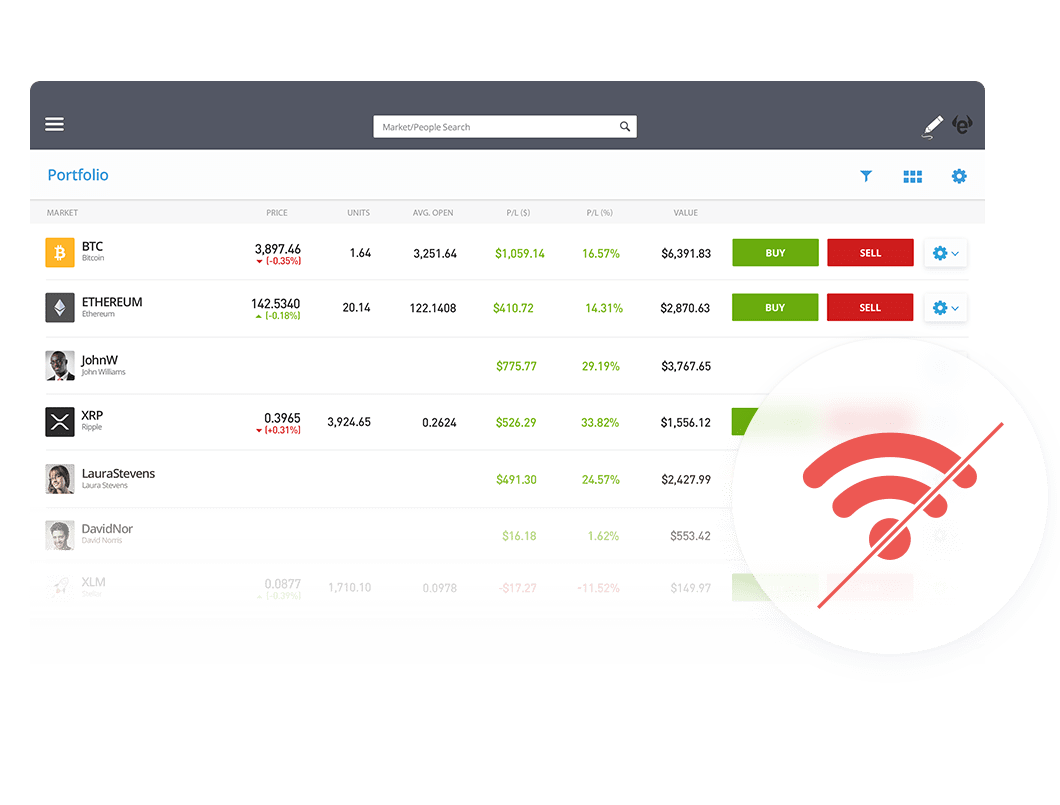

One of eToro’s key differentiators is the fact that it created a community of traders and investors, in contrast to the often solitary feeling of trading online. eToro is a bustling online social network of traders who interact, discuss ideas and share their trading decisions and strategies on the social news feed.

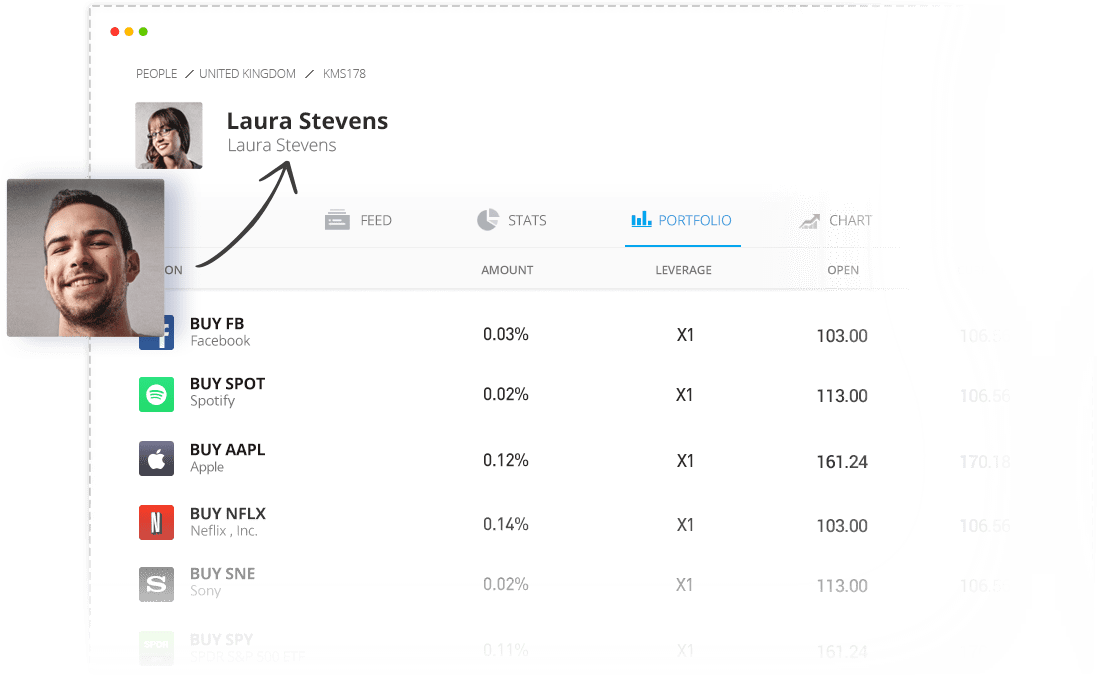

CopyTrader

CopyTrader, enables traders to replicate other traders’ actions in real time. To encourage top traders to get copied, eToro created the Popular Investor program.

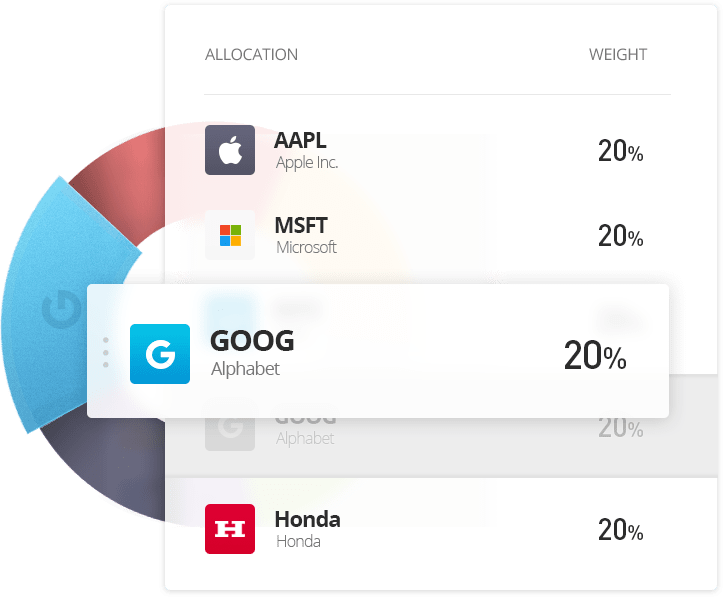

Smart Portfolios

Another unique product offered by eToro is Smart Portfolios, which are ready-made, investment strategies, offering thematic investment, such as medical cannabis, driverless cars, and people-based portfolios.

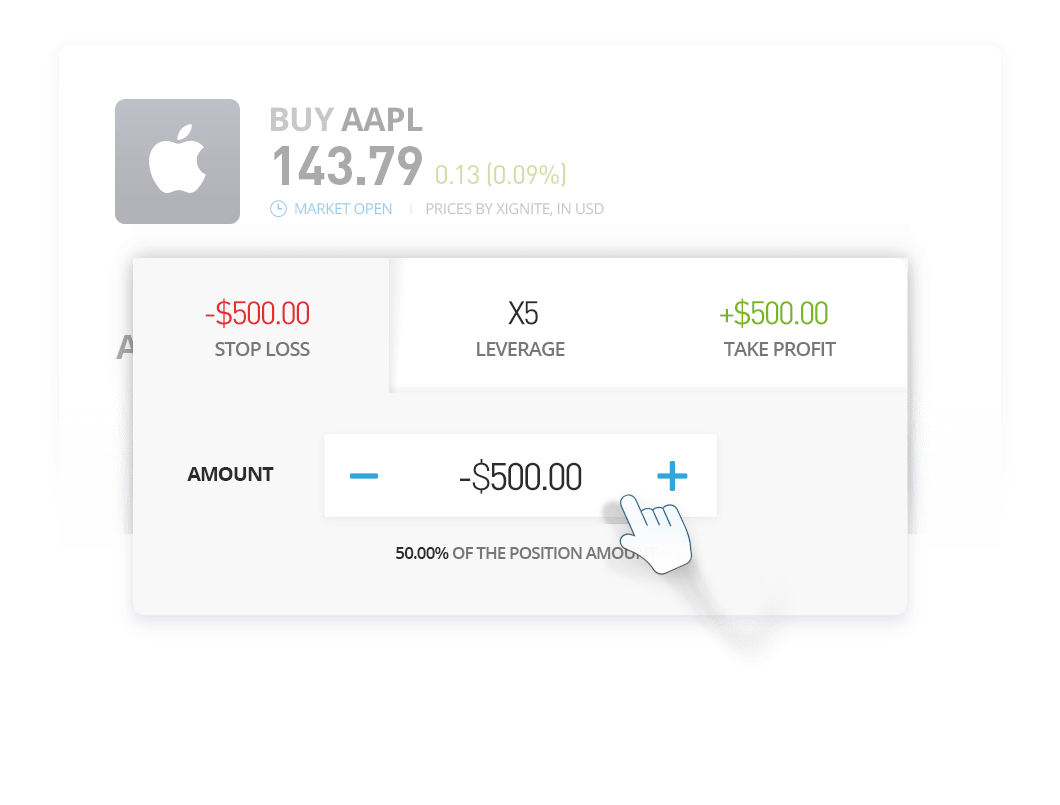

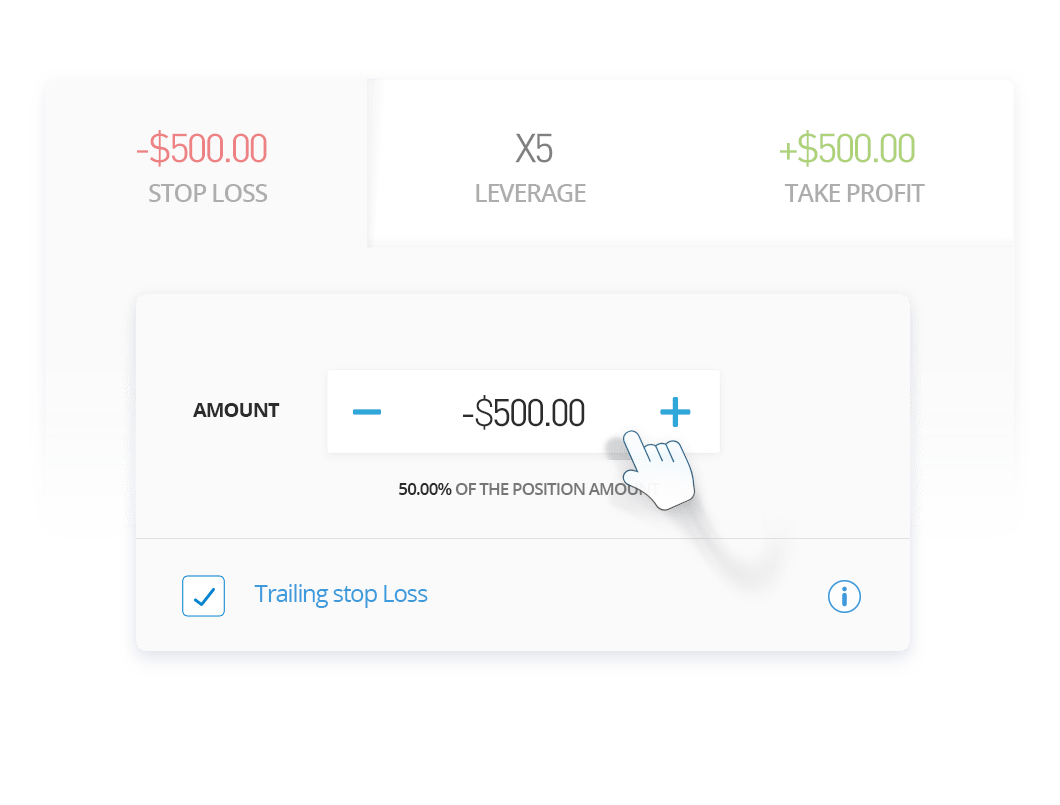

To enable eToro clients to use advanced trading features, such as leverage and short (SELL) orders, and to offer financial instruments that normally cannot be traded, such as indices and commodities, eToro utilises Contracts for Difference (CFDs). To read more about CFD trading, click here.

Additionally, to enable traders and investors direct access to the market, some asset classes, such as stocks and cryptoassets, offer direct ownership of the underlying assets, which we buy and hold in each client’s name.