It’s official, the Volkswagen emissions scandal is turning into a financial catastrophe for the company, the scope of which can be compared to the BP oil spill in the Gulf of Mexico in 2010.

In case you haven’t been following the news, the veteran German auto manufacturer has admitted to cheating in diesel emissions tests in the United States as well as manipulating the test in Europe.

In practical terms, this means that 11 million Volkswagen vehicles have been certified to meet certain ecological standards, whereas in fact the vehicles pollute much more than they are certified to do.

While it remains to be decided exactly what actions the relevant environmental agencies will force Volkswagen to undertake, the investors have already begun abandoning ship in droves.

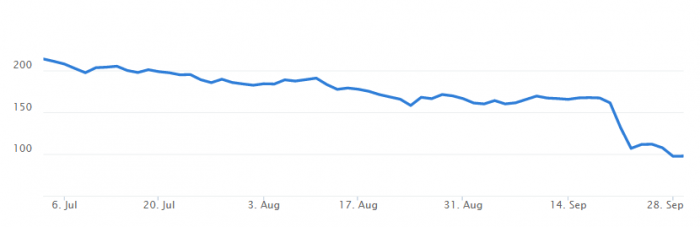

To be clear, accusations of cheating on the emission tests have been hovering around the company for the past year or so, forcing the stock into a downtrend. However, since the EPA’s public accusation on September 18th, the stock price has plummeted from around $165 to below $100, where it has found some stability, at least temporarily.

Volkswagen is only the canary in the coalmine

The fallout from this scandal is unlikely to be contained to Volkswagen alone. Already the various agencies are gearing up to take a second look at other manufacturers alleged performance statistics.

Just a few days ago, on September 28, Mercedes, BMW and Peugeot have been accused of manufacturing cars that consume 50% more fuel per mile than the official figures quoted by the company.

And this is only the beginning. Both the EPA and the European Environmental Agency have announced radical changes to testing procedures that will from now on rely on actual road tests rather than reports delivered by the companies themselves.

In Europe, over 100 car models are scheduled to undergo road tests before the end of the year. For manufacturers who have thus far enjoyed the agencies’ pretty much unconditional trust, a discovery of faulty numbers may come as a rude awakening, and many investors are not sticking around to see it through.

The entire automotive industry is in fact already starting to experience a downturn in stock prices, though the numbers are nowhere near as dramatic as those of VW, the stock at the eye of the storm. Even the stalwart Ford took a couple of nosedives during the past two weeks as the scandal broke and evolved:

Bears beware

Like any crisis, this scandal immediately sends the signal of “selling opportunity” for the Bears among us.

However, bear beware: for many of these companies, the slump will most likely be very temporary, as long as they have nothing to hide. The automotive industry is not going anywhere, and even the unfortunate Volkswagen is not likely to shut down its 78 year old shop because of a couple of millions of recalled vehicles.

Just look at the Libor scandal that hit the banking industry in 2012. Barclays, which received a large portion of the media attention as well as the criminal indictments, lost almost half its stock’s value during the scandal, and yet is now trading at pre-crisis levels again.

On the contrary, as the crisis blows over and the environmental agencies finalize their new procedures and run their new tests, all these solid automotive stocks will be up grabs at bargain prices.

So make sure to follow the news and the stock prices closely to see when the stock you’re interested in bottoms out and presents an interesting buying opportunity.

What do you think the future holds for Volkswagen and its industry peers? Share your thoughts!