“The biggest risk is not taking any risk… In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” – Mark Zuckerberg

Risk is the first and last thing on the minds of professional and amateur investors alike. It’s very personal though, and each person must choose their own level of risk that they are comfortable with. If you’re reading this, it means that you are willing to take on some level of risk, which is good because without it there is no reward. This is the CopyTrader Gains Report for the week ending February 14th, 2014.

As we’ve discovered in previous reports, the most Popular Investors at eToro are generally those who are willing to take on a moderate to high level of risk. But risk can be like a double edged sword. Many times, we see investors who gain a lot very quickly but then fall down just as fast because the risk was too great and the markets eventually went against them.

The clever investors however, know how to spread their risk around by diversifying their portfolio. Meaning, that they invest in many different things to protect themselves against erratic market movements. So instead of just trading on currencies, they add things like Stocks, Commodities, and Indices to their portfolio.

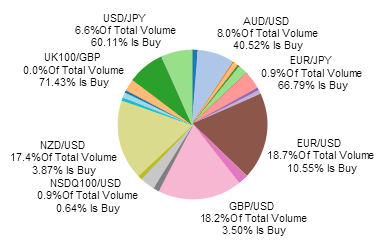

For example, the stocks and commodities investors did very well this week but the currency markets were not so great for our clients. Here’s a map of the overall currencies being held by the Popular Investors.

We can see here that almost half of all the money on currencies is going towards selling the Euro and the British Pound against the US Dollar ($EURUSD & $GBPUSD). When we consider the average prices of the Euro & the Pound over the past year, it might not be a bad investment. Both currencies are way above their yearly average prices.

This chart shows the British Pound over the past year. The blue line represents the yearly average price.

The chart for the Euro against the Dollar is very similar. Even though we’re far above the averages the prices still managed to go up last week, which had a negative impact on many of our clients. But most of these positions are still open and the popular investors are waiting for the prices to return to their normal levels.

At the moment, risky currency investments make up less than half of the total investments at eToro. However, because of the leverage involved, it brought the average gain for Copiers down to -11.17%, while only 12 of the top 50 most copied investors had positive gains this week.

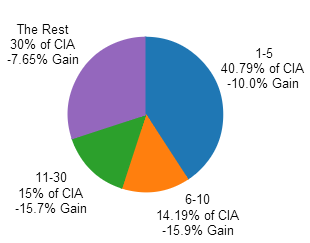

Here is the pie chart that we are showing every week, which groups the top 50 most popular investors by who has the most copiers.

It goes without saying that the most profitable people are the ones who have diverse portfolio’s and are holding Gold, Oil, and Stocks, which have all gone up nicely in the past few weeks.

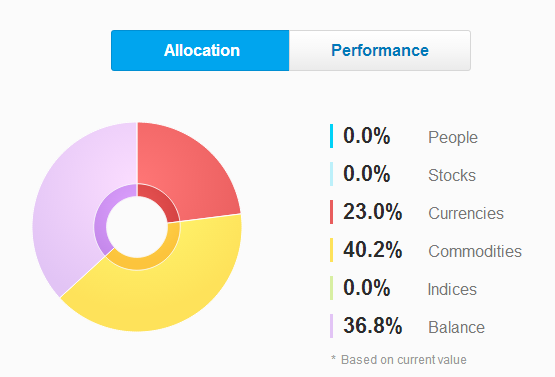

James Lawrence Regan from Brazil has worked very hard in his life to get where he is today. After reading his bio today, I couldn’t help but be inspired. Right now 384 people are copying him with real money making him the #35 most copied investor in eToro. At the moment his portfolio is made up of an excellent balance of Commodities, Currencies, and Cash balance. He’s also very active on the eToro network, so feel free to visit him and say hello. James’s username is @JimmyIron.

This next investor has inspired the title of this week’s report No Risk No Reward. Jafar Talebizadeh-D from Germany goes by the username @Bazarepool. We can see that much of his portfolio is in the Indices and he does a little bit of copying for diversity. Feel free to check him out and consider following his investments.

Last but not least we have young Lucas Quentel @LucasQuentel, whose portfolio is really everything we’re looking for when we think about diverse investing. He has only 4 manual trades and is copying 8 popular investors, some of them on high risk and some with low risk. Lucas has gone through some ups and downs in the past year but it’s good to see that he’s slowly but surely defining his investment style and finding a comfortable way to manage his risk.

Last but not least we have young Lucas Quentel @LucasQuentel, whose portfolio is really everything we’re looking for when we think about diverse investing. He has only 4 manual trades and is copying 8 popular investors, some of them on high risk and some with low risk. Lucas has gone through some ups and downs in the past year but it’s good to see that he’s slowly but surely defining his investment style and finding a comfortable way to manage his risk.

Let me know if you have any feedback or questions about this report, I always enjoy hearing your thoughts.

Note: Past performance is not an indication of future results. This post is not investment advice. CFD trading bears risk to your capital.