The 28th of April , an infamous day no Twitter investor will ever forget, the day the Twitter bird took a plunge of 20% in a single day, the day the dream of Twitter being the next Google was shattered. As if this was not enough drama for one stock, just two weeks ago the high profile rock star CEO, Dick Costolo has forced to resign amid mounting pressure from nervous investors.

Now the social media company is flying on autopilot in search of a new captain, and investors. The latter are inclined to ask: after all this drama and fall in the stock price, should you buy or sell Twitter?

Red Ink all over

So what makes investors edgy about the social media stock? Its lack of ability to produce profits for its shareholders. While the Twitter business has been growing at a robust pace, losses for the company have been deeper. Unlike Facebook, the social giant and Twitter’s closest rival, which has been in the black (profitable) for a while, posting a net profit for five consecutive years ,Twitter has missed analyst estimates to break even for the first time in 2014.

For investors this clearly indicated that there is a management issue with Twitter. What investors fear is that those losses, largely incurred by hefty R&D expenses and other administrative expenses, reflect on the company’s culture. If administrative and R&D costs are so high then perhaps the company has a culture of overspending and a lack of accountability. For investors there is nothing worse than a cultural problem in a company because it’s the hardest to turn around, even if Twitter’s new CEO, who is yet to be found, turns out to be remarkably talented.

Growth Still Robust

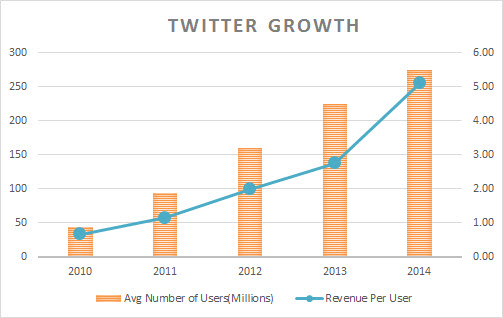

But not all things are going bad for Twitter. In fact while the company’s new CEO will have to work hard to turn the business around, there are still rays of hope. That hope is not in the company’s earnings but in its revenues. When taking into account Twitter’s active users (Source Statista) and comparing that to the growth in revenue, there is a clear trend.

The number of active users and the number of revenue per user, both important indicators on how well a social network is doing, is growing steadily thus far. This clearly means that beneath the surface, Twitter is doing well and this means that more efficiency has a real chance of not only stabilizing but turning it into a profitable company , if only it spends less.

Sell Now, Buy Later?

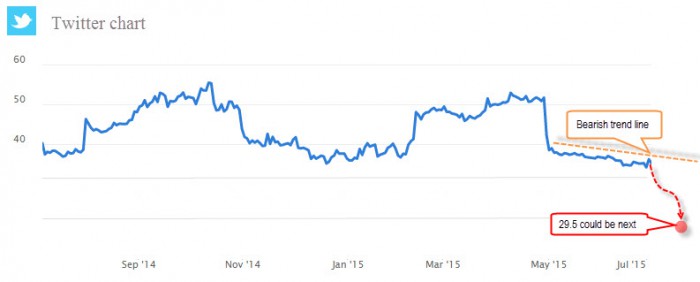

Yet despite this ray of light, there is a lot of work to be done and it will take a while before Twitter could turn around into a profitable company. This means that even if a new rock star CEO comes , earnings in the next one two quarters could be still disappointing and this is likely to keep the selling pressure on the stock and perhaps push it to as low as 29.5.

Thus making the case that at the moment if anything Twitter is still a sell. But once the stock reaches that low, any sign of a turnaround in earnings will be the first green shoot, a signal that the stock is on the path higher. Hence in the current dynamics the play for Twitter is sell now and buy it later when it’s cheaper.