Read the latest information on Brexit and learn how certain events and outcomes could affect your trading before it happens.

-

EU Referendum

What's happened?

In June 2016, the UK went to the polls to vote on whether to remain part of the European Union, deciding 52/48 to quit the world’s largest trading bloc.

After almost four years of tense negotiations – and three UK Prime Ministers – the two sides settled on a withdrawal agreement. However, a final trade deal has still not been forthcoming, meaning the UK faces a “no-deal” Brexit scenario, leaving the EU with no trading relationship in place after December 31.

Should this happen, the UK and the EU’s trading relationship will be on World Trade Organization terms, meaning tariffs on food and other goods imported from the continent – although these terms are usually seen as a starting point for international trade.

-

Now what?

Post-Brexit topics

Companies from around the globe have been assessing their options in Europe and how the UK can be factored in or focused on. This has led to new offices opening in both the EU and the UK to support the continuation of business as close to ‘usual’ as possible.

It will take some time for companies to get used to the new landscape, and in the meantime, there could be further changes to regulations as EU rules either become part of the UK rulebook or are removed.

Although the UK is no longer in the EU, there will continue to be trading between the two regardless of what the final deal looks like. The companies that can best navigate this tricky period will be the ones to watch.

-

Trading Brexit

Opportunity knocks...

While a huge amount of work has been done over the past four years by companies in preparation for Brexit, it won’t be until the UK is fully out of the EU that it will become clear whether this preparation is enough to survive and thrive in this new world.

In the coming months there are plenty of rollercoaster moments to be expected as plans meet the reality of the UK post-Brexit.

While companies doing business across borders might be challenged, there will be opportunities in areas such as technology and environmental services, as the government has highlighted these sectors as crucial for the UK in the future.

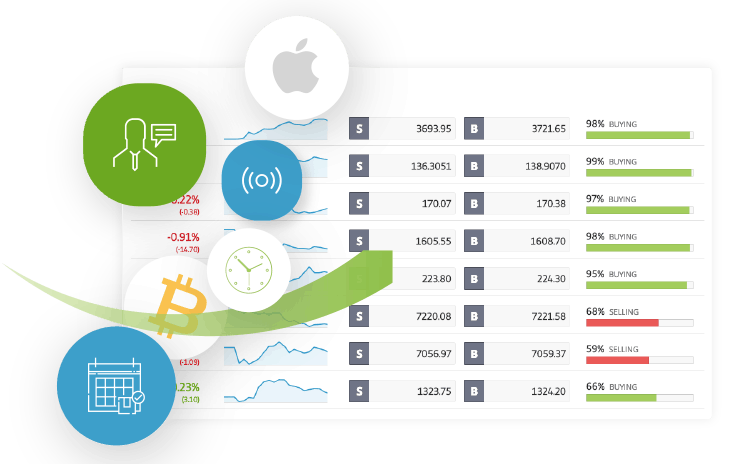

Exchange rates could settle to a ‘new normal’ as relationships are confirmed, with winners and losers from the movements to find this level. And don’t forget that cryptoassets were invented as an alternative to a government or central bank-controlled monetary system.

Whatever happens, through the eToro platform, you can be ready to take advantage of upswings on stock and currency markets and use our risk management tools to limit the downswings.

Cabinet reshuffle? Budget bonanza? Trade deal trade off? Whatever happens during the post-Brexit negotiations, stay plugged in and up to date with events that could offer opportunities to trade.

With no sign of a deal in place by the end of Sunday, as hoped, the UK and EU negotiators agreed instead to extend the talks beyond the 13th December deadline – which some have taken to mean that a deal of some kind can be reached in the coming days.

Read morePolitics in a pandemic: what about Brexit?With the coronavirus pandemic dominating news feeds, it might seem an odd time to think about Brexit.

Read moreBoris plays Brexit hardballOver the past few weeks, the news has been busy with floods, Megxit and Covid 19, but this week Brexit came back with a bang, as the UK set out its demands for a trade deal – and the EU didn’t like a lot of it.

Read moreBrexit boom or bust? Place your betsAs the clock struck 11pm on January 31, fireworks lit up UK skies with those that had voted to exit the European Union partying in the streets.

Read moreBye bye Brussels…It was the best of times, it was the worst of times – however you felt about the UK’s time in the European project, at 11pm GMT today it will all be over.

Read moreMarkets jump for joy as Conservatives win UK electionYesterday was the day the nation took to the polls to decide who will be the next resident of Number 10 in the first Christmas election for nearly 100 years.

Read moreBoris, Brexit and the great beyondIt’s official. The UK has a new Prime Minister. Now what…?

Read moreBanking on Brexit?

Banks hit the headlines for all the wrong reasons in 2008 as some of their practices got them in to very hot water and they crashed the whole global economy…

Read moreHigh Street spending and Brexit – looking for a dealThe Great British High Street is not enjoying a purple patch right now…

Read moreBrexitproof your investments – go on the defensiveDeal or no deal, no one really knows what will happen to financial markets in the days after the UK leaves the European Union – but there are places to hide should they get really choppy…

Read moreCould housebuilders get a Brexit boost?In one of its “disorderly Brexit” scenarios last year, the Bank of England warned UK house prices could fall by 30%…

Read morePlaying the pound in Brexit LimbolandSince June 2016, sunbathing with a sangria has cost Brits more than it used to…

Read moreHow long will Brexit keep the pound undervalued?Sterling’s fall in recent years has been nothing if not dramatic…

Read moreWhat goes up… UK stocks and BrexitWhat goes up, must come down, but equally it might go up again – and that’s where stock markets get interesting…

Read moreWhether it’s bollocks to Brexit or bring it on: how can you benefit?Brexit. The term sends chills down the spine of many investors for its continued disruption of the UK’s stock market – but it could hold significant value to those willing to look closer to home…

Read moreTracking tech to the topRemember when you had to book holidays in a travel agent? When you fell out with real friends rather than blocking people on social media?

Read moreLive prices on popular markets.

Plan your strategy with help from eToro and benefit from Brexit.