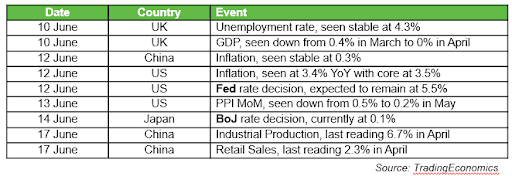

It’s a big week for markets, with the Fed looking at its first rate cut since December. The Daily Breakdown looks at the week ahead.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Weekly Outlook

The Nasdaq 100 and QQQ ETF have enjoyed an eight-day win streak that has sent the index to record highs. Tech has been leading the way amid the slow-but-steady rally over the past two weeks ahead of what’s expected to be a key week for markets.

Earnings and Economics

On the earnings front, it’s pretty quiet this week, but we’ll still hear from firms like General Mills, Lennar, and FedEx.

On the economic front, tomorrow’s retail sales update is the key report to keep an eye on. We’ve seen months of weakening jobs data, but consumers have remained fairly resilient. Will that remain the case with Tuesday’s update?

All Eyes on the Fed

The Fed’s interest rate decision is due up on Wednesday afternoon at 2 p.m. ET. Markets are now fully pricing in a rate cut, with a majority expecting a 25 basis point reduction. That helps explain the rally we’ve seen in tech, small caps — the IWM ETF is up 10.9% amid a five-week win streak — homebuilders, banks, and other rate-sensitive stocks.

While the 25 basis point cut is already expected, it’s what Chair Powell will say in his statement and Q&A session that investors will be focused on.

Want to receive these insights straight to your inbox?

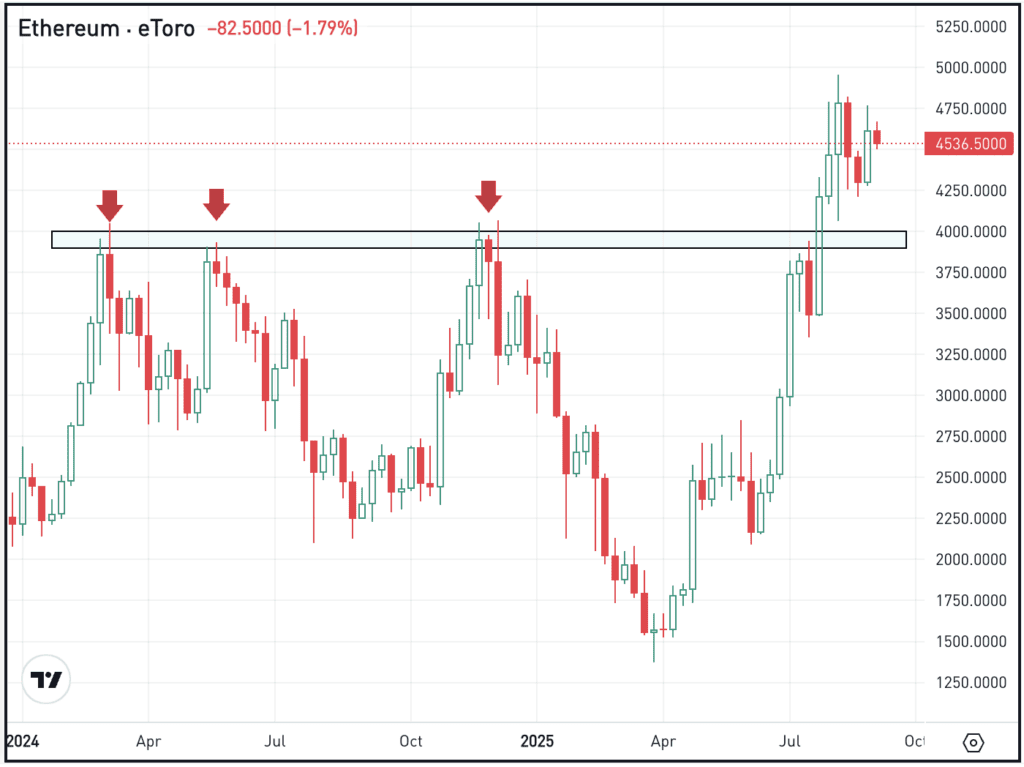

The Setup — Ethereum

Between Thursday and Friday, Ethereum rallied almost 9%, giving investors hope that it was breaking higher and going to make another charge at the $5,000 level. After losing steam over the weekend though, those hopes have diminished. Still, ETH continues to trade pretty well following its breakout over the $4000 area.

After such a big rally — where ETH went from ~$1,500 in April to almost $5,000 in August — bulls may be growing impatient with the current price action. But this consolidation is actually quite healthy. As long as ETH remains above $3,900 to $4,100, then the weekly chart remains constructive.

ETFs and Options

For investors who can’t trade or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the Ethereum front, ETHA remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Tesla roared higher last week, gaining more than 12%. Now shares are rocketing higher to start this week on reports that Elon Musk spent ~$1 billion to buy more than 2.5 million shares of Tesla. With the move, TSLA stock is vaulting back over $400 — see for yourself.

Microsoft finally gained ground last week, climbing 3%. The rally snapped a five-week losing streak, which is notable after the stock rallied in 14 of the prior 15 weeks. Now bulls are looking to see if the stock can regain momentum this week or if more consolidation is needed. Check out the fundamentals for MSFT.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.