The Daily Breakdown takes a closer look at Bittensor, while zooming in on the charts for Uniswap. Plus, we look at what’s moving markets.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors get more familiar with the 100+ cryptoassets offered by eToro. Today we’ll discuss Bittensor and Uniswap.

Bittensor (TAO): Currently trading near $375 with a market cap of roughly $3.85 billion

Bittensor is a decentralized, open-source protocol that aims to create a collaborative, blockchain-based marketplace for AI. Founded in 2019, the network rewards participants for contributing useful machine learning models through its native token, TAO, which is used for staking, governance, and validator rewards. Built around subnets — modular AI task-specific networks — Bittensor fosters open competition among developers and model trainers. Governed by the Opentensor Foundation and maintained by a distributed community, it uses a hybrid Yuma consensus combining Proof-of-Work and Proof-of-Stake. The project’s mission is to decentralize AI ownership and innovation across a global, permissionless ecosystem.

Uniswap (UNI): Currently trading near $5.25 with a market cap of roughly $3.3 billion

Uniswap is an Ethereum-based decentralized exchange that allows users to swap digital assets directly through automated smart contracts. Launched in 2018, Uniswap pioneered the automated market maker model, where prices are determined by supply and demand rather than order books. The UNI token, introduced in 2020 via an airdrop, serves as a governance token and liquidity incentive — not as a profit-generating asset. Governance decisions are made by UNI holders through a community-driven proposal and voting system. With over a trillion dollars in cumulative trading volume, Uniswap remains one of the largest and most influential DEXs in crypto.

Want to receive these insights straight to your inbox?

The Setup — Uniswap

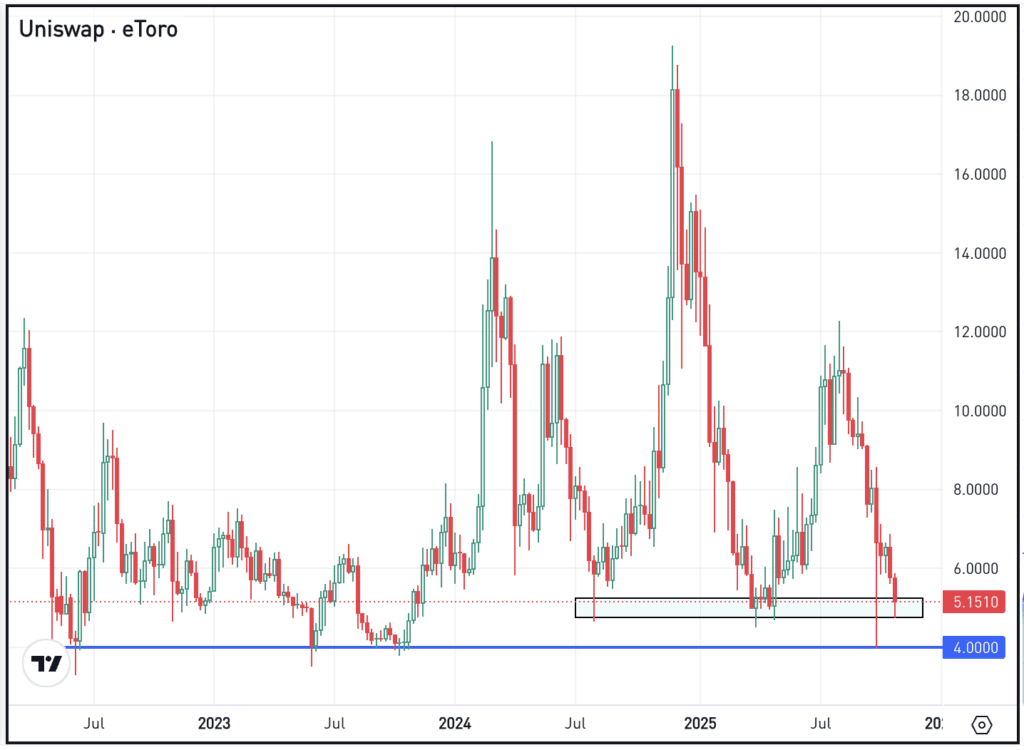

We’ve seen volatility increase in the crypto space lately, with big names like Bitcoin and Ethereum taking a hit. But we’ve also seen some of the smaller names — like Uniswap — come under pressure too. UNI topped $12 at one point this summer. Now it’s clinging to the $5 area, which has been support for more than a year.

If this area holds as support, bulls will look for a larger rebound to take hold. If it does not hold as support, that could open the door to more selling pressure, potentially putting $4 (or lower) in play. While the $5 area has been key support for the last year, $4 was a notable level going back to 2022 (as shown on the chart with a blue line).

What Wall Street’s Watching

Shares of Snap are soaring this morning, climbing almost 20% in pre-market trading. The rally comes after better-than-expected quarterly results, where revenue of $1.51 billion topped estimates for $1.49 billion and daily active users of 477 million beat expectations of 476 million. Management also announced a $500 million stock repurchase plan. Check out the chart for SNAP.

Duolingo shareholders are having the opposite experience this morning, with shares down more than 20%. Revenue of $271.7 million grew more than 40% year over year and beat expectations for $260.6 million, while profit also topped expectations. Management’s overall revenue outlook was also above analysts’ expectations.

After a brutal 2024 (-51.7%), Celsius Holdings stock was up 127.5% for 2025 coming into Thursday’s session. Those gains will be lower at the open, with shares down about 10% in pre-market trading. That’s even after the firm delivered a top- and bottom-line beat in its latest quarterly results. Dig into the fundamentals for DUOL.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.