The Daily Breakdown takes a closer look at LayerZero and Tezos, before diving into the weekly charts for Bitcoin as it searches for support.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors become more familiar with the 110+ cryptoassets offered by eToro. Today we’ll discuss ZRO and XTZ.

LayerZero (ZRO): Currently trading near $1.82 with a market cap of roughly $540 million

LayerZero is an omnichain interoperability protocol designed to enable seamless communication and data transfer across blockchains. Developed by LayerZero Labs, the network allows applications to move messages and assets across chains without relying on traditional bridges. The ZRO token is used for governance, giving holders a voice in protocol upgrades, fee structures, and decentralization initiatives. LayerZero’s lightweight, modular architecture has been integrated across multiple Layer-1 networks, positioning it as a key infrastructure layer for cross-chain applications and scalable Web3 interoperability.

Tezos (XTZ): Currently trading near $0.48 with a market cap of roughly $512 million

Tezos is a Layer-1 smart contract platform launched in 2018, designed around on-chain governance, formal verification, and long-term upgradeability. It uses a Liquid Proof-of-Stake model that allows token holders to delegate staking while retaining ownership. The XTZ token is used for staking, transaction fees, and voting on protocol upgrades. Tezos’ self-amending design enables seamless evolution without hard forks, supporting use cases in finance, NFTs, and tokenization, with ecosystem growth funded by the Tezos Foundation.

Want to receive these insights straight to your inbox?

The Setup — Bitcoin

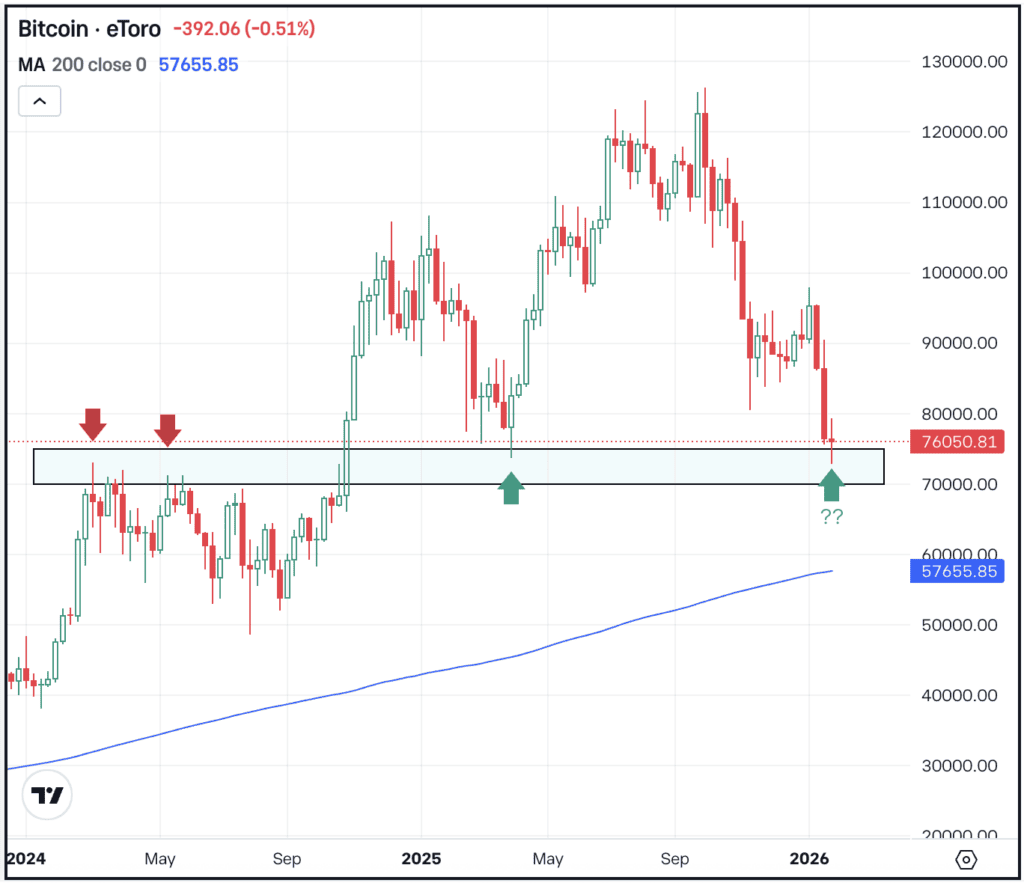

Bitcoin looked like it had found its footing in the mid-$80Ks, then swiftly rolled over, falling almost 18% in two weeks. Currently, BTC bulls are hoping the $75K level is able to act as support.

In 2024, the $70K to $75K range had been stiff resistance, until a breakout in the fourth quarter sent BTC past $100K. Since then, this prior resistance range has been support — remember our “role reversal” discussion from the Technical Analysis Boot Camp. In any regard, bulls are hoping this area remains support, just as it did last April. If it fails, lower prices may be in store. If it holds, investors will look for a rebound.

Options

For investors who can’t trade or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the BTC front, IBIT remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Advanced Micro Devices are not faring well this morning, down almost 10% despite beating on earnings and revenue expectations. While Q1 revenue guidance also came in ahead of expectations, investor expectations were elevated heading into the report, with shares up 77% in 2025 and up more than 13% so far this year. Check out the chart for AMD.

On the flip side, Eli Lilly stock is up about 8% this morning after it reported earnings. Revenue of $19.3 billion topped estimates of $17.9 billion, while earnings of $7.54 a share were comfortably ahead of consensus expectations of $6.96 a share. Investors will be keeping an eye on Eli Lilly’s 52-week high near $1,134. Check out the price targets for LLY.

Speaking of new highs, Walmart notched its second all-time high of the week yesterday, climbing about 3% to $128.17. The rally follows Monday’s 4.1% gain, while WMT stock is now up 9.5% amid a four-day win streak. Dig into the fundamentals for WMT.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.