The Daily Breakdown dives into Cintas stock to understand its business, growth, and valuation. Here’s what we found.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Many of the companies we’ve covered in our Deep Dive series are already well known, like Visa (here), Ferrari (here), PepsiCo (here) and many others. And while investors have likely seen plenty of Cintas trucks on the road, many may not be familiar with the business.

Cintas provides a wide range of products and services that help businesses maintain their professional image, safety standards, and regulatory compliance. The company’s offerings include uniform rental and facility services, first aid and safety programs, and fire protection solutions. Cintas delivers value through dependable service, predictable costs, and reduced administrative burden, while supporting workplace cleanliness, safety, and compliance — helping clients focus on their core operations with confidence.

Growth and Margins

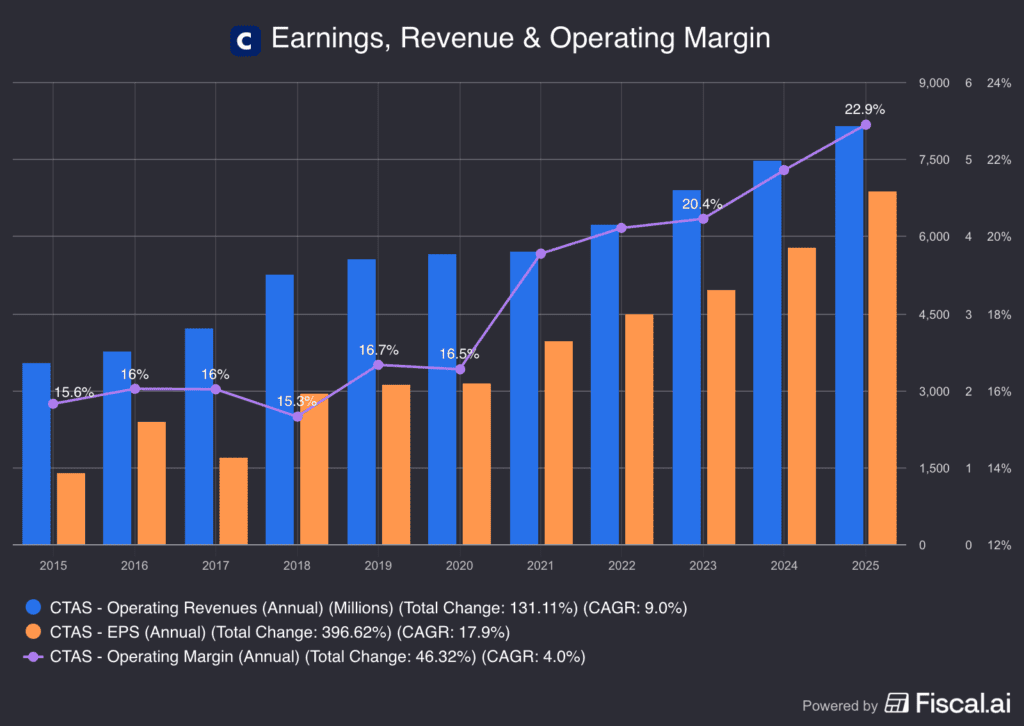

While growth may have stalled in the 2018 to 2020 period, Cintas has really hit its stride over the last few years. Notice how revenue, earnings and operating margins have all cruised to record highs over the last few years.

According to Bloomberg, here’s what analysts expect Cintas to do moving forward:

- Earnings growth: 16.2% in fiscal 2026 (this year), 11% in 2027, and 10.1% in 2028.

- Revenue growth: 7.8% in fiscal 2026 (this year), 7.7% in 2027, and 7.2% in 2028.

Analysts currently have a consensus price target of ~$221 on CTAS stock, implying almost 20% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper — Valuation

Cintas stock has been a monstrous performer, rallying 117% over the last five years and 687% over the last decade. In comparison, the S&P 500 is up “just” 109% and 229% over those timeframes, while the Nasdaq 100 is up 134% and 456%, respectively. Another fun fact? CTAS stock has generated an annual gain for 16 straight years.

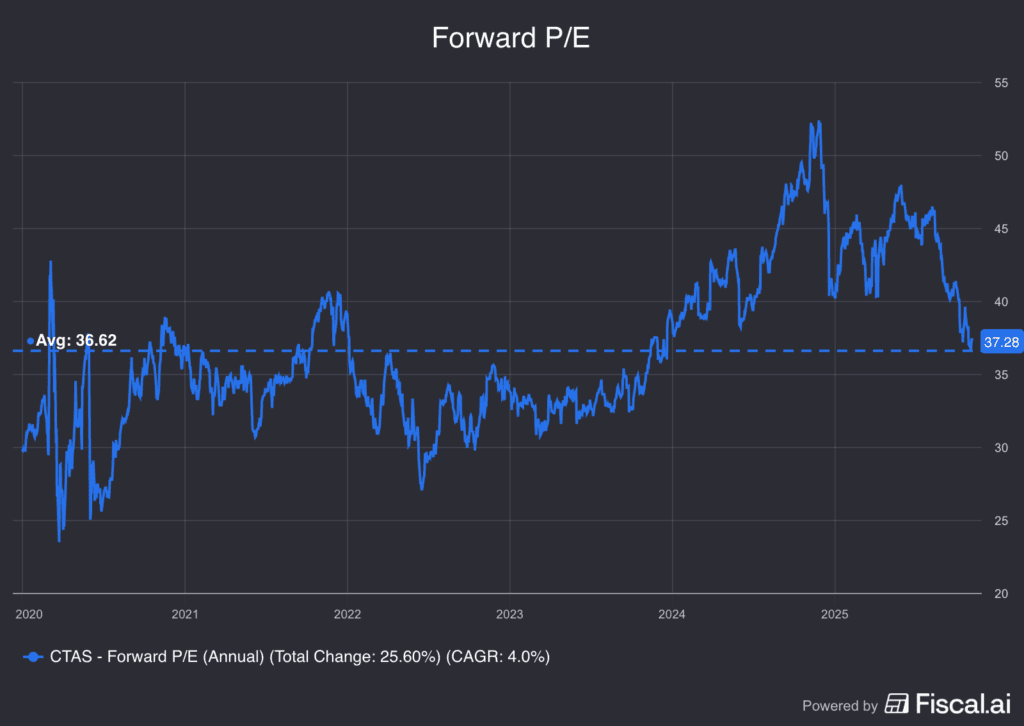

While the stock has risen substantially, the valuation has climbed as well.

On the chart above, you can see that CTAS stock rarely traded above 40 times earnings. Conversely, the current selloff is the first time the stock has traded below that figure so far this year. Since 2020 though, CTAS stock has only traded below 30 times earnings twice: The COVID-19 selloff and the 2022 bear market. Now trading near 37 times, it’s about in-line with its average dating back to 2020.

Risks

Some investors may view Cintas as overvalued relative to its growth rate. Others see the company’s consistency, operational strength, and expanding margins as justification for a premium valuation. And some may recognize both sides but prefer to keep CTAS on their watchlist, waiting for a better entry point.

None of these perspectives are wrong — it ultimately depends on individual investing style and risk tolerance. Cintas shares could trade lower on valuation concerns alone, or if the economy weakens and the labor market continues to cool. That risk is amplified by Cintas’s cyclical exposure, which could make the business more sensitive to economic slowdowns.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.