Bitcoin 2025 was a massive show in Las Vegas. The Daily Breakdown crew was there to observe and here are our biggest takeaways.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

All this week, we’ve been in Las Vegas for the Bitcoin 2025 conference. I’ve even had the pleasure of running into and meeting with some eToro clients who are here as well. Talking with others in the industry and listening to some of the speakers has helped shed further light on what’s going on in the crypto space.

So what are some of the biggest takeaways?

Enthusiasm

Right now, the crypto group is excited — and it helps that BTC recently notched a record high this month. The rush back into “risk-on” assets has been led by Bitcoin, which held up in early April amid heavy stock market volatility and has now cruised back to all-time highs.

I’ve heard price targets ranging from “modest” six-figure outlooks to $100 million per BTC — literally!

Obviously, it’s not surprising to see excitement around Bitcoin and other cryptocurrencies — we’re at a Bitcoin conference, after all — and it helps tremendously that it continues to hold up over $100,000. But reaching that level is being viewed as a milestone on the road to something bigger, regardless of whether anyone can predict Bitcoin’s long-term target.

Remember, eToro added a dozen new cryptocurrencies this week.

Regulation Expectations

From corporate leaders, technologists, and political figures, BTC 2025 has had all sorts of speakers (one of them was even VP JD Vance). From almost all of these different vantage points, the expectation is clear: Leaders expect friendlier regulations in the future.

In the early days, a lack of regulation made crypto like the Wild West. While there were some benefits to that, it left investors unprotected and vulnerable to bad actors. On the flip side though, over-regulation has stifled growth and left investors frustrated.

Finding a balance here is key, but the tone from this conference is united on this front: An improving regulatory situation is being viewed as a “when not if” scenario. If that pans out, it could be a clear catalyst for Bitcoin, Ethereum, Bitcoin Cash and others.

Institutions Could Be the Next Catalyst

There is one other major takeaway from Bitcoin 2025: Institutional involvement in Bitcoin.

Unlike traditional assets — like an IPO for example — retail investors were the first on the scene for Bitcoin. With its finite supply, a notable increase in demand has the potential to dramatically lift the asset price. The industry is watching (and waiting) for that demand boost to come from the institutional side.

Be it from increased access via Bitcoin ETFs, like IBIT, sovereign wealth funds, private investors, traditional banks, family offices — and likely, a combination on all of these fronts. Even a modest portfolio allocation for these groups have the potential to move the needle when it comes to Bitcoin.

The potential fund flows from institutions aren’t being looked at as a short-term catalyst, either. Instead, investors are viewing this as a potential long-term tailwind for BTC.

Want to receive these insights straight to your inbox?

The Setup — Bitcoin

Some investors check BTC multiple times a day. Others check it sparingly as part of their buy-and-hold approach. Everyone’s different — and that’s okay.

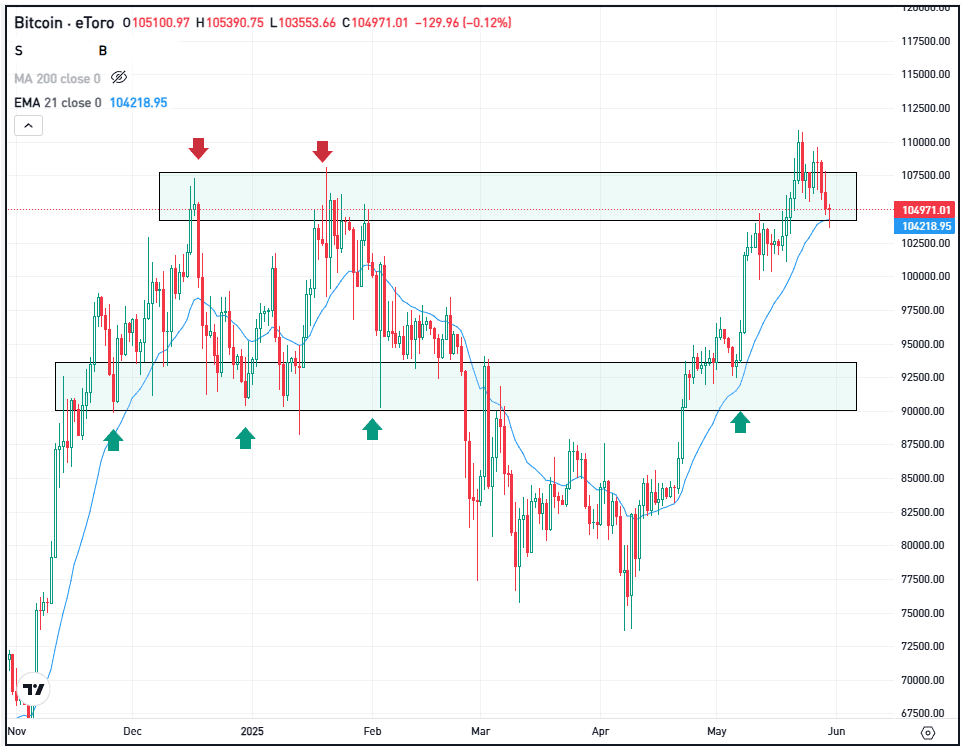

When I look at BTC, the $110K area stands out to me. This zone was resistance in December and January, and while Bitcoin technically made new record highs, it’s still contending with this area.

From here, bulls would love to see BTC hold up in the six-figures range. Wouldn’t it be something to see Bitcoin not only make it to $100K, but for this area to become a floor of support? If it can’t do so yet, that’s okay. The next area of possible support may be in the low-$90K range — an area active investors may remember from earlier this month.

Ultimately, bulls will need to see a breakout over the $110K area, allowing for a larger potential move to the upside and — hopefully — for the $100K to $110K area to become future support.

If not and BTC retreats below current support, we could see further selling pressure. After all, BTC is a risk asset and is prone to volatility swings. But it’s been an upside leader lately, not only for crypto assets, but other risk-on assets as well (like stocks).

Options and ETFs

For investors who can’t or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the BTC front, IBIT remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.