The Daily Breakdown takes a look at the week ahead, including Nvidia’s earnings report, GDP results for Q1, and the charts for Palantir.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Monday’s TLDR

- NVDA reports Wednesday

- GDP, PCE in focus too

- Palantir looks for support

Weekly Outlook

As we kick off the holiday-shortened trading week, there are a number of key events packed into this four-day stretch. However, a number of investors will be focused on one event: Nvidia’s earnings report.

The company will report on Wednesday after the close. Given how large Nvidia has become, with its market cap swelling to $3.2 trillion, and how pivotal the firm has become for the AI trade, all eyes will be on this name.

Additionally, Salesforce, C3.ai, and HP Inc will also report after the close. But let’s back up — and I’m not just talking about the earnings reports that morning, which include Macy’s, Dick’s Sporting Goods, and Abercrombie & Fitch.

Let’s go back to Tuesday morning, when we get the consumer confidence report at 10 a.m. ET. This measure has been in free-fall, hitting multi-year lows in its reading last month. So far, this hasn’t resulted in a major dent in retail sales, but we want to see confidence start to rebound.

On Thursday, we’ll get earnings from Best Buy, Kohl’s, and Foot Locker before the open. Also before the open is the second GDP reading for Q1, which could have some bumpiness due to tariff impacts. After the close, Costco will headline the earnings reports, alongside Dell and Ulta Beauty.

On Friday, we’ll get the PCE inflation report at 8:30 a.m. Remember, the Fed prefers the PCE reading over the CPI report. Bulls will hope for a lower-than-expected print, which could increase the odds for a rate cut sooner than expected.

Want to receive these insights straight to your inbox?

The Setup — Palantir

One of the strongest growth stocks of the current bull market has been Palantir. Shares have rallied more than 1,000% from its 2023 lows, allowing its market cap to swell to nearly $300 billion. The name has become a favorite among retail and growth-oriented investors.

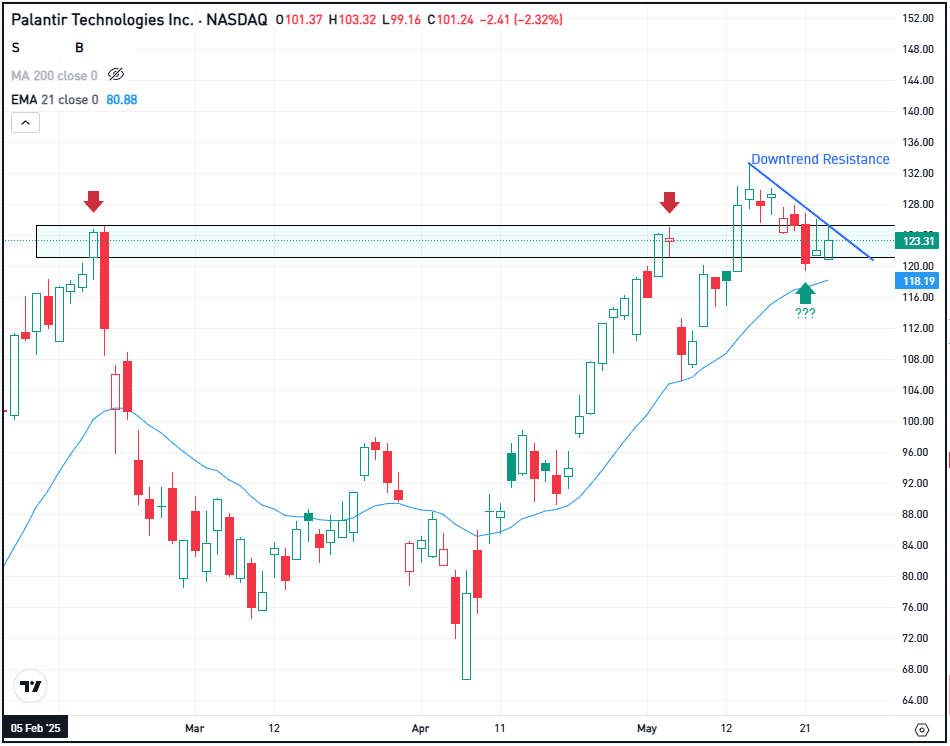

The stock is now idling near a key level, in the $120 to $125 range. Bulls are hoping it can find support, while bears are hoping the stock breaks below this area and continues lower.

Twice this year, Palantir rallied up to the $120 to $125 zone, and then pulled back. However, earlier this month, it was able to break out over this zone, pushing up toward $135 before dipping back down. Bulls are hoping that this area of former resistance can now act as current support.

This zone is not necessarily a make-or-break situation — although investors are hoping it holds.

However, technical investors are also likely keeping an eye on the rising 21-day moving average (which was support earlier this month) as well as current downtrend resistance. If PLTR is able to clear downtrend resistance, bulls might hope for another charge toward the recent highs.

If support fails to materialize though, Palantir shares could embark on a further correction.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, investors might consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

SPY

The S&P 500 ETF — SPY — along with other markets index ETFs like the QQQ and DIA, are catching a boost this morning. Constructive trade talks between the US and EU have investors gravitating back toward “risk-on” assets this morning, with US markets higher by more than 1%.

Other risk-on assets are catching a boost too — like Bitcoin. After three straight daily gains over the holiday weekend, bulls are looking for a fourth day of gains as BTC hovers just below the record high it set last week. For non-crypto traders interested in Bitcoin, they could consider ETFs, like IBIT, which also has options trading available. Check out the chart for Bitcoin.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.