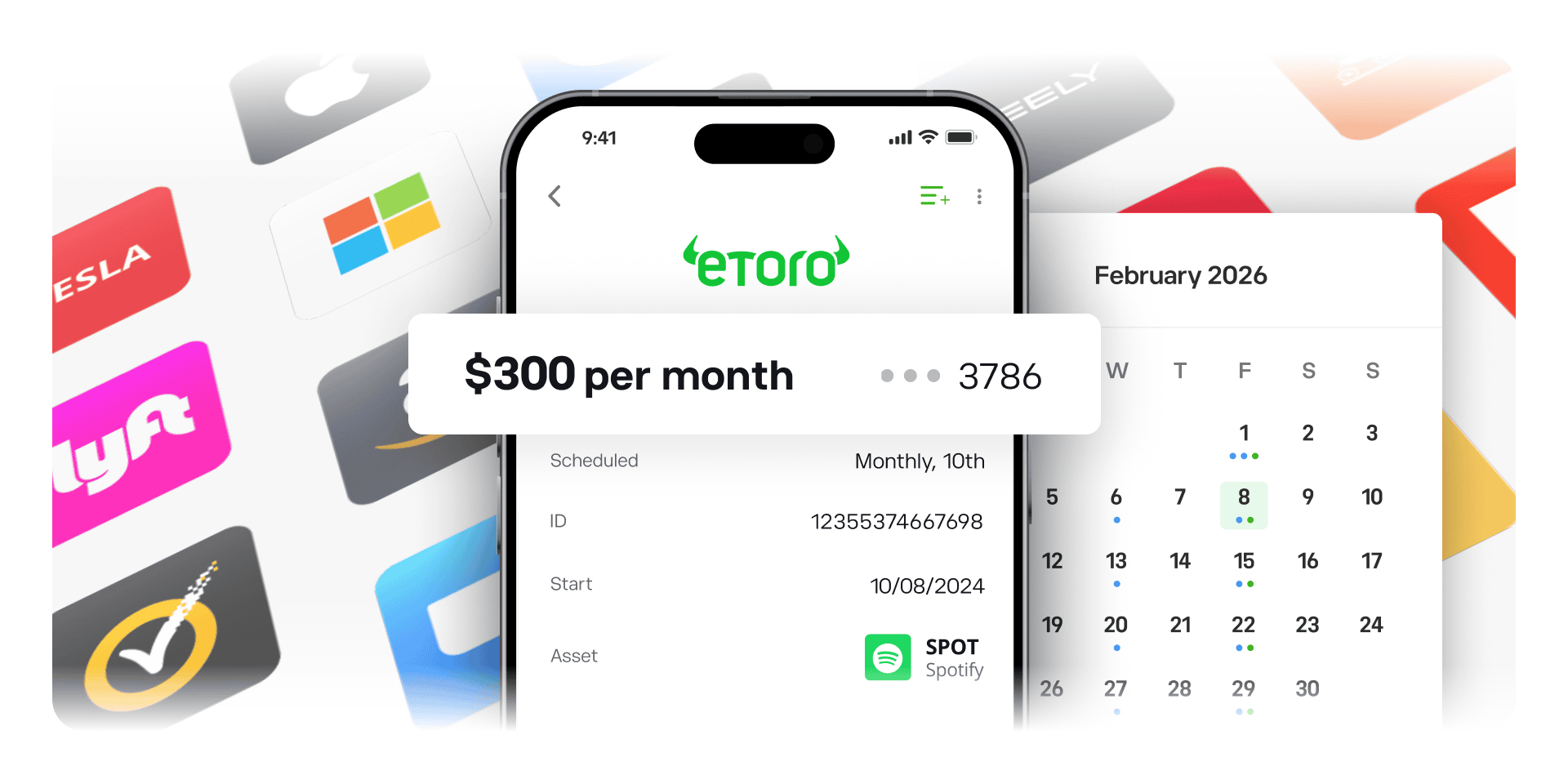

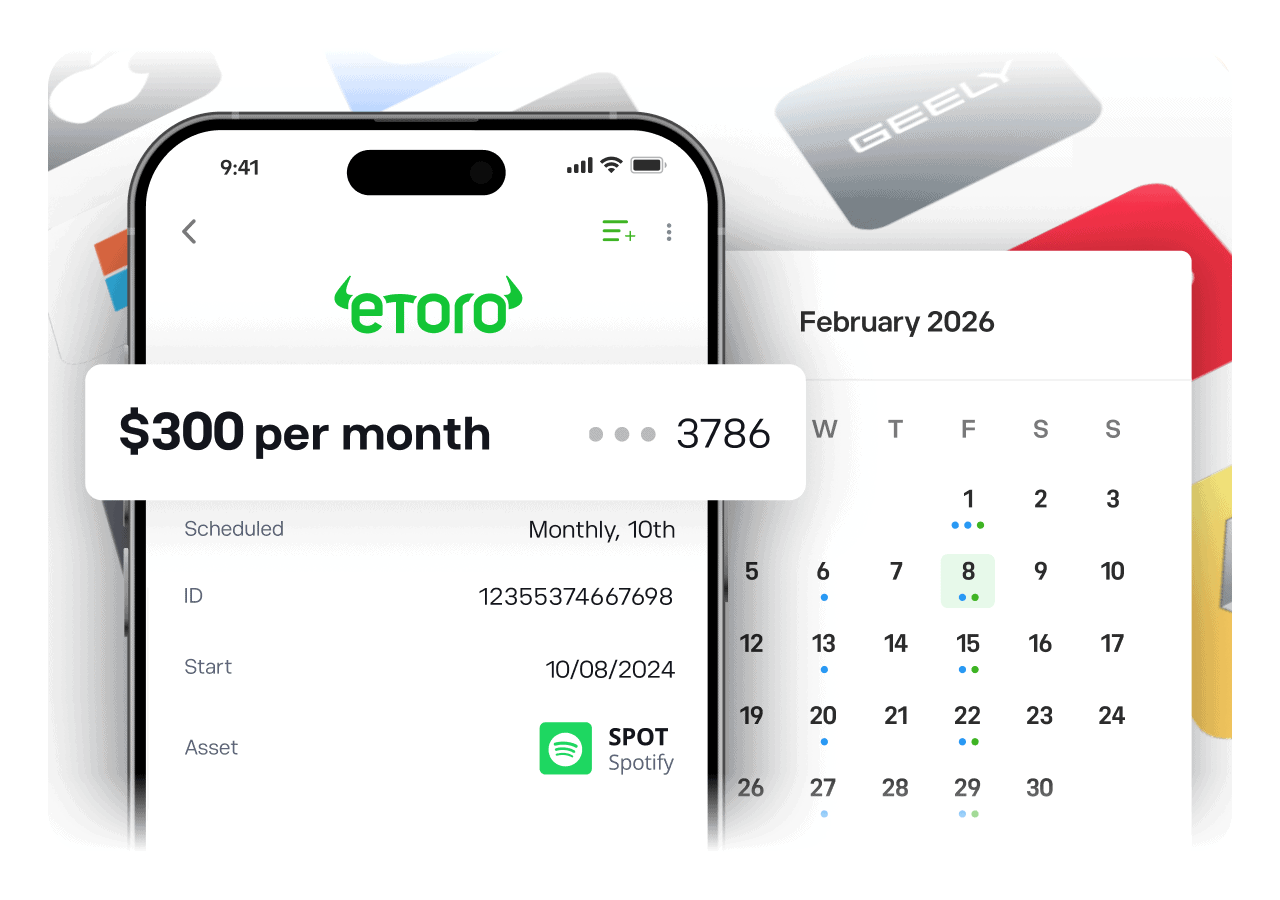

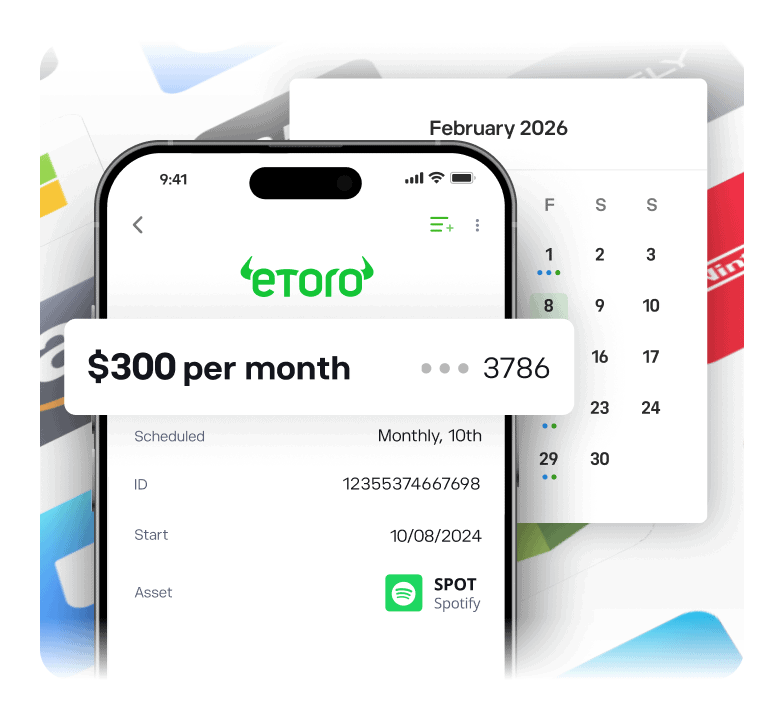

Automate your goals with Recurring investments

Stop trying to time the market, and put time on your side instead

Set it and stay on track

Investing on a set schedule helps you to consistently build your portfolio for the long term

Low $25 minimum monthly investment to get started

Spread your investments over time to reduce risk

Enjoy reduced FX fees plus lower commissions on stocks and ETFs

Set it and stay in control

Choose from thousands of stocks, ETFs, crypto, Pro investors and Smart Portfolios for your recurring plans and manage them all in one place

Remove the stress of missed opportunities and impulsivity

Adjust or cancel your recurring plans at any time

We’ll notify you when each automatic investment is executed

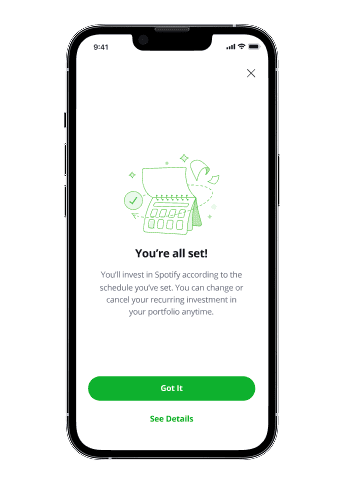

Set it with just 3 steps

A simpler way to help grow your portfolio

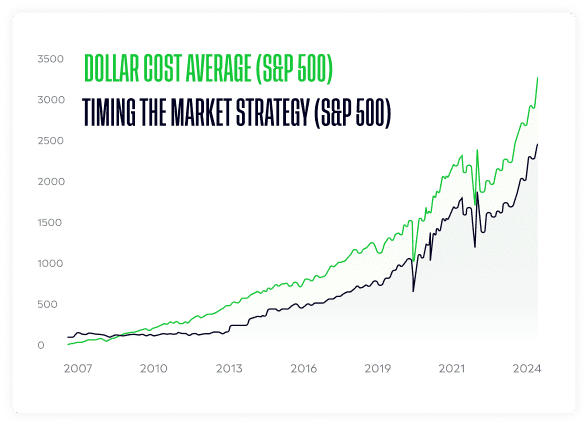

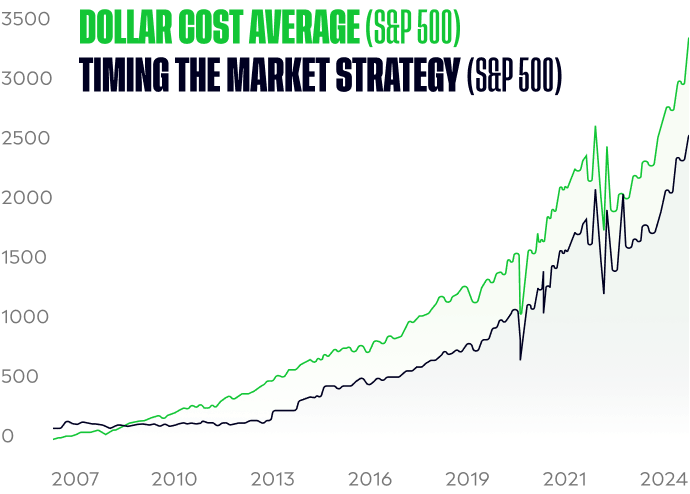

What happens when you invest consistently over time versus trying to predict the best times to buy or sell?

If an investment had been made in SPY whenever the S&P 500 index dropped by more than 5% (“buying the dip”), this would have resulted in 16 investments, compared to 210 months of consistent dollar-cost averaging – with the recurring investment strategy performing 125% better.

Hypothetical $1000 investment in SPDR S&P 500 (SPY) ETF (2007-2024)

Data as of December 1, 2024. For illustrative purposes only. This is not investment advice. Past performance is not an indication of future results.

FAQ

- What is a recurring investment?

-

A recurring investment (also known as a recurring order) lets you automatically invest a fixed amount into an asset, a pro investor, or a smart portfolio on a regular schedule.

You choose the amount and date, and eToro places a market order for you each month.

- Which assets support recurring investments?

-

You can set up recurring investments for:

- Stocks

- ETFs

- Cryptoassets

- Pro investors

- Smart Portfolios

Not supported: CFDs, leveraged or inverse ETFs, and elevated-risk stocks.

- How do I set up a recurring investment?

-

- Go to the asset, Pro Investor, or Smart Portfolio page and click Get Started on the recurring investment banner.

You can also access your plans from your Recurring investment Portfolio. - Choose your monthly investment amount and scheduled day.

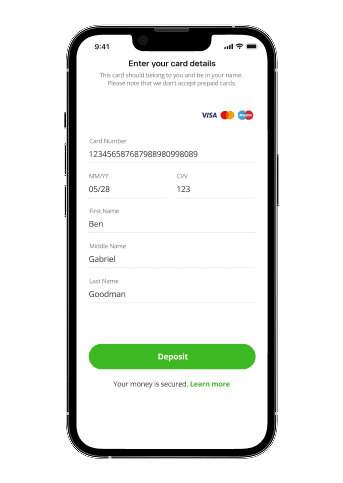

- Select your payment method.

- Review and confirm your plan.

Note: Recurring investments are not available for CFDs, leveraged or inverse ETFs, or elevated-risk stocks. Learn more here.

- Go to the asset, Pro Investor, or Smart Portfolio page and click Get Started on the recurring investment banner.

- How do I fund a recurring investment?

-

Recurring investments are funded using the payment card you select when creating your plan.

eToro (UK) Ltd clients can only use debit cards.

Coming soon: funding with available USD balance.

- How often can I invest?

-

Recurring investments currently run once a month, on the date you choose.

Orders are processed at 14:00 UTC and executed at 14:45 UTC

- What are the minimum amounts for recurring investments?

-

The current minimums are:

Stocks, ETFs, Crypto: US$25

Smart Portfolios: US$500

Copying a Pro Investor: US$200Minimums may change. The app will always display the up-to-date minimum.

- What happens if I don’t have enough funds when a recurring investment is due?

-

If your available funds do not meet the minimum for that plan, the order won’t be placed and that month’s occurrence is skipped.

Your schedule continues as normal the following month.

- What if Ihave multiple plans but not enough funds for all of them?

-

Each plan is checked independently at the time it runs. If you have enough funds for one plan’s minimum, it executes; if not, it’s skipped. We do not split amounts across multiple plans.

- Is there a priority order between my recurring plans?

-

Yes.

If multiple plans are scheduled for the same time, they are attempted in the order they were created (oldest first).

If earlier plans use your available funds, later plans may be skipped.

- How do I make sure all my plans execute?

-

Ensure your available balance (or card limit) covers the total required minimums for all plans scheduled on the same day.

Example:Two Smart Portfolios + one Pro Investor = $500 + $500 + $200 = $1,200 minimum needed.

- Does each recurring investment create a new position or add to my existing one?

-

Yes.

Each monthly execution opens a new position, which appears separately in your portfolio.

- Are there any fees for recurring investments?

-

1. Stocks & ETFs

No commissions on recurring purchases.

Closing a recurring stock position may incur a small $1–$2 commission.

A 0.5% (UK Stamp Duty applies to LSE-listed stocks.

2. Cryptoassets

A 1% fee applies when buying or selling crypto, including recurring orders.

3. Smart Portfolios

No management fees for recurring investments.

If the portfolio includes crypto or CFDs, the relevant fees apply.

4. Copying Pro Investors

No fees on stock or ETF trades.

Crypto or CFD trades incur standard costs.

5. Currency Conversion

Conversion fees are waived for non-USD deposits until March 31, 2026.

After that, standard conversion fees may apply. - How do I edit or cancel my recurring investment plan?

-

To cancel a recurring investment plan:

Go to “Recurring Investment Portfolio.”

Select the relevant plan, tap “Edit,” and choose “Cancel.” - What exchange price is used for recurring investments?

-

Recurring investments are executed as market orders at the scheduled execution time (14:45 UTC).The price you receive depends on the type of asset and whether the market is open:

For products dated 24/5 or crypto:

- The order is executed immediately at market price (normally reflected about 45 minutes after the execution time).

For stocks and ETFs:

- If the market is open: The trade executes at the market price at the time of execution.

- If the market is closed: The trade executes at the next market-open price on the following business day.

- Where can I view all my recurring plans?

-

You can access your Recurring Investment Portfolio from your main Portfolio screen. Just open your Portfolio and look for the Recurring Investments section, where all your active and previous plans are listed.

- Can I have multiple recurring plans for the same asset?

-

No

- Can I pause a recurring investment instead of cancelling it?

-

At this stage, pausing a recurring investment isn’t supported.

If you wish to stop the automated purchases, you’ll need to cancel the recurring investment entirely. You can always set up a new one later if you choose to resume.