Summary points:

- The sharp stock price drop after a solid earnings report is an entry or accumulation opportunity;

- Fortinet, despite a cautious guidance due to macro uncertainty, continues to dominate the majority of the firewall market shares;

- Fortinet is potentially the best value play among large cybersecurity stocks with a reasonable valuation, high growth rates and strong margins.

The Catalyst

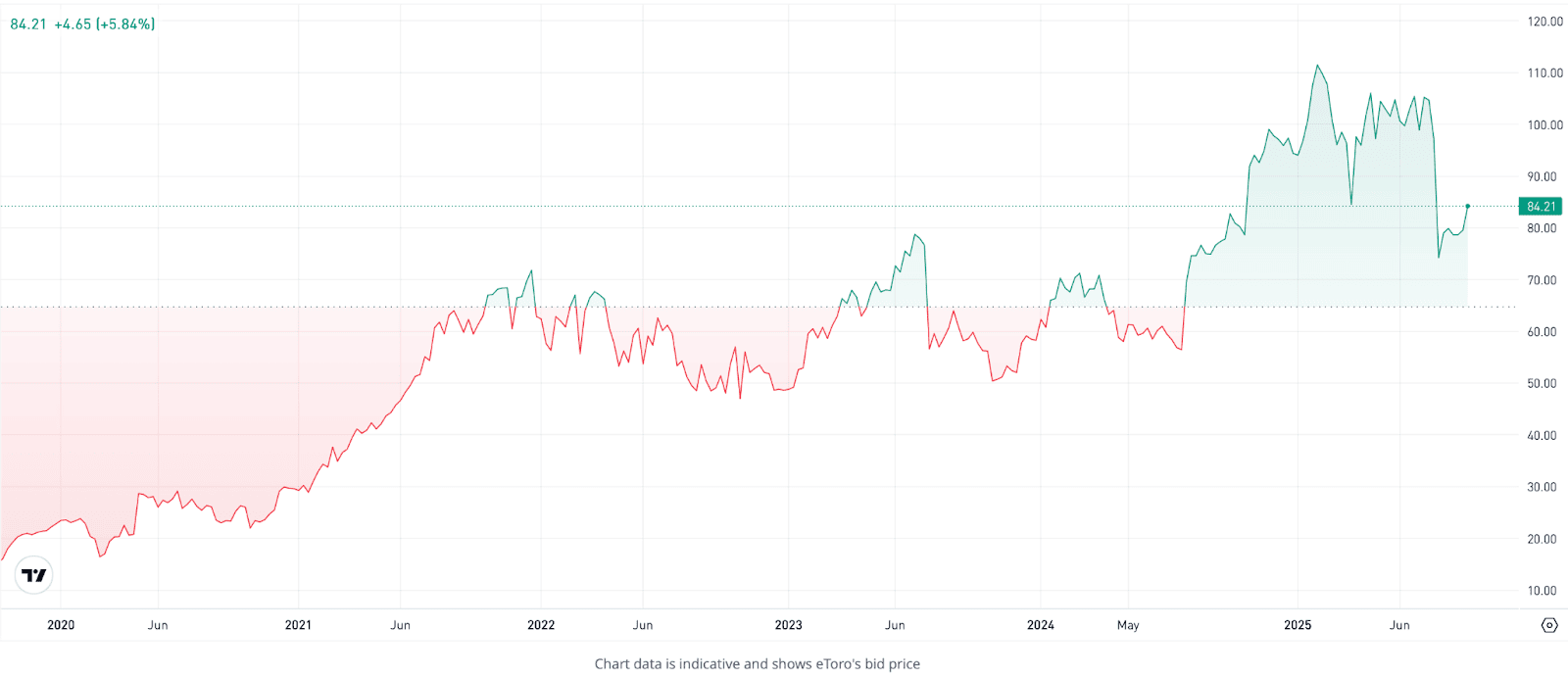

Fortinet Inc. ($FTNT) is up over 250% in five years and over 800% in 10 years, reflecting high revenue growth rates and a successful business model in the cybersecurity sector. The stock is currently trading new 52-week lows after a sharp drop in early August post Q2 earnings report. The report was actually convincing but the guidance came in conservative due to a high level of macro uncertainty amidst tariffs and a slowing US economy. The drop below $75 in August (from a $107 high in July) is unjustified, and although the stock has already started the recovery, crossing the $80 price tag a few days ago, it is still well below its 52-week highs of $114.

The company announced a share repurchase program which will act as a major catalyst in my opinion. The announcement of a $1 billion increase in the share repurchase program and its extension to February 2027 should act as a floor for the stock, therefore limiting downside. The share repurchases also significantly improve shareholder sentiment: a company that buys its own shares is a company that believes it can grow further.

Source: Fortinet, May 2025 Investor Presentation

Fortinet has been an aggressive share repurchaser in the recent years, in particular during the 2022-2023 bear market, while it hasn’t bought any during the 2024 bull year, which overall reflects a smart capital allocation. The above chart was published in May and I expect the share repurchases to accelerate since the August drop. A strong rebound is definitely in the cards in the short-term.

Business Overview

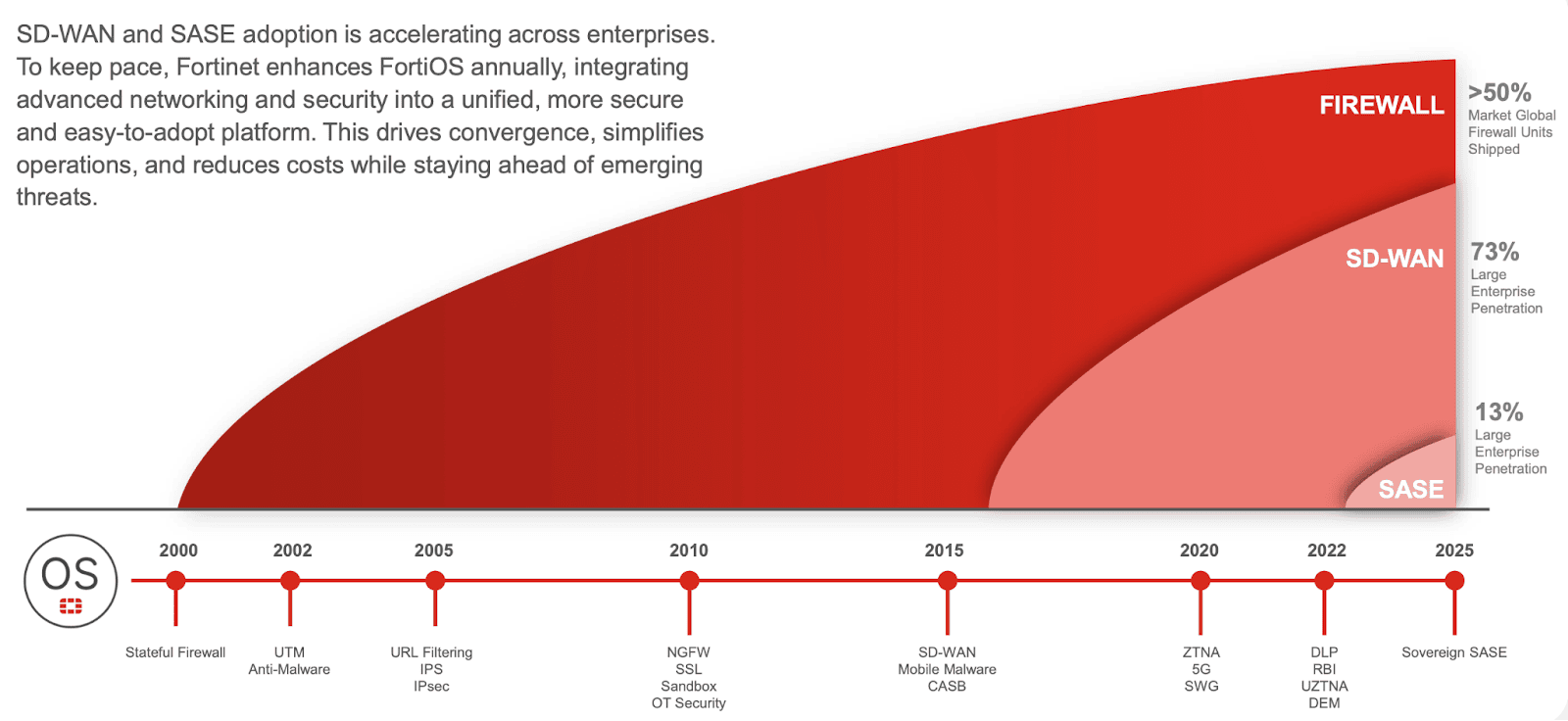

In the long-term, Fortinet is well poised to continue outperforming its peers thanks to its business moat. Fortinet’s firewalls are the most advanced in the world, at a time where cybersecurity threats multiply and everything continues to become more digital, connected and powered by AI. The business controls over 50% of the global market share of deployed network firewalls as per its last report.

Firewalls are network security devices that act like security gates to network traffic. It protects a network from the intrusion into a trusted internal network by untrusted and potentially dangerous external networks. This is the core of Fortinet’s business and revenue, but it has successfully expanded to other segments such as its SASE line for clouds (not technically a “firewall”, but it is like a firewall for clouds) and SD-WAN which is an AI-powered network optimiser steering network intelligently across multiple WAN links.

Source: Fortinet, August 2025 Earnings Presentation

The company just crossed 1,400 issued patents worldwide, and over 500 issued and pending AI patents, driven by R&D investments. The pipeline is enormous and revenue growth catalysts should continue to emerge, while the core business remains well ahead of competition.

Hard Figures Supportive of the Investment Thesis

This short-term and long-term investment opportunity is highly attractive, supported by the AI tailwinds and share repurchases mentioned above, but also by its strong financials and valuation.

Despite a cautious guidance due to macro conditions, the figures show a much rosier picture. Indeed, revenue increased by 14% YoY to reach €1.63 billion at the end of Q2, with gross profit margin steady at 81.3% and net income margin at 30.6%. Earnings per share have increased by 54%, powered by rising earnings and a declining number of shares (thanks to share repurchases).

Fortinet has had positive FCF every year without exception since its IPO in 2009 and boasts a 32% FCF margin, a reflection of the business model’s solidity throughout the years. The balance sheet is therefore pristine, with $4.56 billion of cash, equivalents and short term investments and only $1.0 billion in debt. The investment grade rating of BBB+ is justified.

Source: eToro, TradingView

Last but not least, Fortinet may be the best value play among large cybersecurity stocks thanks to its August stock price drop as you can see in the chart above. The stock is indeed now trading at around $84 per share which gives it a P/E of 32x. The PEG stands at only 0.67x, reflecting the high growth rates, which makes it in my opinion an excellent GARP (Growth At a Reasonable Price) opportunity. The P/S of 9.8x is also attractive, significantly lower compared to peers. Zscaler (ZS) is trading at 16.5x sales and Cloudflare (NET) has a P/S of 41.4x, and both have at the moment negative earnings (unprofitable) while Fortinet has been profitable and growing since 2009. The much larger and more established players such as Palo Alto Networks (PANW) and Crowdstrike (CRWD) are profitable but they are also significantly more expensive at 14.4x and 25.4x sales, respectively.

Risk Factor To My Case

The key risk factor is the one that has been outlined by management and caused the stock to erase 25% of its price. The uncertainty in terms of capex investments amidst a turbulent environment could cause Fortinet customers to postpone their refreshes and cybersecurity updates. Interestingly, despite the cautious guidance, management did raise 2025 full year billings guidance midpoint by $100 million. The macro uncertainty caused multiple bank analysts to announce downgrades for the stock as capex spending may be reduced or stagnate in the cybersecurity sector, and these downgrades, while short lived, could continue to act as headwinds to the stock price recovery in the short term.

Bottom Line

Bottom line: volatility can be an opportunity when it causes a stock to sell off unjustifiably, while the business remains strong and continues to grow. The price drop is an excellent price entry for a long-term investment. Its advanced products, at a time where the world is becoming increasingly digital and cybersecurity threats continue to boom, should continue to support the financial growth of the company. Share repurchases will likely limit the downside and the upside remains uncapped given the cheap valuation versus peers.

Sources

https://investor.fortinet.com/static-files/2d21430a-2c22-4b9d-b7f5-3f4bdaa420b6

https://www.etoro.com/markets/ftnt

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.