It has been a challenging few weeks in the markets for investors. From a major tech sell-off to bitcoin tumbling more than 30%, recent moves have left many questioning whether this ferocious bull market is nearing its end. There aren’t many investors who wouldn’t bite your hand off for an end-of-year rally, except maybe Michael Burry. The star investor recently warned against excessive market euphoria and, with short positions in Nvidia and Palantir, is clearly betting on headwinds for the AI hype.

Stories like these fuel the debate in the markets, which are currently divided between hopes for a rally and concerns about valuations and market bubbles. Burry’s bets have left question marks for investors, and the recent sell-off across risk assets has some investors on edge. So, what really matters right now? Let’s find out.

- After a volatile stretch for risk assets, investors are hoping for a year-end boost, but valuations are looking stretched.

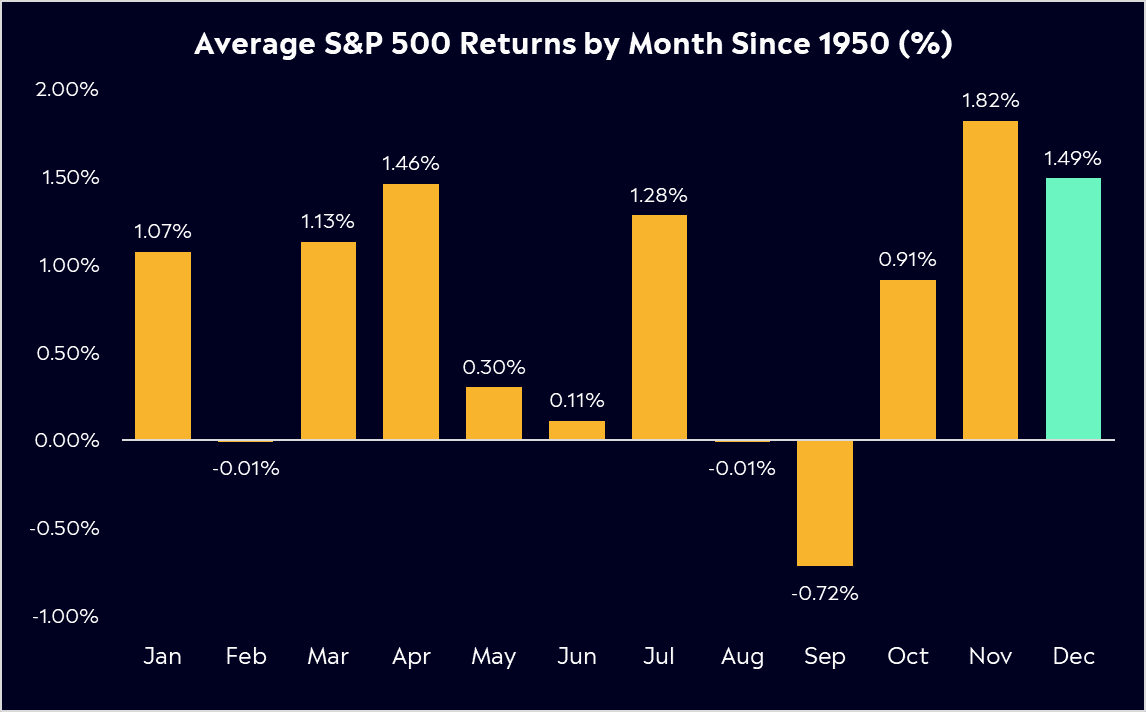

- Historical data shows a real Santa Rally exists, with November and December the best performing months on average since 1950.

- With markets divided between optimism and caution, staying diversified and focused on quality is key heading into 2026.

Investor Psychology

There is no doubt that it’s been a great year for markets. On Wall Street, the S&P500 is up 15%, while the Nasdaq has rallied 20% and in Asia, the Hang Seng has delivered a huge 29%. These returns are higher than historical averages, showing how strong 2025 has been. As the year draws to a close, investor psychology is now taking centre stage. Hardly anyone wants to sell and potentially miss out on a year-end rally, often dubbed the ‘Santa Rally’. This could make the market more emotional and less rational. A “buy the dip” mentality is likely to prevail, with investors viewing pullbacks as an opportunity rather than a warning sign, a trend we’ve seen throughout this year.

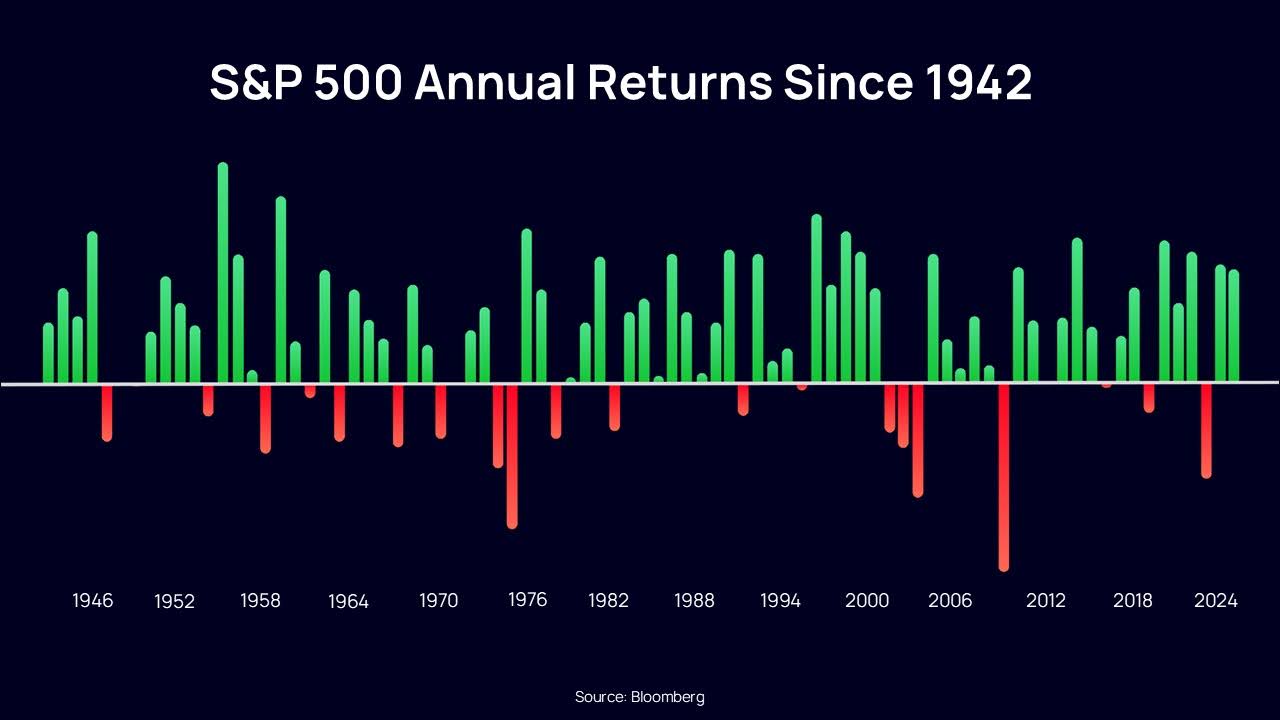

It’s important to remember that pullbacks are normal, and volatility is standard. Since 1974, the S&P 500 has averaged three pullbacks of 5% or more each year, while the average intra-year pullback is roughly 14%. We’ve seen five corrections (10% declines from peak to trough) in the last 9 years, and since 1974, the S&P 500 has returned over 24% on average following a correction.

*Past performance is not an indicator of future results

Reasons for Optimism: The Bull Case

Despite the recent noise and cautionary voices, there are solid reasons for bullish optimism. Fundamentals, seasonality, and the macroeconomic climate currently suggest a continuation of the rally or at least stable prices until the end of the year. Inflation, although still volatile, appears to be largely under control, and US tariff policy has not triggered a new surge in inflation. This means that interest rates can be cut further next year.

Corporate earnings have also delivered the goods. The third-quarter earnings season was broadly strong. In the US, S&P 500 company profits are on track to rise about 14% from a year earlier, with an impressive majority of companies beating expectations. This solid performance underpins the market’s gains with real earnings growth, not just hype. Looking ahead, analysts remain optimistic that earnings will continue to climb into 2026. Forecasts call for double-digit profit growth next year, roughly +13% for US companies, once again supporting the bull case into next year.

Seasonality adds further wind at investors’ backs. The end of the year is historically a strong period for equities. Since 1950, December has been among the best months for the S&P 500, averaging gains of 1.5%. This seasonal trend, often dubbed the “Santa rally,” bolsters investor confidence, it’s a pattern many are eager to see repeat. The common denominator is the repositioning of investors for a new year. Looking ahead 12 months, and when markets tend to rise, allocations are usually positive. This could be especially strong this year.

All these factors, from benign inflation, supportive central banks, strong earnings, a seasonally good period, and a respite from bad news, make a compelling case that the rally can continue or at least hold its ground through December.

*Past performance is not an indicator of future results

Reasons for Caution: The Bear Case

On the flip side, it would be naive to be blindly complacent and not take into account reasons to be cautious as we approach year-end. First and foremost is valuations. The S&P 500 now trades around 23 times forward earnings, a valuation multiple near its highest level in decades, and well above the index’s 10-year average of around 18-19. What does that mean in simple terms? A lot of good news is already baked into share prices. When valuations are elevated, markets become more fragile, and investors are quick to react to any disappointment since there’s less margin for error.

Much of that good news has stemmed from the AI hype. There’s no denying that excitement around artificial intelligence has been a massive driver of shares, with AI-related stocks accounting for a considerable percentage of the S&P 500’s returns since 2022. Tech giants are investing hundreds of billions of dollars to drive the AI revolution. Investors are essentially paying up now for the promise of AI riches later. It remains to be seen whether these enormous AI investments will translate into long-lasting profits.

Added to this are political uncertainties. The US government shutdown is the longest in history and could weigh on market confidence. A rate cut in December now looks unlikely, with the probability now only around 15%. Markets are walking a fine line between euphoria and overvaluation. The higher the valuation, the more sensitive investors could be to negative surprises. Minor pullbacks would be healthy, but larger corrections would need a clear trigger.

Navigating the Risks

One thing that I always remind investors is that uncertainty is a constant in markets, it never truly goes away and accepting that is part of the investing mindset.

One key point is that big market volatility usually has catalysts; it doesn’t come out of nowhere. Sharp swings tend to be sparked by surprises that catch the crowd off guard, perhaps a sudden earnings miss, an unexpected policy move, or an external shock like a geopolitical conflict. While we can’t predict these events, we can generally prepare for them.

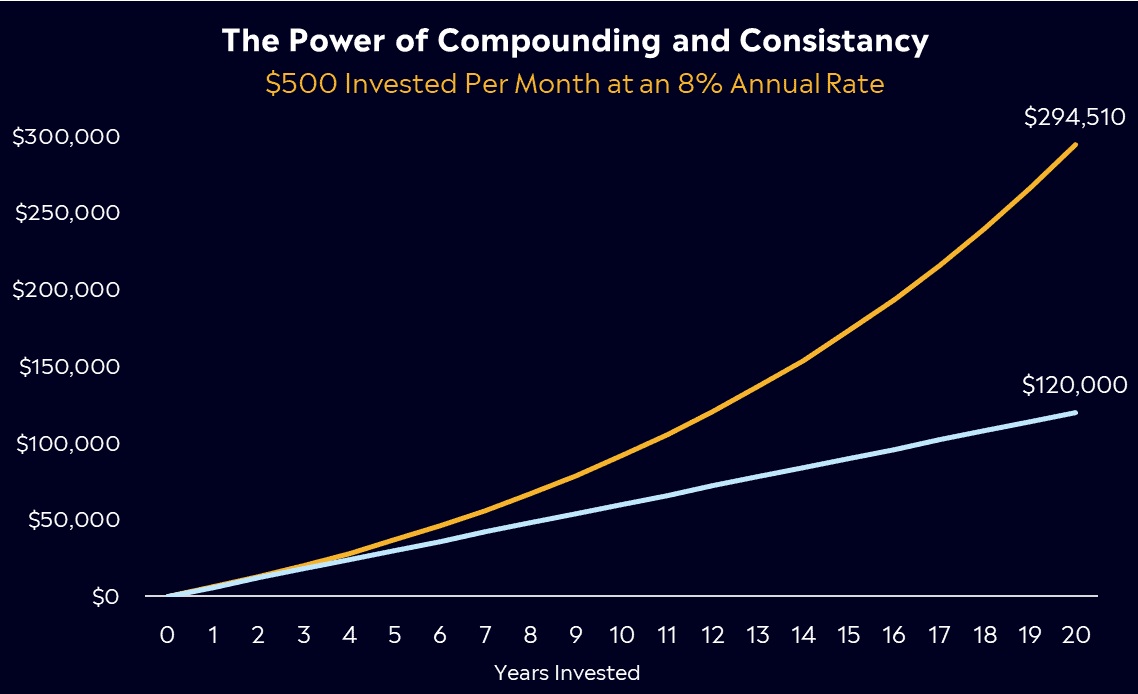

If you have a long-term investing plan, stick with it. A plan helps investors stick to the good ideas they came up with during calmer times. Those who consistently add to their long-term stock exposure tend to do well over time. Selling investments in a panic can lock in losses. Historically, markets rebound, and those who stay invested often benefit from the recovery.

The current volatility highlights the importance of diversification in an investment portfolio. By spreading investments across a variety of assets, diversification reduces the impact of any single asset’s poor performance. In times of market turbulence, not all sectors or individual stocks react the same way; some may even see gains, which can help offset losses in other areas. This strategy smooths out the volatility in a portfolio, providing a steadier return over time and leading to better risk-adjusted returns.

Let’s take an S&P500 ETF as an example, such as SPY, VOO, or IVV. This type of ETF invests in the 500 largest publicly traded companies in the US, offering broad market exposure. The S&P500 includes a wide range of industries such as technology, healthcare, finance, and consumer goods, which means that the ETF is inherently diversified across multiple sectors. Within the S&P500, different sectors perform differently based on various economic conditions. For instance, during a pullback in the technology sector, other sectors like utilities or consumer staples may perform better, thereby cushioning the overall impact on the ETF.

*Past performance is not an indicator of future results

The Bottom Line for Investors

High valuations are no reason to panic, but it’s important to note that they do make markets vulnerable to disappointments or shocks. That’s why I believe the mantra should be one of cautious optimism. Let profits run, but this is a good moment to critically review your holdings. Make sure you’re concentrated in companies with solid fundamentals, businesses that have tangible earnings, strong balance sheets, and real competitive advantages. In particular, focus on firms that can convert innovation into profits. It’s one thing for a company to have a flashy new technology or product; it’s another for that innovation to actually generate sustainable earnings.

Whether we ultimately get a textbook year-end rally or not is of little consequence to the patient, long-term investor. If stocks continue to climb through December, that’s a welcome bonus. If the rally fizzles or a temporary pullback occurs, it’s not the end of the world; it could even be an opportunity to pick up quality assets at slightly better prices.

Remain optimistic, but remain vigilant enough to protect yourself from downside. Cautiously optimistic is the sweet spot. After a year of strong returns, it’s a good time to calibrate your strategy. The year-end rally would be nice, and it may very well come to fruition. But if it doesn’t, remember that investing is a long game. Those who stay level-headed and focused on fundamentals will be the real winners when the dust settles and the next year begins.

Explore Markets

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.