Analyst Weekly, February 9, 2026

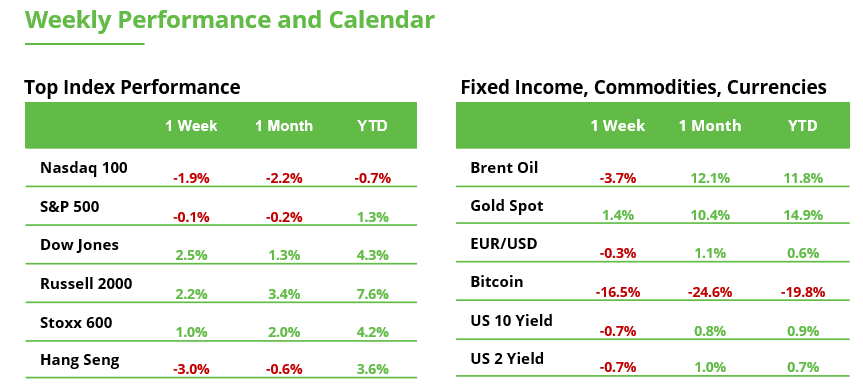

Early 2026 has been volatile, but it has also made one thing clear: there is more than one way to stay risk-on. Recent market movements signal that performance is no longer dependent on a narrow group of mega-cap names and that incremental capital is being deployed more selectively.

Breadth Over Concentration

Flow data supports this shift. Since late 2025, allocations have rotated toward Emerging Markets, ex AI thematic exposures, and cyclicals, while crypto-linked products have seen outflows. Investors remain risk-on, but with greater emphasis on diversification, valuation discipline, and earnings delivery.

EM Equities Move From Trade To Allocation

Emerging market equities sit at the center of this adjustment. After posting a 31% return in 2025, EM has extended its outperformance into 2026, beating developed markets by roughly 5% YTD in USD terms. This strength reflects earnings momentum, supportive policy settings, and a weaker dollar, and importantly, not crowded positioning, which remains well below historical norms.

From a portfolio perspective, we think that EM may offer multiple ways to express core macro themes while improving diversification.

AI Exposure Without US Mega-Cap Valuations

One of the clearest EM expressions is continued AI momentum at lower valuations. Korea, Taiwan, and China are central to the global AI supply chain, particularly in advanced semiconductors and memory. Korea stands out. It’s strong 2025 performance continues to lead in 2026, anchored by the memory sector.

Earnings revisions have been material. Consensus 2026 tech EPS in Korea has been revised up by roughly 130%, with memory leaders expected to deliver earnings well above current consensus and sustain strong growth into 2027. There aren’t enough high-density memory chips to meet that demand right now, so prices have risen quickly. Some long-term contracts haven’t fully caught up yet, which means companies are still selling part of their output at older, lower prices, but that gap is closing. As a result, pricing is likely to stay favorable through 2026, supporting strong earnings growth even as the market gradually normalizes.

Valuations reinforce the case. Korean tech trades at a meaningful discount to US peers, despite improving market breadth, strong earnings momentum, and supportive structural reforms. The Korea Value Up programme which is focused on governance, shareholder returns, and transparency, provides an additional catalyst for re-rating over time.

Weaker USD and Asymmetric EM Easing

A second EM pillar is exposure to a softer US dollar. Monetary policy across EMs are diverging, with a majority of EM central banks still expected to cut rates. In this environment, high-yielding markets such as Brazil, Mexico, and South Africa may offer attractive carry alongside equity upside.

A weaker dollar improves financial conditions, supports capital flows, and enhances the relative appeal of EM assets, reinforcing the diversification case.

Gold As A Structural Diversifier

Gold remains an important portfolio component. While the recent correction has reduced near-term momentum, structural support remains intact, driven by central bank accumulation, investor diversification, and strong physical demand.

South African equities are particularly leveraged to this theme. Miners now account for roughly 37% of the Top40 index, and earnings momentum remains closely tied to gold prices above $2,000 per ounce. Higher precious metal prices continue to support terms of trade, fiscal revenues, and the currency, feeding through to equity performance.

US: Broadening Beyond The Mag7

In the US, we think that as the macro recovery broadens, returns are becoming less concentrated. This creates room for the equal-weighted S&P 500 to outperform the Mag7, without undermining the longer-term AI supercycle.

The focus is not on exiting large-cap tech, but on capturing improving breadth and more balanced earnings delivery across sectors.

US Tech: Multiple Compression Has Been Rapid and Material

In the US, recent technology sector weakness has been driven primarily by valuation compression rather than earnings deterioration. Forward P/E multiples have fallen from roughly 28x to ~23x in two months, a ~20% contraction, placing valuations near levels seen during prior market corrections. By comparison, during 2022, tech multiples declined from ~27x to ~18x, while the 2024 pullback saw compression from ~27x to ~21x.

Earnings expectations, however, have remained broadly stable, and large-cap technology continues to generate substantial free cash flow. This suggests risk is increasingly company-specific, favouring firms with clear earnings visibility and balance-sheet strength rather than broad sector exposure.

Investment Takeaway: We think that the key shift driving allocations will involve moving the same risk budget away from concentration and toward breadth, earnings delivery, and valuation support. Overall, emerging market equities have an attractive combination of valuation support, earnings momentum, and macro alignment, trading at roughly 14x forward earnings versus 20x for developed markets. Within EM, AI-linked technology leaders in Korea, Taiwan, and China, alongside high-yielding markets may benefit from a weaker dollar. In the US, we think that the broader equity exposure via equal-weighted indices offers better risk-reward as leadership widens. Diversification is increasingly where returns are being generated.

Stabilization Instead of Panic: First Buyers Return to the Crypto Market

The crypto market continued its downward move last week. However, unlike the previous two weeks, the selloff lost momentum. From Thursday onward, buyers became active again. On the weekly chart, Bitcoin and Ethereum formed candles with long lower wicks. Key support levels were respected.

This is not yet a trend reversal, but such stabilization is often the first step. The key question now is whether this can develop into renewed upward momentum.

Bitcoin temporarily fell to around $60,000 last week, its lowest level since October 2024. From the all-time high, the price had more than halved. A short-term rebound followed, with buyers pushing the price back above a Fair Value Gap, which is acting as support in the $63,800–$64,500 zone.

On the upside, the key resistance on the weekly chart remains at $98,000, where the previous selloff began. As long as this level is not reclaimed, further selling waves cannot be ruled out. In that case, the next major support zone lies between $52,500 and $58,400, which already absorbed several sharp declines in 2024.

. Source: eToro

. Source: eToro

Ethereum’s price action closely mirrors Bitcoin’s, but ETH was hit harder. At its worst, the distance from the all-time high reached around 65%. Here too, a technical rebound followed, allowing part of the previous week’s losses to be recovered.

The first key support zone is a broad Fair Value Gap between $1,855 and $2,299. The lower zone between $1,674 and $1,715 was not reached, as selling pressure faded before that level. The main resistance currently stands at $3,402.

ETH, weekly chart. Source: eToro

What Matters Now

For both Bitcoin and Ethereum, the most important resistance levels remain well above current prices. Investors can therefore look to lower timeframes to assess whether a new trend is emerging from this stabilization. Typical signals would be a sequence of higher highs and higher lows.

As an additional confirmation, a move back above the 20-day moving average could be used. This level currently sits at around $78,900 for Bitcoin and $2,488 for Ethereum.

What to Expect Now from Bitcoin (and the Crypto Market)

After the past few weeks, the market is not signaling a structural breakdown, but rather a phase of adjustment and cleansing. The decline has been driven primarily by derivatives deleveraging, forced liquidations, and episodic institutional outflows, not by a deterioration in Bitcoin’s fundamentals or in the broader crypto ecosystem.

Bitcoin is currently trading in a zone of technical and macro stress, where price has converged toward key reference levels such as the market’s average cost basis (55K USD) and historically relevant capitulation areas. In this environment, volatility tends to remain elevated, narratives become louder, and short-term visibility is limited. That does not necessarily imply higher structural risk, it implies higher timing risk.

In the near term, the market needs time rather than direction: time to absorb forced selling, normalize liquidity conditions, and allow leverage to reset. Price action may remain erratic, with sharp rebounds and pullbacks, typical of markets still dominated by derivatives rather than spot flows.

Looking slightly further out, and assuming no escalation in macro or liquidity shocks, the base case points toward gradual stabilization rather than collapse. Historically, these phases have favored investors who prioritize risk management, position sizing, and patience, over those attempting to predict the next short-term move.

In crypto, as often happens, the main risk at this stage is not that “everything breaks,” but mistaking volatility for a regime change.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.