Analyst Weekly, January 19, 2026

The week ahead puts earnings firmly in focus, with results spanning streaming, semiconductors, healthcare, consumer staples, industrials, energy, and UK-listed cyclicals. Investors will be watching not just headline numbers, but what these reports reveal about pricing power, demand resilience, margins, and 2026 guidance across sectors.

- Netflix (NFLX). Focus: Advertising growth, pricing power, and user engagement are in the spotlight more than subscriber additions. Investors will be watching if Netflix’s new ad-supported tier and recent price hikes keep revenue growing ~17% YoY as expected, and whether management guides for continued subscriber momentum. Market Reaction Drivers: Strong ad revenue traction (versus forecasts) could lift the stock, while any slowdown in engagement or cautious forward guidance may weigh on sentiment.

- Intel (INTC). Focus: The chipmaker’s report will be scrutinized for signs of a turnaround in its PC and server businesses as well as progress in its AI and foundry initiatives. A strong Q4 is expected thanks to improving PC demand and data-center trends, along with more optimism around its foundry business. Market Reaction Drivers: Investors will look for gross margin stabilization and upbeat 2026 guidance. Any positive surprise in chip demand (or cost-cutting benefits) could boost shares, whereas weak outlook or further market-share losses to rivals may pressure the stock.

- Johnson & Johnson (JNJ). Focus: J&J’s performance in key drug franchises and medical devices will be pivotal. The company has been delivering mid-single-digit revenue growth (Q3 sales +6.8% YoY) across its Innovative Medicine and MedTech segments, so investors will focus on whether that momentum continued and on any updates to 2026 profit guidance. Market Reaction Drivers: Solid growth in pharmaceutical sales (especially new therapies) or expanded device margins, coupled with a confident outlook for 2026, could support the stock. Conversely, any signs of slowing demand or cautious guidance might temper enthusiasm in the defensive healthcare space.

- Procter & Gamble (PG). Focus: The consumer staples giant’s report will center on organic sales trends and profit margins. P&G has maintained a modest full-year growth outlook (FY2026 sales +1% to 5%, with flat to +4% organic sales), so investors will parse Q4 for the mix of pricing vs. volume changes across its product categories. Cost pressures have eased, so an uptick in gross margin is expected. Market Reaction Drivers: If P&G shows it can keep raising prices without losing volume, or if it signals higher earnings guidance on easing input costs, the stock could see a positive reaction. However, any weakness in consumer demand or margin compression would raise concern for the staples sector and could weigh on the shares.

- General Electric (GE). Focus: Now focused on aerospace after spinning off other units, GE’s earnings will highlight jet engine orders, service revenues, and supply-chain status. The report will test GE Aerospace’s execution amid booming air travel demand, with attention on whether supply constraints have eased and high-margin aftermarket services continue to grow. Market Reaction Drivers: A strong quarter driven by robust aircraft engine deliveries and upbeat 2026 guidance (e.g. double-digit aerospace revenue growth) would underscore GE’s transformation and likely bolster the stock. Any signs of production bottlenecks or a slower-than-expected ramp in aviation markets, on the other hand, could give investors pause after GE’s recent run-up.

- Schlumberger (SLB). Focus: Results will shed light on global drilling activity and energy capex trends. Last year, SLB beat expectations but cautioned that an “excess oil supply” was making customers cautious, projecting flat revenue into 2025. This Q4, investors will focus on international project strength (SLB’s specialty) versus any North America softness, and listen for management’s outlook on 2026 spending by oil & gas producers. Market Reaction Drivers: If SLB signals that upstream investment is set to rebound (or if it reports better-than-feared revenue despite $59 oil), its stock could rally, especially given SLB’s recent dividend hike and buybacks. However, a subdued outlook (continued customer caution or flat activity levels) might temper the stock and weigh on the broader energy sector.

- Burberry Group (BRBY). Focus: Burberry’s trading update will be eyed for the impact of its brand revamp. Analysts expect only low-single-digit growth in key markets, ~3% in China and ~2% in the Americas, so investors will look for any upside surprise from the crucial Chinese market rebound or new product lines under Burberry’s refreshed creative direction. Market Reaction Drivers: Meeting or beating those modest sales forecasts (for example, delivering a positive ~2% like-for-like sales uptick) would be well received, potentially sparking a re-rating of the stock. Conversely, if luxury demand in China or the US disappoints, or if management sounds cautious on current trading, it could weigh on Burberry and other luxury names given high market expectations for a China-led recovery.

- Rio Tinto (RIO). Focus: The mining giant’s operational update will highlight iron ore production and Chinese demand trends. Rio indicated after Q3 that it needed a “strong Q4 performance” to hit its iron ore shipment targets, noting Chinese infrastructure stimulus has driven iron ore prices to yearly highs. Investors will focus on whether Rio met its volume guidance and on commentary about commodity demand in China and beyond (for iron ore, copper, etc.). Market Reaction Drivers: If Rio shows solid year-end output, and especially if it strikes an optimistic tone on China’s metals appetite, it could boost mining shares and signal strength in the global economy. On the flip side, any production shortfall or cautious outlook (citing costs or weaker demand moving into 2026) might pressure Rio’s stock and the broader materials sector.

- Associated British Foods (Primark). Focus: AB Foods’ update will revolve around its Primark retail arm’s crucial holiday performance amid a tough consumer climate. The company has already warned that Primark’s like-for-like sales fell ~2.7% over the 16 weeks to Jan 3, as “heavy discounting” was needed to clear stock, squeezing margins. Beyond Primark, ABF’s grocery and ingredients units faced weaker US demand late in 2025. Market Reaction Drivers: Investors will watch for any improvement in Primark’s trading trends or inventory levels and any strategies to revive European sales and US footfall. If ABF can reassure that the profit hit was one-off and that measures are in place to lift Primark’s performance, the stock may stabilize. However, confirmation of continued tough trading or a subdued consumer outlook could further pressure ABF shares and spill over to sentiment on UK retail peers.

What US’s Greenland Tariffs May Mean for Markets

Trump’s threat to slap tariffs on eight European countries over Greenland has reopened a familiar risk for markets: policy unpredictability. Even if the levies never materialise, the message is clear: trade deals under a second Trump presidency may not be durable, and headline risk is back.

In the near term, this points to higher volatility rather than a clean directional move. Europe is not just a major US trading partner; it is also the largest foreign holder of US financial assets, which limits how far escalation can go without spilling into capital markets.

The bigger risk sits one layer deeper. If the EU activates its anti-coercion instrument, the conflict shifts from tariffs to financial, regulatory or investment leverage, which would be far more disruptive for FX, rates and risk assets. Ironically, repeated tariff brinkmanship could undermine the dollar by encouraging reserve and portfolio rebalancing away from US assets.

For investors, this is about a rising geopolitical risk premium being repriced across currencies, equities and cross-border capital flows.

Netflix and Intel Ahead of Earnings

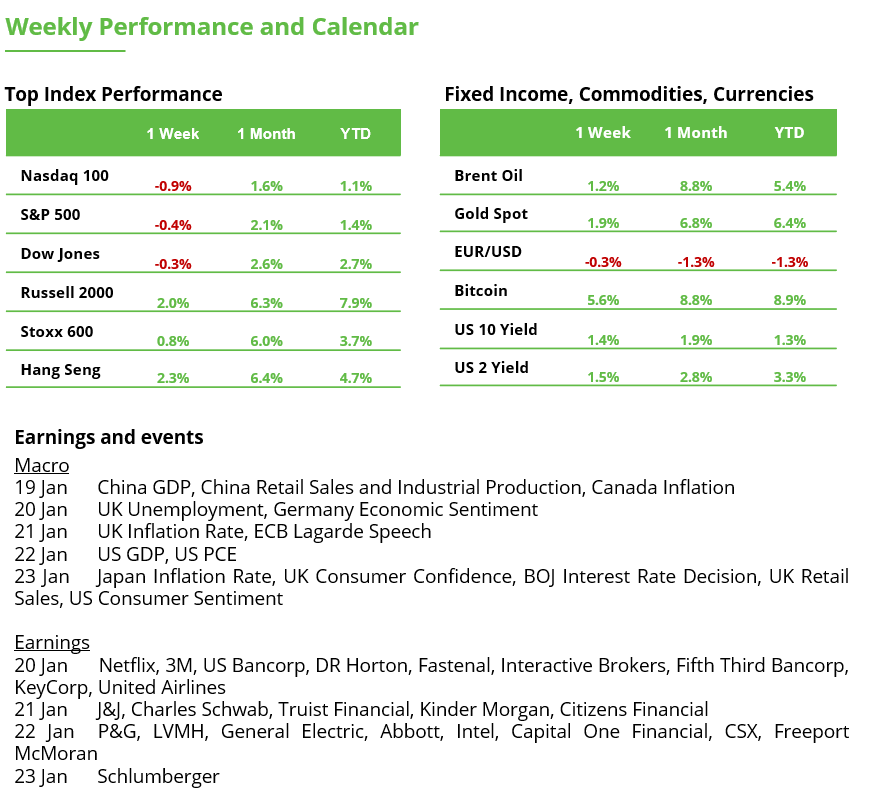

Netflix stock heads toward a key support level

Netflix shares fell by around 30% in the second half of 2025 and extended losses by another 6% in January 2026. The stock is currently trading at its lowest level since April, closing 1.6% lower last week at $88.

A strong support zone around $83 is therefore coming into focus. This area marked a bottom in April, from which the rally began that later pushed Netflix to new record highs. A sustained break below $83 could threaten the long-term uptrend.

The key resistance is located at $110, the interim high of the multi-month downtrend. The most recent sell-off started precisely at this level. A bullish reaction near or at support would stabilize the short-term chart picture and help preserve the long-term uptrend.

Netflix weekly chart, earnings on Tuesday after the close. Source: eToro

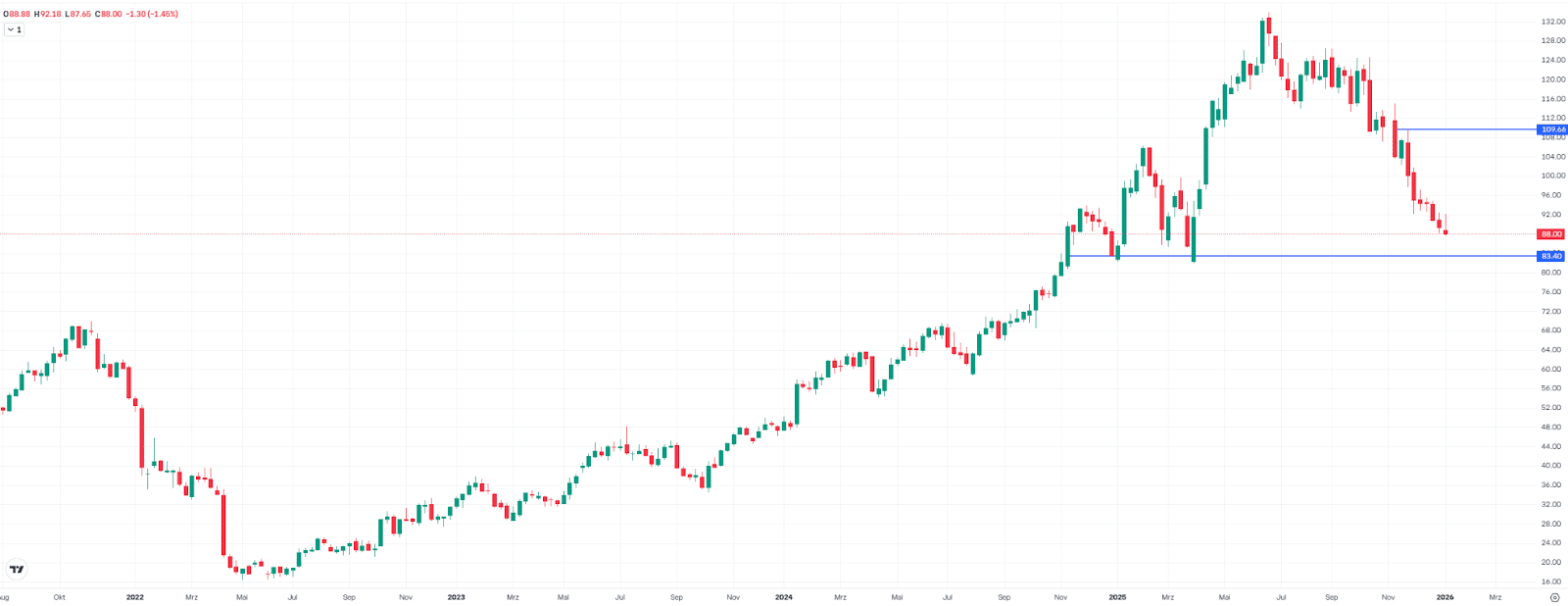

Intel: Will earnings trigger a technical breakout?

Intel shares are up 27% year to date. Last week’s close was around $47, the highest level in a year. The key resistance sits at around $51, the 2023 high.

A sustained breakout above $51 would open up further upside, with a potential target zone around $68. A double top formed in 2021 near this level, making it the next major resistance area.

After the strong short-term rally, a pullback would be possible and technically healthy. In that case, Intel could attempt to break the resistance on a second run. Any declines would initially be classified as a correction within the medium-term uptrend.

Strong support is located around $34, where trading activity was elevated in the fourth quarter. The 20-week moving average is currently near $37.

Intel weekly chart, earnings on Thursday after the close. Source: eToro

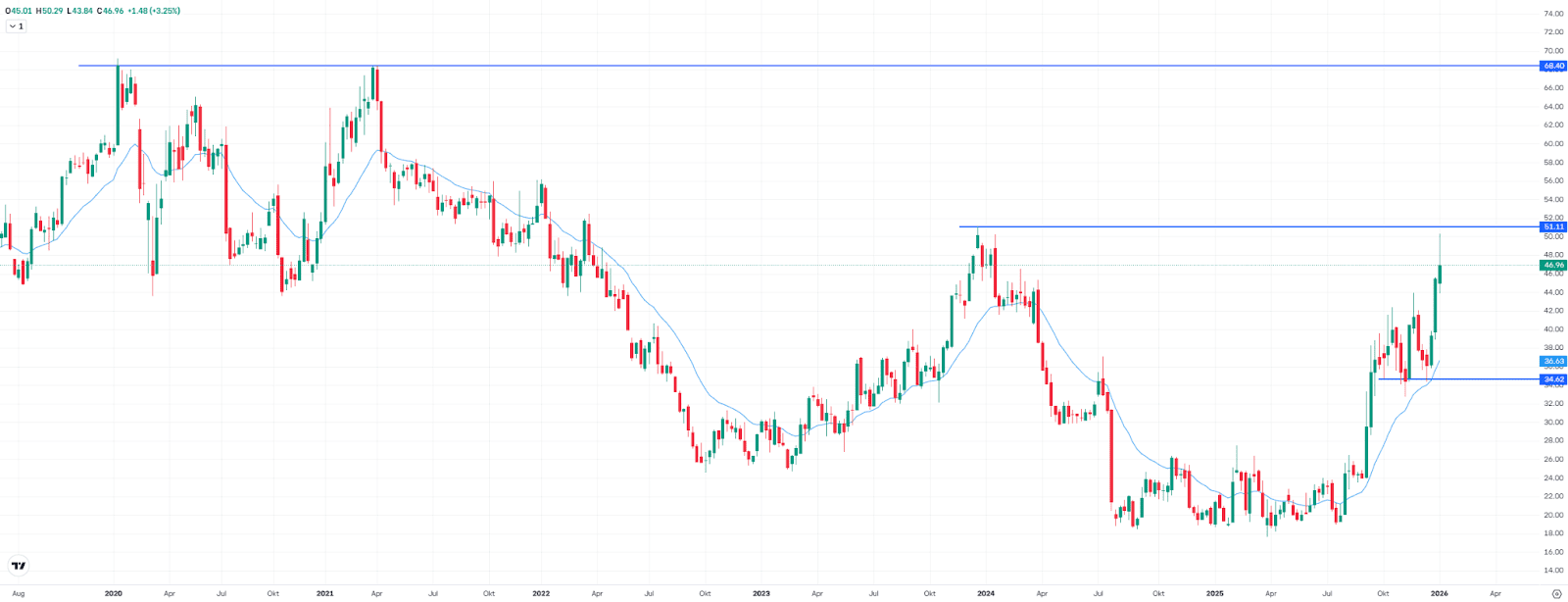

Silver Rally Intact, But Short-Term Warning Signals Are Increasing

Silver crossed the $90 mark for the first time last week but failed to hold above it sustainably. Since Thursday, initial profit-taking has set in.

While the broader uptrend remains intact, the rally is already well advanced, increasing the risk of a correction. An RSI reading of 84 signals a short-term overbought market, while a bearish RSI divergence, rising prices alongside a falling RSI, adds to the caution.

The distance to the 20-week moving average is more than 30%, last tested in May. Two key support zones, known as fair value gaps, are located between $67.40 and $70.00, and $63.60 to $67.30.

In the short term, the risk-reward profile appears unattractive. A pullback would be healthy and could create much more attractive entry levels.

Silver weekly chart. Source: eToro

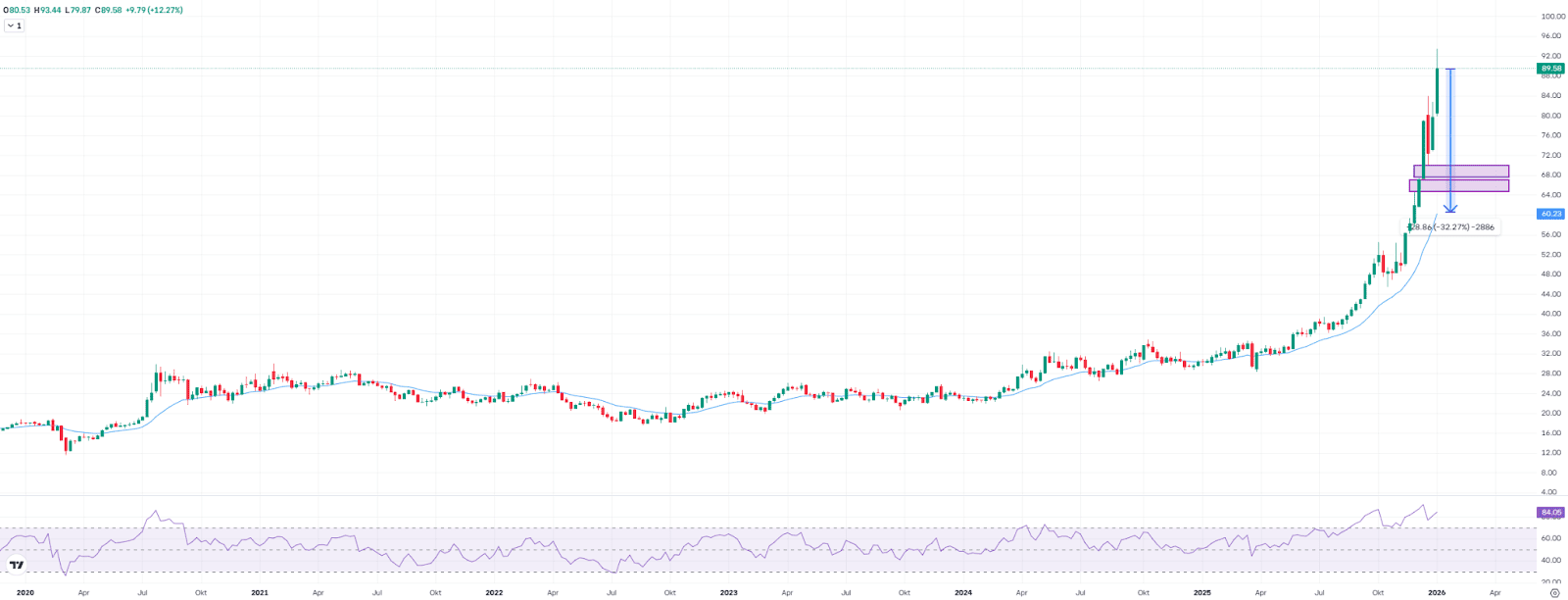

Bitcoin: What Price Shows is Only the Surface

Bitcoin ended the week higher by more than 5%, but this move looks very different from past rallies.

The biggest tell? ETFs pulled in over $1.4bn of net inflows during the week, a sharp reversal from the previous week’s outflows. That suggests demand didn’t disappear, and when sentiment stabilized, capital came back quickly.

What’s missing is just as important. Leverage is muted. CME futures basis and perpetual funding rates remain well below levels typically associated with speculative excess. Prices are rising, but without the fuel that usually precedes sharp reversals.

At the same time, spot volumes are falling. Bitcoin and Ethereum trading activity has cooled, reinforcing a pattern that’s been in place since last year: this cycle is being driven by institutions and ETFs, not retail. Altcoins continue to lag, as excesses from prior cycles unwind.

There are exceptions. XRP has shown relative strength, supported by regulatory progress in Europe and its positioning as a compliant settlement asset. Solana remains on institutional watchlists, but its price is still more sensitive to activity cycles than Bitcoin’s structurally driven flows.

Regulatory noise hasn’t helped. The blockage of the CLARITY Act has weighed on sentiment, especially around stablecoins and tokenization. But the pushback itself highlights where the real friction lies and where long-term change is most likely.

What to watch next week:

- Do ETF inflows persist despite softer spot volumes?

- Can prices rise without leverage returning?

- Does US regulation clarify, or further expose, structural tensions?

- How markets balance institutional adoption with long-term caution.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.