Analyst Weekly, February 2, 2026

Earnings Preview: Week of February 2nd

Earnings this week will test whether AI momentum and resilient demand can keep large-cap growth on track. For most stocks, guidance and forward commentary matter more than the quarter just reported.

Palantir Technologies (PLTR)

- Traders expect a significant stock move around earnings, with options pricing implying at least ~9% potential daily volatility following the report; the stock has been softer recently despite strong gains in 2025.

- Revenue growth acceleration (expected >60% YoY) and AI platform adoption, especially strength in commercial and government contracts, will be key drivers investors watch in the results.

- Guidance and commentary on commercial AI demand and deal momentum (plus clarity on longer-duration government contracts) will be focal topics for analysts and the market.

Amazon (AMZN)

- Surging AWS cloud demand (driven by AI workloads) plus aggressive cost cuts have set the stage for a potential earnings beat and stock jump.

- AWS revenue growth is the top metric: consensus sees cloud accelerating (~24% FY2026 growth vs ~21% prior) thanks to AI-driven usage.

- On the call, investors will seek insight into 2026 margin guidance and cloud momentum: specifically how AI infrastructure investments and recent layoffs will bolster profitability.

Alphabet (GOOGL)

- Advertising and cloud are the twin engines to watch for Google’s parent.

- A solid holiday quarter for ad revenue, including robust search queries and YouTube viewership, and improvement in Google Cloud’s sales could lift the stock

- The call will likely highlight YouTube and Search, with investors listening for updates on ad demand, cost discipline, and how AI innovations (in search and advertising tools) are shaping Google’s strategy going forward.

Advanced Micro Devices (AMD)

- As a bellwether for the chip industry, AMD’s data-center and PC processor sales will heavily influence its stock.

- A strong demand for EPYC server chips or console processors could drive an upside surprise, whereas any weakness in client PC or GPU sales might weigh on sentiment.

- Investors will focus on profit margins and guidance, especially amid intense competition with Intel and Nvidia: for example, whether AMD’s latest AI and graphics products are gaining traction.

PayPal (PYPL)

- Branded Checkout growth: Expected at ~2–3% in 4Q; any miss would likely weigh on the stock.

- Investors want early signs that AI, BNPL and new checkout features can drive usage without hurting near-term growth.

- 2026 outlook: The stock will react to branded growth guidance and confirmation that large buybacks continue to support EPS during the investment year.

Walt Disney (DIS)

- The stock’s reaction will depend on core segment performance and forward strategy.

- Investors will be watching for signs of streaming turnaround, such as Disney+ subscriber growth or narrower streaming losses

- Key points on the call include Disney’s streaming profitability timeline, theme park demand and margins, and updates on strategic initiatives (like plans for ESPN or Hulu) that could shape future growth

Merck & Co. (MRK)

- The fate of Merck’s blockbuster drugs will set the tone for its earnings reaction.

- Its cancer immunotherapy Keytruda (the company’s top seller) and HPV vaccine Gardasil remain critical.

- Investors are laser-focused on how Merck is preparing for looming patent cliffs (Keytruda loses exclusivity later this decade).

Pfizer Inc. (PFE)

- The stock’s reaction will be driven by how well Pfizer’s core portfolio and new launches (e.g. RSV vaccine Abrysvo, migraine therapy Nurtec, oncology drugs from the Seagen acquisition) are filling in the gap.

- The company faces a significant patent cliff in the coming years (major products like Eliquis, Ibrance, and Xtandi face exclusivity losses, with an estimated ~$1.5B revenue hit already expected in 2026).

Eli Lilly (LLY)

- Lilly’s earnings will be dominated by the spectacular growth of its GLP-1 drugs for diabetes and obesity.

- Its twin blockbusters, Mounjaro (tirzepatide for type 2 diabetes, also sold as Zepbound for weight loss), have become the top-line drivers, contributing over half of Lilly’s revenue so far in 2025.

- A big earnings beat could come if sales of Mounjaro/Zepbound exceed expectations yet again.

- Investors will want to hear if demand is still outpacing supply, how the launch of Novo Nordisk’s new oral rival (oral Wegovy) might affect Lilly, and when Lilly’s own oral GLP-1 (orforglipron) could reach the market

Uber (UBER)

- The stock will react to whether Mobility trip growth stays near high-teens (~19% YoY)

- Investors will see if profitability holds as Uber reinvests insurance savings and affordability initiatives.

- AV narrative vs fundamentals: Commentary on autonomous vehicle risk (Waymo, Tesla) matters, but sustained volume growth is the key offset investors want confirmed on the call.

Shell plc (SHEL)

- Oil and trading weakness: Lower oil prices and softer trading results point to weaker Q4 profits versus Q3.

- Gas offset: Higher winter gas prices may support LNG and gas earnings.

- Capital returns: The stock will hinge on buyback/dividend guidance and any signals on capital allocation under the new CEO.

What A Warsh Fed Means For Asset Classes & Sectors

Markets often talk about new Fed chairs in terms of “hawk vs dove,” but that framing misses the real shift. A Warsh Fed is not the market shock some fear, and it’s not a return to ultra-easy policy either. Instead, it signals a change in how support is delivered.

Rather than relying heavily on balance-sheet expansion and detailed forward guidance, a Warsh Fed would likely place more emphasis on market pricing, private capital, and fundamentals. Interest rates may still move lower, but the Fed is less likely to smooth every market move or pre-signal policy far in advance.

We now expect to see:

- A smaller, shorter-duration balance sheet. Importantly, this shift is likely to be gradual, aimed at reducing distortions over time rather than tightening financial conditions abruptly

- A shift of reserve intermediation back to private banks

- Coordination of balance-sheet reduction with Treasury (and possibly housing agencies)

- Shift the Fed’s holdings toward shorter-duration assets, closer to the pre-GFC model

Investment Takeaway: We expect a gradual transition to a market-driven system where prices are set more by fundamentals and private capital, and less by central-bank support, signalling, or balance-sheet intervention.

In practical terms, under a Warsh-Fed this likely means:

- Less reliance on Fed balance-sheet expansion to stabilise markets.

- Less forward guidance telling investors where rates will be months ahead.

- More weight placed on actual data, earnings, cash flows, and balance sheets.

- Assets most sensitive to central bank QE, like Treasuries, MBS, and real assets, will react more to this than to nominal rate changes.

This could be a fundamental shift. Asset class implications are;

Rates move lower, but this is not a duration bonanza

Warsh will likely vote for 1 to 2 rate cuts quickly, possibly a third toward neutral.

However:

- He is focused on inflation expectations, not just the policy rate

- Balance-sheet discipline limits how far long-end yields can fall

- Balance-sheet policy may matter more than rate cuts

- Fed balance sheet shrinks only if private balance sheets can expand

- Deregulation allows banks to absorb liquidity and Treasury supply.If deregulation falls short, balance-sheet reduction could translate into tighter financial conditions and episodic bond market volatility.

Market implication:

Real yields and term premia, not just rate cuts, will remain key drivers of long-term bond performance.

- Treasuries: sensitive to deregulation follow-through

- Front-end and belly of the curve benefit

- Long-duration Treasuries may face capped upside

- This is a curve and carry trade, not an outright duration bet

- Investment-grade credit remains better supported than lower-quality high yield, where the Fed is less likely to act as a backstop.

Equities: dispersion replaces beta

Warsh Fed is not a hawkish shock, but a structural shift away from blanket liquidity.

That may have implications for equity leadership.

Beneficiaries:

- Financials & Banks : deregulation + balance-sheet normalization

- Value / cyclicals: benefit from modest easing without excess liquidity

- Insurers & asset managers: higher long-end yields, less Fed distortion

Market implication:

- Stock selection matters more than index exposure

- More speculative, highly leveraged, or long-duration growth stocks may face a tougher environment without broad liquidity support.

Dollar and FX: stability over weakness

Warsh cuts rates, but preserves:

- Inflation credibility

- Balance-sheet discipline

That is not a classic dollar-bearish mix.

Market implication:

- Dollar likely range-bound to firm

- FX dispersion increases vs low-credibility currencies

Volatility may rise as guidance fades

Warsh is less inclined toward heavy forward guidance.

Markets lose:

- Predictable signaling

- Policy “training wheels”

Market implication:

- Higher macro and policy volatility

- Greater value in:

- Diversification

- Volatility-aware strategies

- Systematic approaches

Investment Takeaway: Taken together, a Warsh Fed represents a shift away from blanket liquidity support and toward market-driven pricing across asset classes. Rates may move lower, but balance-sheet discipline limits upside for long-duration bonds. Credit becomes more selective, equities see greater dispersion, and sectors tied to private capital and balance-sheet strength, particularly financials, gain relative importance. Reduced forward guidance raises volatility, but also increases the value of diversification and active positioning. For markets, this may not be a tightening shock, but a rebalancing of how risk is priced, where fundamentals, cash flows, and balance sheets matter more than central-bank signaling.

Bitcoin & Ethereum Update

Bitcoin and ethereum are undergoing a liquidity-driven adjustment, not a thesis breakdown.

- The recent move reflects a convergence of institutional outflows, forced deleveraging, and contracting base liquidity, amplified by a fragile macro backdrop.

- For the first time since spot ETFs launched, three consecutive months of net selling have removed support near institutional cost levels (~$98k), triggering $1.8bn in liquidations, overwhelmingly on the long side. At the same time, long-term holders are distributing, adding supply into a market with reduced absorption capacity as stablecoin liquidity tightens.

With Bitcoin still highly correlated to large-cap tech and macro uncertainty elevated, key levels now define the regime:

- $85k as the immediate risk threshold, $75k as near-term support, and $50k–$60k as the potential resolution zone if the adjustment continues.

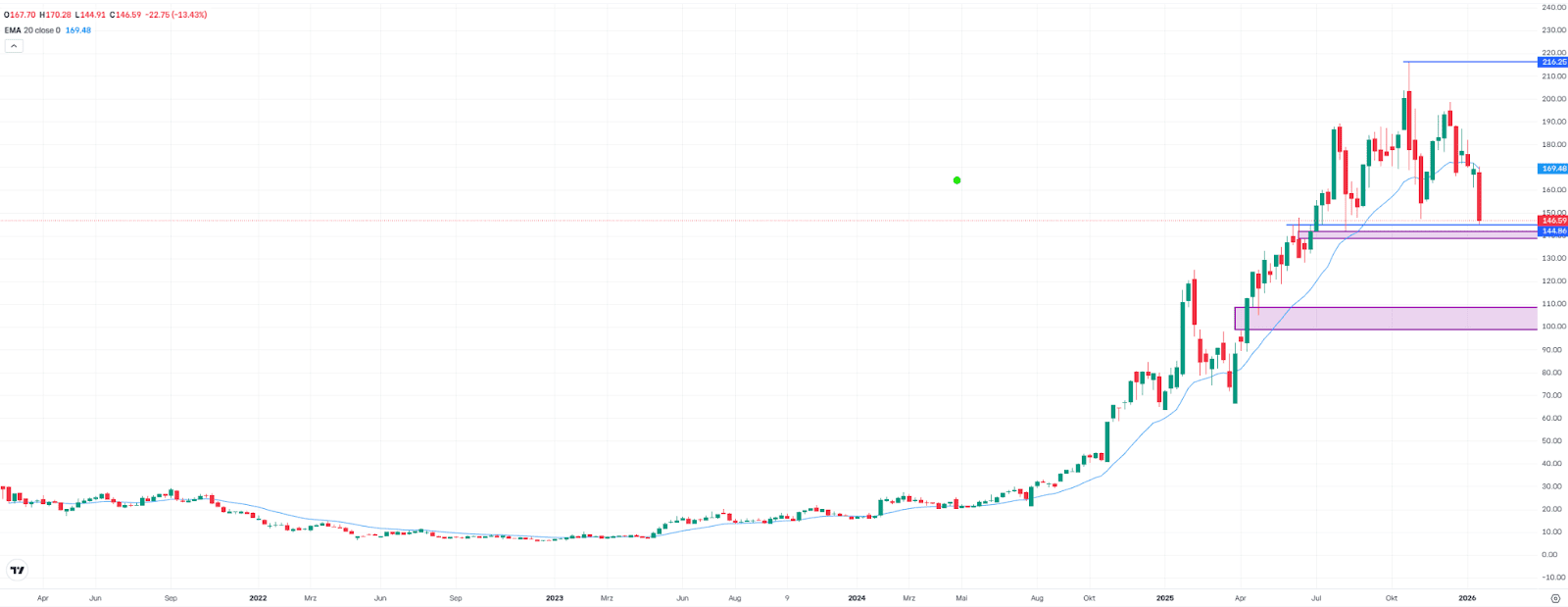

Palantir After the Sell-Off: Will the Key Support Hold?

Palantir shares came under significant pressure last week, falling by 13.4%. A similarly sharp decline was last seen in March. As a result, the distance to the all-time high has widened to around 32%. The stock dropped to $146.59, a level first reached in June and one that already acted as an important support area in August.

Just below this level lies another technically relevant zone. Between $138.66 and $144.85 is a so-called fair value gap, placing the stock in a decisive technical area at present.

The calendar adds further significance. Palantir will report its quarterly results after market close on Monday, which are likely to act as a catalyst for the next major move.

In a positive scenario, part of last week’s losses could be recovered. A move toward the 20-week moving average, currently at $169.48, would be possible. A return above this level would ease the technical picture.

In a negative scenario, however, a break below the current support could trigger further selling pressure. In that case, there would be little in the way of near-term support, with the next relevant support zone—another fair value gap—only between $98.81 and $108.73.

Palantir, weekly chart. Source: eToro

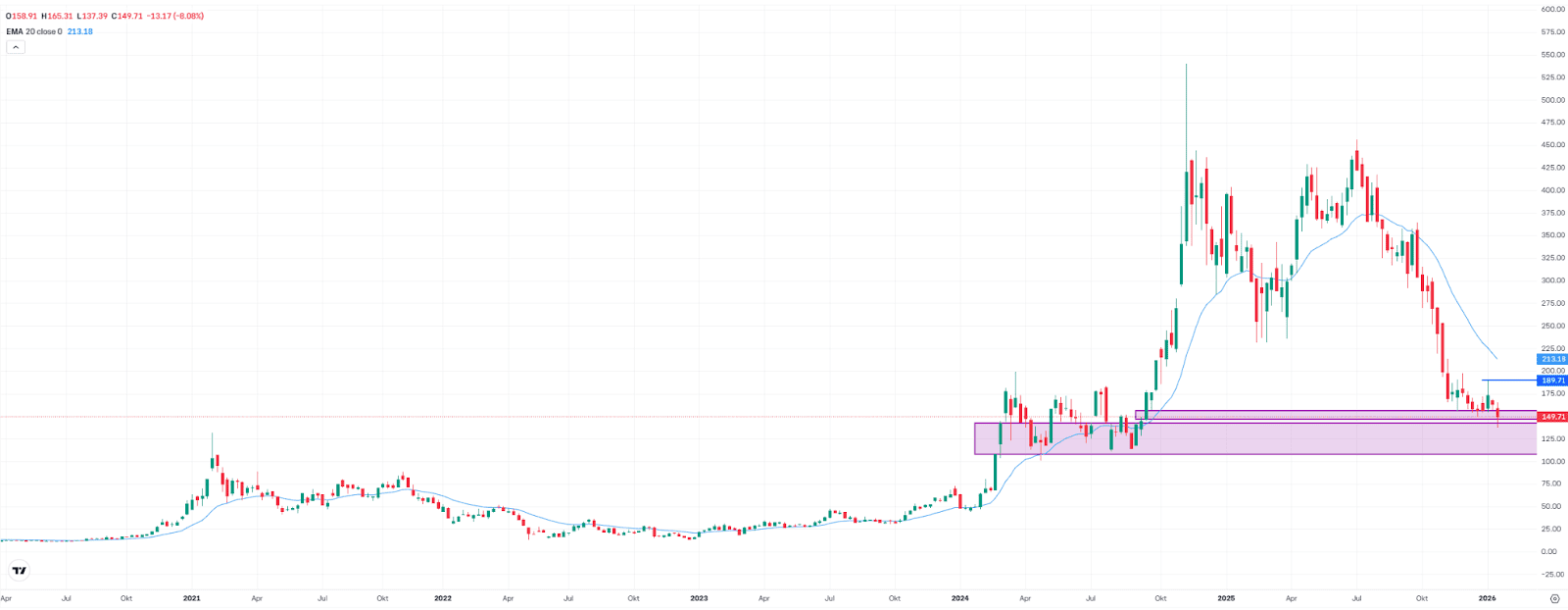

Lowest Level Since 2024: Strategy Struggles for Technical Stabilization

Strategy shares also came under notable pressure last week, falling by 8.1% to $149.71. This marked the lowest level since September 2024. The gap to the record high has now widened to more than 70%.

At least in the short term, there was a first positive signal. The rebound on Friday ensured that two important support zones were respected. Both the fair value gap between $148.67 and $156.84 and the lower zone between $107.83 and $143.59 held. This offers some encouragement, even though stabilization does not yet mean the all-clear. The market could still move lower, but an initial important technical step has been taken.

Attention now turns to Thursday evening. Strategy will release its Q4 results and outlook after the close, which are likely to determine whether stabilization continues or selling pressure returns.

To sustainably improve the chart picture, a move above the short-term high at $189.84 would be required. A return above the 20-week moving average, currently around $213, could serve as additional confirmation. Until then, the situation remains fragile. The risk remains high that the stock could slip deeper into the second support zone.

Strategy, weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.