The Daily Breakdown takes a closer look at Bitcoin’s chart as it contends with a key level, and dives into BONK and SEI.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors become more familiar with the 110+ cryptoassets offered by eToro. Today we’ll discuss Bonk and Sei.

Bonk (BONKxM): Currently trading near $10.50 with a market cap of roughly $920 million

Bonk is a meme-inspired token launched on the Solana blockchain in late 2022, created to reenergize the Solana ecosystem after a period of declining sentiment. Distributed largely through a broad airdrop to users, developers, and NFT communities, BONK emphasizes grassroots participation and community ownership. While it lacks a formal roadmap or deep technical utility, BONK has been integrated across Solana’s DeFi and NFT platforms for tipping, promotions, and microtransactions. Its value is driven primarily by social engagement, ecosystem adoption, and meme culture rather than centralized development or profit-sharing.

Sei (SEI): Currently trading near $0.12 with a market cap of roughly $792 million

Sei is a high-performance Layer-1 blockchain optimized for low-latency trading applications such as decentralized exchanges and derivatives platforms. Designed as a sector-specific chain, Sei features native order matching, price oracles, and parallel execution to reduce front-running and Maximal Extractable Value (MEV). The SEI token is used for gas fees, staking, and on-chain governance, securing the network through delegated proof-of-stake. With interoperability across the Cosmos ecosystem, Sei aims to support fast, scalable DeFi infrastructure tailored for trading-focused use cases.

Want to receive these insights straight to your inbox?

The Setup — Bitcoin

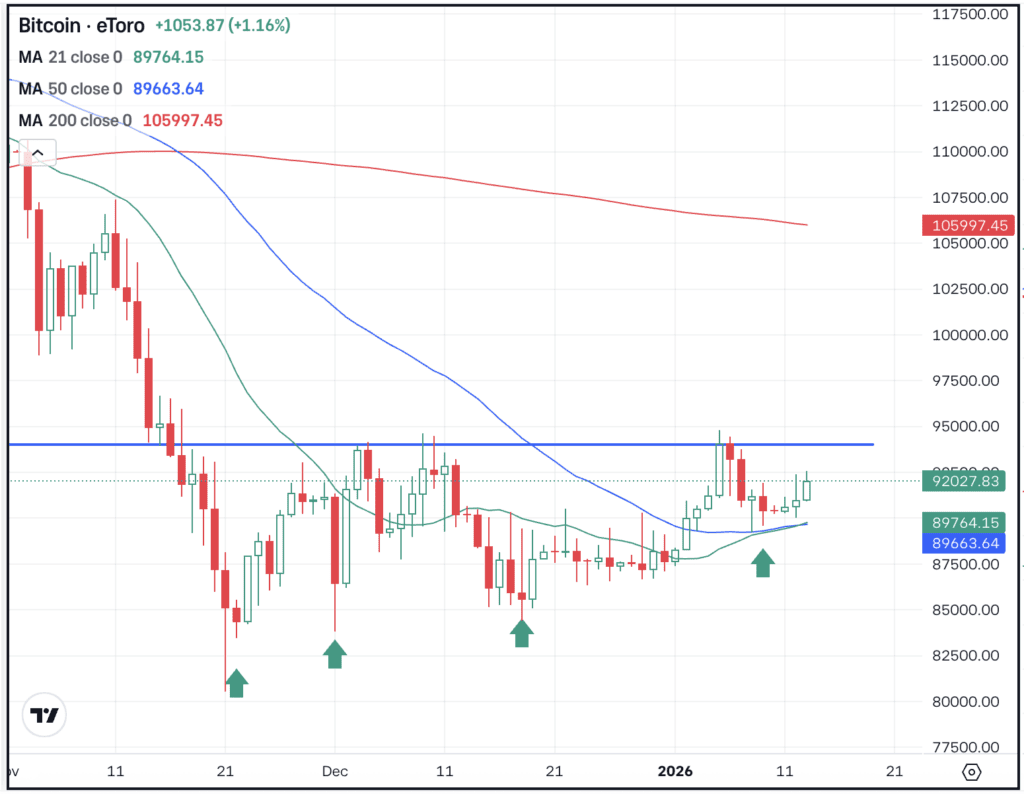

Earlier this month, we discussed Bitcoin’s approach to the $94K area, which has become a key short-term level. BTC was ultimately rejected from this level, as it retreated lower after failing to break above it.

Notice how each low becomes more and more shallow (highlighted by the green arrows). On the latest dip, support came into play around $90K as the 21-day and 50-day moving averages acted as support. Now BTC may be gearing up for another test of $94K. Bulls want to see Bitcoin break out over this level, potentially setting the stage for a test of $100K. Bears want to see $94K continue as resistance and ultimately, they want to see recent support fail too.

Options & ETFs

For investors who can’t trade or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the BTC front, IBIT remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of JPMorgan are in focus this morning after the company reported earnings. The bank delivered adjusted earnings of $5.23 a share on revenue of $46.8 billion, beating estimates of $4.92 a share and $46 billion, respectively. The results mark JPMorgan’s 14th consecutive quarter that it beat earnings expectations. Check out the chart for JPM.

Shares of Delta Air Lines are lower in pre-market trading even after the firm delivered a top- and bottom-line beat. Earnings of $1.55 per share beat estimates of $1.53 per share, while revenue of $16 billion beat expectations of $15.6 billion. For 2026, management expects about 20% earnings growth, providing earnings guidance in the range of $6.50 to $7.50 per share (good for a midpoint of $7 a share). Wall Street analysts were expecting $7.25 a share. Dig into the fundamentals for DAL.

While earnings begin, investors will also be keeping an eye on another report this morning: The CPI inflation report for December. Investors are hoping for a low CPI print, which could be an encouraging sign for lower rates in the year ahead. A hot inflation report could have the opposite effect. Either way, market-based ETFs like SPY and QQQ could be in focus as a result.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.